Time to file your personal income tax declaration Russia

•

0 likes•266 views

The deadline for declaring personal income tax for 2014 is coming. Foreigners who have derived incomes for the work in Russia have to make sure that they make their declaration in a timely manner.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

New filing required for accreditation of foreign representative offices and b...

New filing required for accreditation of foreign representative offices and b...Accountor Russia and Ukraine

More Related Content

What's hot

New filing required for accreditation of foreign representative offices and b...

New filing required for accreditation of foreign representative offices and b...Accountor Russia and Ukraine

What's hot (19)

Transfer pricing reporting and documentation in 2015 Russia

Transfer pricing reporting and documentation in 2015 Russia

Lawyer in Vietnam Oliver Massmann Legal Update November 2016

Lawyer in Vietnam Oliver Massmann Legal Update November 2016

VDS Guidelines and VAT & SD rate for the FY 2021-2022

VDS Guidelines and VAT & SD rate for the FY 2021-2022

Changes in the tax legislation of Russian Federation beginning of 2014

Changes in the tax legislation of Russian Federation beginning of 2014

Rates of TDS or TCS and regular requirements under income tax ordinance and r...

Rates of TDS or TCS and regular requirements under income tax ordinance and r...

New filing required for accreditation of foreign representative offices and b...

New filing required for accreditation of foreign representative offices and b...

The most important changes foreseen by the new 2018 Tax Code in Romania

The most important changes foreseen by the new 2018 Tax Code in Romania

An alternative exists. Fair Tax Code of Uspishna Kraina

An alternative exists. Fair Tax Code of Uspishna Kraina

07. payment of tax before assessment ICAB, KL, Study Manual

07. payment of tax before assessment ICAB, KL, Study Manual

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

Tax rates trends and regional comparison (EU10, Western Balkans, BRIC, Russia...

Proclamation of 2019 National and Provincial Elections

Proclamation of 2019 National and Provincial Elections

Similar to Time to file your personal income tax declaration Russia

Similar to Time to file your personal income tax declaration Russia (20)

Tax & Accounting Related Changes in Russia, June 2015

Tax & Accounting Related Changes in Russia, June 2015

Changes in the tax legislation of Russian Federation – summer of 2014

Changes in the tax legislation of Russian Federation – summer of 2014

HWC competence brochure - Tax & Accounting in Ukraine

HWC competence brochure - Tax & Accounting in Ukraine

Most important accounting and taxation changes in Russia for 2016

Most important accounting and taxation changes in Russia for 2016

Updates on Business Trips Regulations in Russia, July 2015

Updates on Business Trips Regulations in Russia, July 2015

Nigretti Gianmauro: Croazia 2016 - Corporate and Tax Highlights

Nigretti Gianmauro: Croazia 2016 - Corporate and Tax Highlights

Newsletter - tax labour investment Grant Thornton Feb 2016

Newsletter - tax labour investment Grant Thornton Feb 2016

Nigretti Gianmauro: Slovenia 2016 - Corporate and Tax Highlights

Nigretti Gianmauro: Slovenia 2016 - Corporate and Tax Highlights

Tax: Changes Anticipated in 2017 - Olga Mazina - TaXmas

Tax: Changes Anticipated in 2017 - Olga Mazina - TaXmas

More from Accountor Russia and Ukraine

Recent Court Practice: a Review of Civil and Tax Disputes - Pavel Antonov -...

Recent Court Practice: a Review of Civil and Tax Disputes - Pavel Antonov -...Accountor Russia and Ukraine

Практические аспекты подготовки документации по трансфертному ценообразованию

Практические аспекты подготовки документации по трансфертному ценообразованиюAccountor Russia and Ukraine

Сравнительный обзор форм ведения бизнеса для иностранных компаний в России

Сравнительный обзор форм ведения бизнеса для иностранных компаний в РоссииAccountor Russia and Ukraine

More from Accountor Russia and Ukraine (20)

Факторинг - М. Стешина, А. Захаров, АО "Райффайзенбанк"

Факторинг - М. Стешина, А. Захаров, АО "Райффайзенбанк"

Recent Court Practice: a Review of Civil and Tax Disputes - Pavel Antonov -...

Recent Court Practice: a Review of Civil and Tax Disputes - Pavel Antonov -...

Хеджирование валютных рисков на непредсказуемом российском рынке

Хеджирование валютных рисков на непредсказуемом российском рынке

Cash Pooling - Решения по управлению денежными потоками

Cash Pooling - Решения по управлению денежными потоками

Бухгалтерские и налоговые аспекты управления ликвидностью

Бухгалтерские и налоговые аспекты управления ликвидностью

Бухгалтерские и налоговые аспекты хеджирования валютных рисков

Бухгалтерские и налоговые аспекты хеджирования валютных рисков

Бухгалтерские и налоговые аспекты хеджирования валютных рисков

Бухгалтерские и налоговые аспекты хеджирования валютных рисков

Презентация с семинара по трансфертному ценообразованию

Презентация с семинара по трансфертному ценообразованию

Практические аспекты подготовки документации по трансфертному ценообразованию

Практические аспекты подготовки документации по трансфертному ценообразованию

Сравнительный обзор форм ведения бизнеса для иностранных компаний в России

Сравнительный обзор форм ведения бизнеса для иностранных компаний в России

Types of Business Activity Forms for Foreign Companies in Russia

Types of Business Activity Forms for Foreign Companies in Russia

Recently uploaded

Recently uploaded (6)

100%Safe delivery(+971558539980)Abortion pills for sale..dubai sharjah, abu d...

100%Safe delivery(+971558539980)Abortion pills for sale..dubai sharjah, abu d...

2k Shots ≽ 9205541914 ≼ Call Girls In Ganesh Nagar (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Ganesh Nagar (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Vinod Nagar East (Delhi)

2k Shots ≽ 9205541914 ≼ Call Girls In Vinod Nagar East (Delhi)

Will Robots Steal Your Jobs? Will Robots Steal Your Jobs? 10 Eye-Opening Work...

Will Robots Steal Your Jobs? Will Robots Steal Your Jobs? 10 Eye-Opening Work...

Webinar - How to set pay ranges in the context of pay transparency legislation

Webinar - How to set pay ranges in the context of pay transparency legislation

Time to file your personal income tax declaration Russia

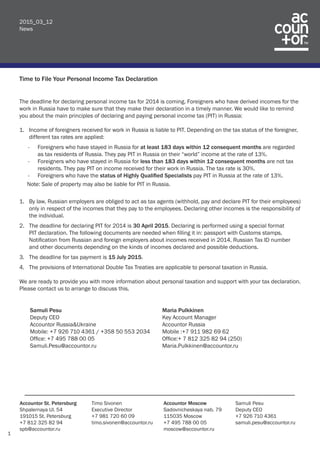

- 1. 1 Accountor St. Petersburg Shpalernaya Ul. 54 191015 St. Petersburg +7 812 325 82 94 spb@accountor.ru Timo Sivonen Executive Director +7 981 720 60 09 timo.sivonen@accountor.ru Accountor Moscow Sadovnicheskaya nab. 79 115035 Moscow +7 495 788 00 05 moscow@accountor.ru Samuli Pesu Deputy CEO +7 926 710 4361 samuli.pesu@accountor.ru Time to File Your Personal Income Tax Declaration The deadline for declaring personal income tax for 2014 is coming. Foreigners who have derived incomes for the work in Russia have to make sure that they make their declaration in a timely manner. We would like to remind you about the main principles of declaring and paying personal income tax (PIT) in Russia: 1. Income of foreigners received for work in Russia is liable to PIT. Depending on the tax status of the foreigner, different tax rates are applied: -- Foreigners who have stayed in Russia for at least 183 days within 12 consequent months are regarded as tax residents of Russia. They pay PIT in Russia on their “world” income at the rate of 13%. -- Foreigners who have stayed in Russia for less than 183 days within 12 consequent months are not tax residents. They pay PIT on income received for their work in Russia. The tax rate is 30%. -- Foreigners who have the status of Highly Qualified Specialists pay PIT in Russia at the rate of 13%. Note: Sale of property may also be liable for PIT in Russia. 1. By law, Russian employers are obliged to act as tax agents (withhold, pay and declare PIT for their employees) only in respect of the incomes that they pay to the employees. Declaring other incomes is the responsibility of the individual. 2. The deadline for declaring PIT for 2014 is 30 April 2015. Declaring is performed using a special format PIT declaration. The following documents are needed when filling it in: passport with Customs stamps, Notification from Russian and foreign employers about incomes received in 2014, Russian Tax ID number and other documents depending on the kinds of incomes declared and possible deductions. 3. The deadline for tax payment is 15 July 2015. 4. The provisions of International Double Tax Treaties are applicable to personal taxation in Russia. We are ready to provide you with more information about personal taxation and support with your tax declaration. Please contact us to arrange to discuss this. 2015_03_12 News Samuli Pesu Deputy CEO Accountor Russia&Ukraine Mobile: +7 926 710 4361 / +358 50 553 2034 Office: +7 495 788 00 05 Samuli.Pesu@accountor.ru Maria Pulkkinen Key Account Manager Accountor Russia Mobile :+7 911 982 69 62 Office:+ 7 812 325 82 94 (250) Maria.Pulkkinen@accountor.ru