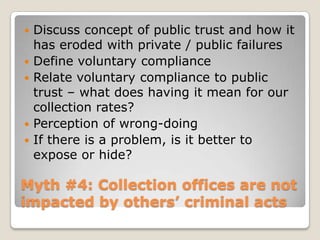

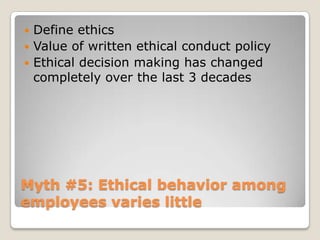

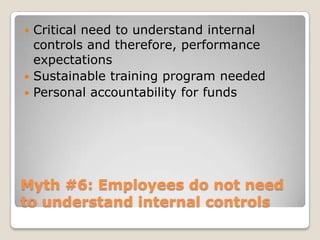

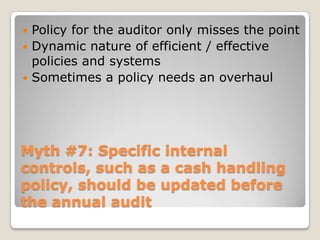

This document discusses 10 myths about internal controls in property tax collection offices. It addresses myths such as the idea that few care about internal controls, that audits never find weaknesses, and that employees do not need to understand internal controls. The document explores concepts like ethics, transparency, and establishing a climate of shared responsibility around internal controls.