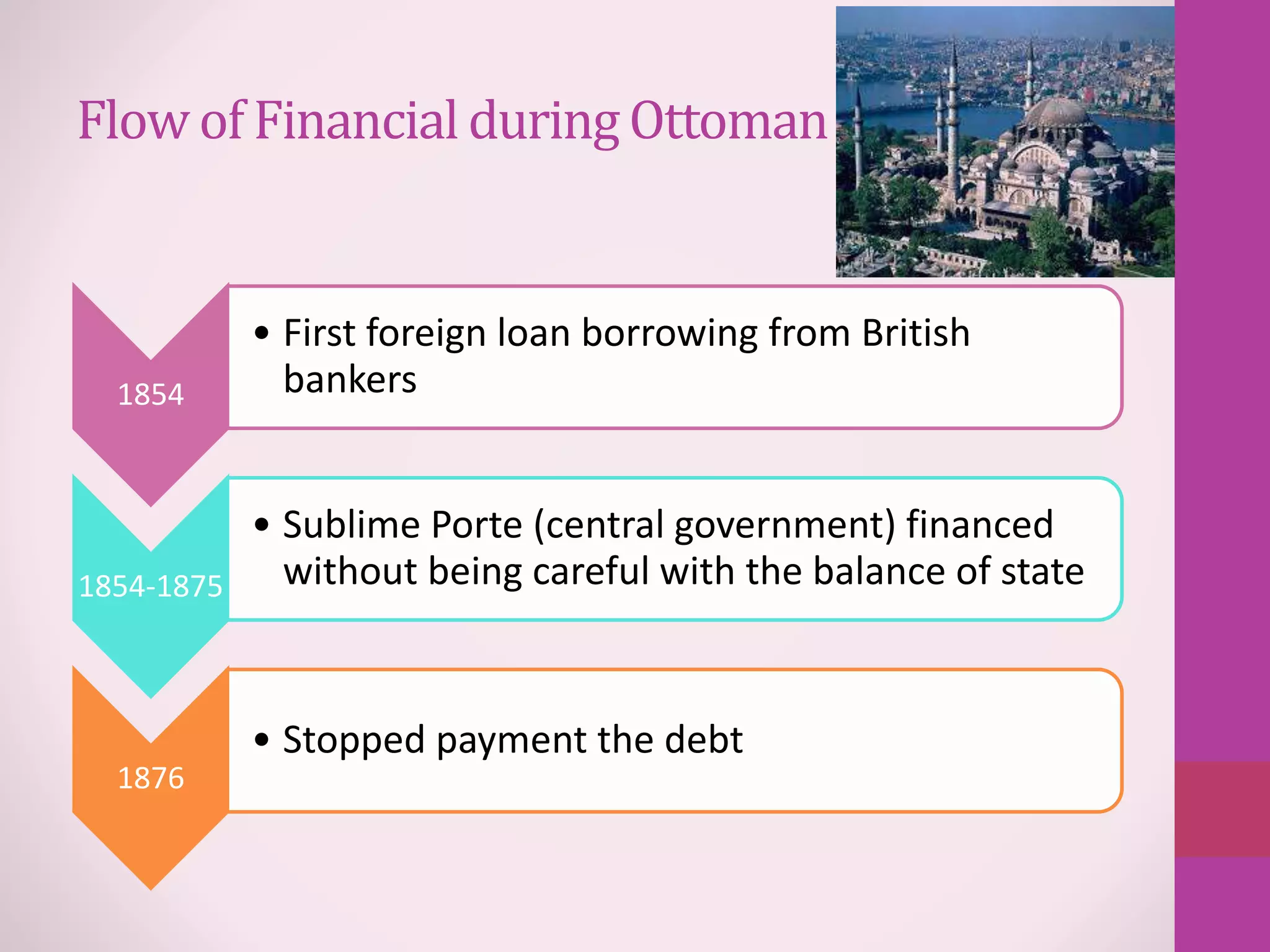

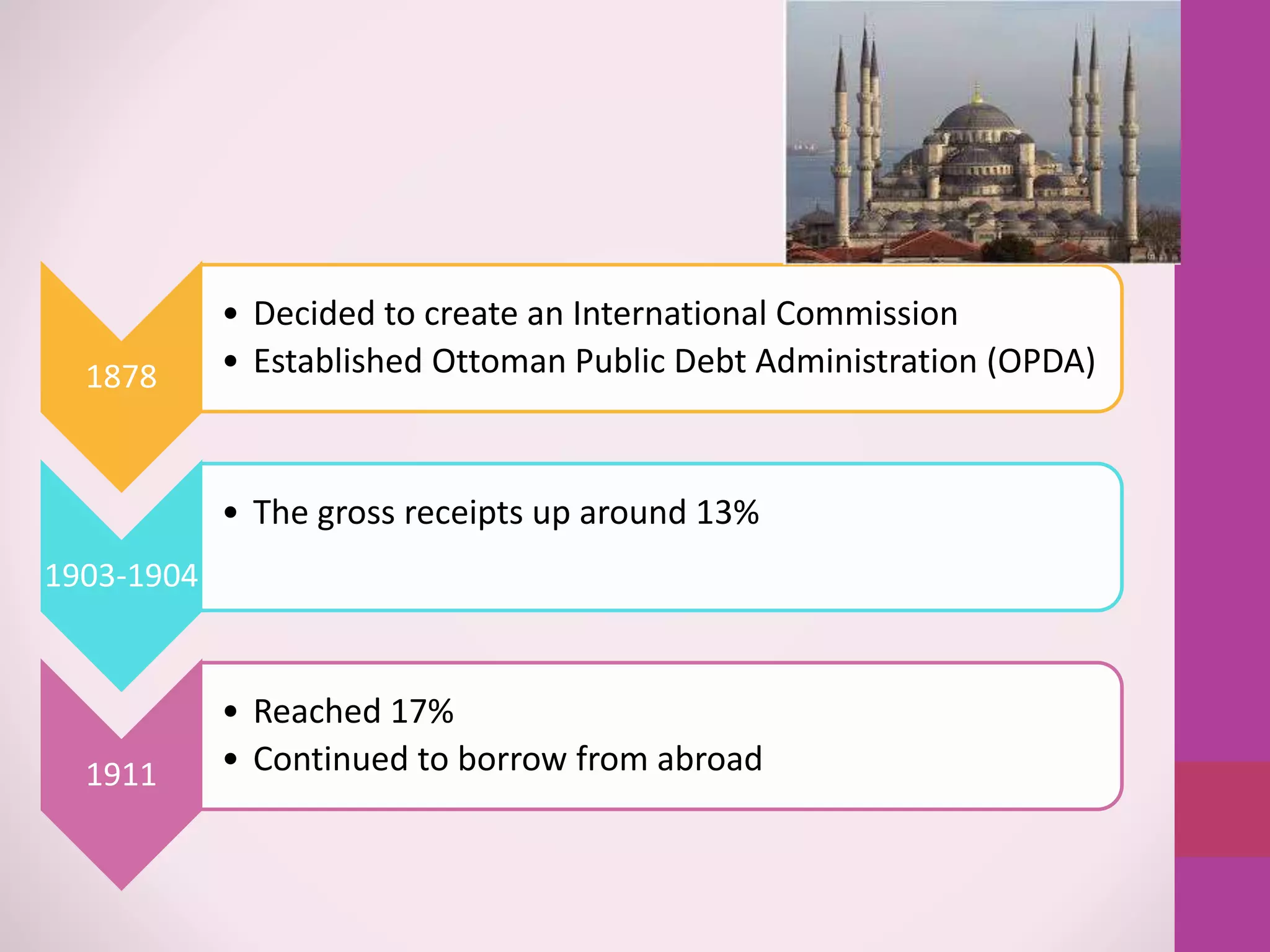

The role of the state during the Caliph Era and Ottoman Empire was to manage public finances, maintain justice, and distribute resources equally. Under early Caliphates like Abu Bakr and Umar, the main sources of revenue were zakat, kharaj, and jizyah which were used to improve welfare. The Ottomans also borrowed extensively from foreign lenders starting in the 1850s to finance the central government without balancing the budget, leading to missed debt payments.