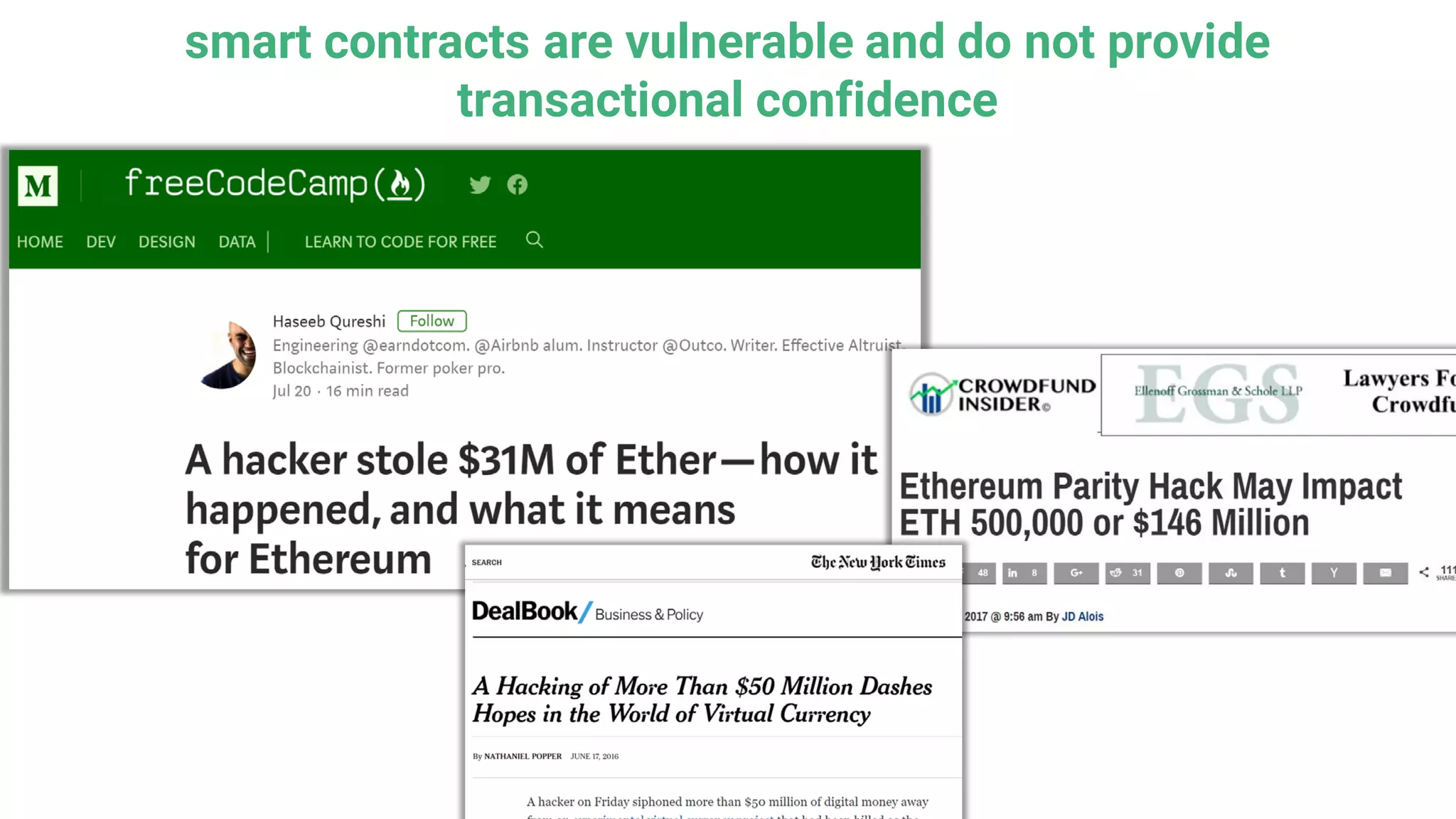

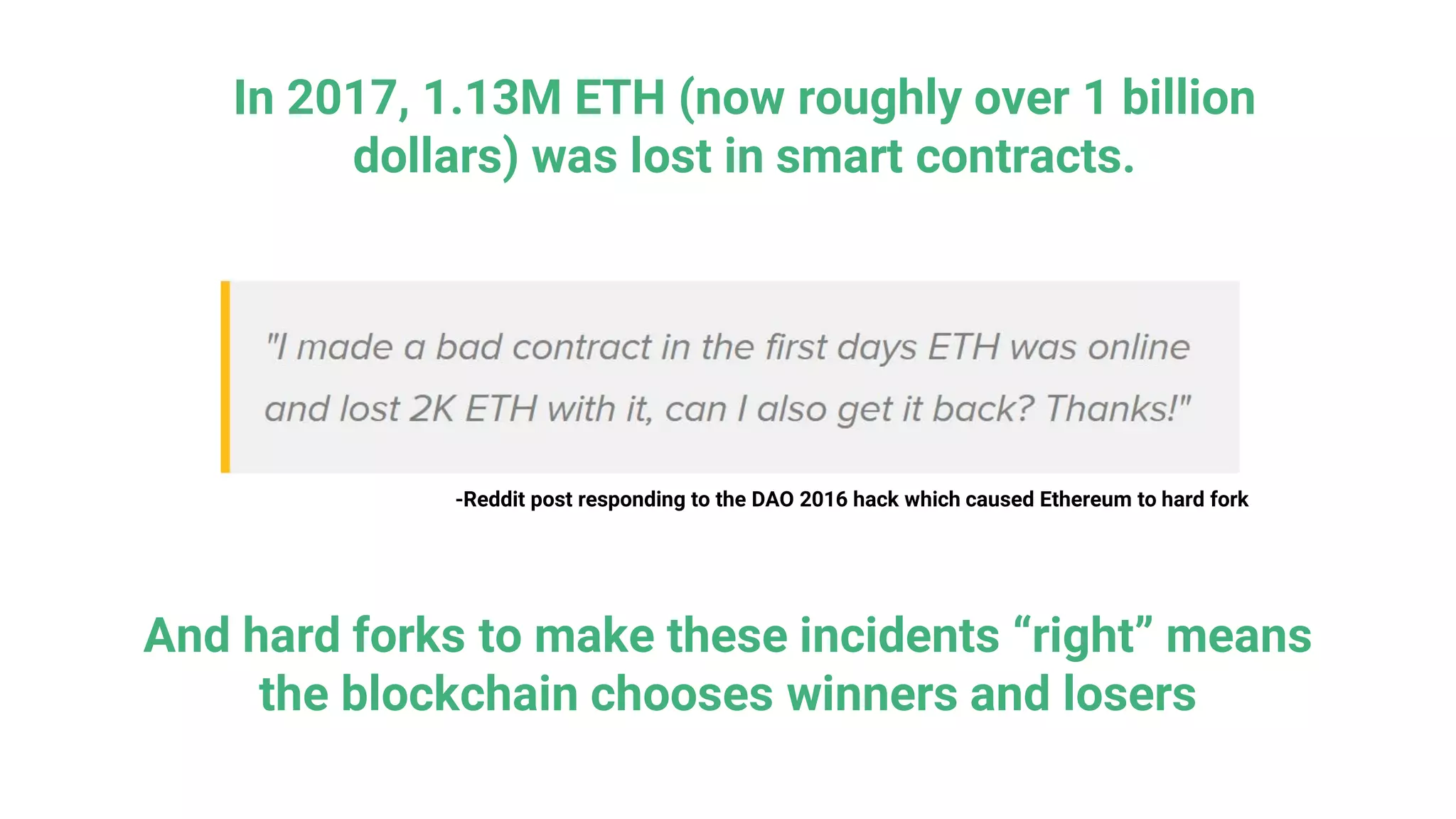

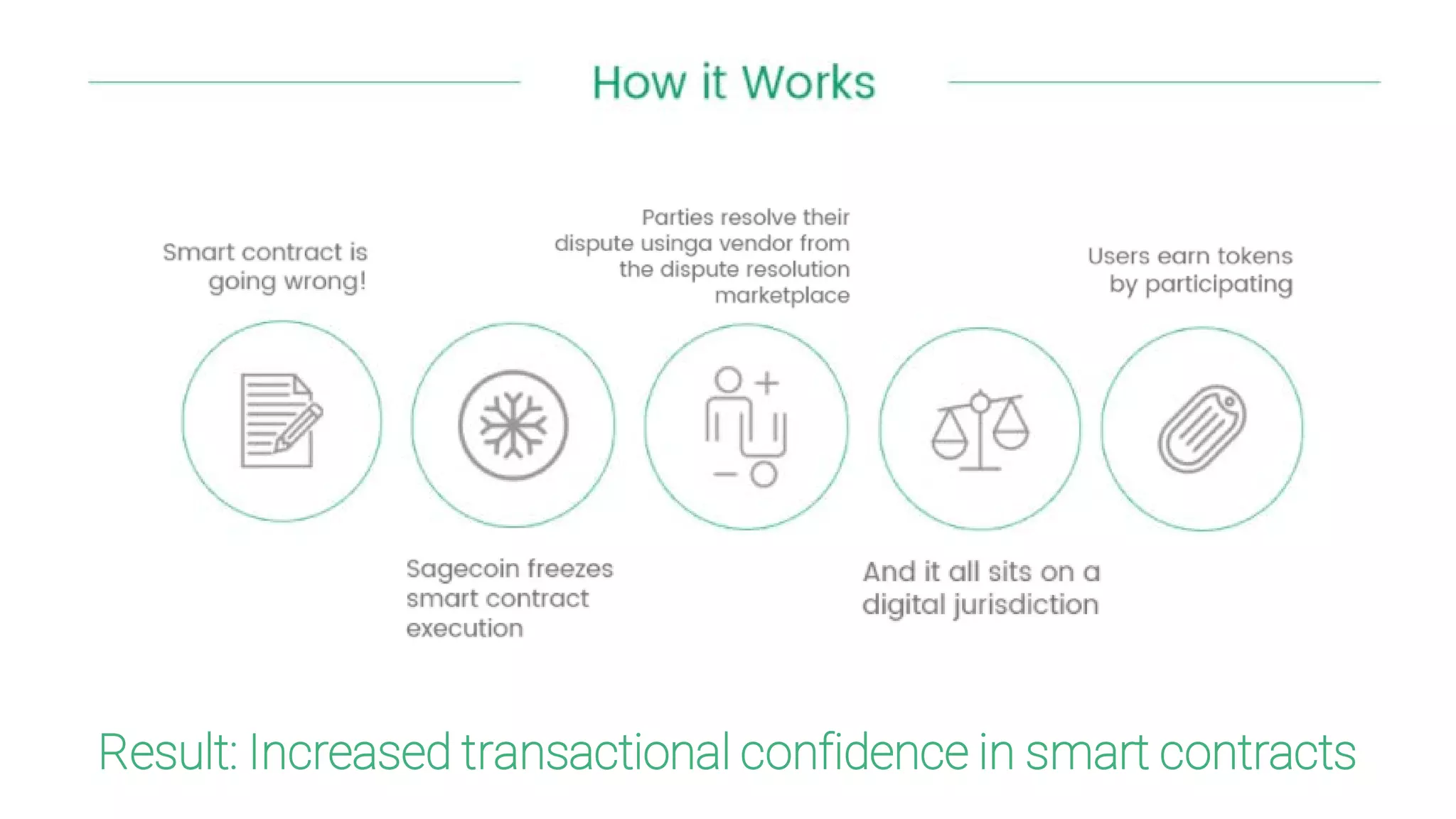

Smart contracts are vulnerable and have led to major losses due to hacks and bugs. Traditional legal systems are unable to adequately resolve disputes that arise from smart contracts due to technical and logistical challenges. Sage's technology aims to increase transactional confidence for smart contracts by providing an alternative dispute resolution system tailored for blockchain and crypto disputes.

![USE CASES: CONSTRUCTION FUNDING

Size of construction dispute market in 2003: $5 Billion

“[T]he construction industry…[is] really the

industry that sponsors our work.”

Mark Appel, senior vice president of the American Arbitration Association (ENR 2000)](https://image.slidesharecdn.com/wcefsmartcontractspresentationamywan-180119053923/75/The-Challenges-of-Smart-Contracts-9-2048.jpg)