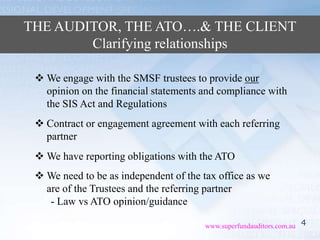

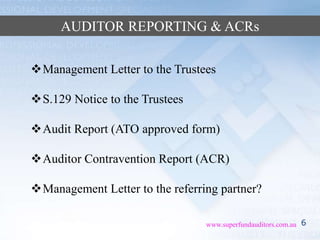

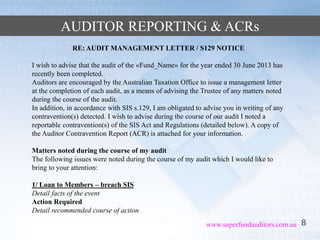

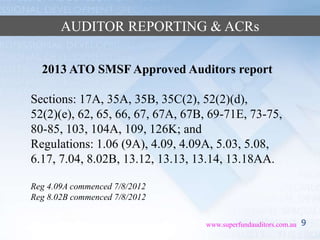

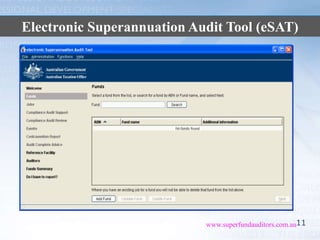

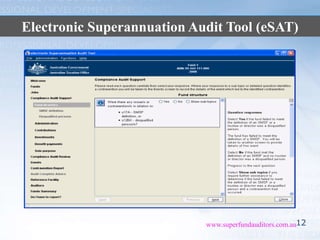

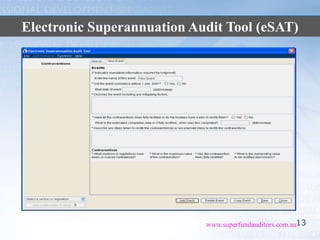

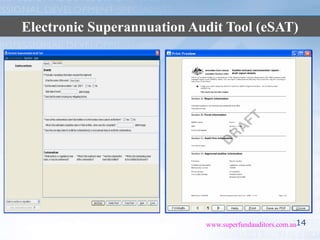

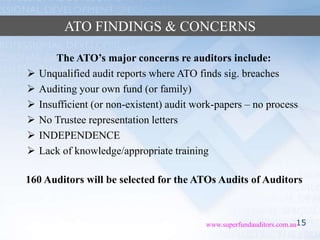

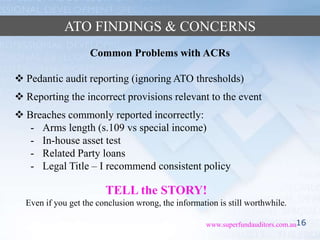

This document outlines a presentation for auditors on their relationship with the Australian Taxation Office (ATO) and SMSF clients. It discusses that auditors work for and report to SMSF trustees, but have reporting obligations to the ATO. It also covers auditor reporting requirements, common ATO findings of issues with audits, and ways the ATO can assist auditors including guidance, private rulings, and enforceable undertakings for fund breaches. The goal is to help auditors improve compliance and educate clients to reduce contraventions.