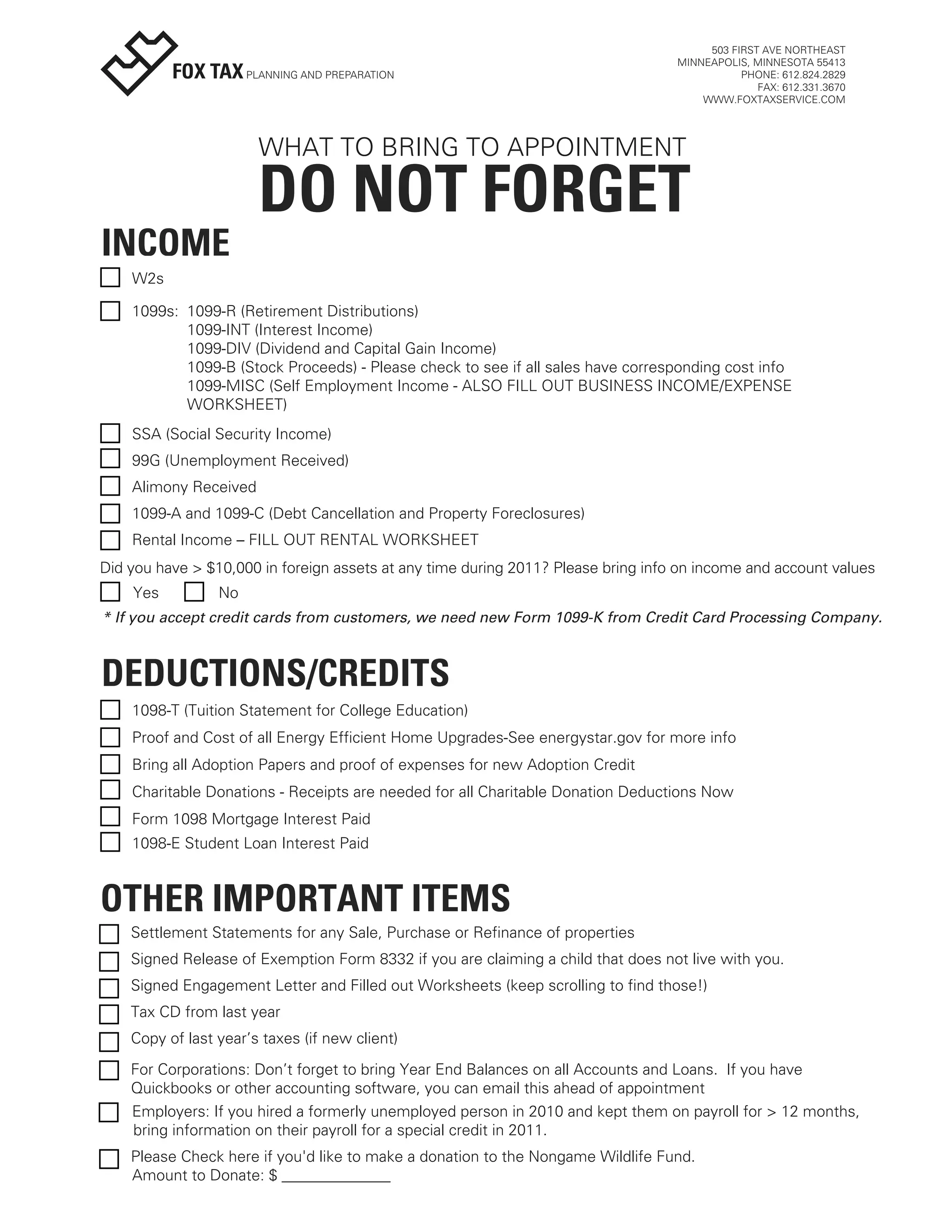

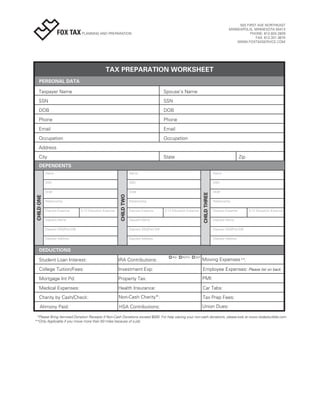

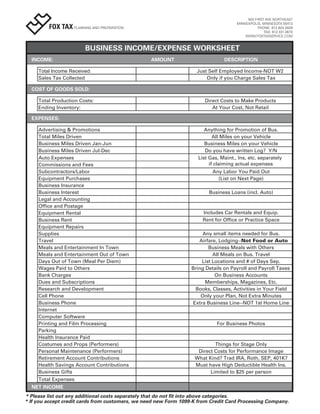

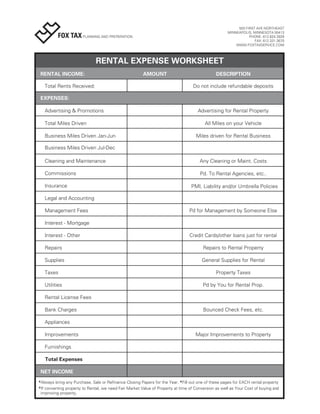

The document provides instructions and forms for clients to bring to their tax preparation appointment. It lists important income documents like W-2s, 1099s, and records of deductions and credits. It also includes a tax preparation worksheet to collect client details, and worksheets to track business, rental, and home office expenses. The engagement letter outlines the scope of tax preparation services and responsibilities of both the client and preparer.