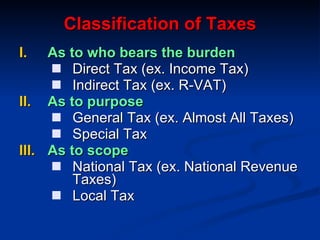

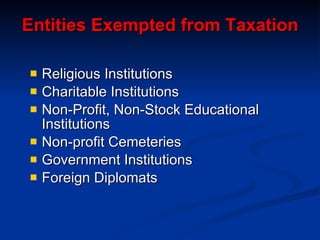

Fiscal policy involves generating government revenue through taxation to fund public services and promote citizen welfare. Taxation gives the state the power to collect a share of individual and business income for public purposes like funding government operations. The primary purpose of taxation is to generate funds for government expenses to benefit citizens. Key principles of taxation include benefit received, ability to pay, and equal distribution of tax burden based on income or wealth. Taxes can be direct or indirect, general or special, national or local. Certain nonprofit entities are typically exempted from paying taxes.