Tax Diversification

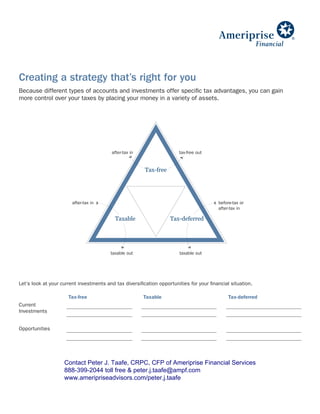

- 1. Creating a strategy that’s right for you Because different types of accounts and investments offer specific tax advantages, you can gain more control over your taxes by placing your money in a variety of assets. after-tax in tax-free out Tax-free after-tax in before-tax or after-tax in Taxable Tax-deferred taxable out taxable out Let’s look at your current investments and tax diversification opportunities for your financial situation. Tax-free Taxable Tax-deferred Current Investments Opportunities Contact Peter J. Taafe, CRPC, CFP of Ameriprise Financial Services 888-399-2044 toll free & peter.j.taafe@ampf.com www.ameripriseadvisors.com/peter.j.taafe

- 2. Tax diversification and your portfolio Managing what you pay in taxes and when you pay them can affect your ability to reach your financial goals. The right combination of taxable, tax-free and tax- after-tax in tax-free out deferred investments can Tax-free help provide more money to invest today and help you pay fewer taxes on your retirement after-tax in before-tax or after-tax in savings, regardless of how tax Taxable Tax-deferred laws change over time. taxable out taxable out Tax-free Taxable Tax-deferred1 Purchase investments: With dollars you’ve With dollars you’ve With dollars you have already paid taxes on already paid taxes not paid taxes on (after-tax dollars) on (after-tax dollars) (pre-tax dollars) When you own investments: You may pay no taxes You pay taxes on: You pay no taxes > Dividends as you receive them > Interest as it accrues When you sell investments: You pay: You pay: You pay: > No taxes on your original > No taxes on your original > Taxes on original investment dollars investment dollars investment dollars or dividends (may be > Taxes on gains, if any > Taxes on your earnings2 subject to state tax) > Taxes on earnings or gains, if any, depending on the investment2 Benefits Could help you manage Tax burden is distributed > Pre-tax dollars provide taxes when you sell your throughout the investment more money for you to investments cycle invest toward your goals > You may pay less in taxes on your investment dollars in retirement when your income could be lower Limitations Post-tax dollars could Post-tax dollars could Could present a significant leave you with fewer leave you with fewer tax burden when you sell dollars to invest dollars to invest your investments 1 Some tax-deferred investments can be purchased with after-tax dollars, and any earnings are taxable as ordinary income when distributed. 2 May be subject to a 10% IRS penalty before age 59½. Neither Ameriprise Financial nor its affiliates may provide tax or legal advice. Consult with your tax advisor or attorney regarding specific tax issues. Brokerage, investment and financial advisory services are offered through Ameriprise Financial Services, Inc., Member FINRA and SIPC. © 2009 Ameriprise Financial, Inc. All rights reserved. 243150 A (9/09)