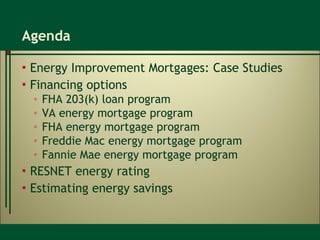

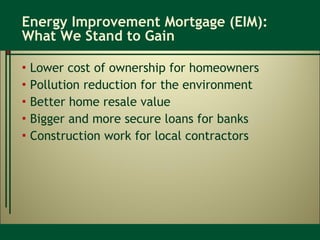

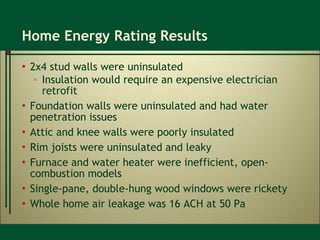

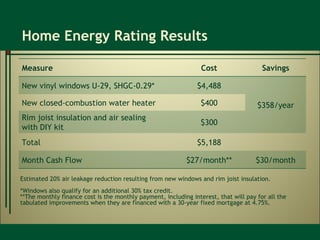

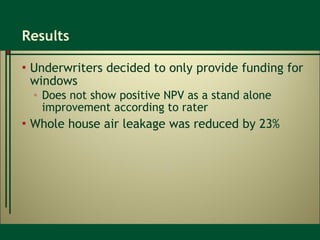

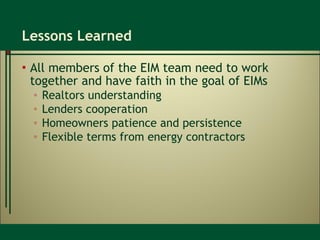

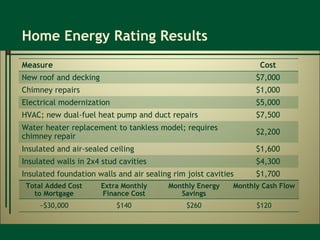

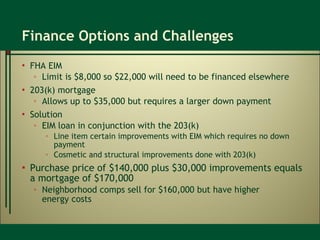

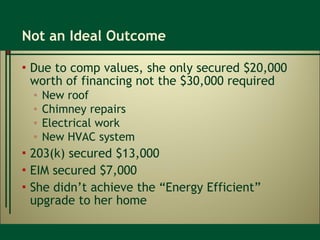

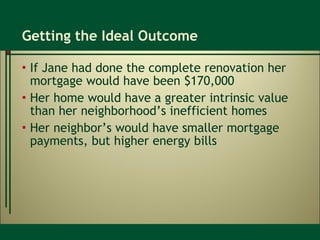

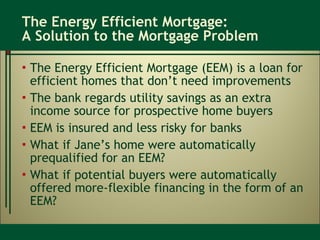

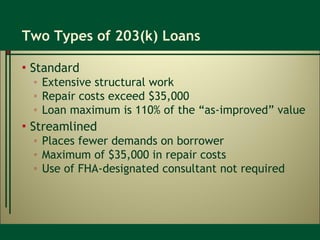

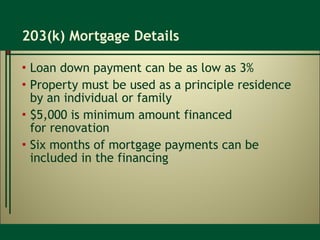

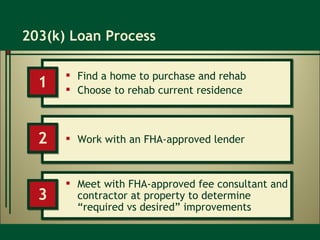

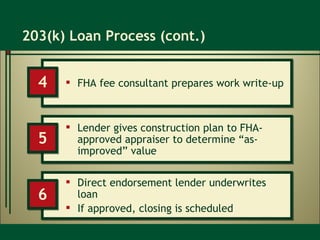

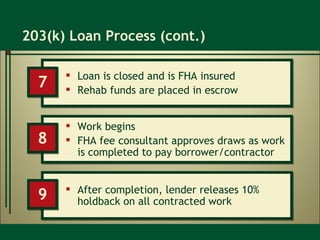

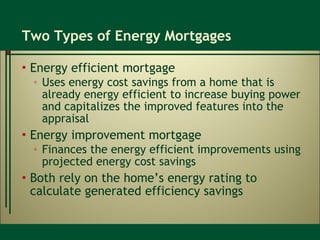

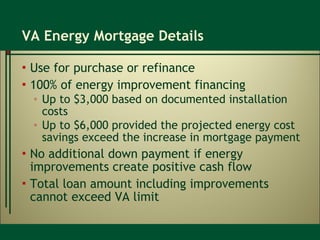

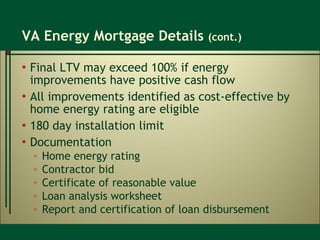

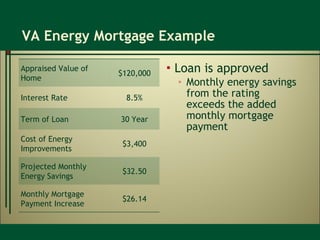

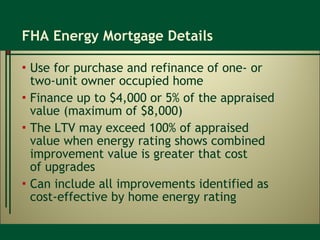

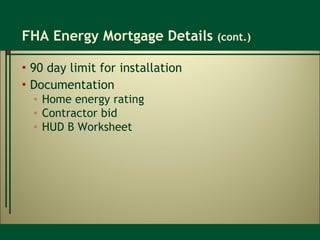

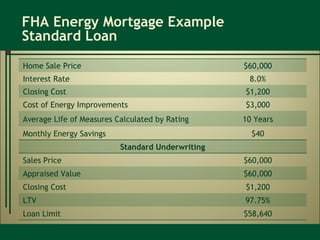

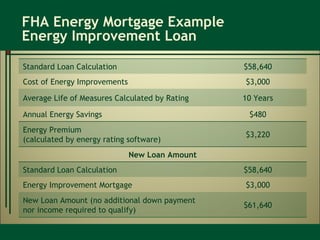

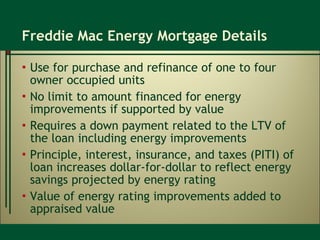

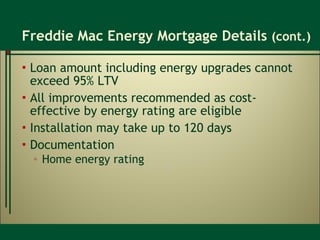

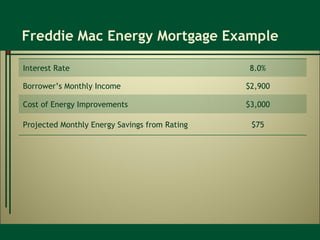

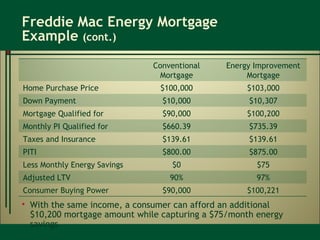

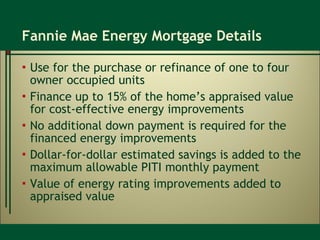

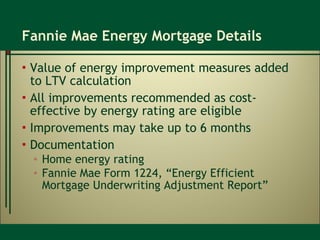

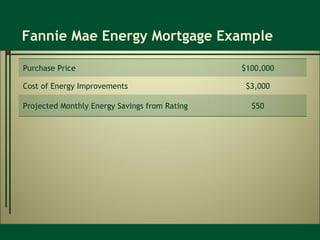

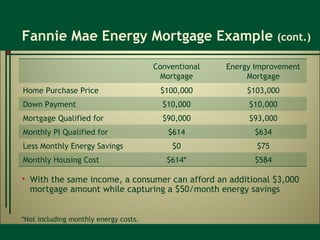

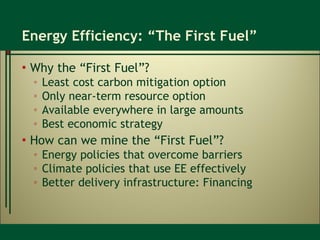

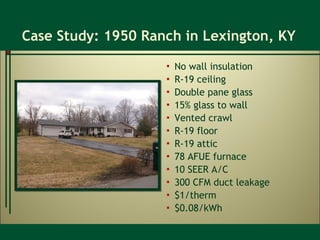

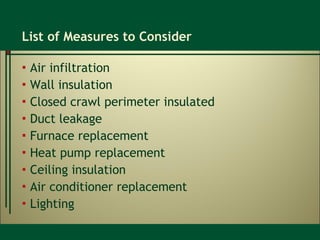

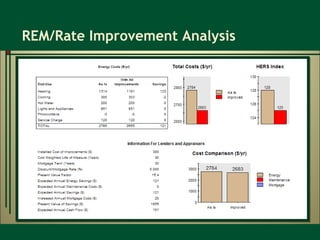

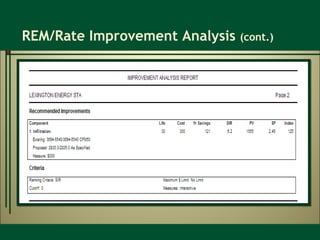

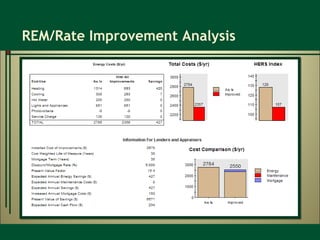

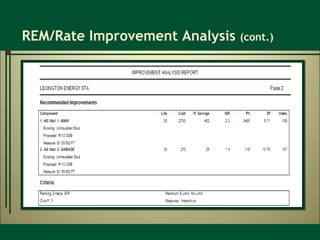

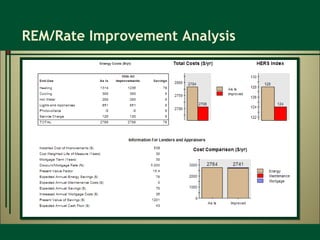

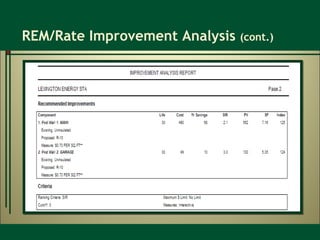

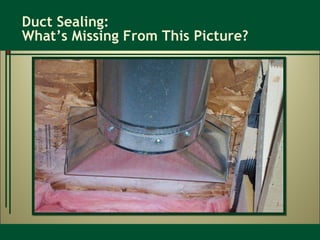

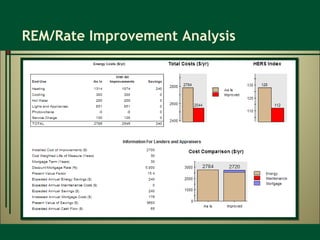

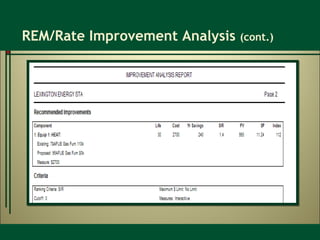

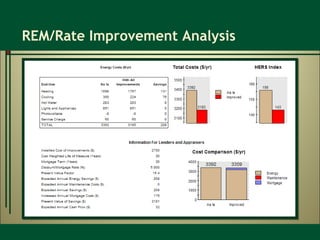

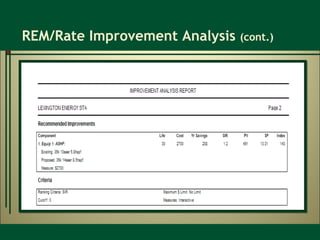

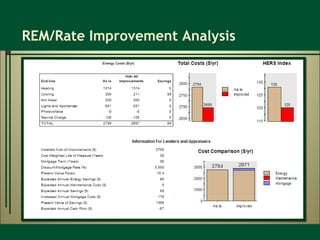

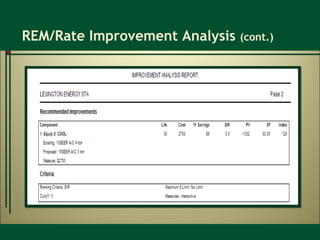

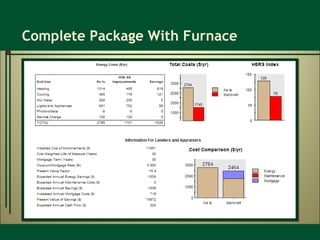

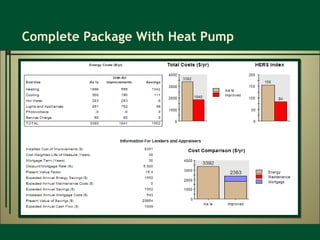

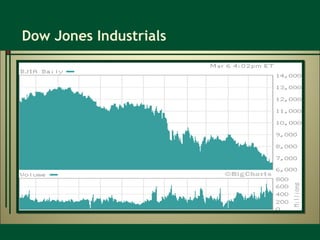

The document discusses various financing options for homeowners to incorporate energy efficiency and design upgrades into existing homes. It outlines programs like FHA 203(k) loans, VA and FHA energy mortgages, and Freddie Mac and Fannie Mae energy programs that can help finance such upgrades. Case studies show how whole-home energy ratings are used to estimate savings from improvements and determine financing eligibility. Flexible terms and cooperation across stakeholders are needed to fully utilize these energy improvement mortgage programs.

![Creative Financing, Energy, and Design Options for the Residential Market David Lantz Owner Shelterwood [email_address] www.prairiegreenhomes.com](https://image.slidesharecdn.com/swcreativefinancing2-25-110221171953-phpapp01/75/Sw-creative-financing-2-25-1-2048.jpg)

![Questions www.prairiegreenhomes.com David Lantz Owner Office: 812-333-2991 Cell: 812-325-6931 [email_address] Mark Quigley Energy Consultant Office: 812-333-2991 Cell: 812-325-5299 [email_address]](https://image.slidesharecdn.com/swcreativefinancing2-25-110221171953-phpapp01/85/Sw-creative-financing-2-25-111-320.jpg)