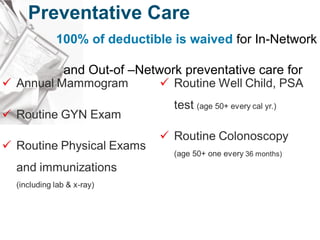

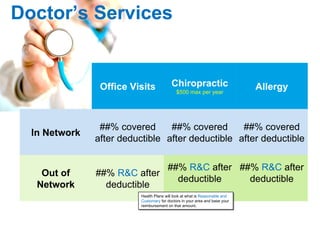

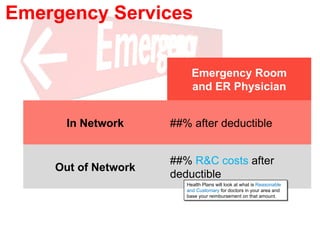

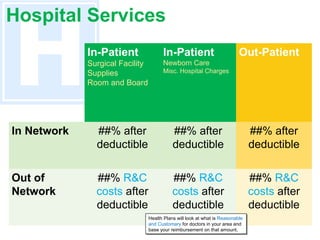

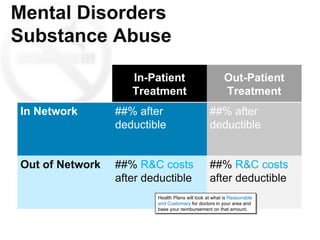

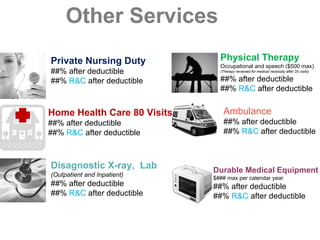

This document summarizes the key health benefits included in an insurance plan, including deductibles, out-of-pocket maximums, coverage for preventative care, hospital services, prescription drugs, doctors' services, emergency services, mental health services, and other benefits. Preventative care is covered at 100% in or out of network. Coverage levels for services vary depending on whether the provider is in-network or out-of-network. Deductibles and out-of-pocket maximums apply to most in-network and out-of-network benefits.