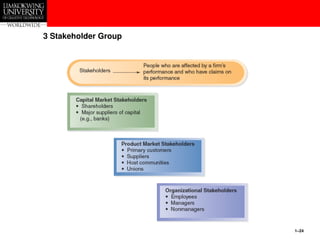

This document discusses strategic management concepts including the strategic management process, competitive advantage, and strategic competitiveness. It covers three key aspects: vision and mission statements which specify an organization's goals and objectives; stakeholders which are individuals and groups that can impact an organization's strategic outcomes; and strategic leaders who use the strategic management process to help an organization achieve its vision.