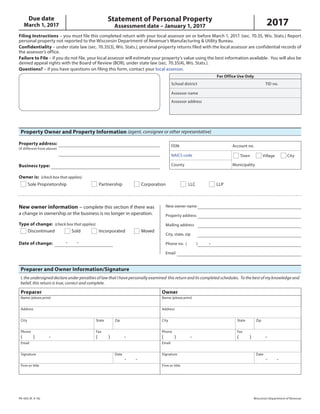

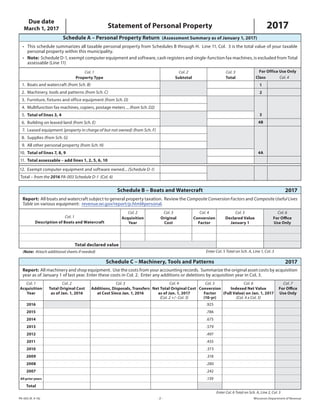

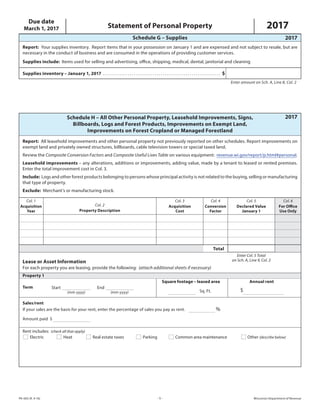

The document outlines the requirements for filing the Wisconsin Statement of Personal Property Assessment due on March 1, 2017, detailing the necessary steps for property owners to report their personal assets. It emphasizes the confidentiality of the returns, consequences of failing to file, and the various types of personal property that must be included in the assessment. Additionally, it provides guidance on reporting changes in ownership, listing different categories of property, and completing schedules for detailed asset reporting.