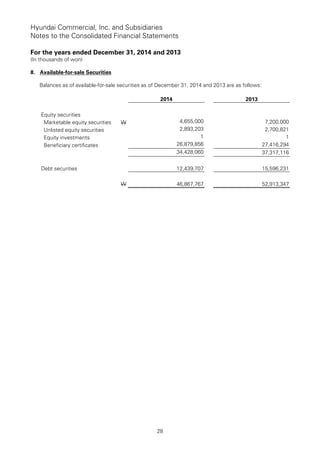

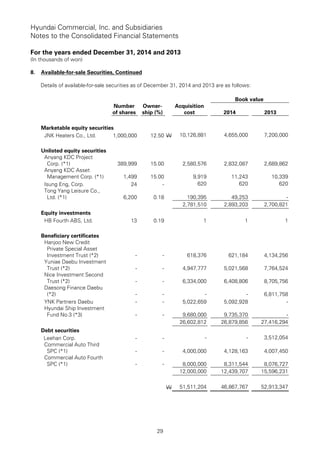

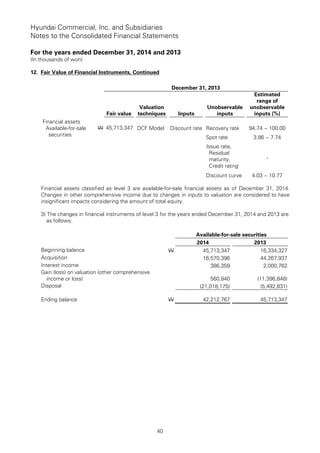

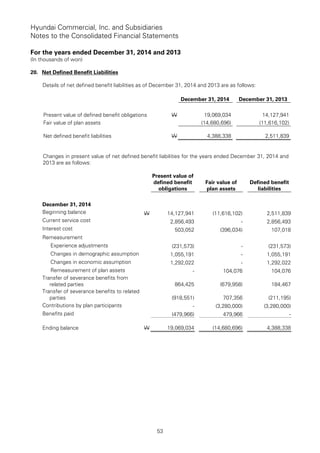

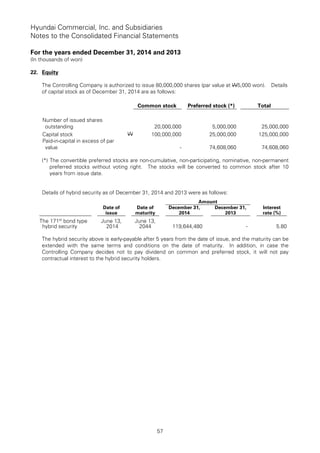

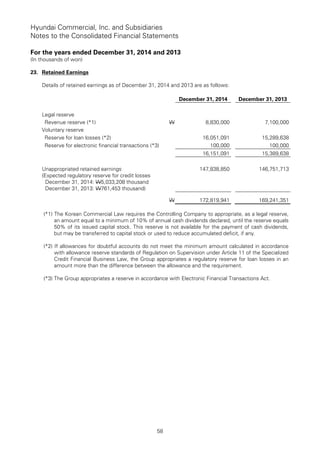

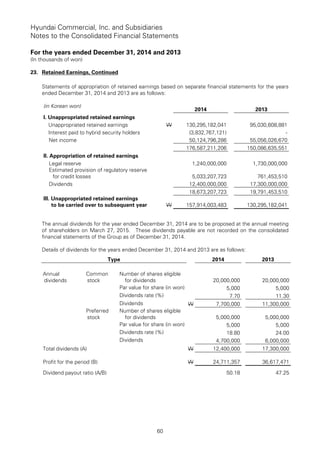

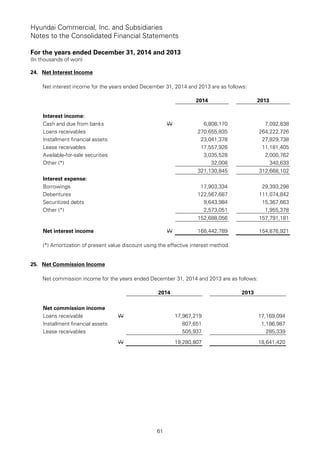

- Hyundai Commercial, Inc. and Subsidiaries consolidated financial statements for years ending December 31, 2014 and 2013 are presented.

- The consolidated statements include the consolidated statements of financial position, comprehensive income, changes in equity, and cash flows for the periods.

- An independent auditor's report is also included which provides an unmodified opinion that the consolidated financial statements present fairly the financial position and financial performance of Hyundai Commercial, Inc. and Subsidiaries for the periods ended December 31, 2014 and 2013 in accordance with Korean International Financial Reporting Standards.