Banks' Key Roles and Services

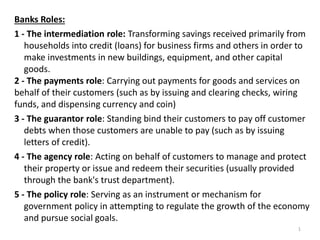

- 1. Banks Roles: 1 - The intermediation role: Transforming savings received primarily from households into credit (loans) for business firms and others in order to make investments in new buildings, equipment, and other capital goods. 2 - The payments role: Carrying out payments for goods and services on behalf of their customers (such as by issuing and clearing checks, wiring funds, and dispensing currency and coin) 3 - The guarantor role: Standing bind their customers to pay off customer debts when those customers are unable to pay (such as by issuing letters of credit). 4 - The agency role: Acting on behalf of customers to manage and protect their property or issue and redeem their securities (usually provided through the bank's trust department). 5 - The policy role: Serving as an instrument or mechanism for government policy in attempting to regulate the growth of the economy and pursue social goals. 1

- 2. The perfect banking advance therefore should be: (1) safe; (2) liquid; and (3) profitable. These requirements will seldom be present together, so that most of the time the banker is working out an acceptable compromise, and exercising the art of lending to the end that. 2

- 3. BANKING SERVICES FIRST: LENDING MONEY (1) overdraft Interest is calculated on a daily basis. The advance will be agreed subject to repayment in full at a certain time, or by periodic installments to extinguish the overdraft after a certain time. Interest rate is fixed by reference to the bank’s base rate. The overdraft is taken on the current account. 3

- 4. (2) loan The amount agreed is transferred from a newly-opened loan account to the customer’s current account. The loan is reduced at agreed intervals, often monthly, by transfers from the current account. Loan interest is charged quarterly or half-yearly on the amount of the loan still outstanding, and is charged to the current account. The rate of interest is fixed by reference to the bank’s base rate. (3) personal loan Interest is added to the amount borrowed and the total is then re-paid by regular monthly repayments, over an agreed period, usually anything from six months to three years. The borrower has to make out an application give certain details of his income and regular outgoings. Personal loan gives the bank no rights over the object purchased with the money lent, but the agreement requires that if any installment is not paid on time, the whole of the remaining debt should re-pay immediately. This gives the bank a right to bring an action for the money. 4

- 5. Second: 1- Current Accounts: The normal banking account, running from day to day, a balance being shown at the end of the day if there has been any transaction on the account. The balance should be credit all the time. No interest is normally allowed on a current account by most of banks but interest can be obtained with the Co-operative Bank, the Trustee Savings Banks and the National Savings Bank. Direct Debiting: Here the creditor of an installment payment makes, by arrangement with the debtor, a direct claim on the debtor’s account. This procedure saves time and money and is very suitable for large creditors such as insurance companies and building societies, The customer has to approve the arrangement before any transfers are made, and authorize his banker to meet the claims. Regular payments so authorized continue until further notice by the customer. The customer should be aware about his account balance should be enough on the time, otherwise, a charge and fines will be applied. Standing orders: Customers who have a regular payment to make, such as mortgage or rate installments, may give their bank a written authority to make the payments on their behalf to the debit of their current accounts, until further notice, or for a fixed number of payments, or until a certain date. 5

- 6. 6 Cash Dispenser: A machine designed to give the customer access to a small amount in notes, principally intended for use during the closing hours of the bank. It consists of a safe let into the outer wall of the bank with a keyboard. The customer is issued with a cash card having an electronic check by the machine. If this is satisfactory the customer is then enabled to key his personal code number on the keyboard, which will prompt the machine to deliver required amount in EGP. 10 or any amount in notes. Collection of cheques: The customer receives cheques from his debtors and pays these into his bank either over the counter, or by post. The cheques are sorted by the recipient bank and at the end of the day are dispatched to their Cairo office, who presents them to the drawee banks through the Clearing House. The clearing procedure takes three working days and if a cheque is dishonored the collecting branch will be notified. The customer’s account is credited on the day that he pays the cheque in, but he should not draw against them until they are cleared (unless he has an agreement with the bank that he may do so).

- 7. 7 2- Deposit Accounts: Money is put on deposit accounts to earn interest. Deposit interest is paid at a rate determined by the bank’s base rate. No cheque book is issued. Withdrawals are nominally at seven days’ notice, but money can be obtained on demand, subject to a forfeiture of seven days’ interest on the sum withdrawn. Interest is credited to the current account, if there is one, half- yearly, otherwise it is added to the balance of the deposit account. Fixed deposits of lager sums can be arranged for an agreed term at rather better rates. Budget scheme: This is a scheme whereby a customers’ regular payments out over a year are evened out and debited to him by equal monthly sums. The customer advises his bank of the details of his expected outgoings (e.g. electricity, gas, telephone, fuel, insurance, licenses, school fees, holidays, clothing, subscription, maintenance, etc). The bank totals the annual cost, opens a budget account for the customer, and issues him with a special budget account cheque book. Thereafter the bank will debit the customer’s ordinary current account, and credit the budget account, with a monthly sum equal to one-twelfth of the annual total. The service costs a few pounds per year.

- 8. 8 Savings Account: Accounts maintained for small amounts, designed to encourage saving by young people. They carry interest. Withdrawals may be made at any time at the branch where the account is kept, up to any amount, on production of the savings book; and at any branch of the bank. 3- Credit Cards: Credit cards are similar in size and general appearance to Debit cards, and contain similar details. The best known cards in this country are Visa, and American Express. With the credit card, goods can be bought in a shop, hotel bills paid, meals out paid for, air fares met, in many parts of the world. The retailer sends in his account to the card company which sends out monthly statements to each cardholder. The cardholder should pay the statement during 45-60 days.

- 9. Third: Other Services: 1- Safe Custody: Articles of value, wills, and many other things can be left by customers with their banks for safe keeping. Everything must be either placed in a locked box, the customer retaining the key, or sealed in a parcel. The bank will issue a receipt if it is asked to do so. The bank may make no specific charge for this service. Some banks maintain a safe deposit service, where the customer is given access to the strong-room and himself puts the articles or documents of value into his box, or safe cubicle, to which he alone has the key, or takes them out. 2- Night Safe: A customer wishing to pay in regularly after the bank has closed may be offered a night safe wallet. He puts his credit and the cash in the wallet, locks it, and then inserts it in an opening in the outer wall of the bank so that it falls into the night safe. The entrance to the chute has a locked cover to prevent undesirable items being inserted. In the morning the bank’s staff clears the night safe and sort out the two types of wallet available. The service is particularly suitable for shop keepers wishing to bank their days’ takings after the shop has been shut, and avoids their having to take the money home with them or leave it in the shop. 9

- 10. 10 3- Computer Services: Selling a bank of time on one of its computers to a customer who has no computer of his own, but has a need from time to time for the use of one. 4- Hire-purchase: Hire purchase is now an integral part of the nation’s trade. The purchaser deals with the seller and the finance company finances the deal by paying the seller and accepting installments from the buyer. The regulations details to be specified for the benefit of the purchaser include the cash price of the goods or the amount of the loan, the cost of credit, the number and amount of installments and the total sum payable. The true interest rate must be specified, so that the purchaser can compare rates under different contracts.

- 11. 5- Income Tax Management: This work consists of preparing the customer’s annual statement of income and outgoings, claiming any allowances applicable, checking that the customer gets any rebate to which he is entitled and, generally, pays no more tax than he is obliged. The income tax department will also advise on ways to minimize tax payable, such as the setting up of certain trusts. 6- Insurance: The bank’s insurance department will arrange cover for any requirement of the customer, such as fire insurance, car and house insurance, and holiday insurance. The bank acts as an agent in this business, obtaining the best rate possible from insurance companies. A big advantage for customers of insurance cover effected through a bank is the complete reliability of that cover. 11

- 12. 12 7- Investment Management: The bank’s investment department will manage the portfolio of customers, attending to registrations, rights issue or bonus shares. The bank will review the securities in the portfolio from time to time, make any sales or purchases as seem desirable, and keep a running valuation of the portfolio. To be able to do this, the bank must have the investments transferred into its name. It will collect the dividends and interest and credit them to the customer’s account. An annual fee is charged, based upon the market value of the portfolio.