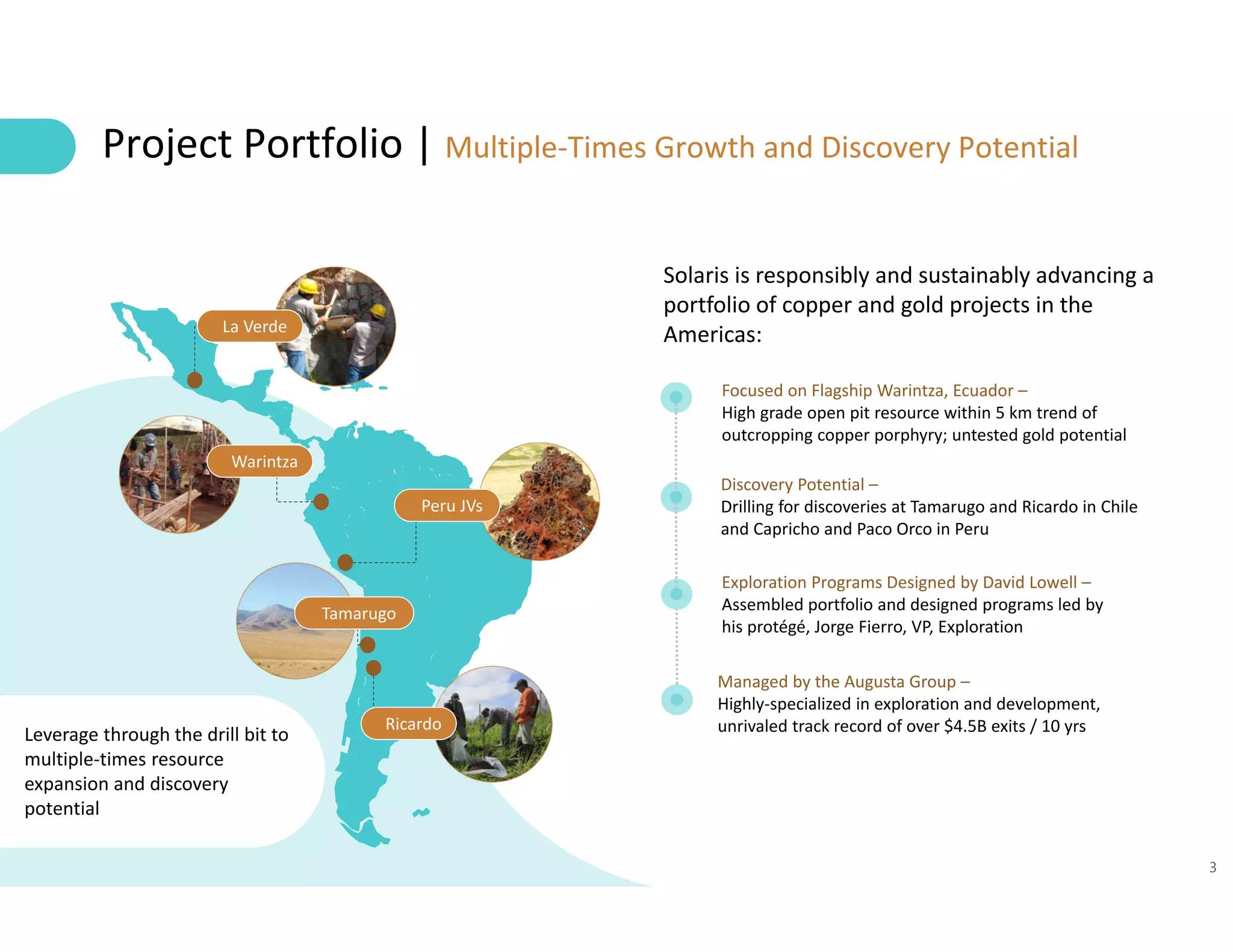

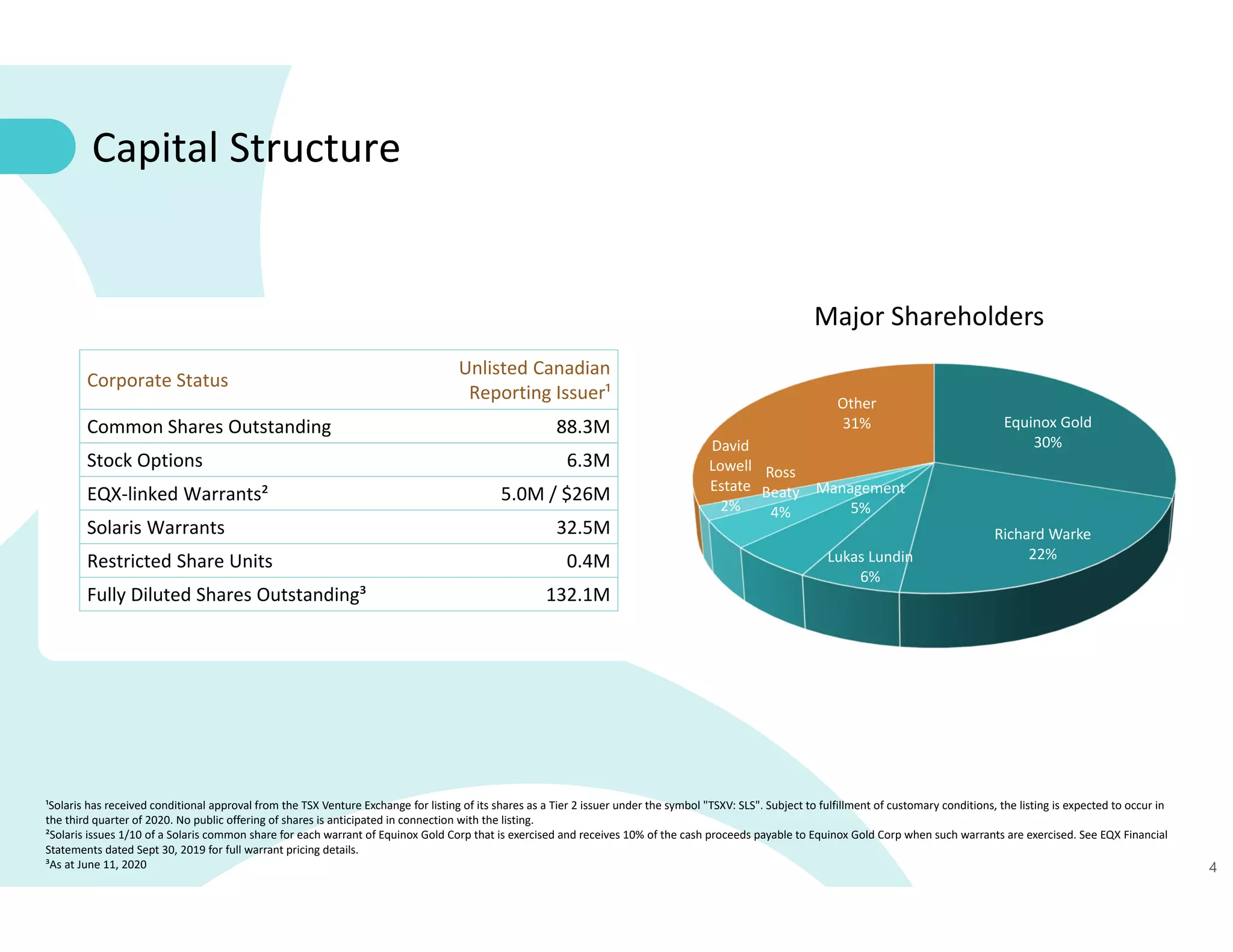

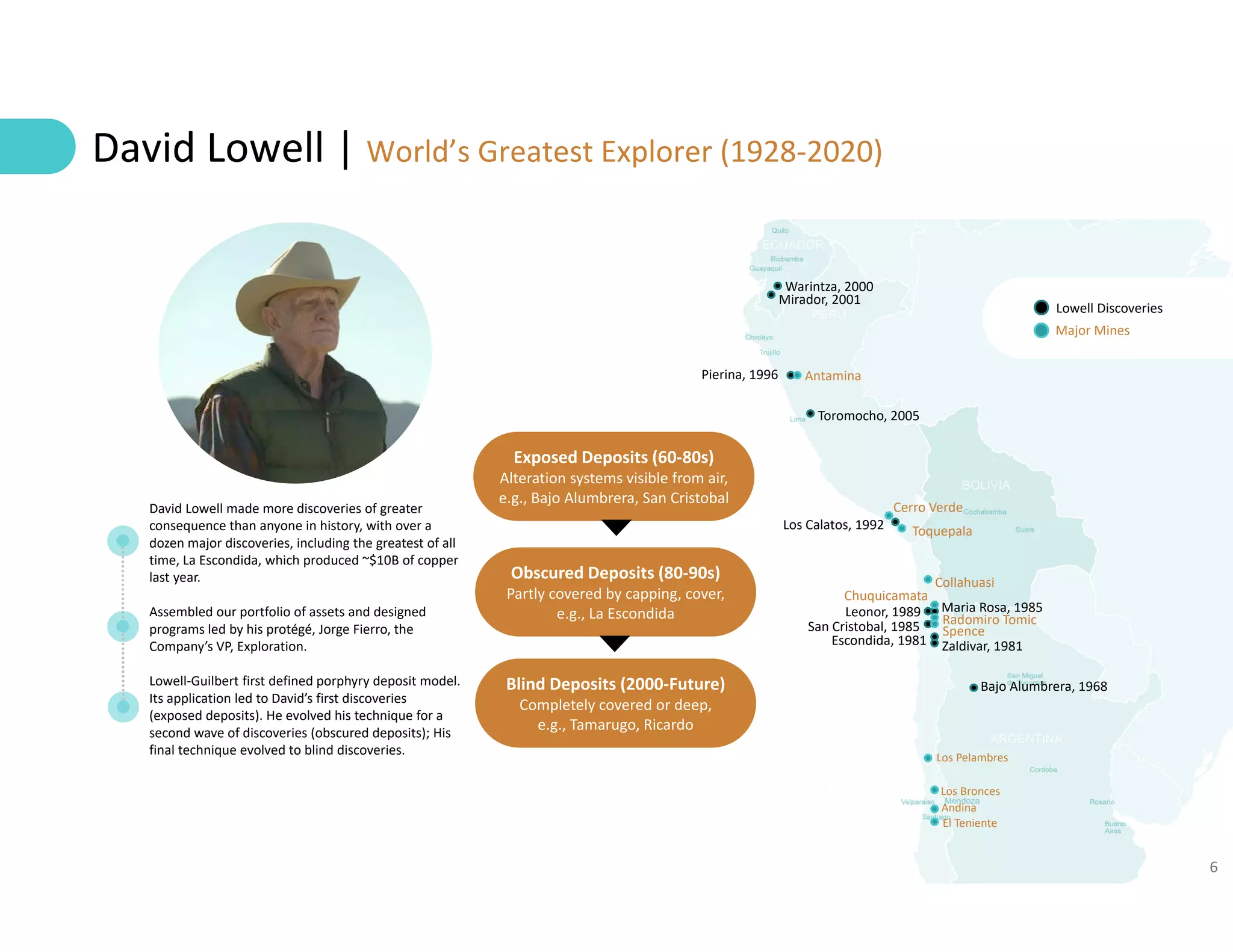

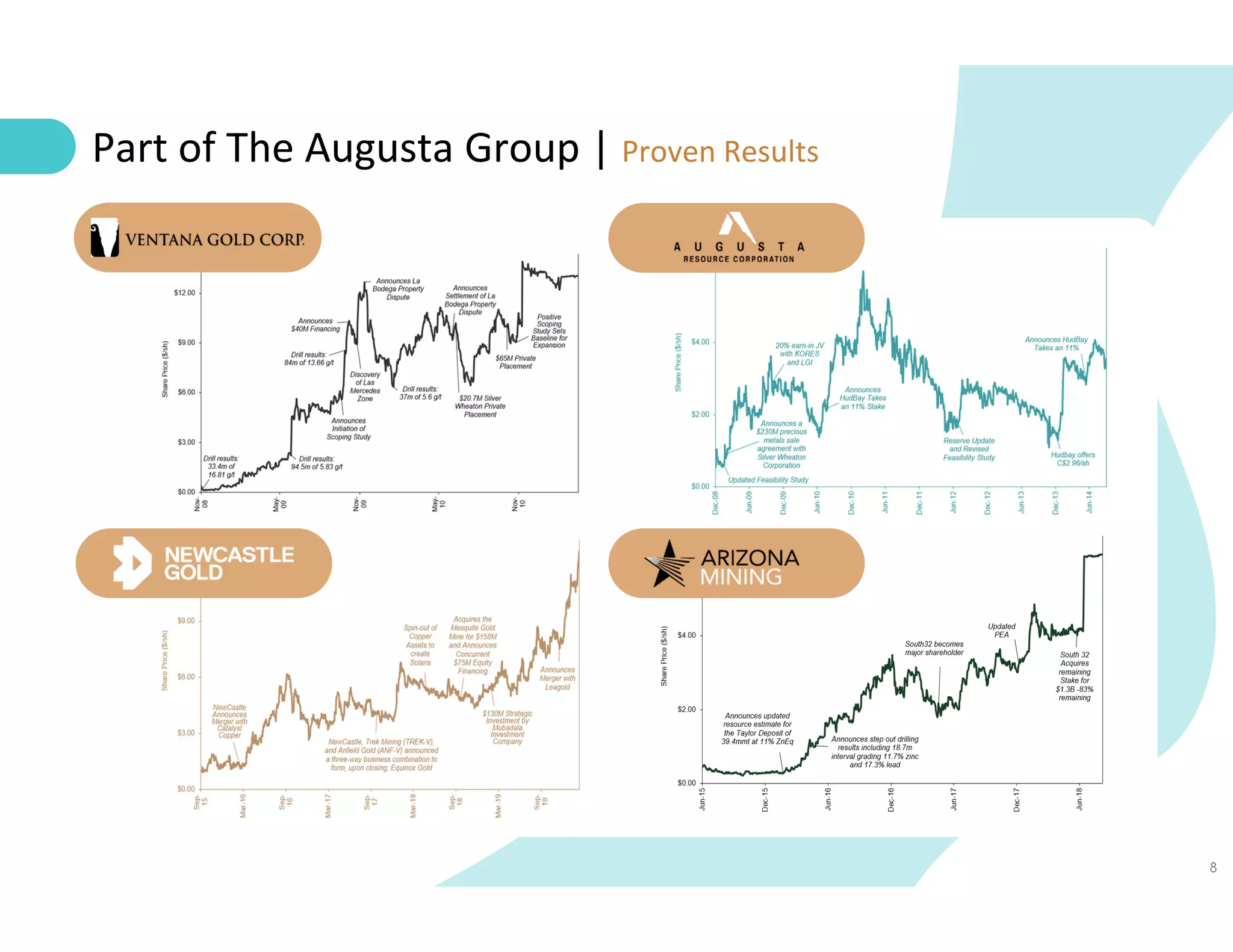

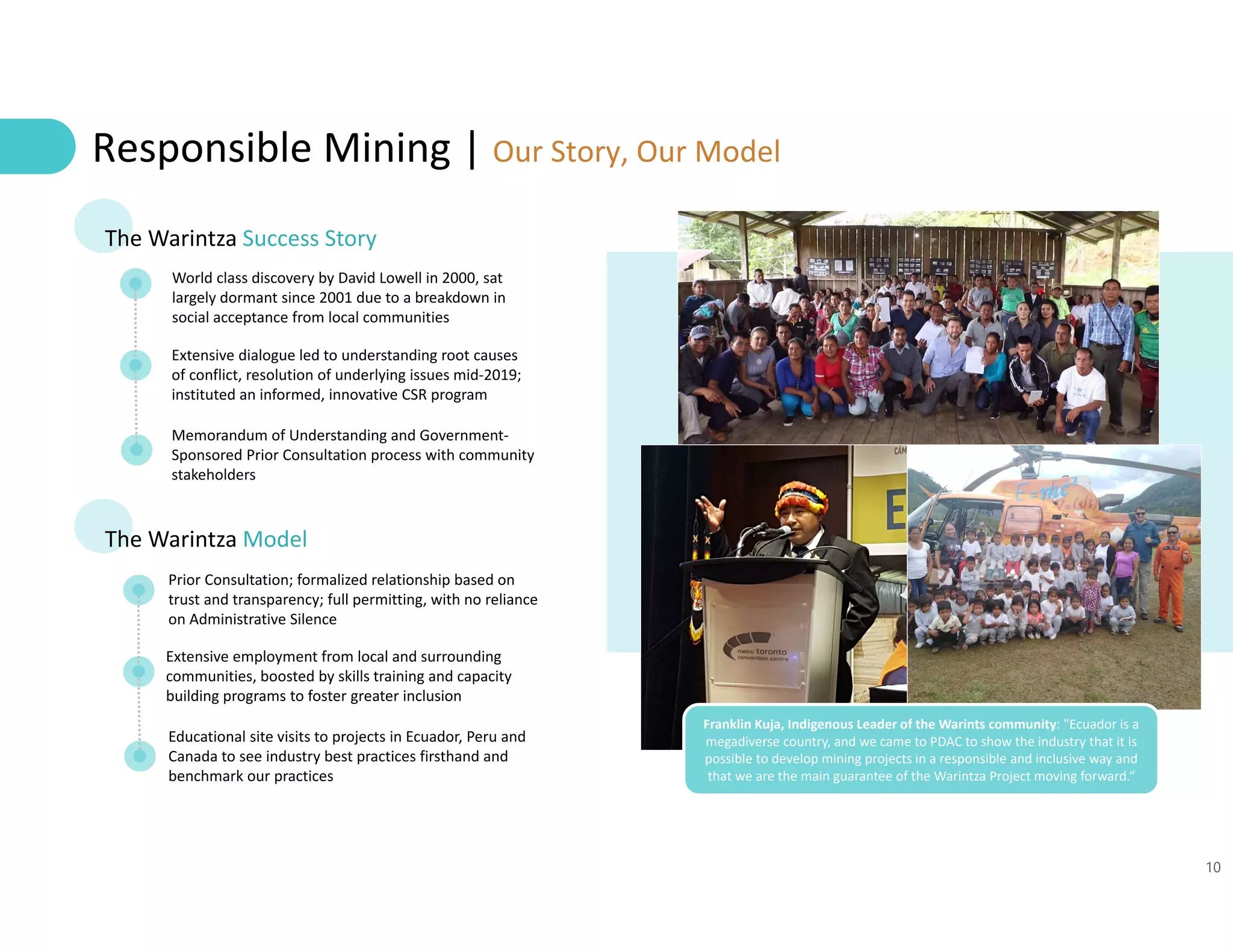

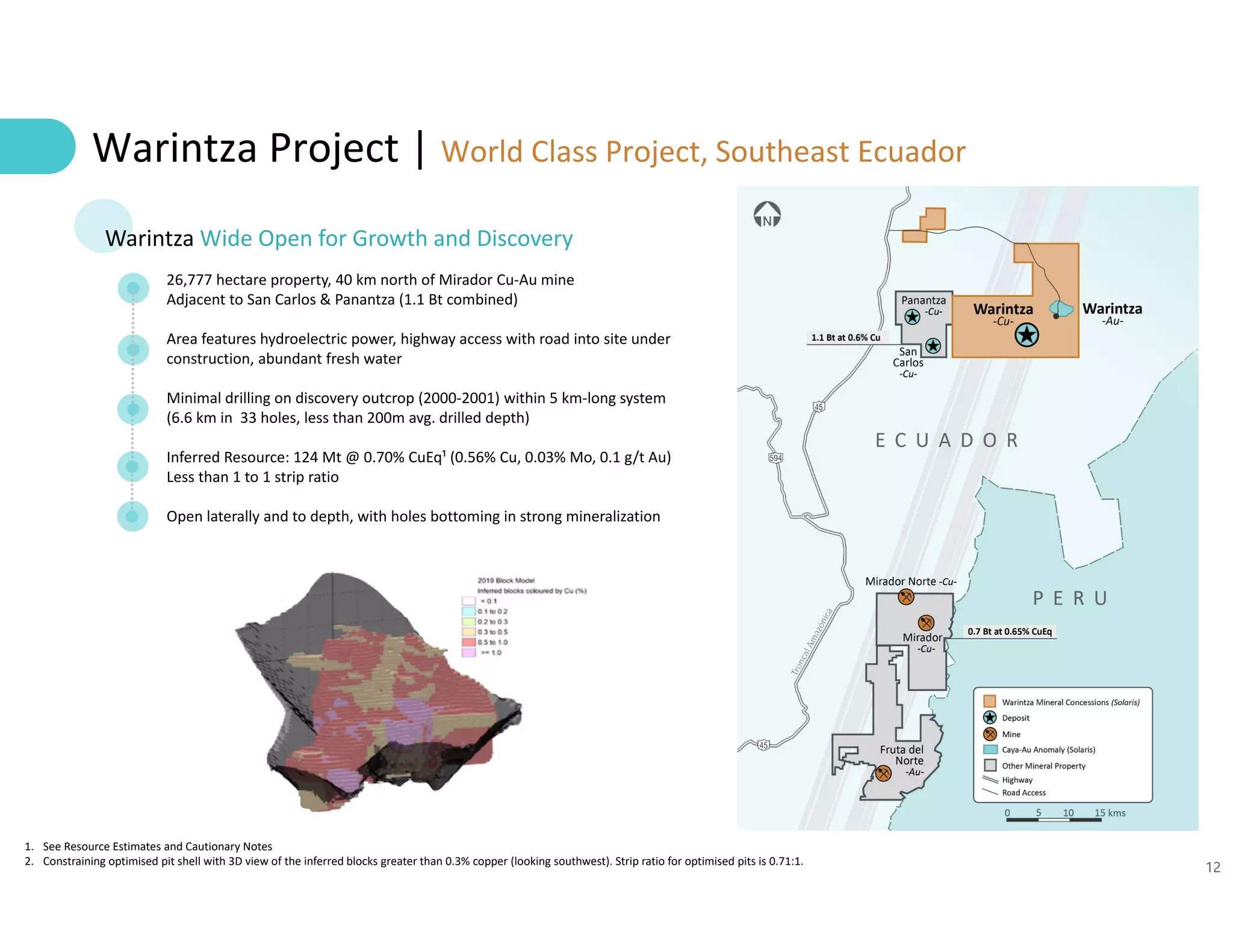

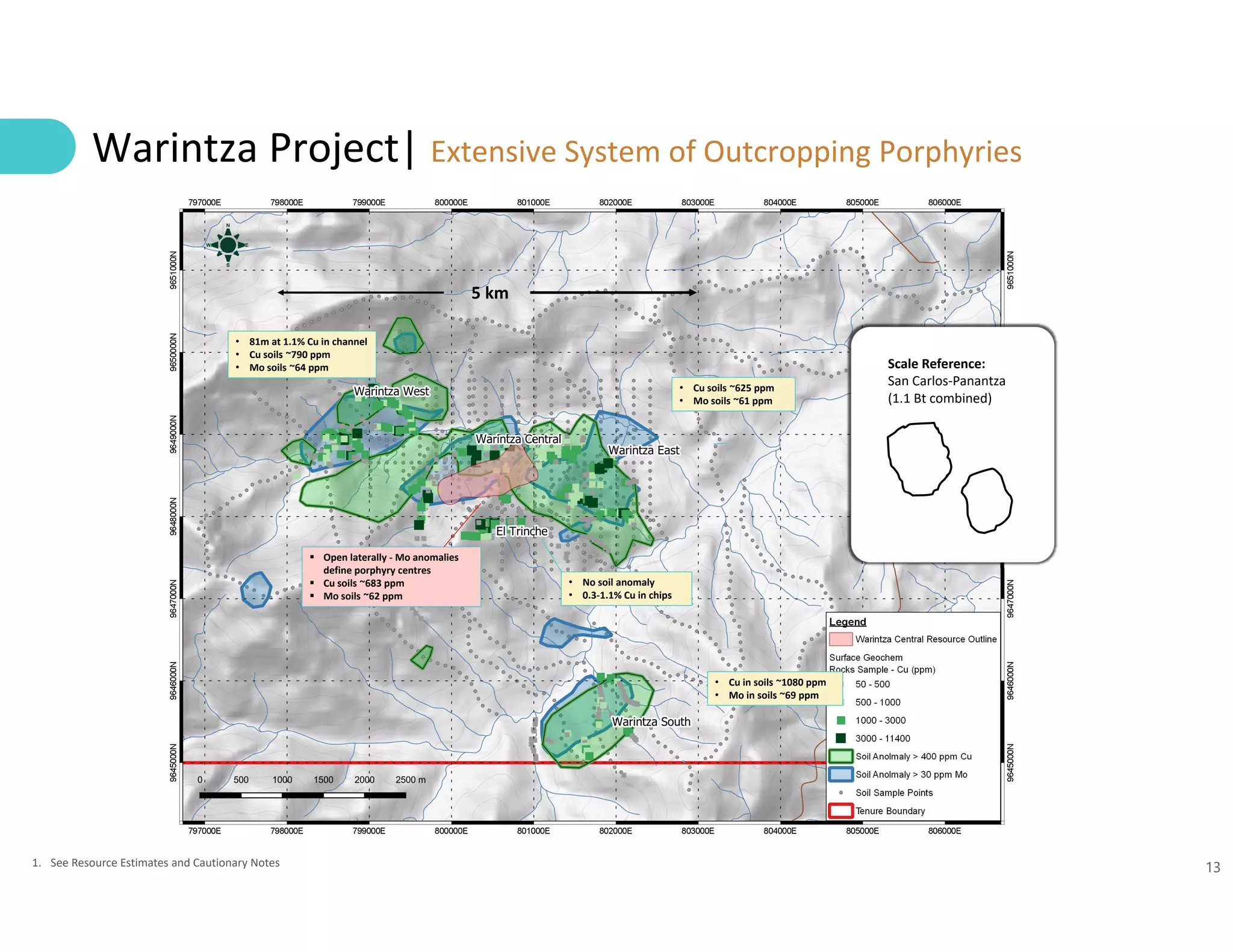

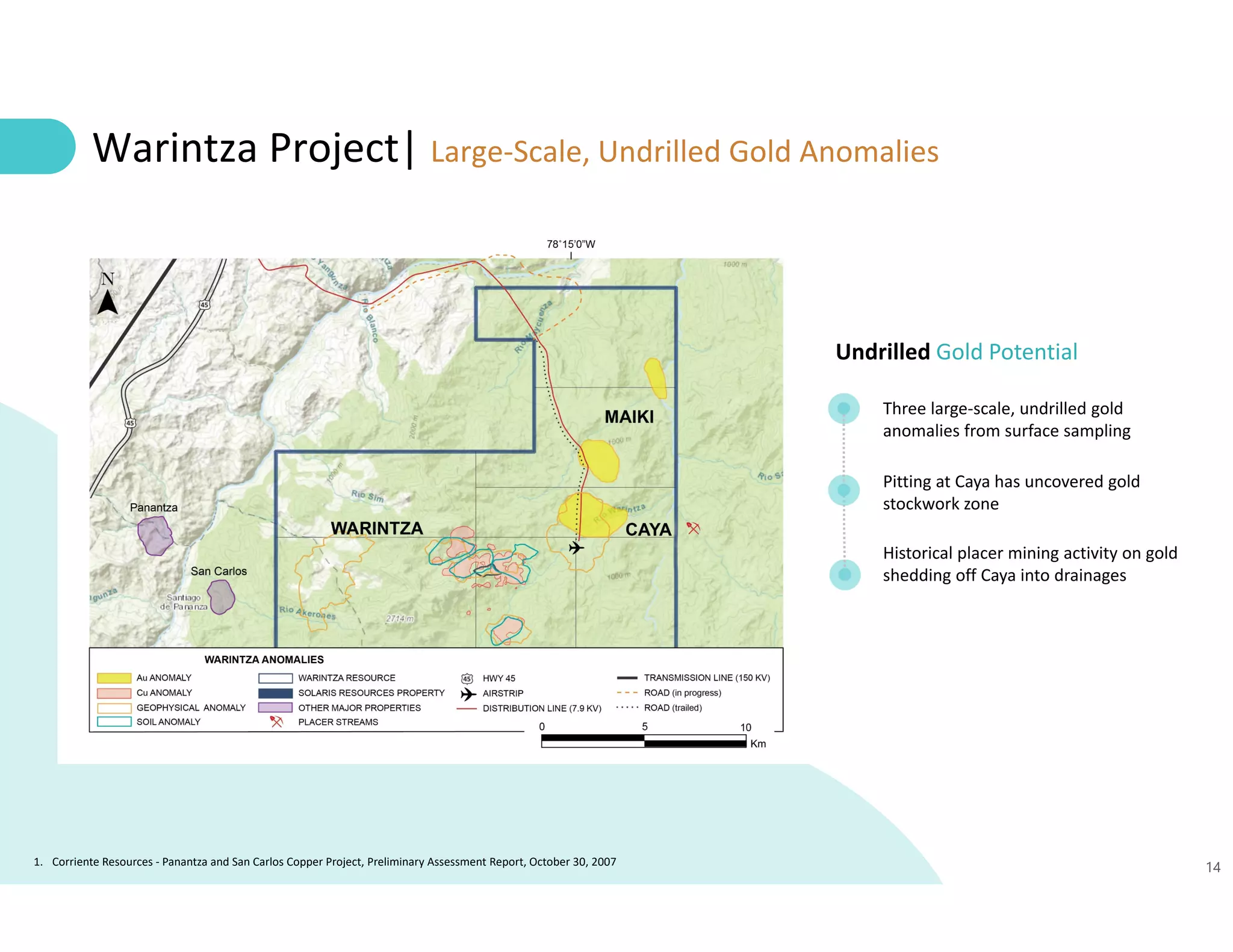

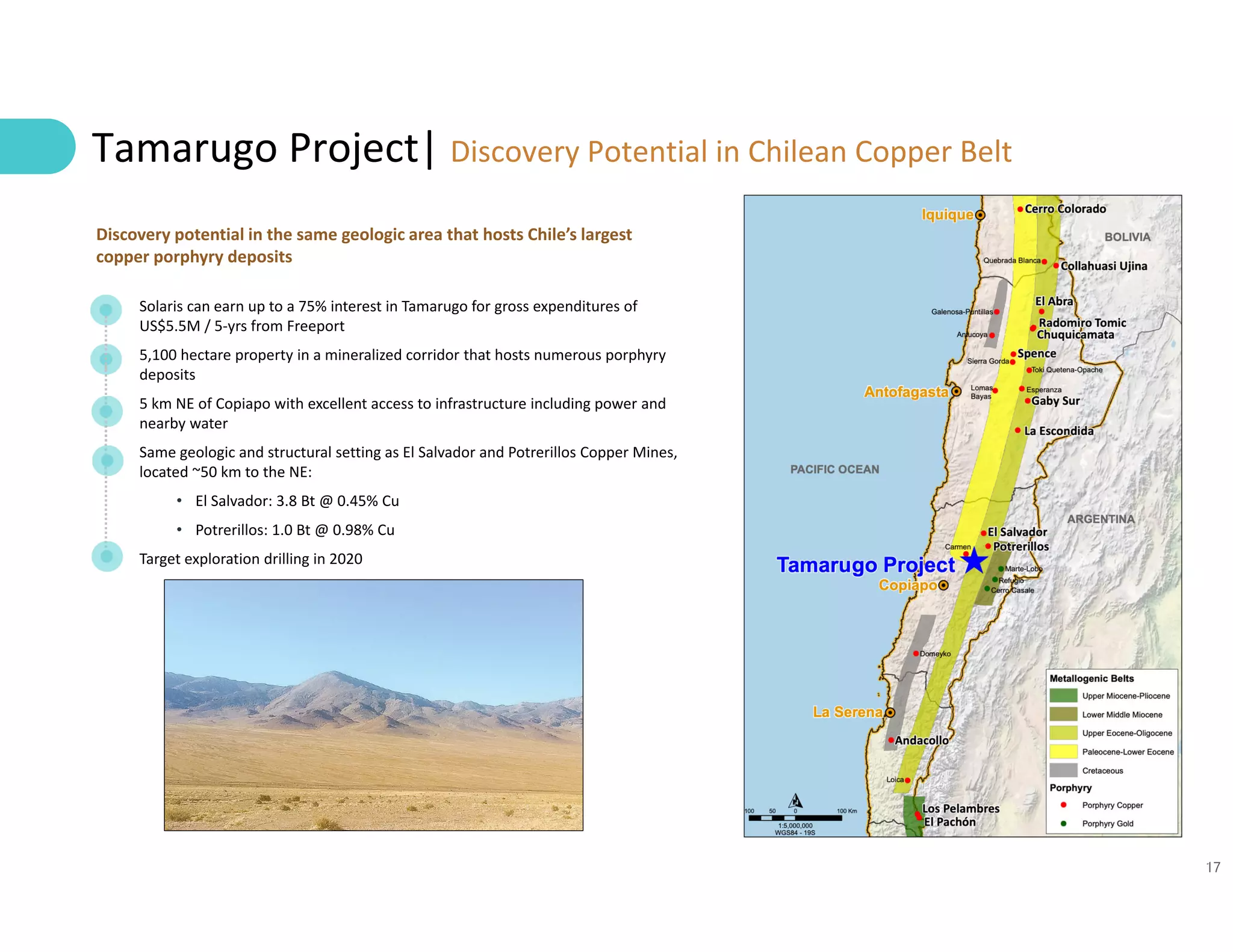

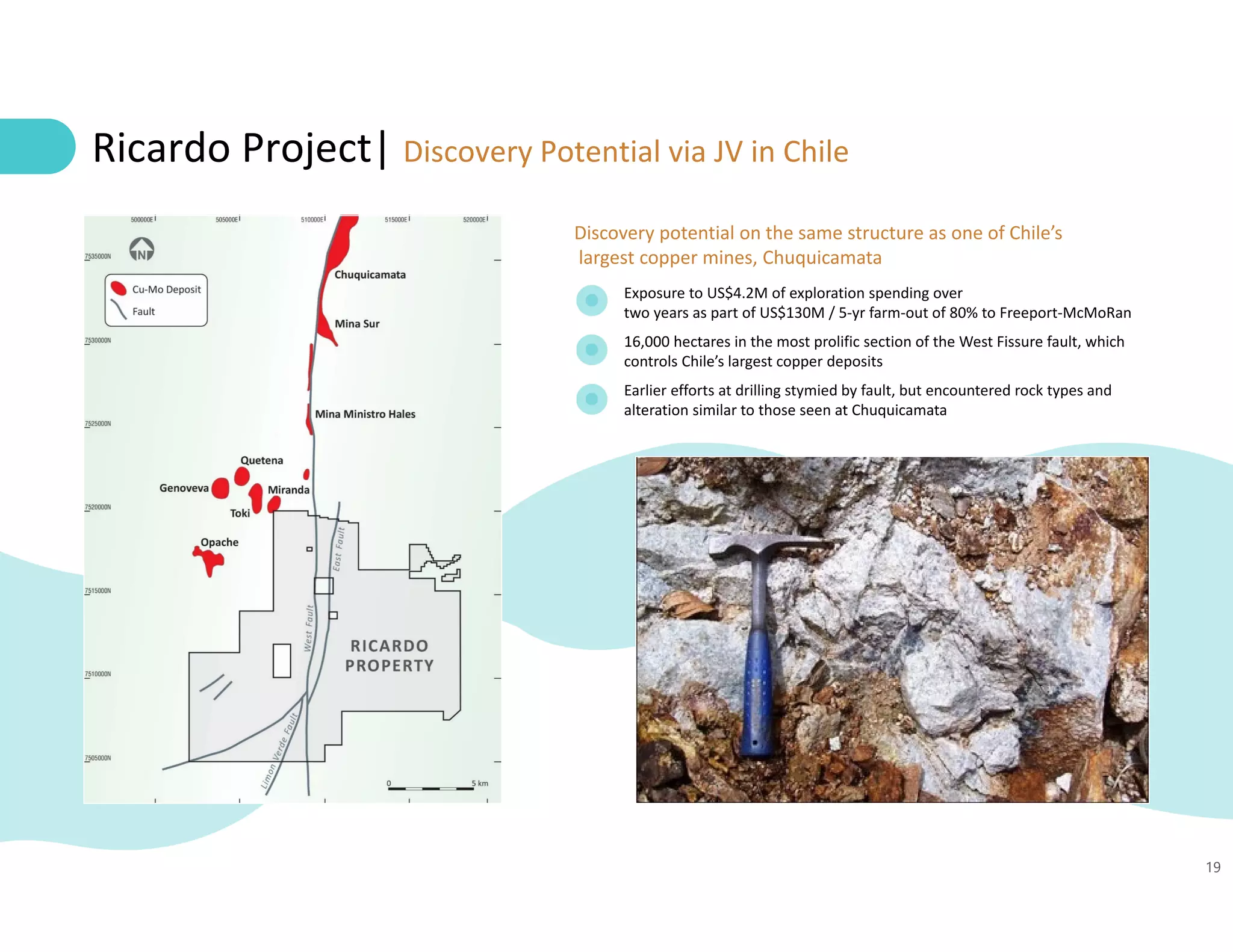

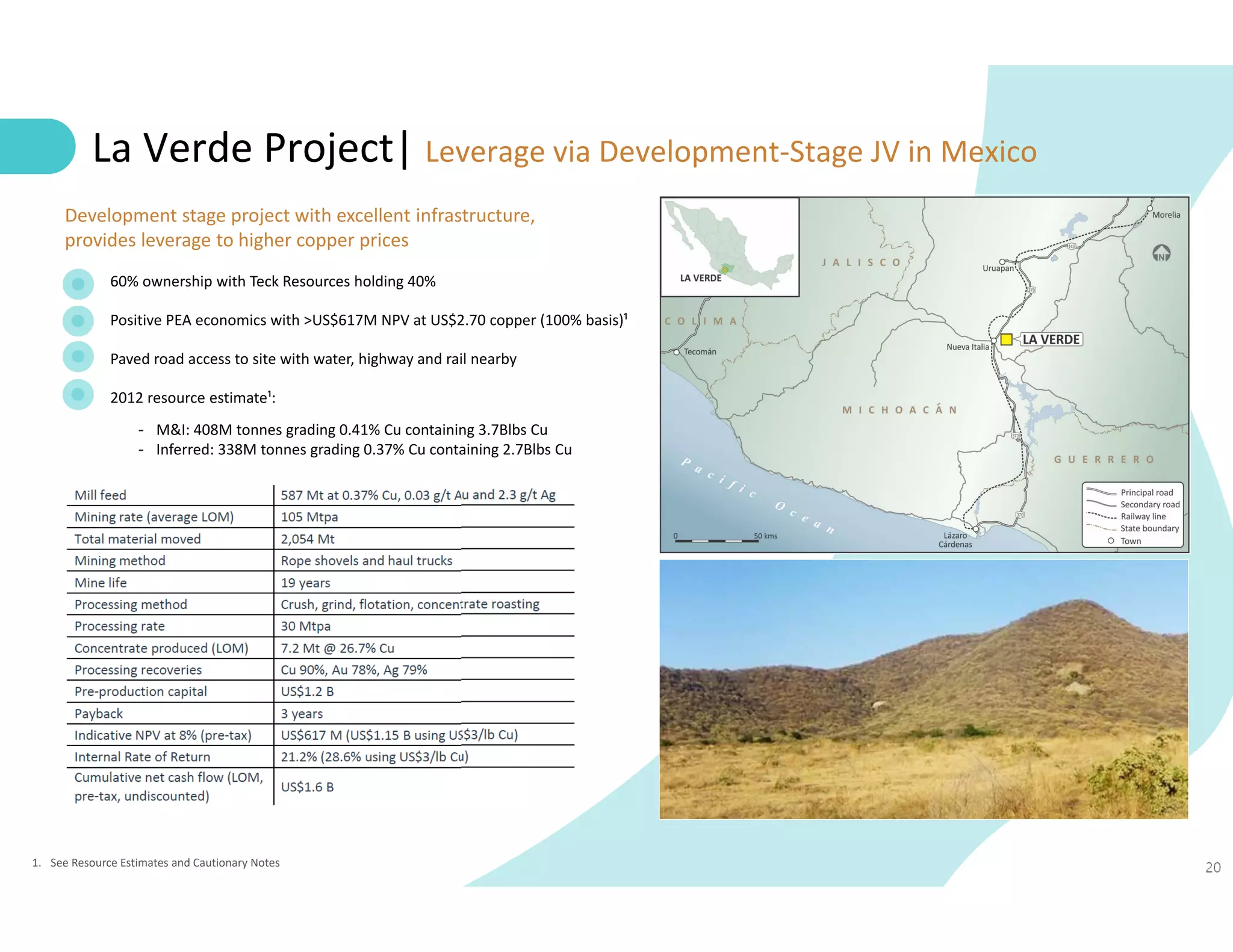

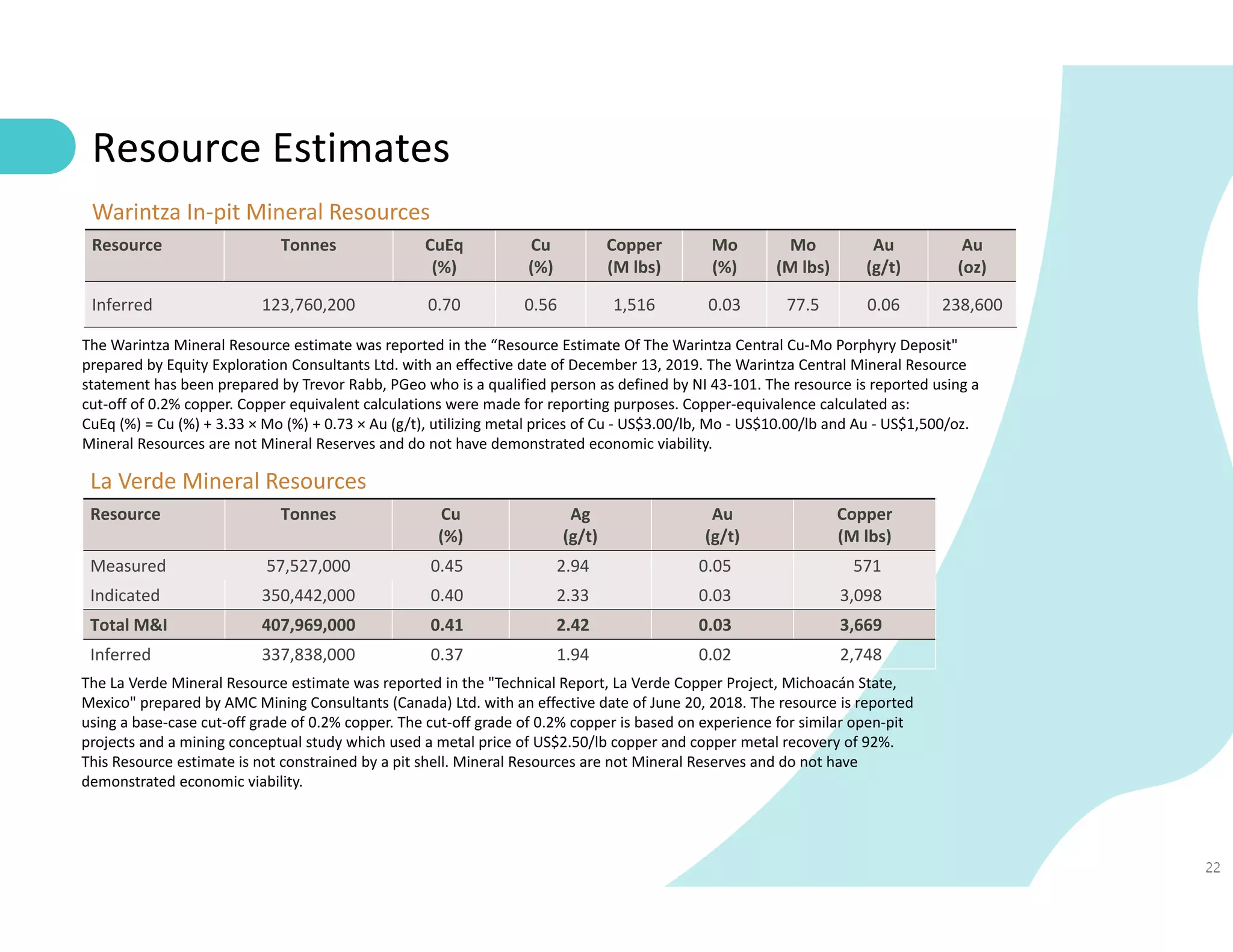

This presentation summarizes Solaris Resources' portfolio of copper and gold projects in the Americas. Solaris is focused on advancing its flagship high-grade Warintza copper project in Ecuador through drilling programs, with the goal of multiple-times resource expansion and discovery potential. Solaris also has exploration projects in Chile and Peru that it believes offer discovery potential. The company aims to leverage its projects through drilling to drive resource growth and discoveries, and is managed by the experienced Augusta Group with a track record of value creation through past mining exits and mergers.