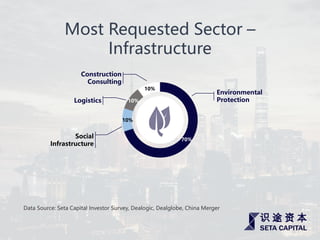

The document reports on the growth trends of China's outbound mergers and acquisitions (M&A) in 2016, highlighting an increase in both the number of deals and their total value. It outlines the sectors that are most sought after for investment, including technology, healthcare, automotive, energy, and infrastructure, in alignment with China's 5-year plans. Key rationales for these investments include acquiring technology, market value, and financial returns.