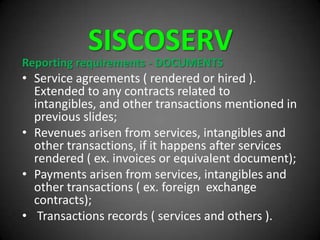

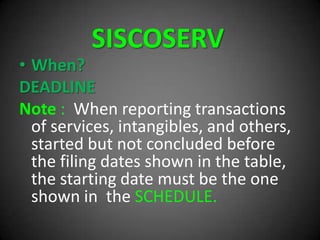

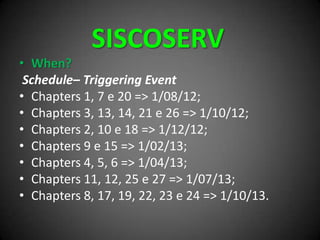

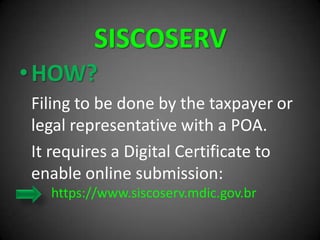

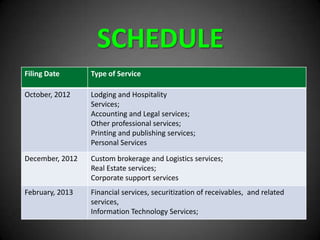

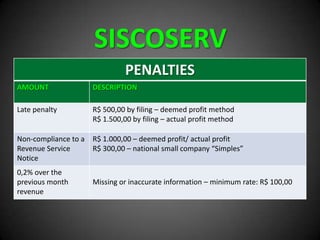

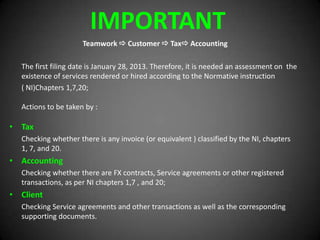

This document summarizes new Brazilian tax filing obligations for cross-border services and intangible transactions performed with Brazilian residents according to Normative Instruction IN1277. It outlines reporting requirements for services provided to or taken from foreign entities, intangible transactions, and other transactions that may impact net worth. It provides the deadlines and schedule for filing transaction reports either 180 days after the event or by the last working day of June for the previous year's transactions. It also describes the process for online filing through the SISCOSERV system and penalties for late or non-compliant filings.