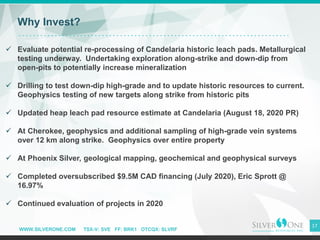

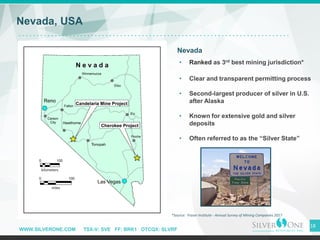

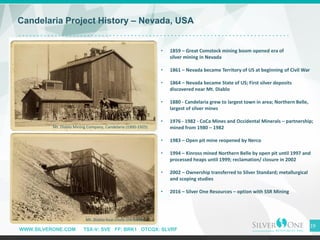

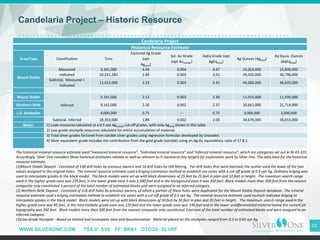

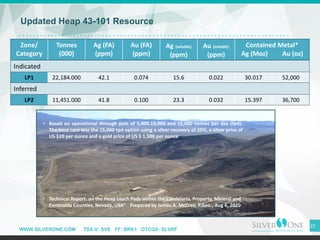

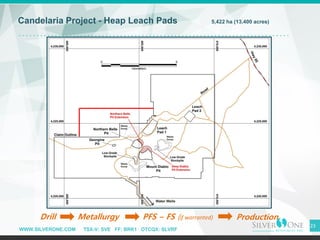

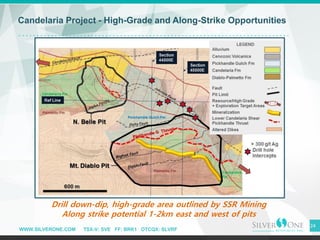

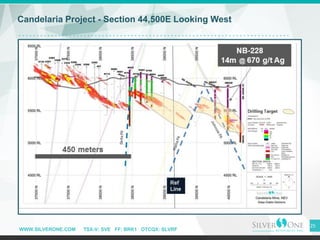

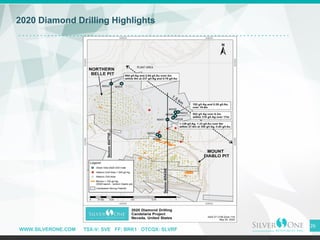

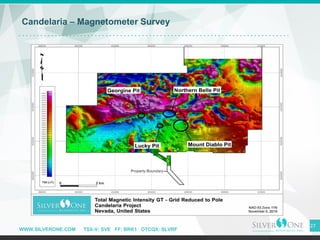

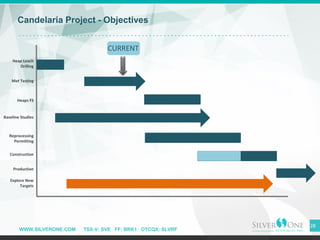

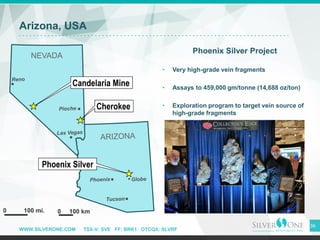

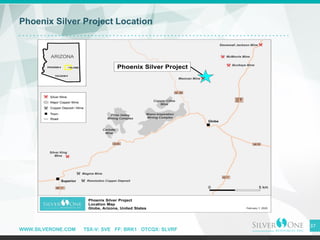

Silver One Resources is a silver exploration company with three highly prospective silver projects in Nevada and Arizona. The company's flagship project is the Candelaria Silver Project in Nevada, which hosts a large unexploited historic silver resource of 68 million ounces and multiple opportunities to create value through heap leach reprocessing, high-grade drilling, and exploration along strike from historic pits. Silver One is led by an experienced management team and has strong financial backing from investors to advance exploration and drilling programs at its projects throughout 2020 with the goal of advancing toward potential near-term production.