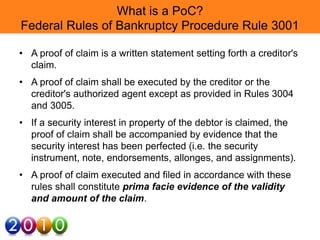

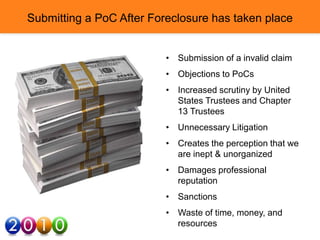

This document discusses preparing proofs of claim in bankruptcy cases involving foreclosed properties. It begins by defining what a proof of claim is according to bankruptcy rules, noting the documentation required to prove a security interest. It warns that filing invalid claims after foreclosure can result in penalties like sanctions. The document outlines signs a property has been foreclosed, like being omitted from bankruptcy schedules. It provides research tips for investigating foreclosure records online or with county clerks to verify sale details. Creating a thorough foreclosure record and notating findings is advised to avoid filing improper proofs of claim on properties already foreclosed.