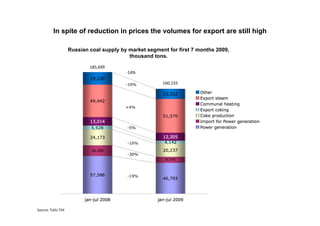

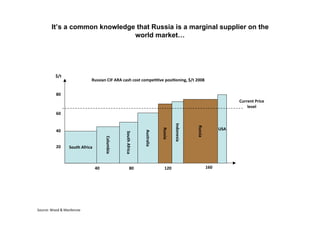

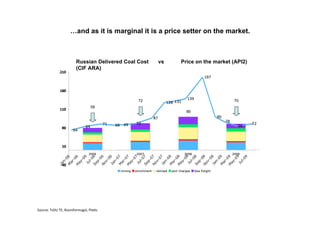

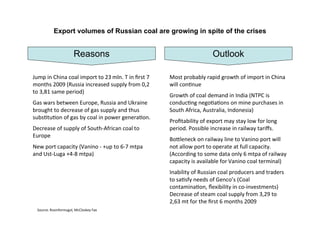

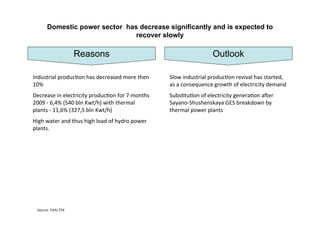

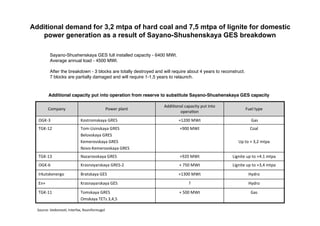

The document discusses Russian coal markets and prospects on export and domestic markets. It summarizes Russian coal supply and export volumes for the first 7 months of 2009. Export volumes grew despite the economic crisis due to increased demand from China and decreased supply from other countries. The domestic power sector decreased significantly due to the economic downturn but demand is expected to increase to replace the lost capacity of the Sayano-Shushenskaya hydroelectric station. Russian coal prospects look positive on export markets due to strong demand in China and India, and on the domestic market due to replacing the lost hydroelectric capacity.