Embed presentation

Download to read offline

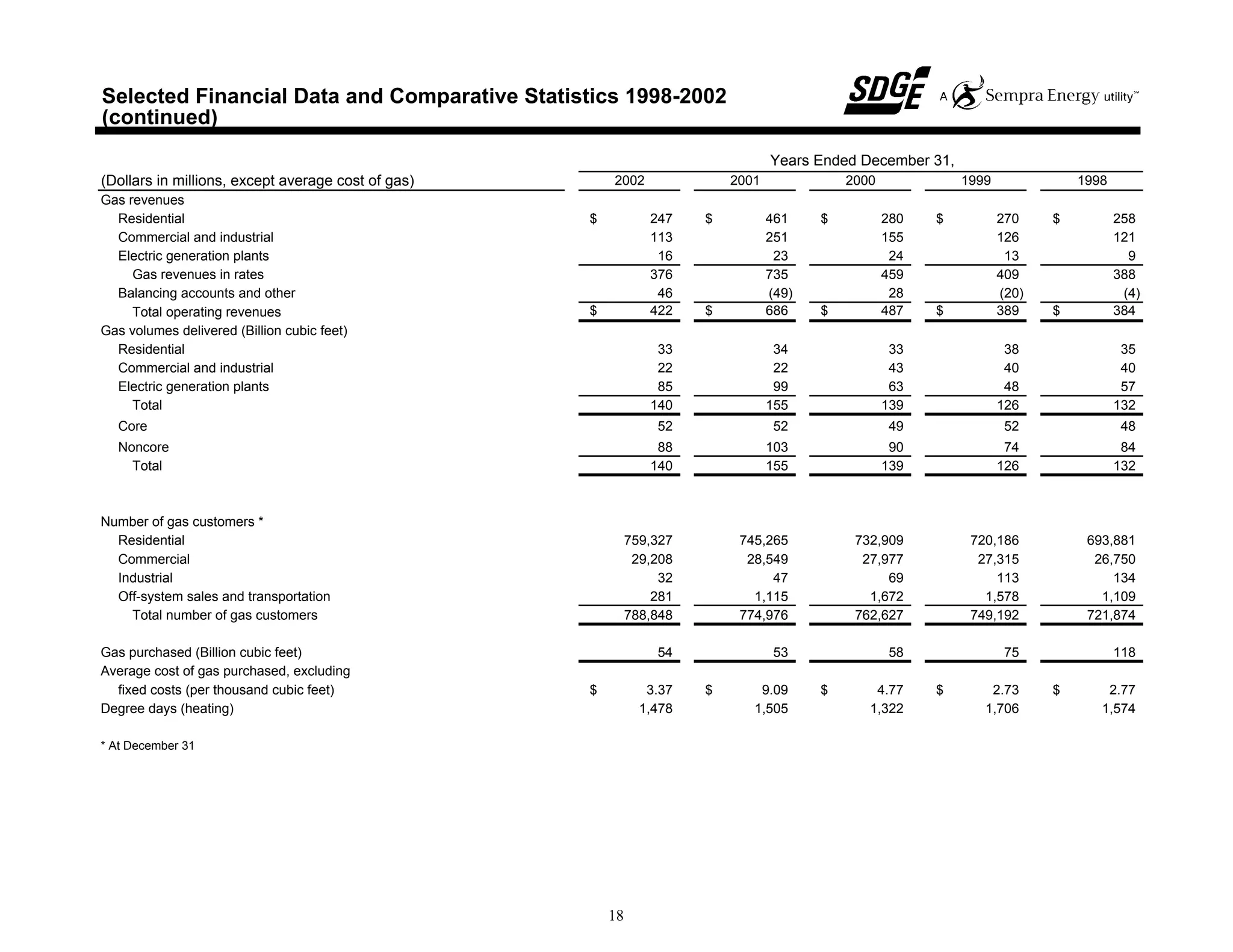

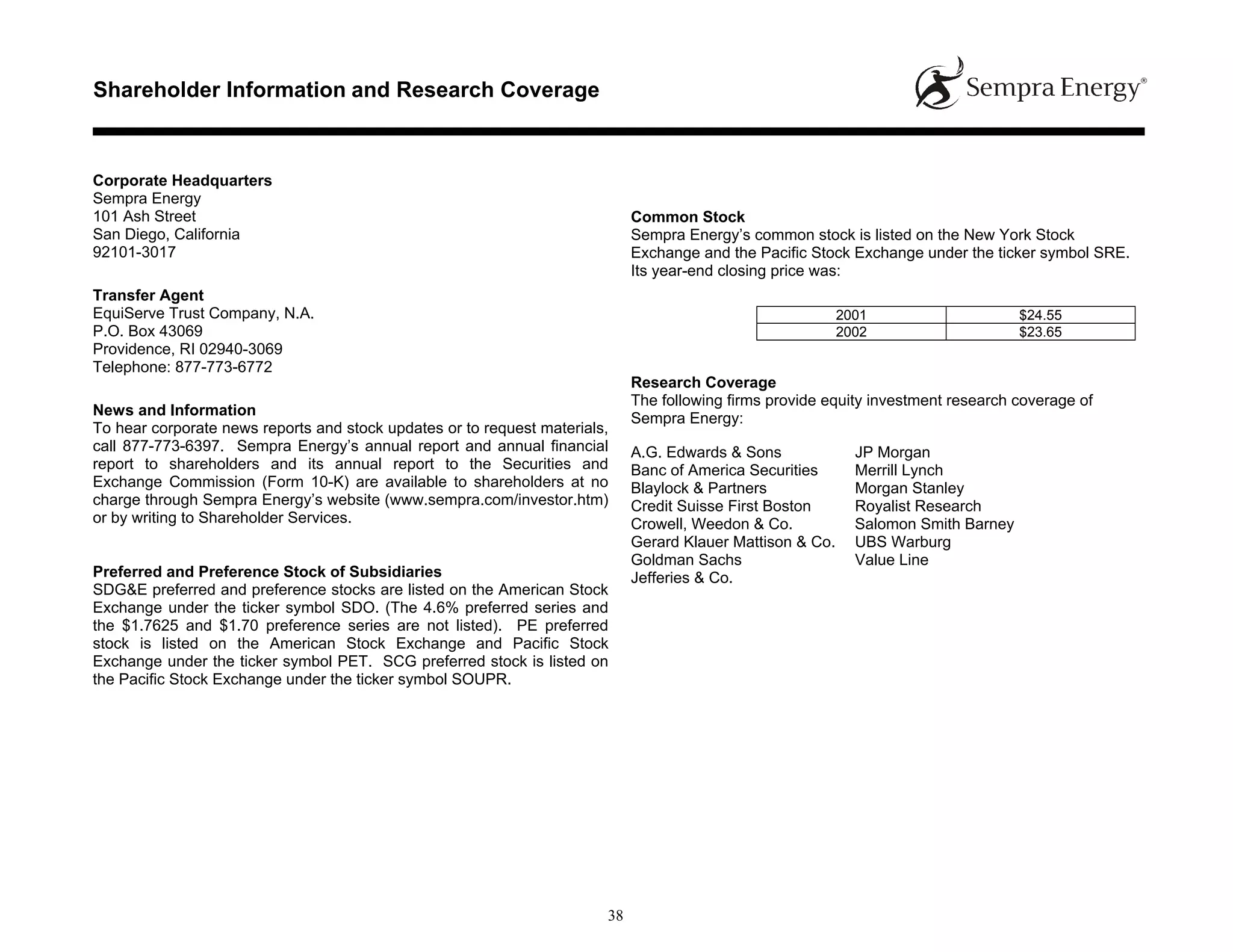

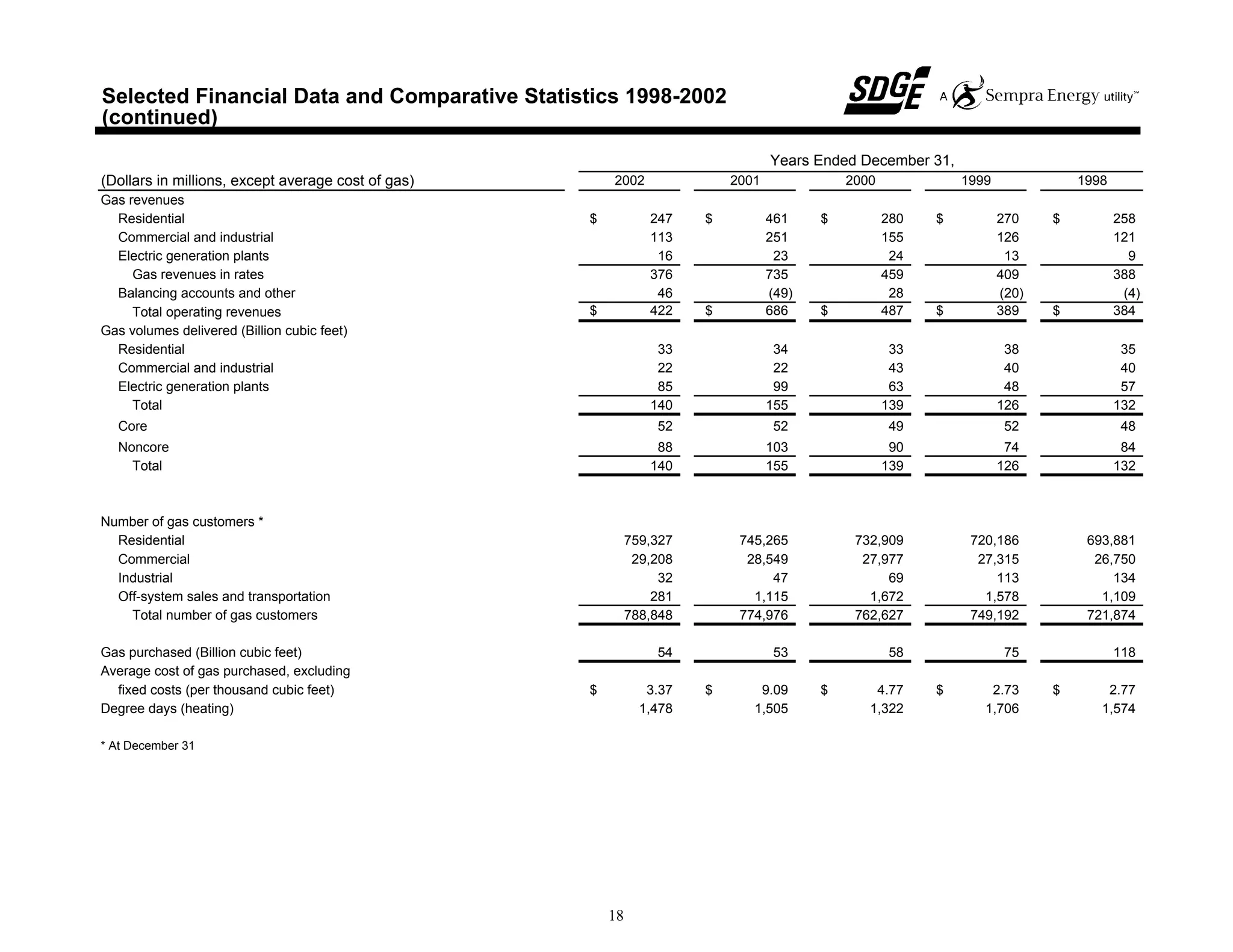

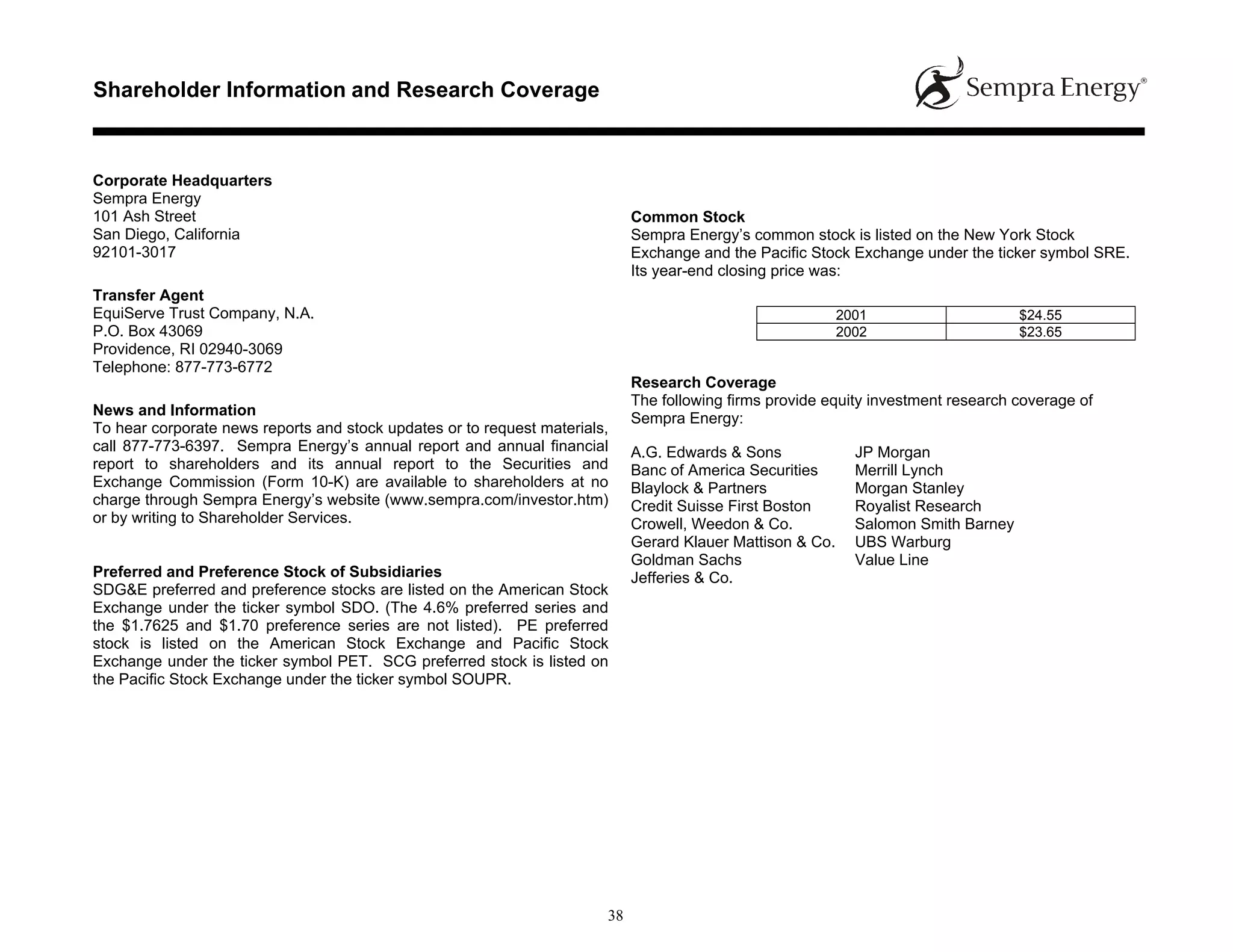

The document provides contact information for shareholders of Sempra Energy and its subsidiaries regarding general questions, investor relations, and stock exchange listings. Sempra Energy is a Fortune 500 energy services holding company based in San Diego with over $6 billion in annual revenues and 12,000 employees. It operates utilities and energy businesses that serve over 9 million customers across North America, Europe, Asia, and South America.