The agenda outlines a board meeting for Schibsted discussing the company's strategic direction and various business areas. The meeting will include opening remarks from the Chairman, a presentation by the CEO on strategic direction, and presentations from the heads of Schibsted Classified Media, various classifieds sites, Media Houses Scandinavia, and the CFO. There will also be Q&A sessions throughout. The dinner following the meeting will take place at the Andaz Hotel.

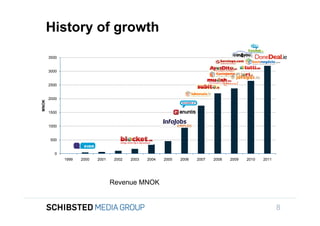

![TvM Revenues and EBITDA incl. Hitta

are already significant

Revenues and EBITDA, Schibsted Tillväxtmedier

[MNOK]

835

CAGR 08-11:

+36%

To get back,

656

511

335

101 117

25

-18

2008 2009 2010 2011

Revenues EBITDA

SIFICED’ via

icking off the

16](https://image.slidesharecdn.com/schibsted-120603175736-phpapp02/85/Schibsted-2012-126-320.jpg)