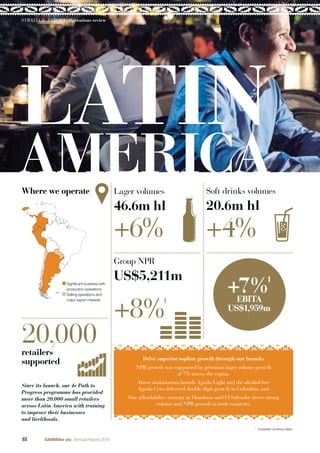

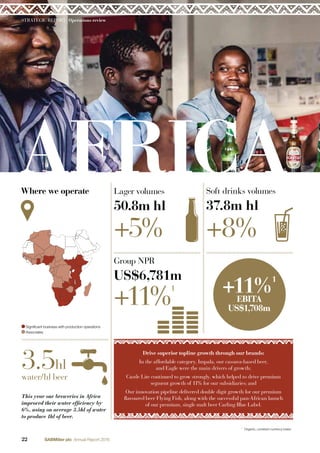

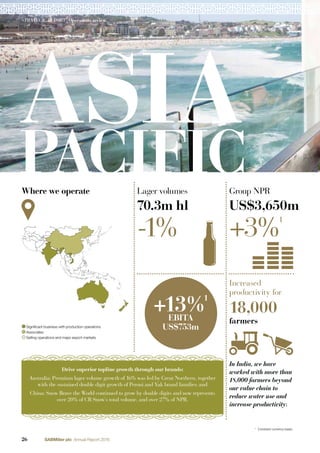

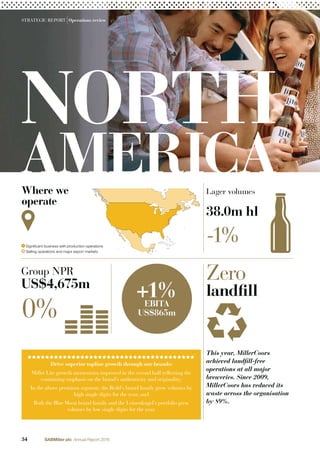

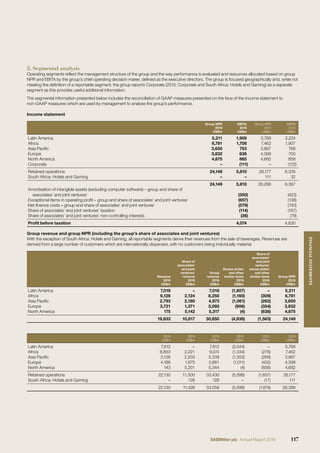

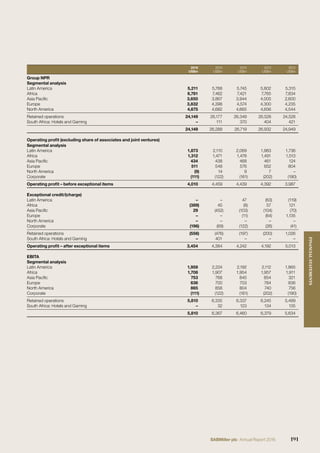

SABMiller plc is an international beverage and brewing company operating in over 80 countries. In 2016, the company had $5.8 billion in EBITA across its five regions - Latin America (33%), Africa (29%), Asia Pacific (13%), Europe (11%), and North America (14%). SABMiller has over 70,000 employees and produces over 200 beer brands, selling over 140,000 bottles of beer per minute. The company has leading market positions in many countries, with a focus on developing markets which make up 69% of its EBITA.