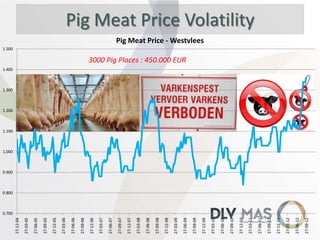

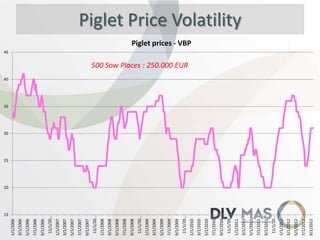

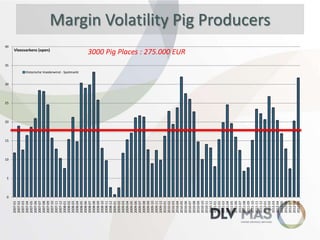

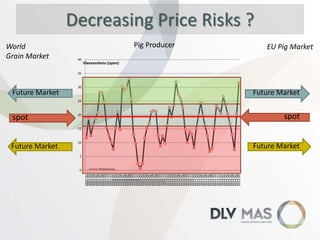

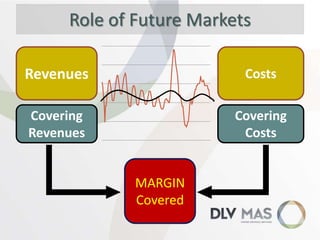

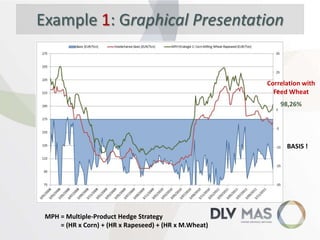

The document discusses the increasing price volatility in the agricultural derivatives market, particularly regarding pig and feed prices, which has turned price risks into significant financial challenges for companies. It emphasizes the importance of risk management strategies, including hedging techniques and price stability solutions, to mitigate these risks in the agricultural sector. Additionally, it highlights collaborative efforts across the supply chain, from producers to retail, to maintain stability and effectively cover costs.