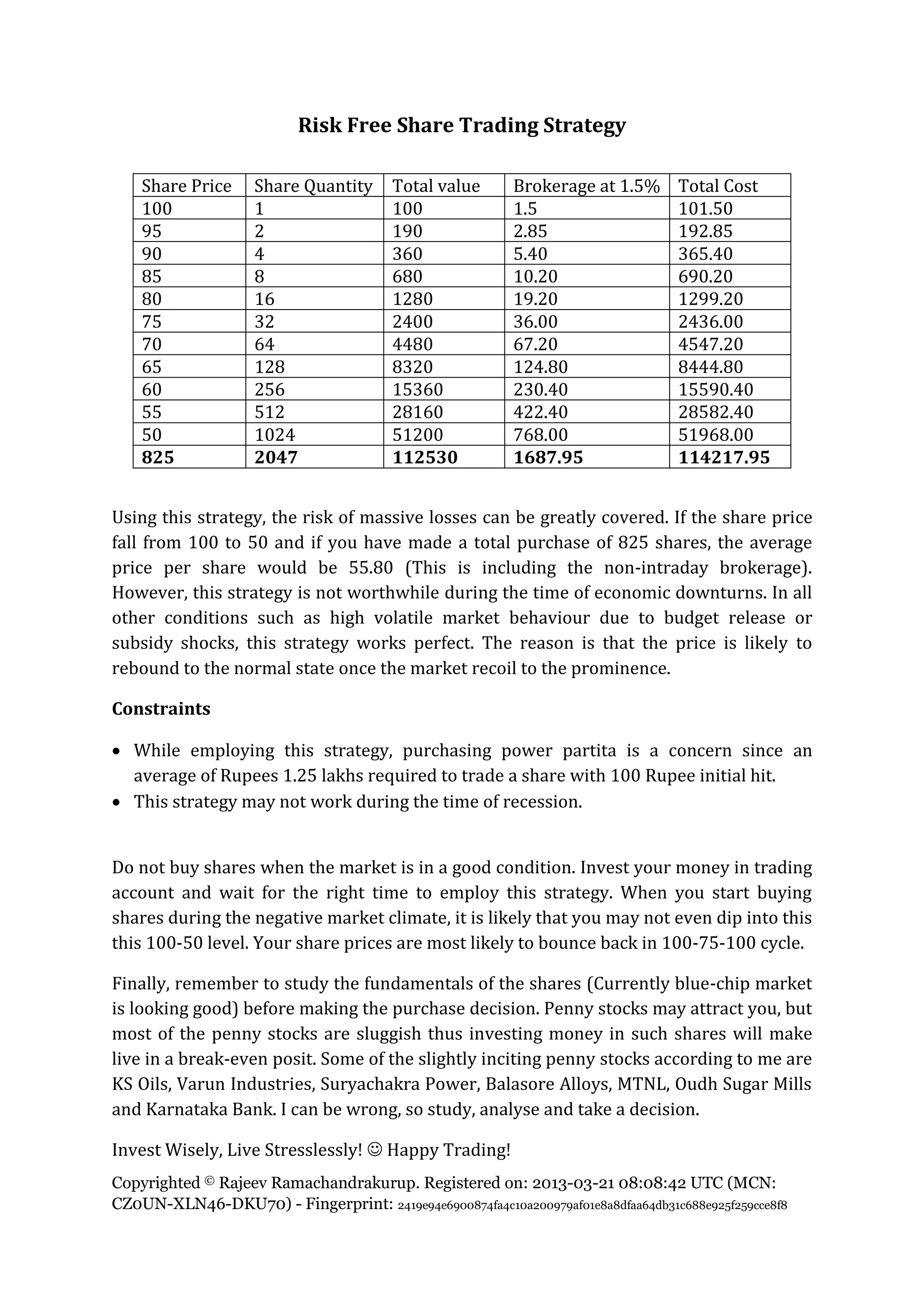

This document describes a risk-free share trading strategy where shares are purchased in increasing quantities as the share price decreases, averaging the purchase price. While this strategy mitigates losses if share prices fall significantly, it is not advisable during economic downturns. The strategy works best when the market is volatile, as share prices are likely to rebound after disturbances. Constraints include the large initial capital required and unsuitability during recessions. The document recommends waiting for negative market conditions before employing this strategy and studying company fundamentals before purchasing.