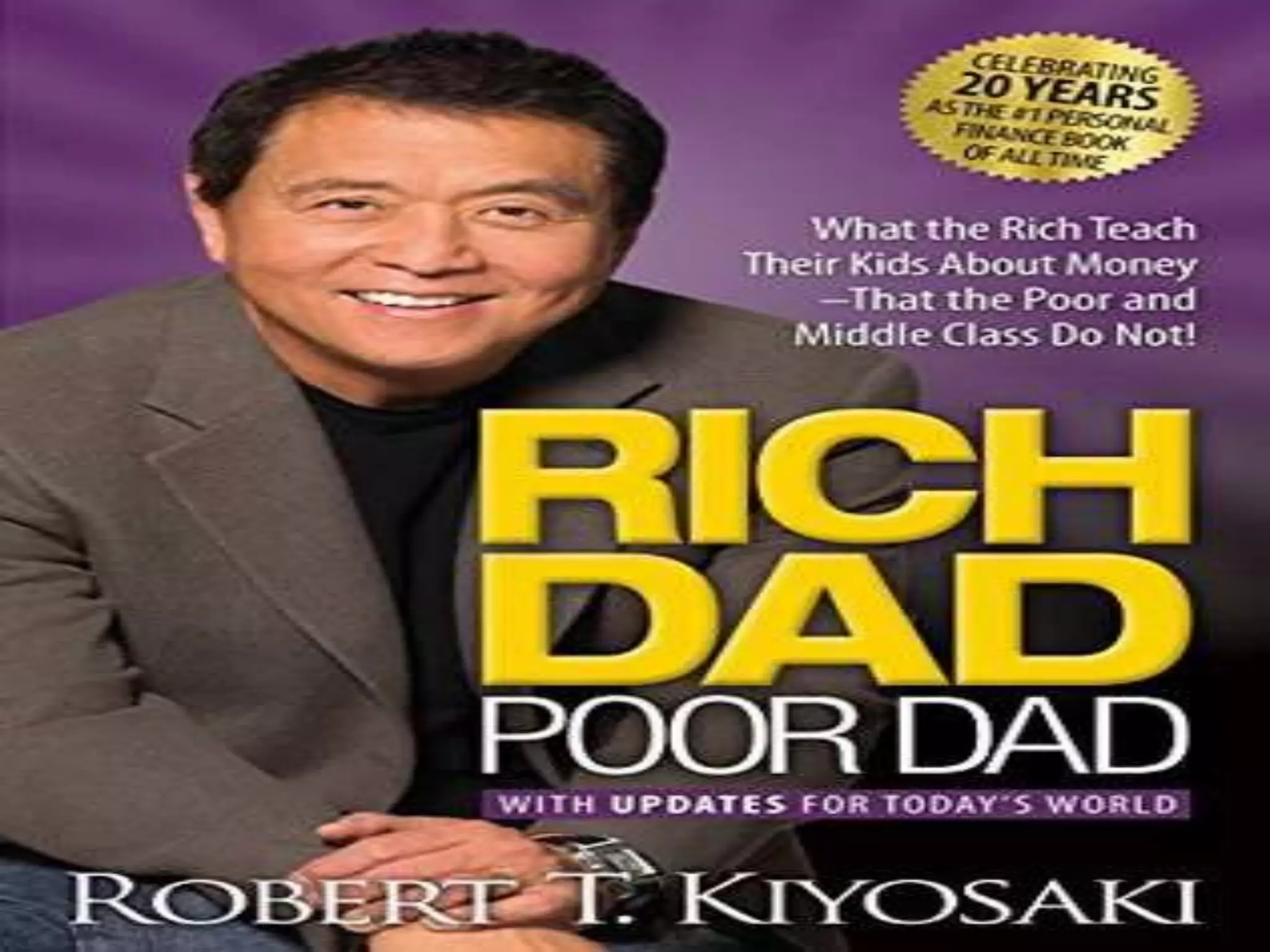

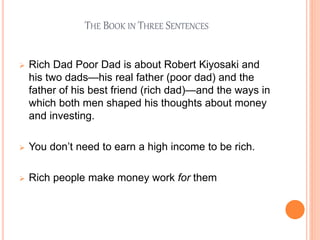

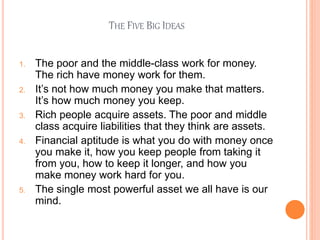

Rich Dad Poor Dad, written by Robert Kiyosaki and Sharon Lechter, emphasizes the significance of financial literacy, independence, and asset investing through parables based on Kiyosaki's life. The book contrasts the philosophies of his 'rich dad' and 'poor dad' regarding money management and encourages readers to shift their mindset to make money work for them. With over 32 million copies sold and endorsements from various celebrities, the book serves as a motivational framework for achieving financial freedom.