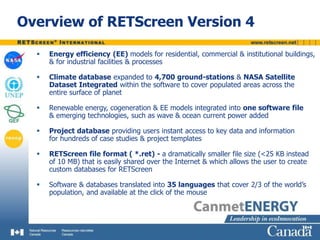

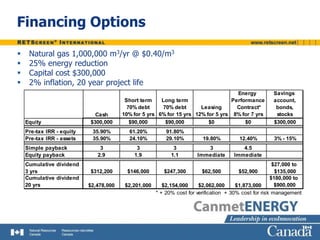

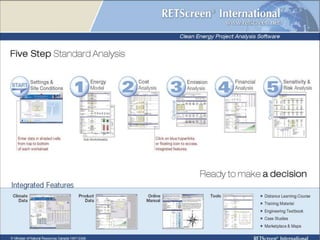

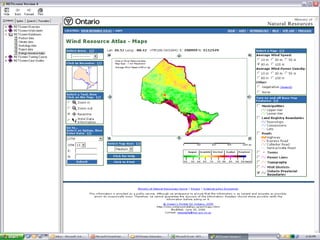

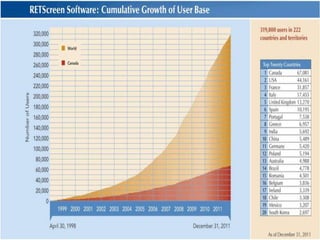

RETScreen is software that models energy efficiency, renewable energy, and cogeneration projects. It contains models for buildings, facilities, processes and emerging technologies. The software integrates climate data from around the world and allows users to access case studies and project templates. RETScreen uses a small file format to allow sharing project data over the internet. The software is translated into many languages. It performs financial analyses on projects, including costs, financing options, incentives, and rates of return. RETScreen contains examples to model projects like solar air heating and a 2,000 kW wind turbine.