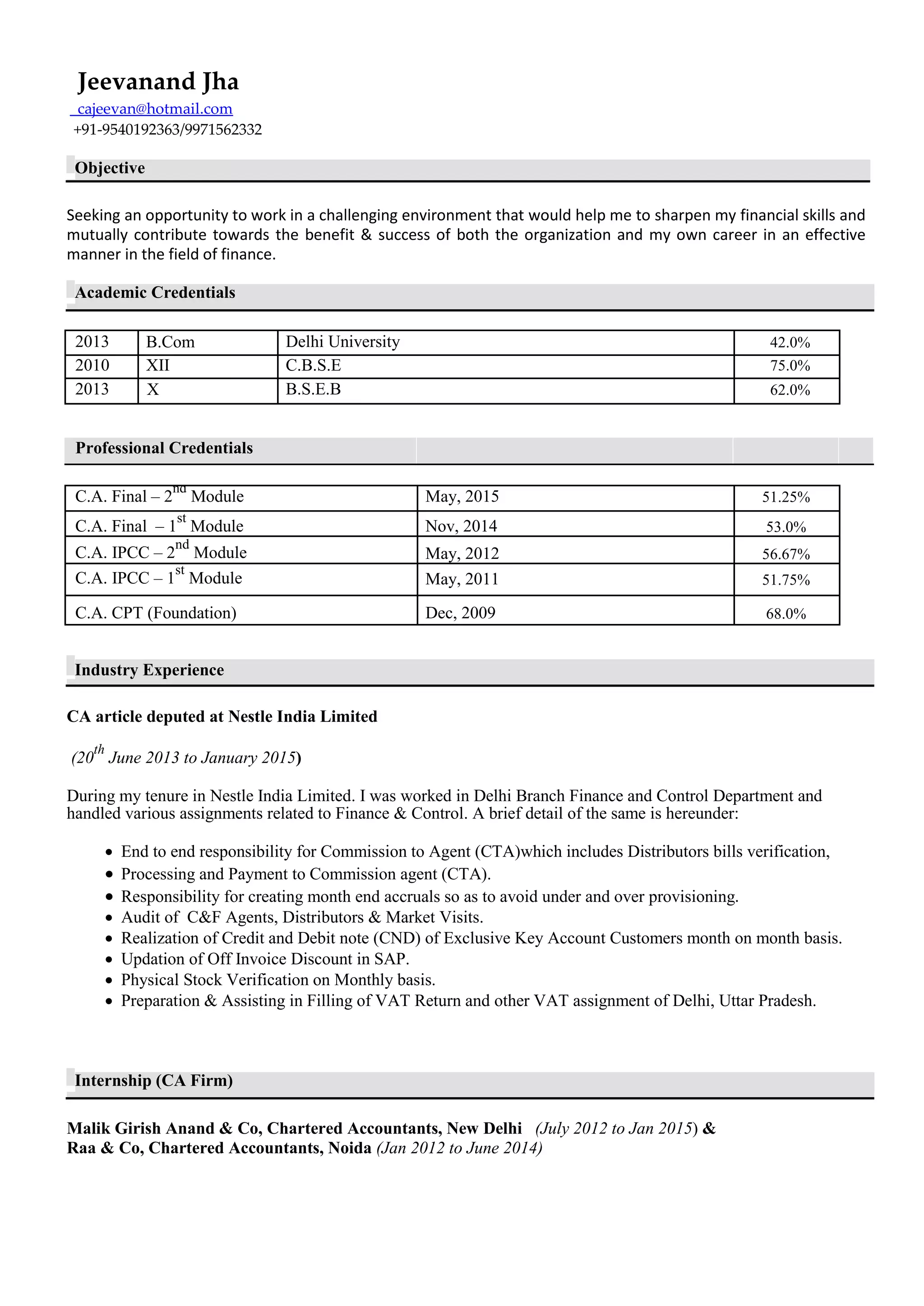

Jeevanand Jha is seeking a position that utilizes his skills and qualifications as a Chartered Accountant with 3 years of experience. He has cleared his CA Final exams and gained experience through articleships at Nestle India Limited and internships at two CA firms. He is proficient in accounting software, taxation compliance, auditing, and financial reporting. Jeevanand is looking to contribute his skills and knowledge to furthering an organization's success.