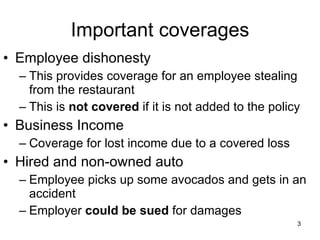

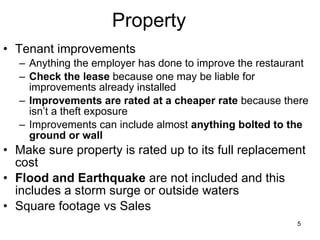

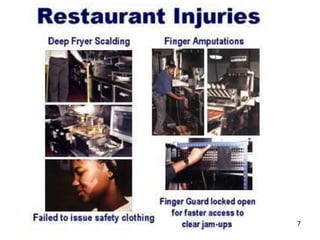

The document discusses various types of insurance relevant to restaurants, including liability, workers' compensation, and employee practices liability. It highlights important coverage aspects such as employee dishonesty, business income loss, and specific policy exclusions like flood and earthquake damage. Additionally, it addresses claims management and legal protections for issues like sexual harassment and discrimination among employees and patrons.