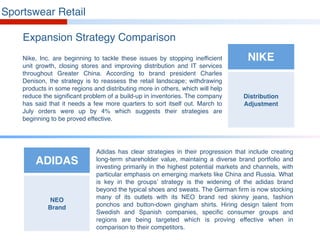

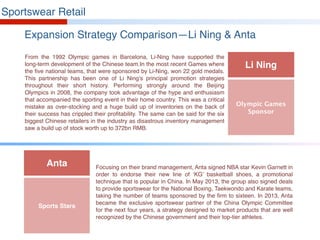

This document provides an overview and analysis of the sportswear retail and motor vehicle industries in China, focusing on representative Fortune 500 companies in each sector. For sportswear retail, it examines the performance and expansion strategies of Nike, Adidas, Li-Ning, and Anta in China. It finds that while Nike and Adidas have faced challenges, their strategies of adjusting distribution and expanding brands beyond core products are proving effective. In contrast, Li-Ning and Anta struggled after over-relying on Olympic hype, and now need innovative strategies to compete against global brands.