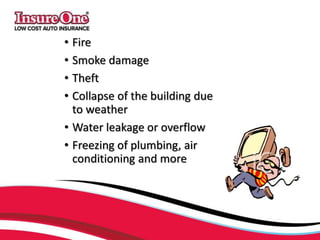

Renters insurance is essential for individuals who rent their homes, offering protection for personal property and liability in various situations like fire, theft, and water damage. It covers the costs of replacing possessions and can also provide financial assistance for temporary housing if displaced. Even if not mandated by landlords, having renters insurance is recommended for peace of mind and financial security.