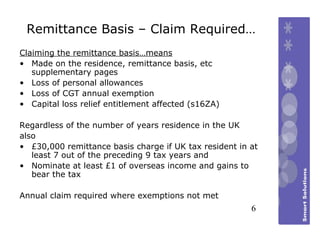

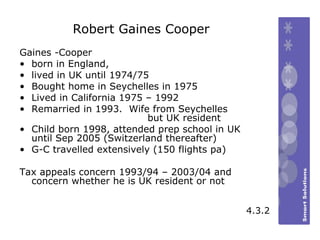

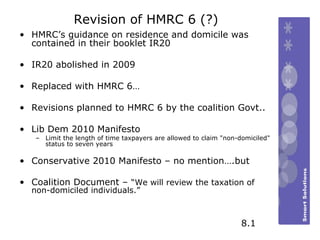

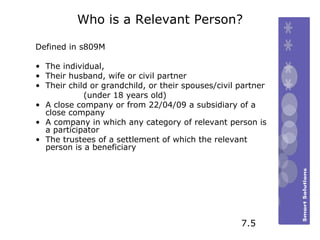

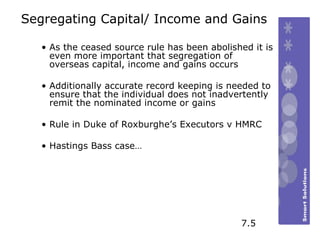

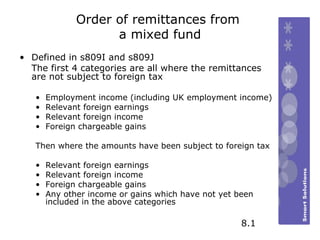

The document summarizes the UK tax rules regarding the remittance basis for taxation of foreign income and gains for non-UK domiciled individuals. It discusses who qualifies for the remittance basis, what constitutes a taxable remittance, and recent cases related to residency and domicile status. It also provides an overview of how the remittance basis rules are applied in practice and considerations around segregating different types of income and gains.

![Remittance Basis – Claim needed? It depends on: Less than £2,000 of unremitted income and gains? – s809D [5.1] S 809 E exemption? Under 18 at the end of the tax year? Not resident in the UK for more than 6 out of 9 preceding tax years Or eligible for the s828C exemption? [income if taxed in the UK would be subject to basic rate tax and they are employed in the UK]](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-8-320.jpg)

![Remittance Basis – Claim needed? (4) Exempt remittances Money paid to the Commissioners [s809V] Consideration for UK services [s809W] Public access rule [s809Z & s809Z1] Personal use rule [s809X(40 & s809Z2] Clothing, footwear and jewellery Repair rule [s809X(5)a & s809Z3] Temporary importation rule [s809X(5)b] De minimis provision - <£1000 [s809x(5)c]](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-11-320.jpg)

![Remittance Basis – Nominated income and Gains Where an individual pays the £30,000 [RBC] they must: Nominate the overseas income and gains that the RBC is levied on. This can be as low as £1 – care needed if seeking to claim Double Tax Credit overseas for the RBC Funds from the nominated account must not be remitted to the UK, although the account can be used to pay the RBC direct to HMRC If funds remitted to the UK from the nominated account then s809J triggered which changes the basis of taxation for overseas assets to be as if they had arisen from a single mixed fund](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-13-320.jpg)

![Recent Tax Cases “ The Residence Cases” Grace [4.3.1] Sheppard Genovese vs HMRC [4.3.3] (ordinarily resident?) Tuczka Tuberville Gaines Cooper – the saga continues 3.2 Special Commissioners – lost High Court - lost Court of Appeal – lost Supreme Court – watch this space… No Domicile Cases recently…..](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-14-320.jpg)

![What is a Taxable Remittance? A remittance is a transfer from overseas in to the UK by a non UK domiciled individual Meeting one of 4 conditions s809L [7.1] Very wide definitions covering cash transfers, Goods Payments of UK related debts traced directly or indirectly to previously unremitted foreign income or gains Money or other property representing or derived from foreign income or gains is brought to, used in, or received in the UK for the benefit of a relevant person](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-19-320.jpg)

![What is a Taxable Remittance?(2) Money or other property representing or derived from foreign income or gains is brought to, used in, or received in the UK [Condition A] for the benefit of a relevant person or A service is provided in the UK to, or for the benefit of a relevant person Regardless whether the service is paid offshore or payment is made in the UK [Condition B] Further provisions apply to gift recipients [Condition C] And 3 rd party connected operations provisions [Condition D] 7.1/7.2/7.3](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-20-320.jpg)

![Interaction of Capital Gains Before 6 April 2008 foreign capital losses for someone on the remittance basis were unable to be set against UK capital gains [CG25330] Revision in FA 2008 allows this to occur by election under s16ZA TCGA 1992 Irrevocable Must be made in the first year in which s809B remittance basis is claimed by a non UK domiciled individual Practical considerations…. 9](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-24-320.jpg)

![Interaction of Capital Gains Before 6 April 2008 foreign capital losses for someone on the remittance basis were unable to be set against UK capital gains [CG25330] Revision in FA 2008 allows this to occur by election under s16ZA TCGA 1992 Irrevocable Must be made in the first year in which s809B remittance basis is claimed by a non UK domiciled individual Practical considerations…. 9](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-26-320.jpg)

![For Further Information Contact me at: Email : [email_address] Website: www.smartsolutions-online.co.uk Tel: 01883 715848 Mob: 07952 217249 Smart Solutions 88 Pollards Oak Road Hurst Green Oxted Surrey RH8 0JW](https://image.slidesharecdn.com/remittancebasispresentation161010-13015763038795-phpapp01/85/Remittance-Basis-Presentation-16-10-10-27-320.jpg)