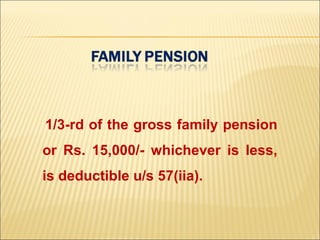

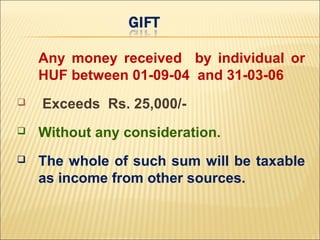

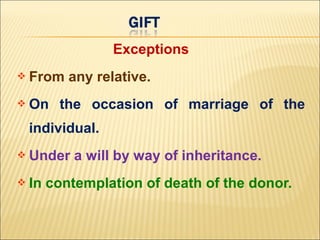

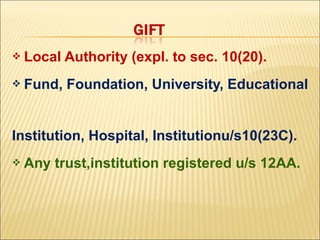

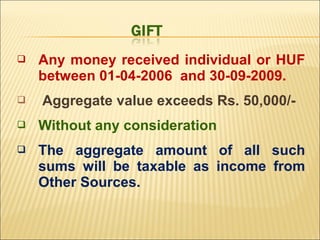

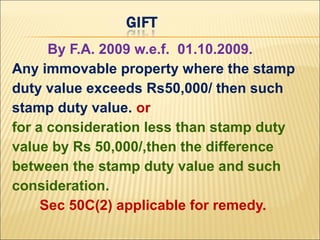

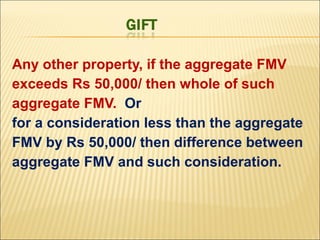

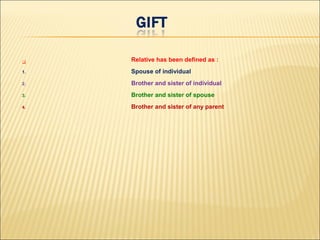

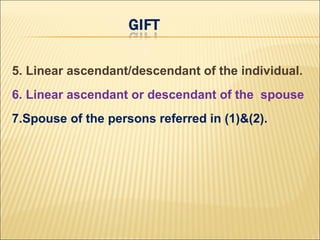

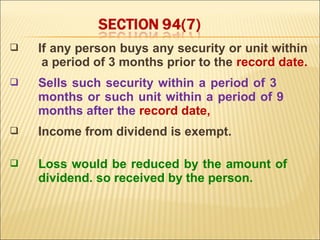

Family pension, gifts, and other income sources are taxed under section 94(7) as income from other sources. Gifts received between 2004-2006 of over Rs. 25,000 without consideration are fully taxable. Between 2006-2009, the threshold was Rs. 50,000. Exceptions include gifts from relatives, on occasions like marriage. Income from winning lotteries or bets is taxed at 30%. Dividend income is exempt if related security is sold within 3 months of record date.