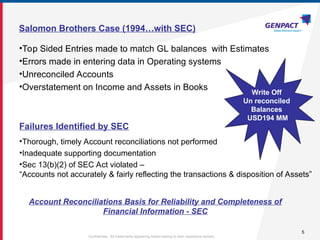

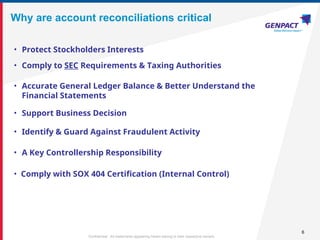

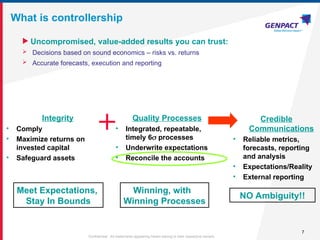

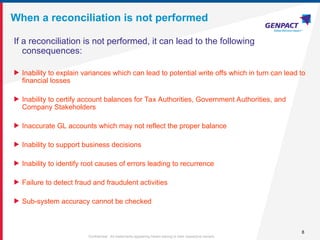

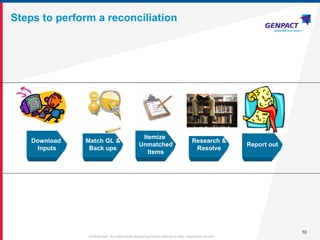

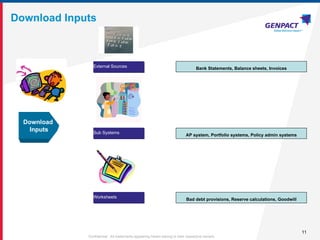

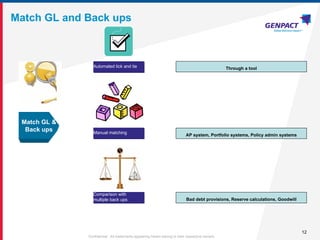

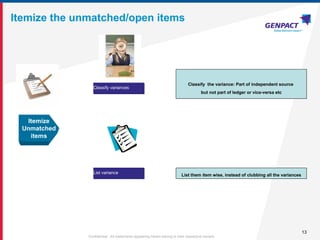

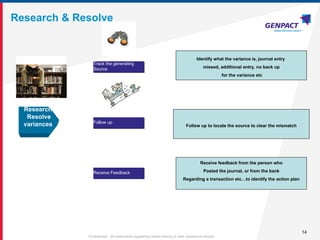

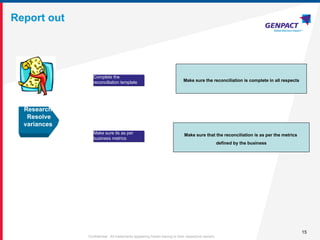

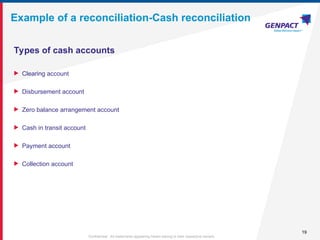

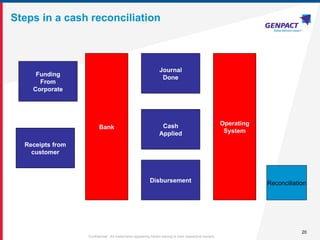

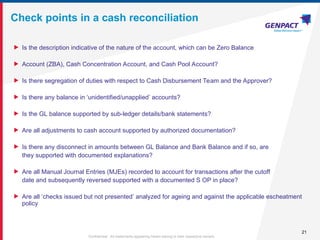

The document provides a comprehensive overview of account reconciliations, emphasizing their importance in ensuring accurate financial reporting, compliance with regulations, and detecting fraud. It outlines the processes involved in reconciling accounts, key concepts such as controllership, and potential consequences of failing to reconcile accounts. It also includes structured steps and checkpoints for performing cash reconciliations and common variances that can arise.