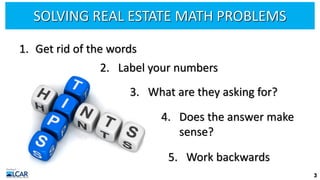

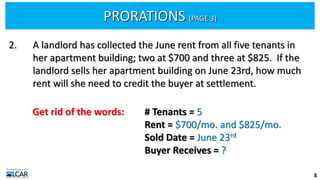

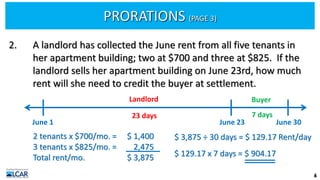

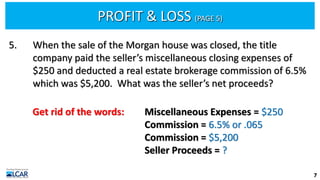

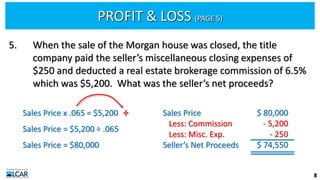

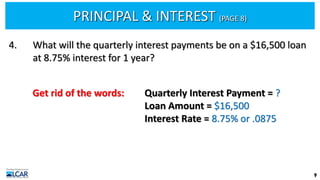

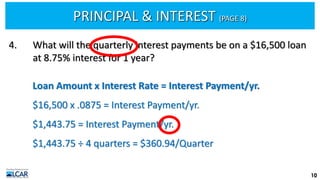

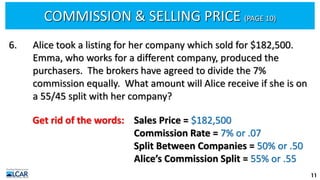

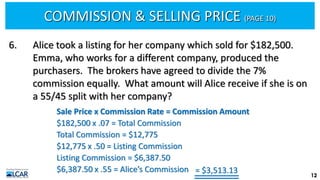

The document provides examples and step-by-step instructions for solving various types of real estate math problems commonly found on licensing exams. It addresses strategies for prorating rent and expenses, calculating profit and loss from a home sale, determining interest on a loan, and computing commissions based on a property's selling price. Examples show setting up and solving equations to find unknown values related to properties, rents, commissions, interest rates, and other financial factors involved in real estate transactions.