Embed presentation

Download as PDF, PPTX

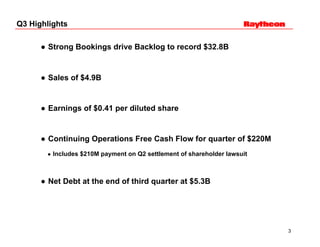

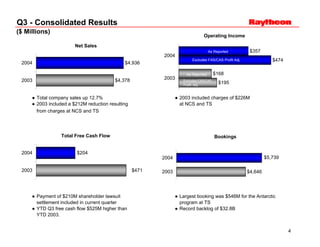

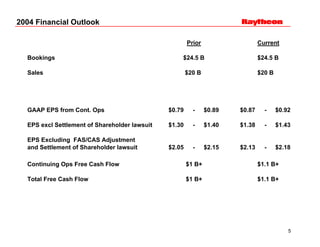

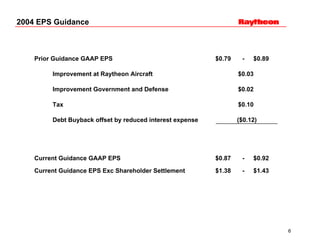

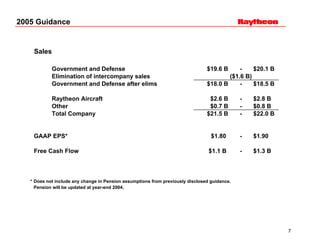

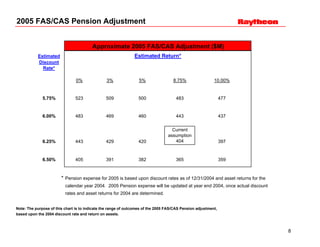

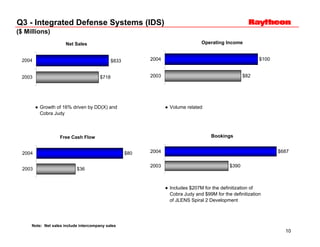

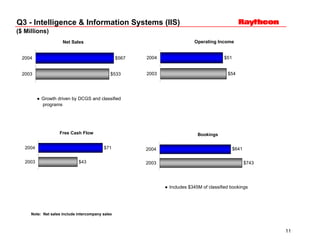

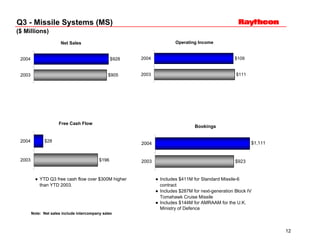

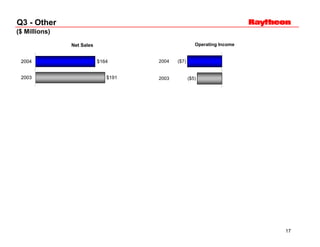

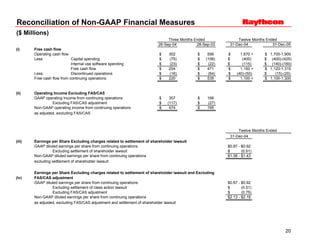

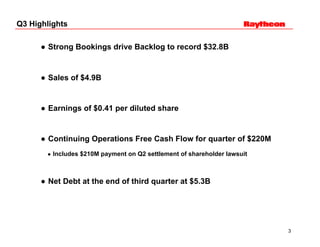

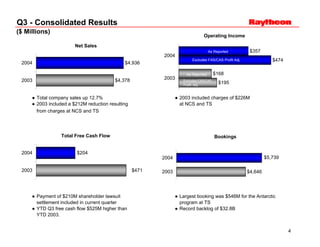

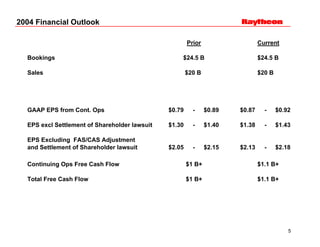

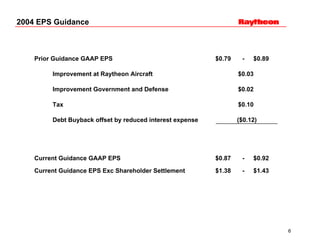

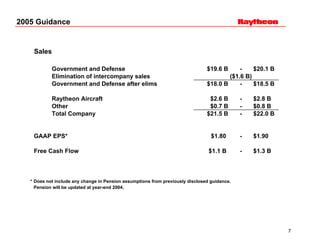

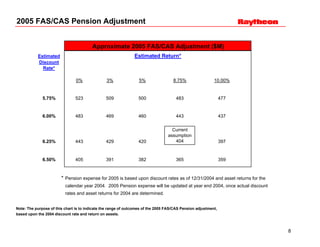

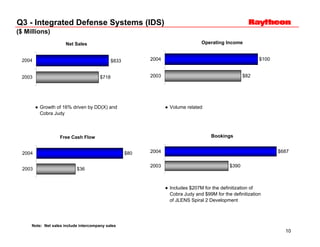

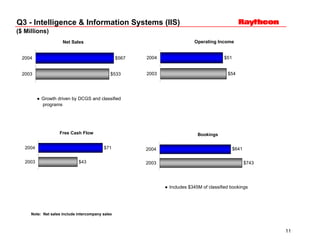

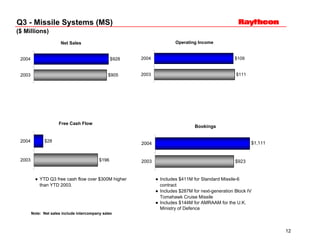

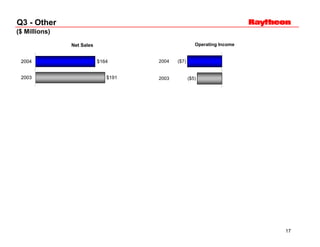

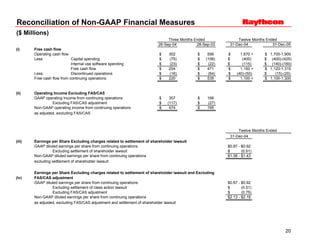

- Raytheon reported Q3 sales of $4.9 billion, up 12.7% from 2003, and earnings of $0.41 per share. - Backlog reached a record $32.8 billion driven by strong bookings of $5.7 billion in Q3. - Free cash flow for Q3 was $204 million including a $210 million payment for the settlement of a shareholder lawsuit. - Guidance for 2004 was increased for GAAP EPS to $0.87-$0.92 and excludes the settlement payment.