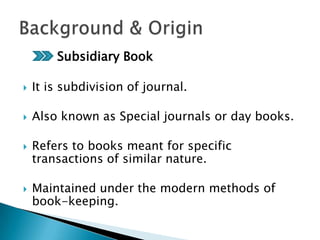

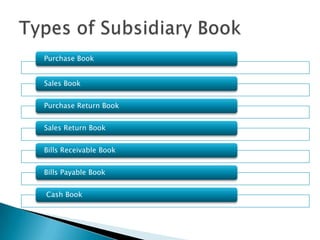

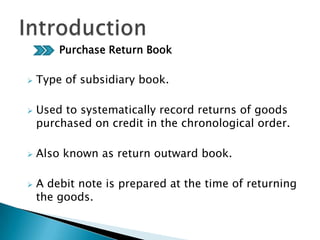

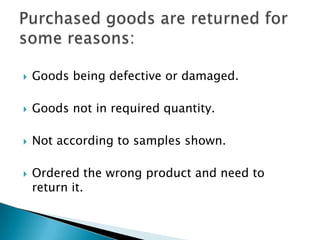

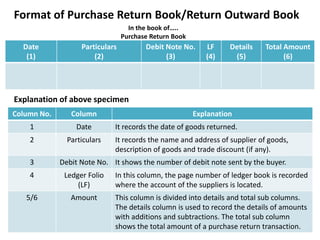

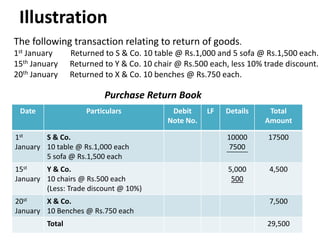

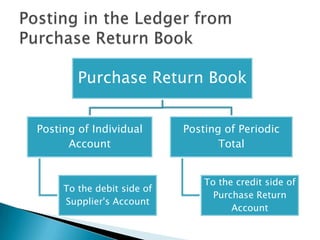

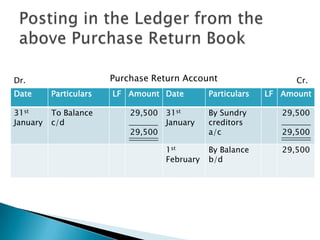

The document discusses the purchase return book, which is a subsidiary book used to systematically record returns of goods purchased on credit. It contains details of items returned such as date, supplier name and address, item description, quantity returned, and amount. The total amount of returns is posted periodically from the purchase return book to the purchase return account. The purchase return account is closed by transferring the balance to the sundry creditors account.