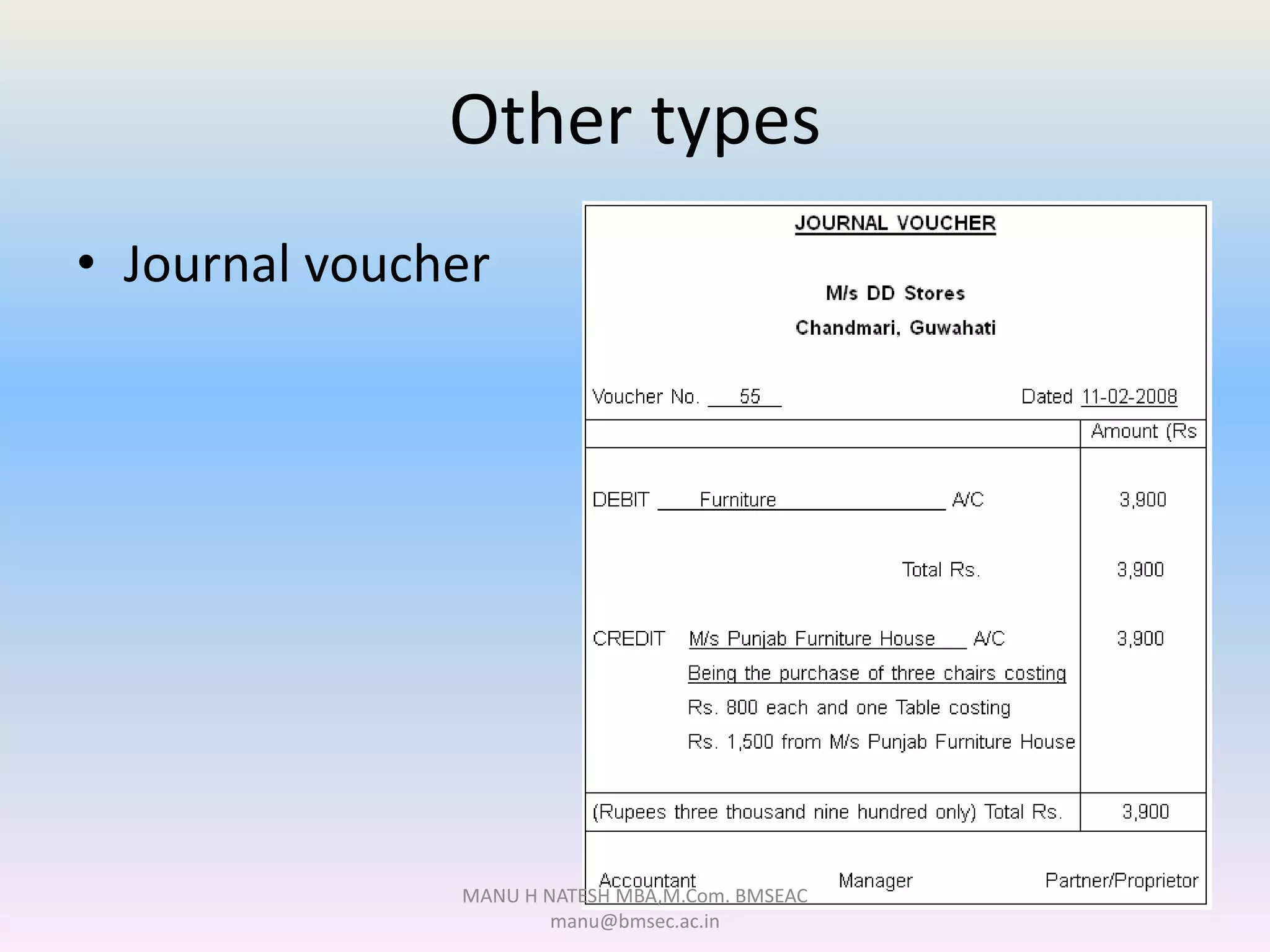

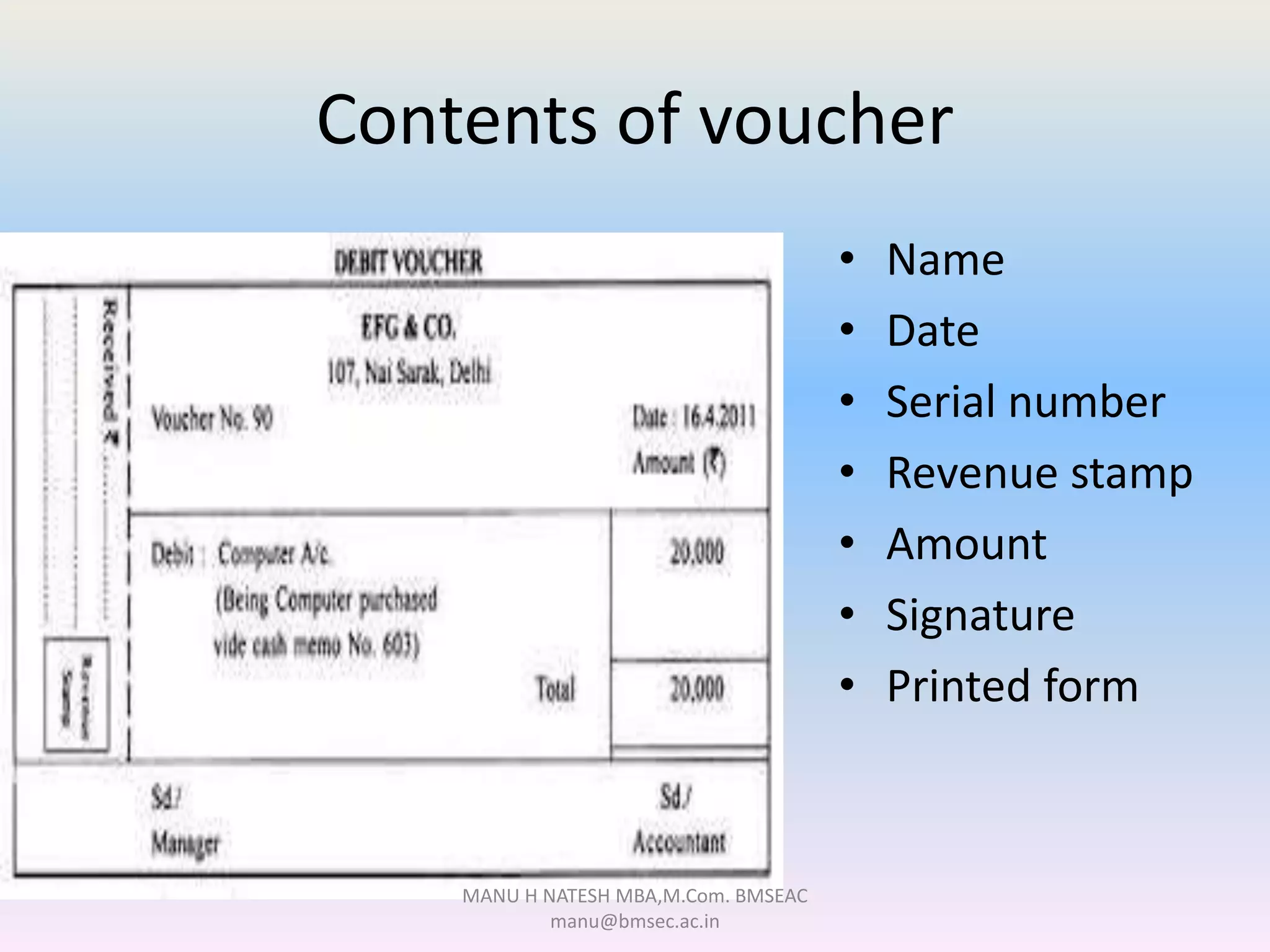

This document discusses the process of vouching in accounting. It defines a voucher as documentary evidence that supports an accounting transaction. The main objectives of vouching are to detect errors and frauds, verify the accuracy of accounts, and ensure that all transactions are authorized. When vouching, the auditor examines documents to check for proper evidence of transactions, verification of amounts and time periods, and that the transactions are related to the business. Vouching of source documents and ledger accounts is a key part of the auditing process, as it helps validate the accuracy of financial records.