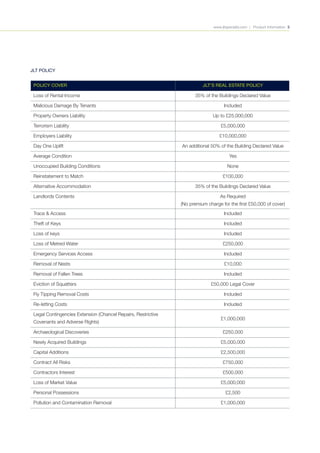

This document discusses JLT Specialty's residential real estate property insurance. It provides comprehensive coverage for owners and occupants of residential properties. This includes risks like loss of rent, theft, water damage, liability, and weather events. JLT Specialty has experience insuring various aspects of the private rented sector, including advising property developers and investors. The insurance also includes specialized clauses requested by financial backers. A case study describes how JLT Specialty worked with Zurich to provide over £1 billion in coverage for the Olympic Village conversion project in London.