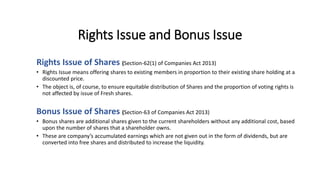

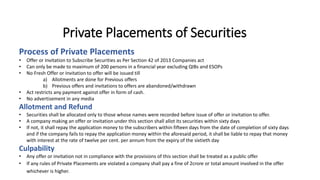

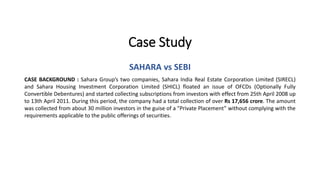

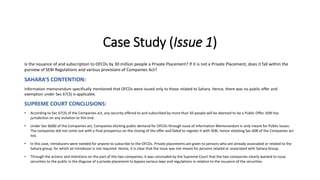

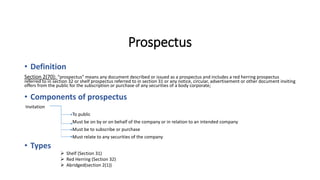

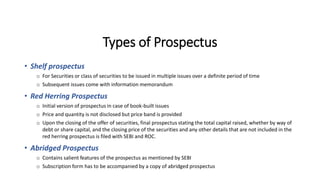

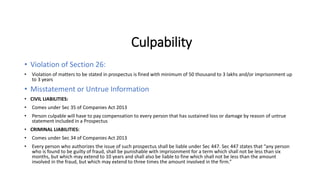

The document discusses various topics related to raising capital such as prospectuses, private placements, rights issues, and bonus issues. It provides definitions and processes for private placements, rights issues, and bonus issues. It also discusses the Sahara vs SEBI case involving Sahara's issuance of securities disguised as a private placement but ruled a public issue by the Supreme Court. The document includes a sample private placement form, prospectus components and types, and culpability for prospectus violations.

![Raising of capital

Chapter III, Prospectus and

Allotment of Securities,

Companies Act(2013)

Fund raising by private

Company [Sec 23(2)]

Rights Issue

Private Placements

Bonus Issue

Fund raising by public

company [Sec 23(1)]

Private Placements

Through

Prospectus(IPO & FPO)

Rights Issue

Bonus Issue](https://image.slidesharecdn.com/privateplacement-180403144034/85/Prospectus-and-Private-placement-2-320.jpg)