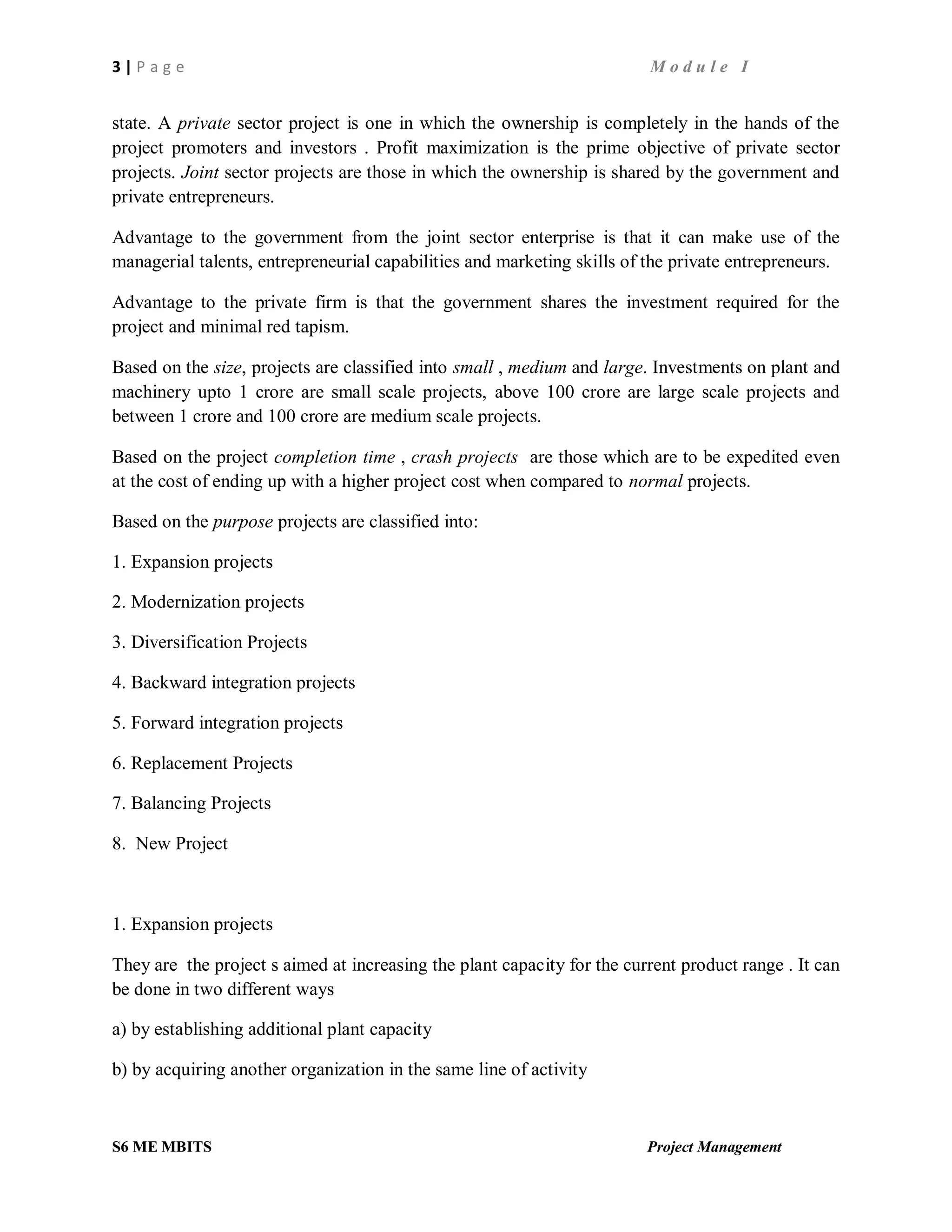

The document defines key concepts in project management including characteristics of a project, the project management process, and capital budgeting. A project has objectives, a defined timeline, uniqueness, and involves teamwork. The project management process includes identification, preparation through a feasibility study, implementation, and review. Capital budgeting involves planning, analysis, selection, financing, implementation, and review of investment projects.

![2 | P a g e M o d u l e III

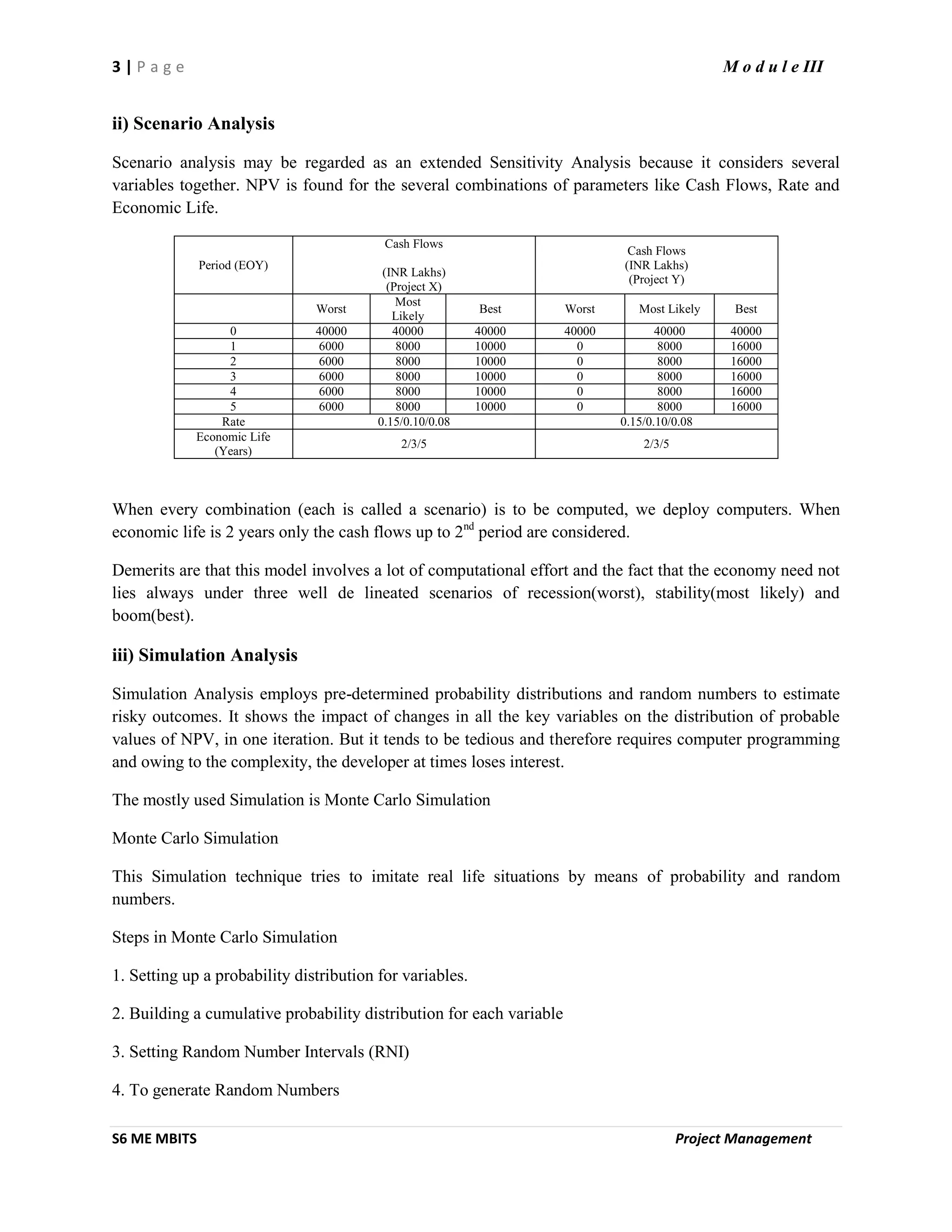

S6 ME MBITS Project Management

Importance of Corporate Risk

Undiversified investors (promoters) are more concerned about Corporate Risk than Market Risk.

Even Diversified investors (Retail investors) are interested in this Risk because it has a bearing on the

earnings and obviously the required returns.

The stability of the firms cash flows are valued by managers, suppliers, creditors, customers and the

community in which the firm operates and they take this measure as a criterion for joining hands with the

firm.

Importance of Market Risk

The ultimate aim of the project and the company is to maximize the shareholders wealth and therefore

this measure of Risk is very important.

Measurement of Risk

Sensitivity Analysis, Simulation, Standard deviation and Hillier Model are absolute measures of Risk,

whereas the coefficient of variation is a relative measure.

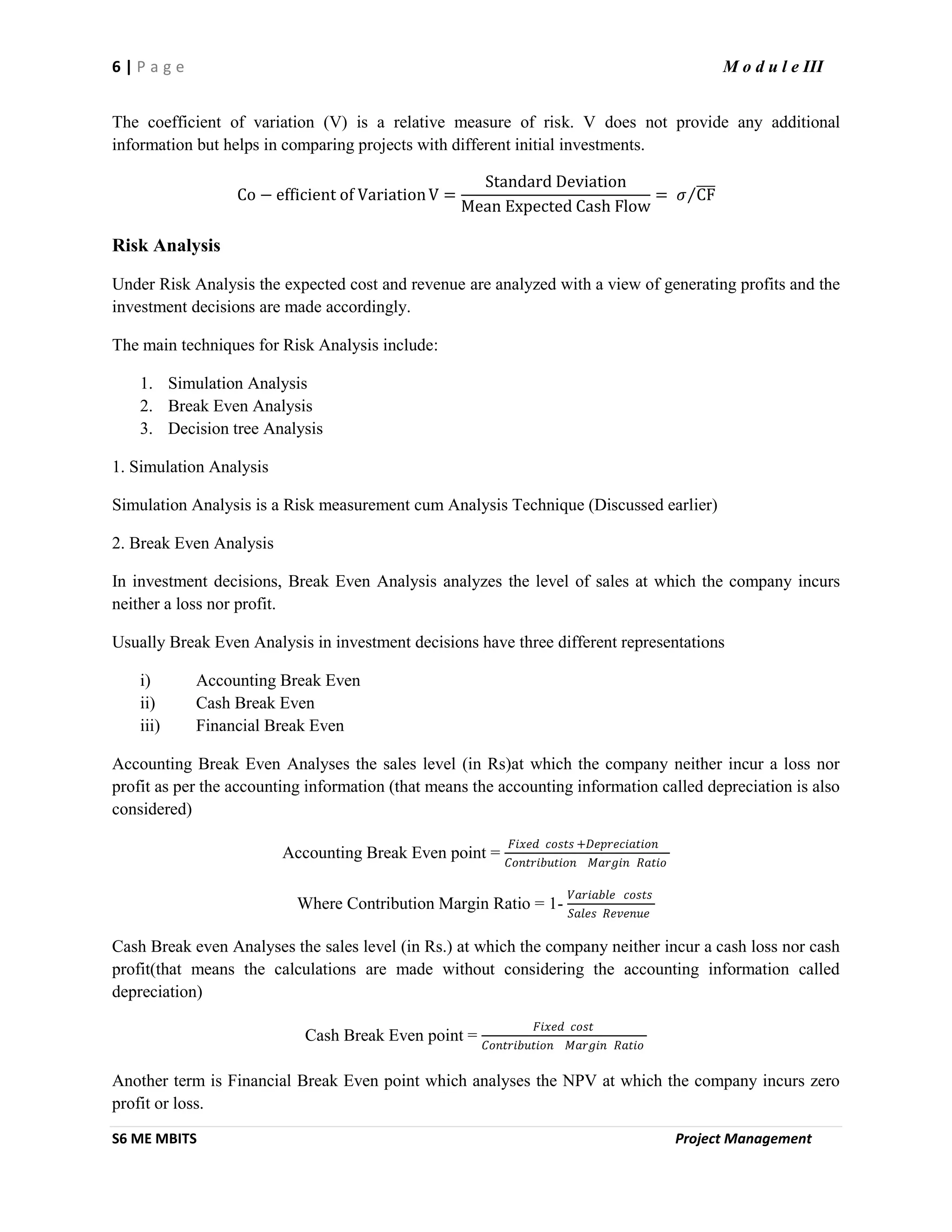

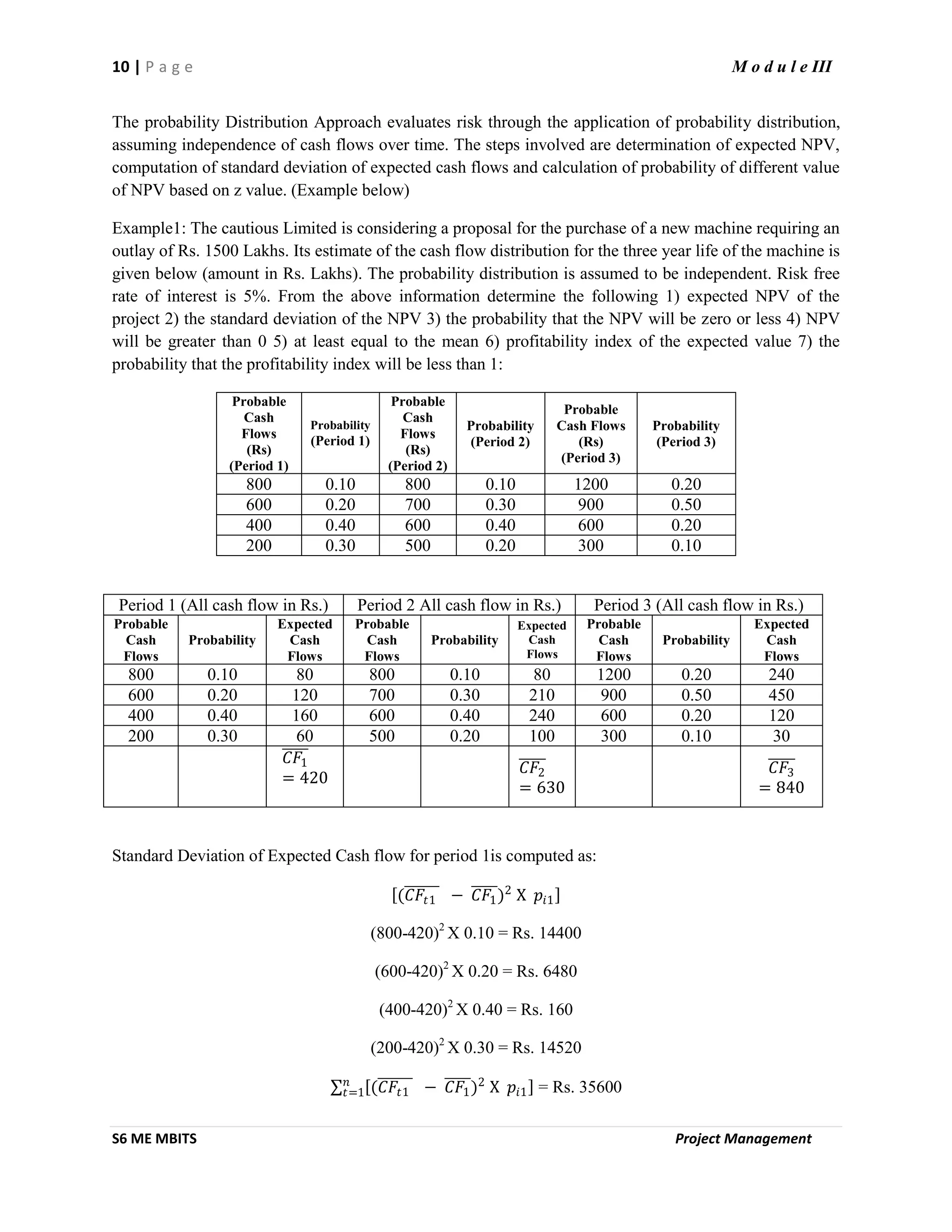

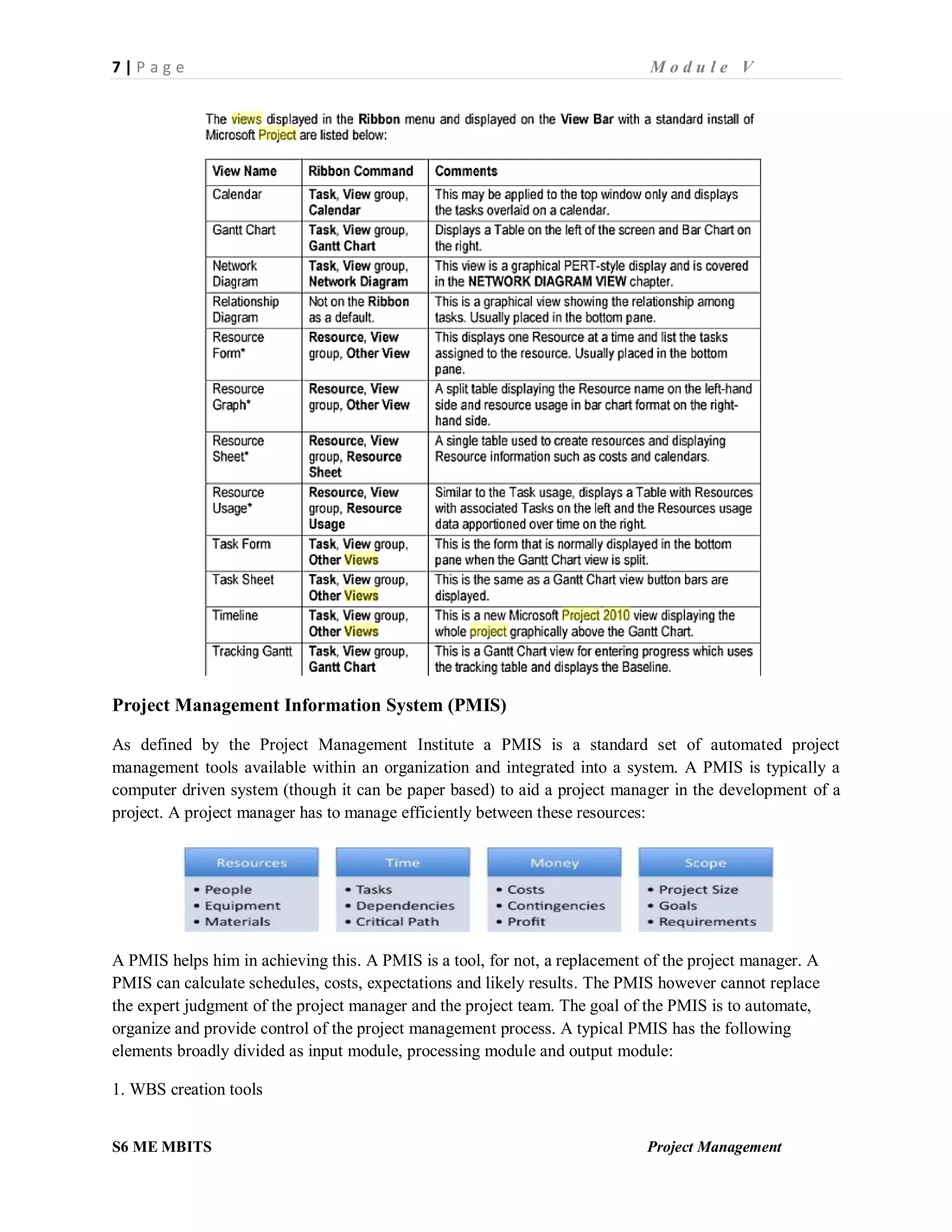

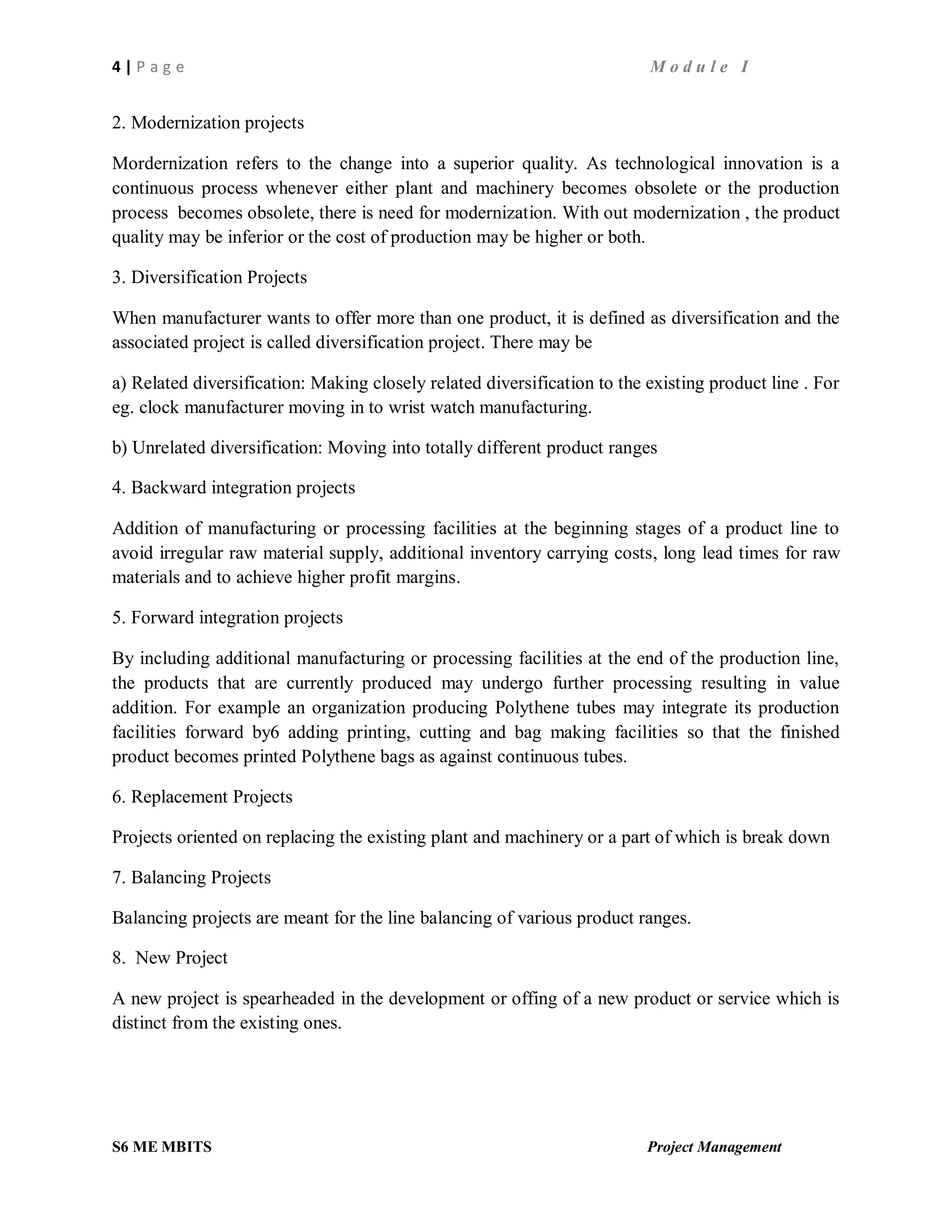

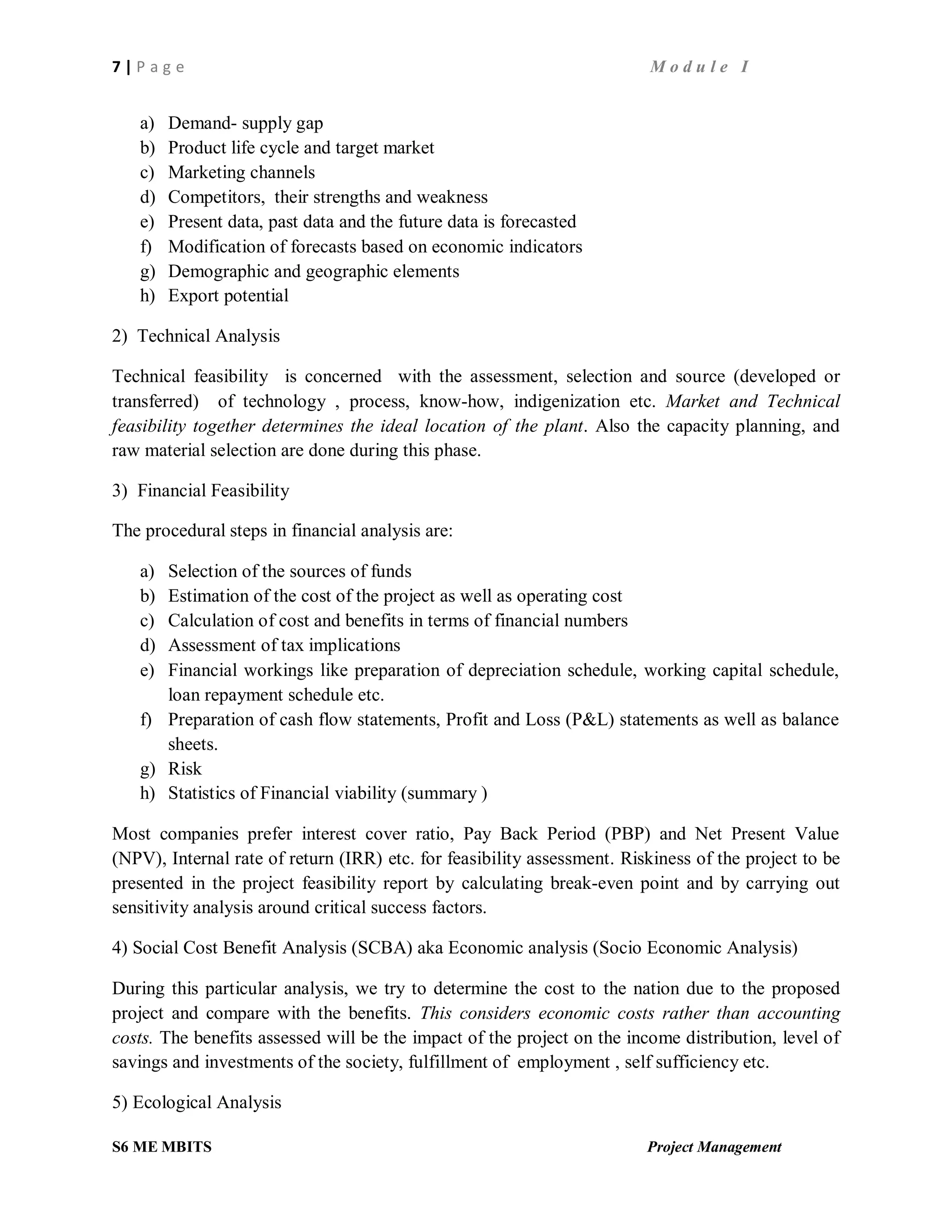

i) Sensitivity Analysis

Sensitivity analysis provides information as to how sensitive the various estimated project parameters

namely Cash Flows, Cost of capital and projects economic life are to estimation errors. In most cases the

variation in NPV are found out for the three different situations like best, most likely and worst.

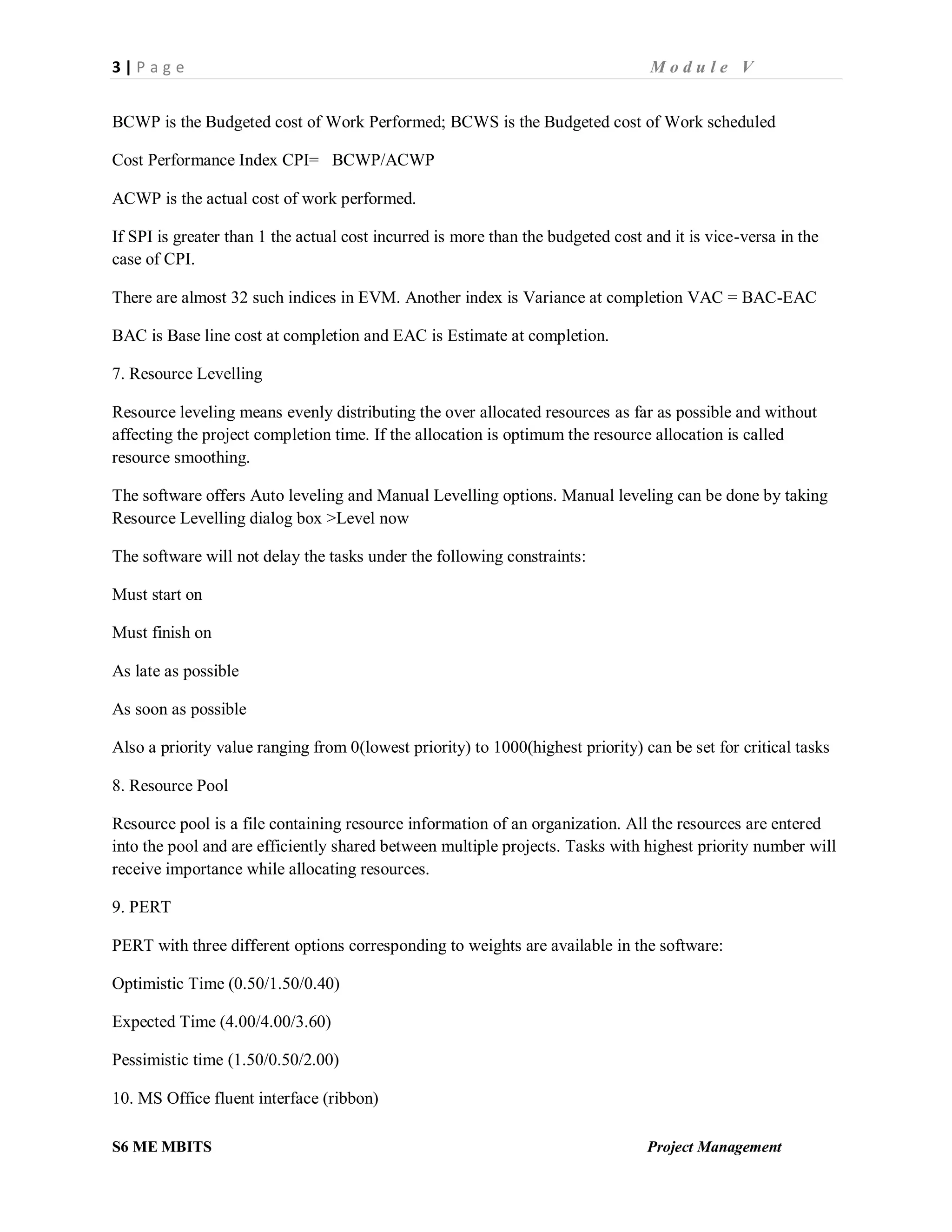

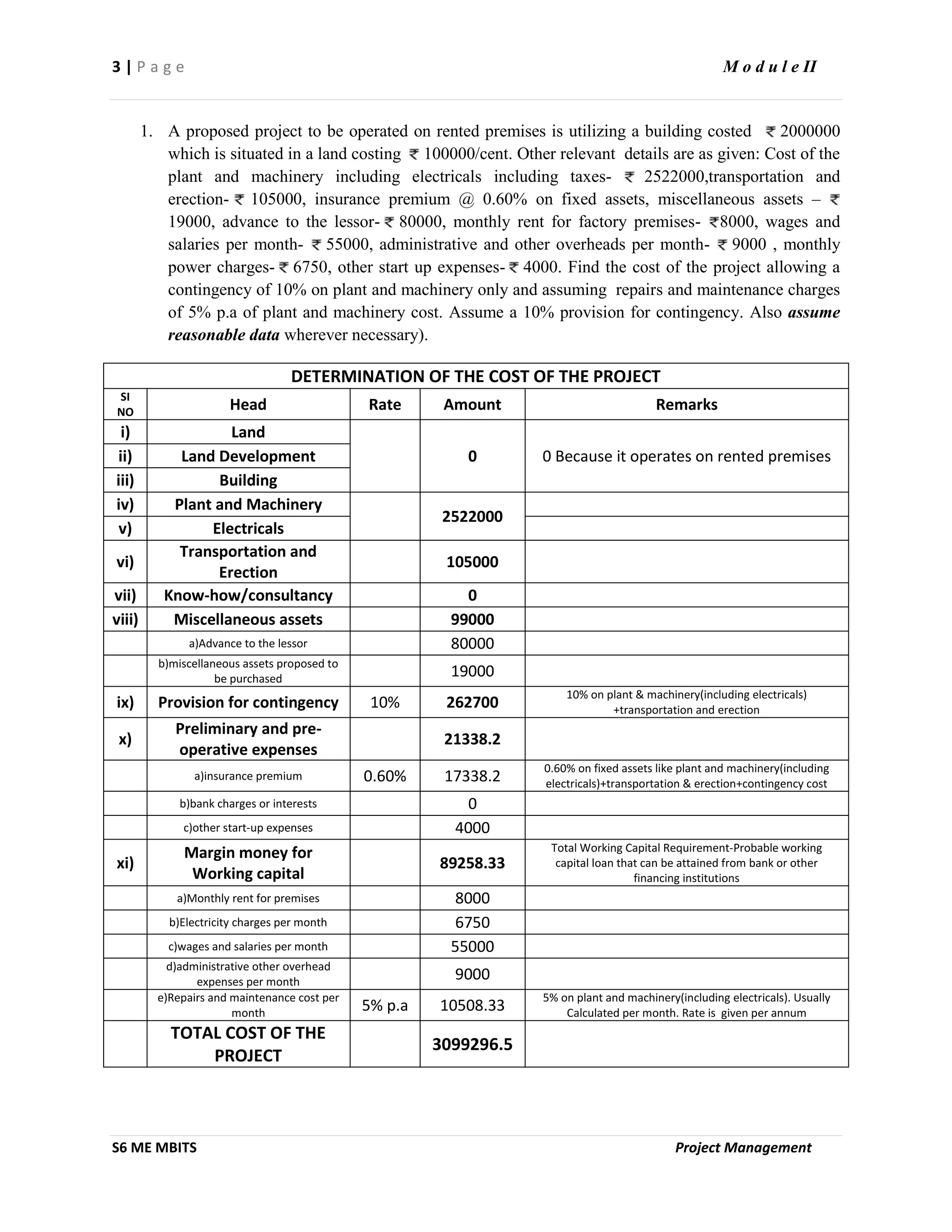

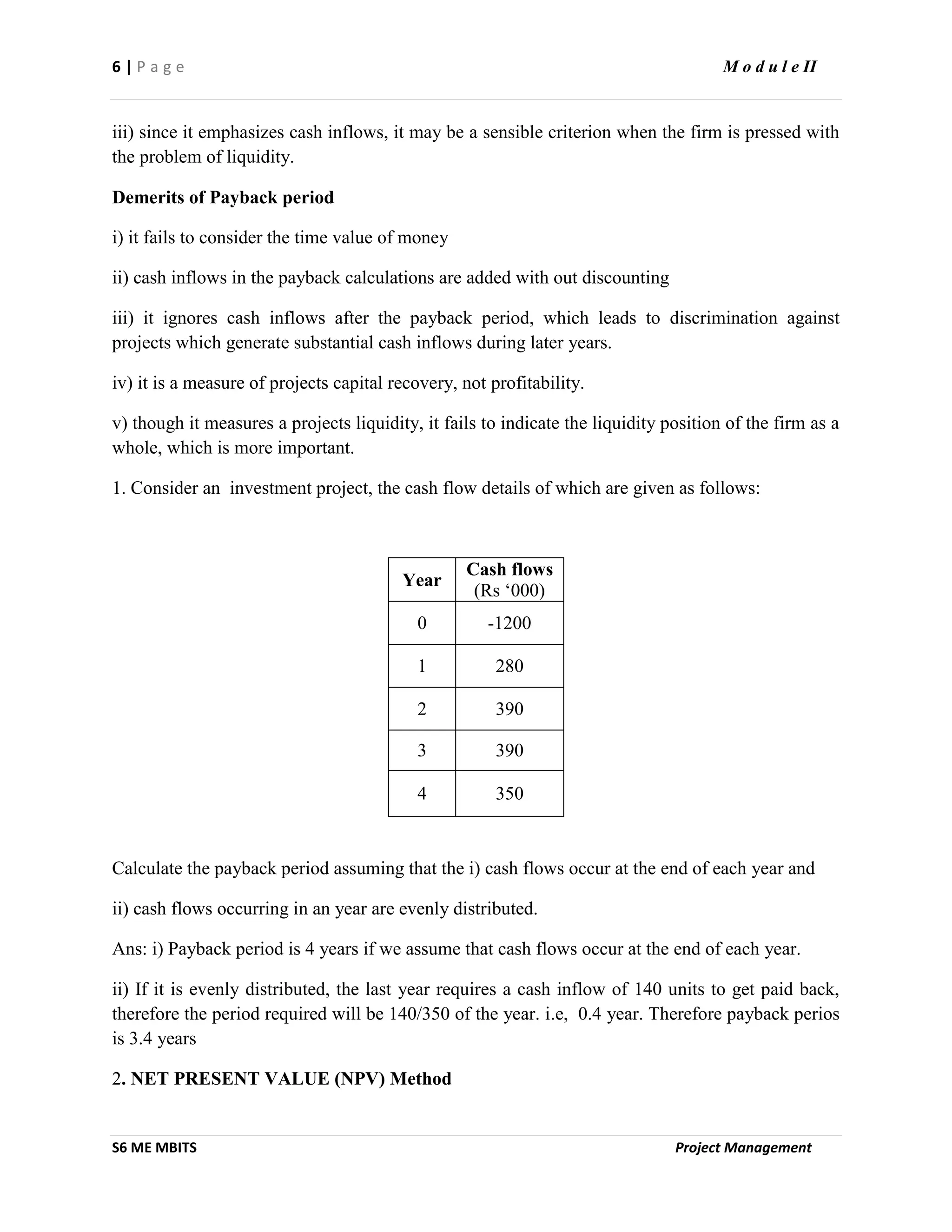

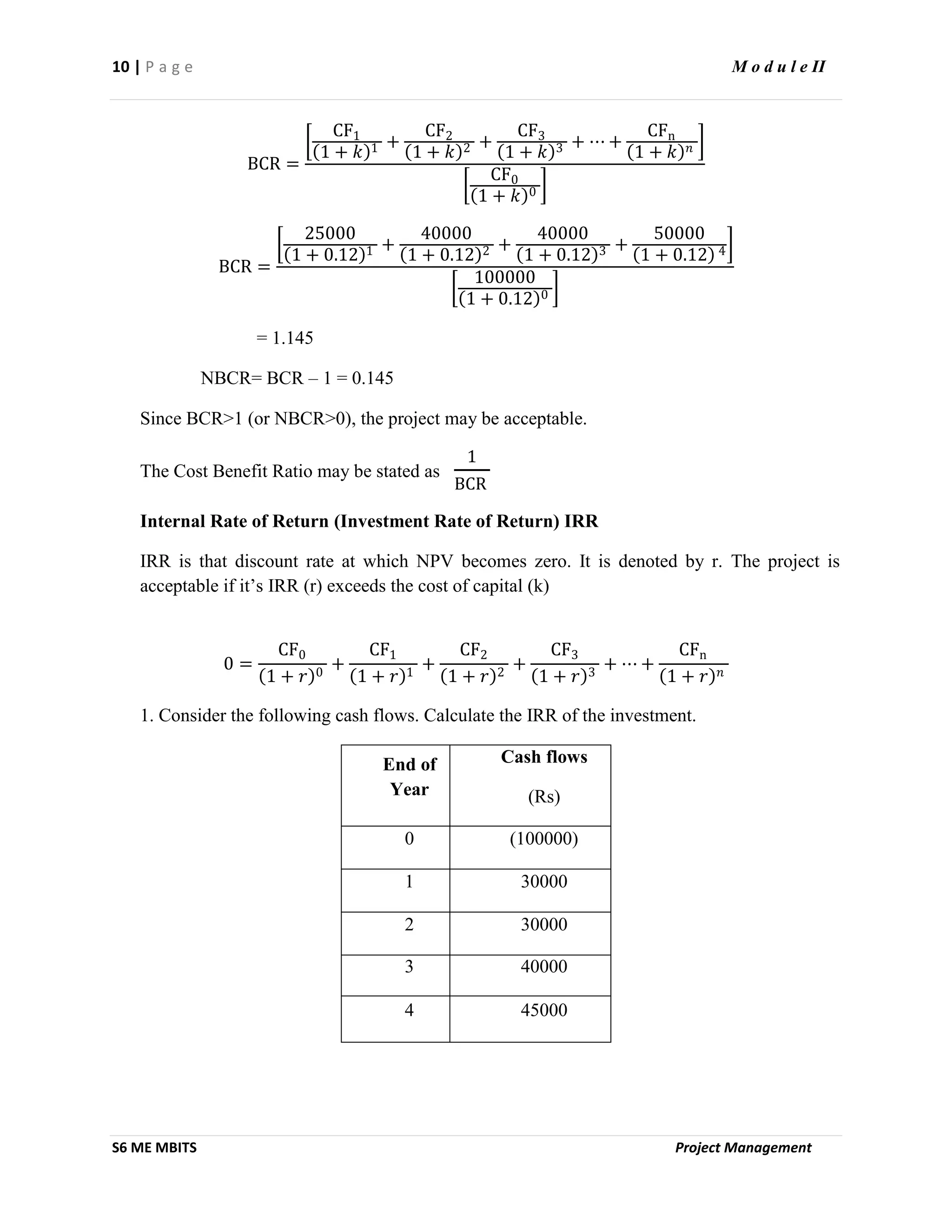

Period (EOY)

Cash Flows (INR Lakhs)

[Project X]

Cash Flows (INR Lakhs)

[Project Y]

Worst

Most

Likely

Best Worst Most Likely Best

0 40000 40000 40000 40000 40000 40000

1 6000 8000 10000 0 8000 16000

2 6000 8000 10000 0 8000 16000

3 6000 8000 10000 0 8000 16000

Rate 0.10 0.10

Economic life

(Years)

3 3

Sensitivity Analysis performed on the above yields an outcome which is summarized in the following

table:

Period (EOY)

Cash Flows (INR Lakhs)

[Project X]

Cash Flows (INR Lakhs)

[Project Y]

Worst

Most

Likely

Best Worst Most Likely Best

0 40000 40000 40000 40000 40000 40000

1 6000 8000 10000 0 8000 16000

2 6000 8000 10000 0 8000 16000

3 6000 8000 10000 0 8000 16000

NPV

(INR Lakhs)

5636 20848 30060 (40000) 20848 81696](https://image.slidesharecdn.com/ilovepdfmerged-200220114434/75/project-management-pm-note-in-mg-university-S6-sem-26-2048.jpg)

![4 | P a g e M o d u l e III

S6 ME MBITS Project Management

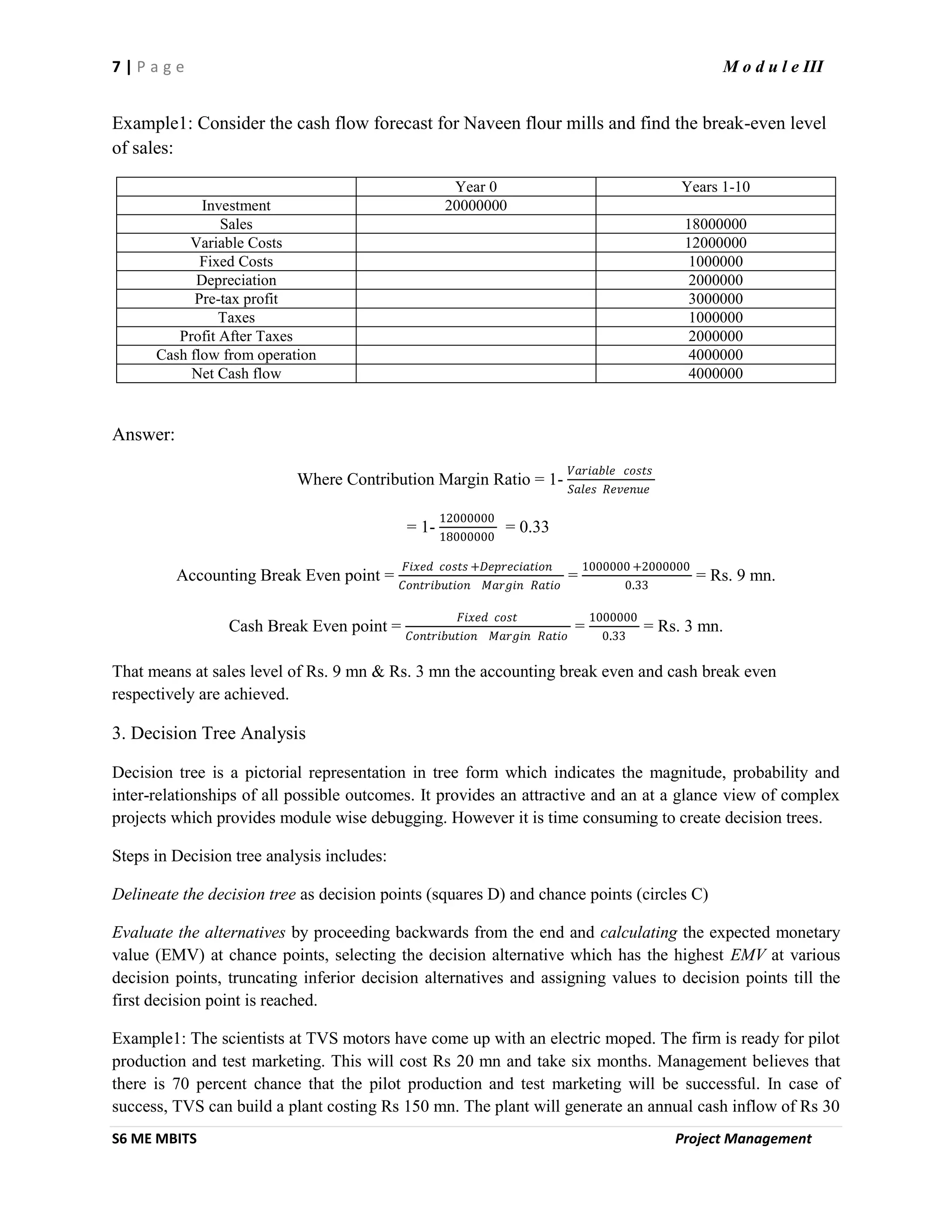

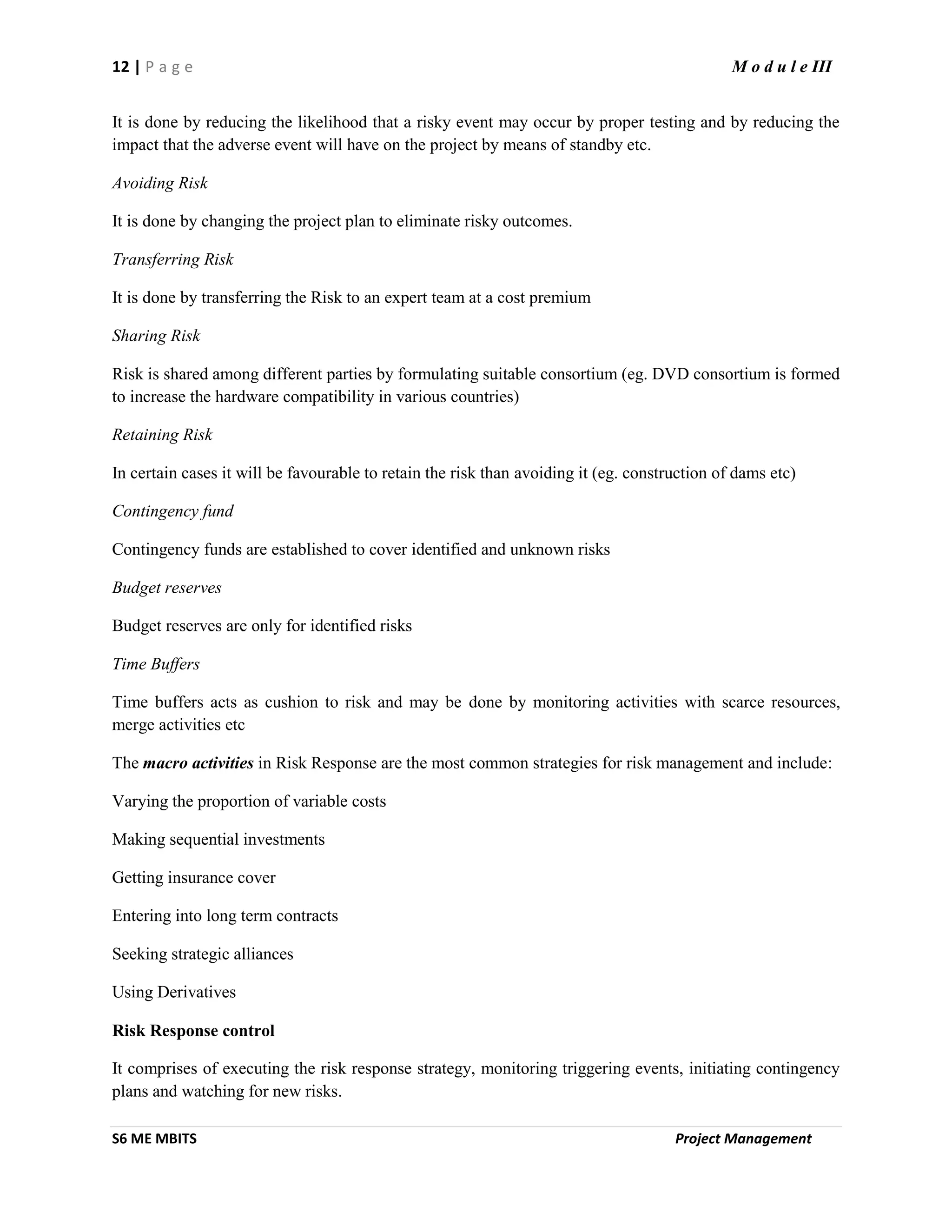

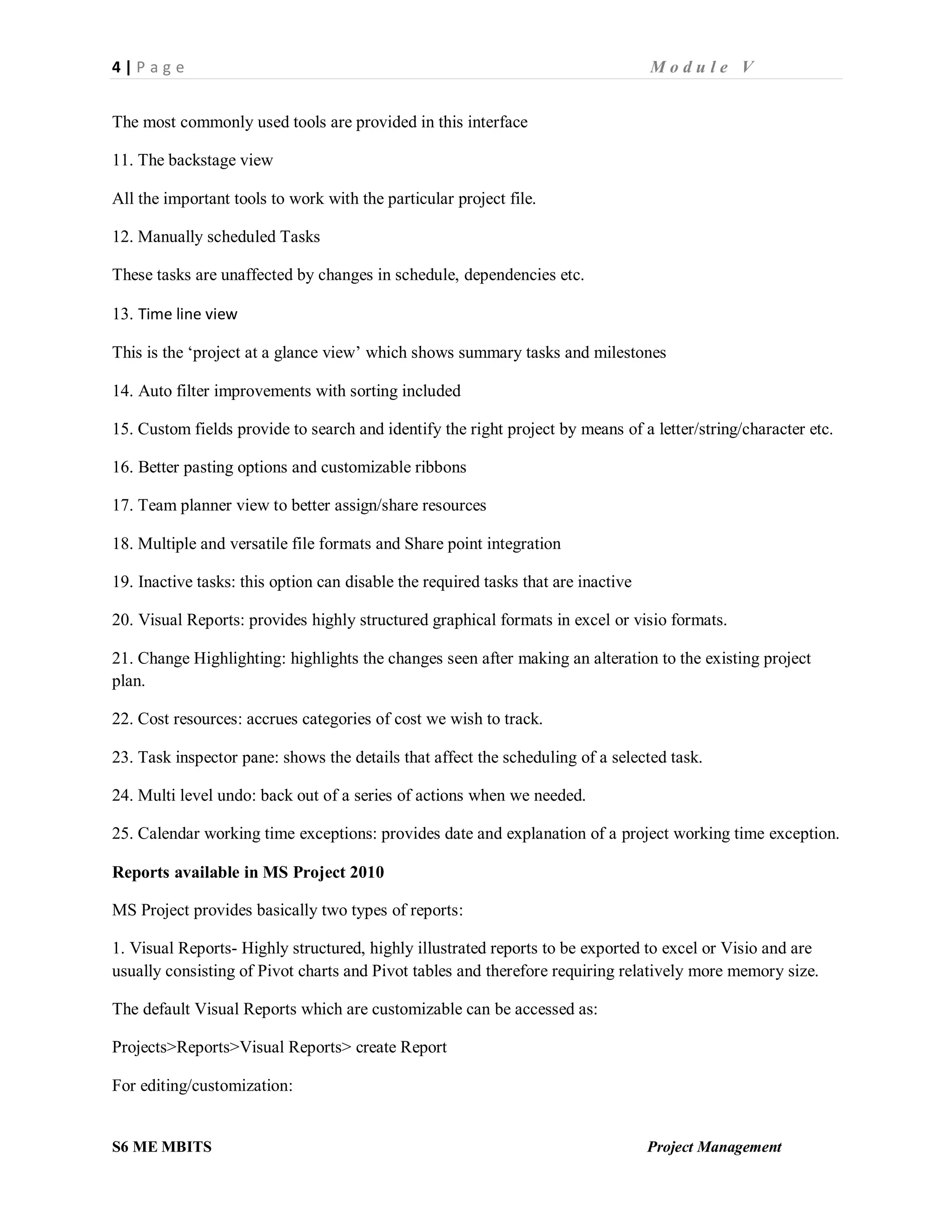

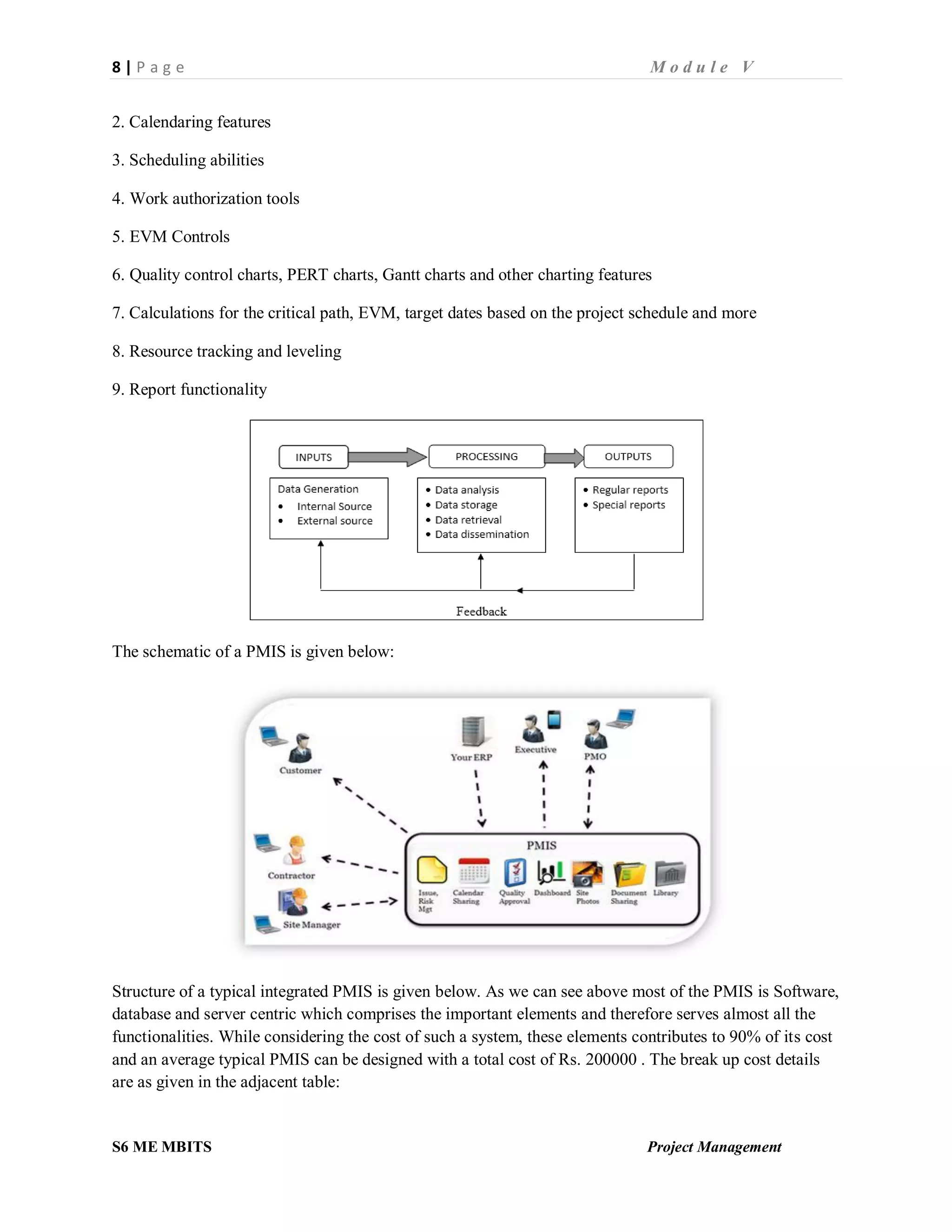

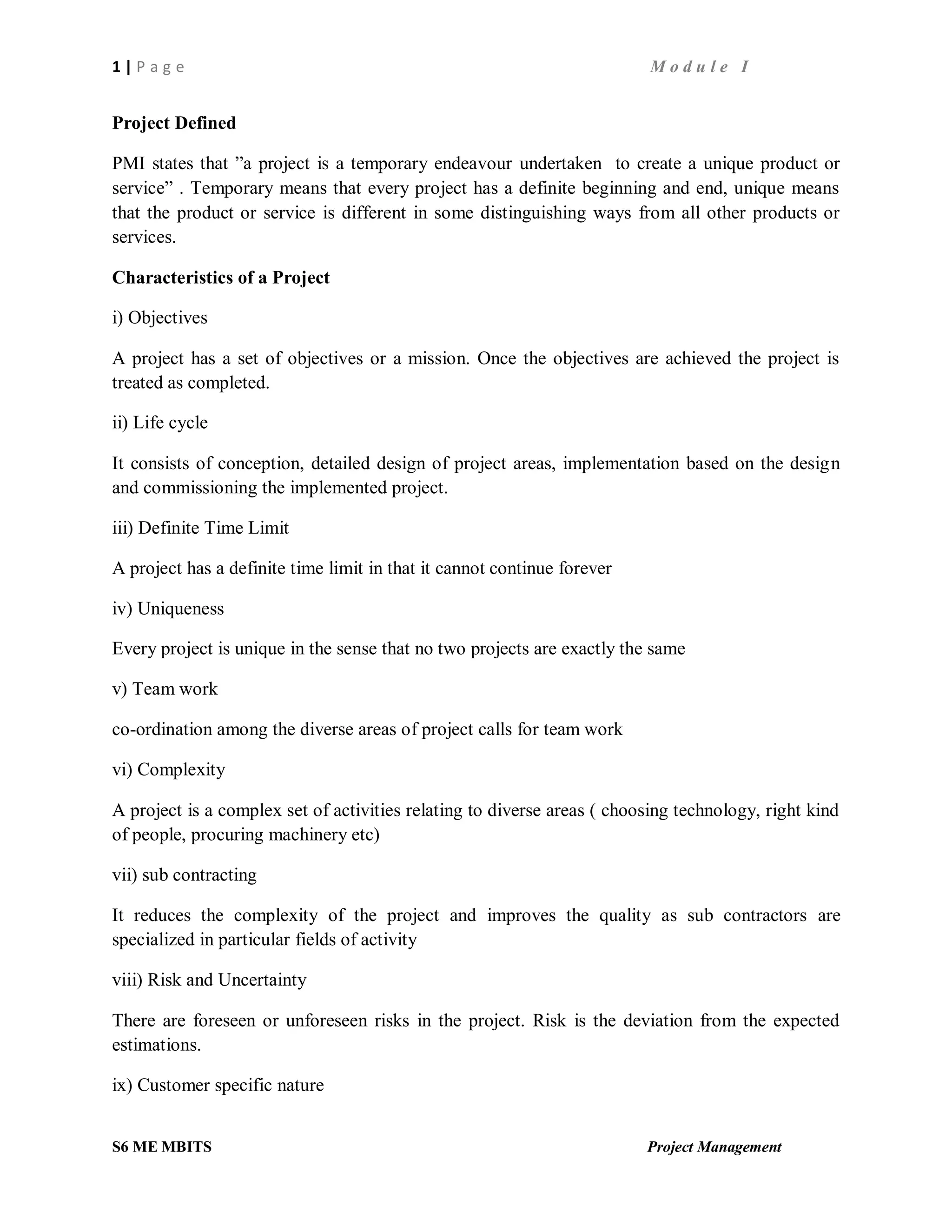

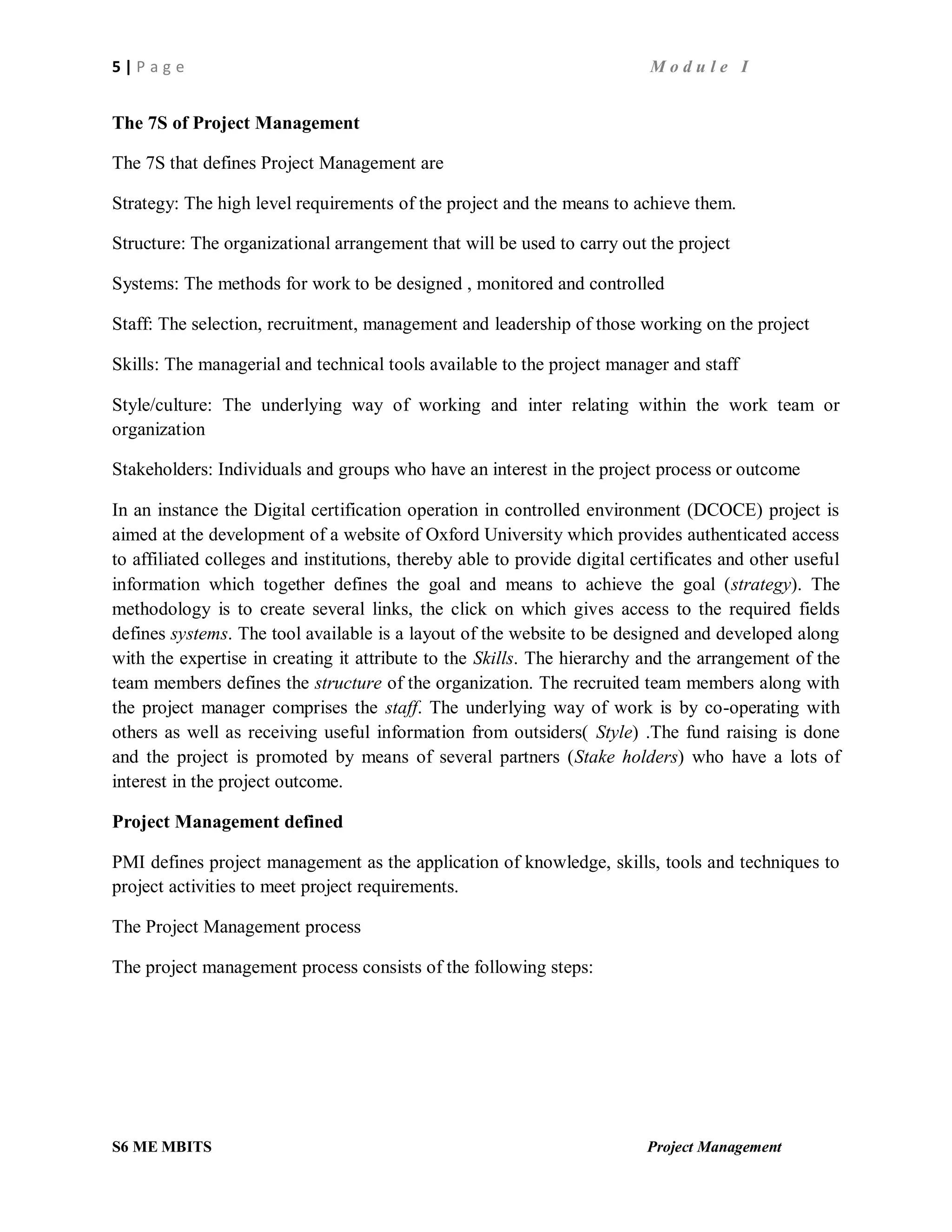

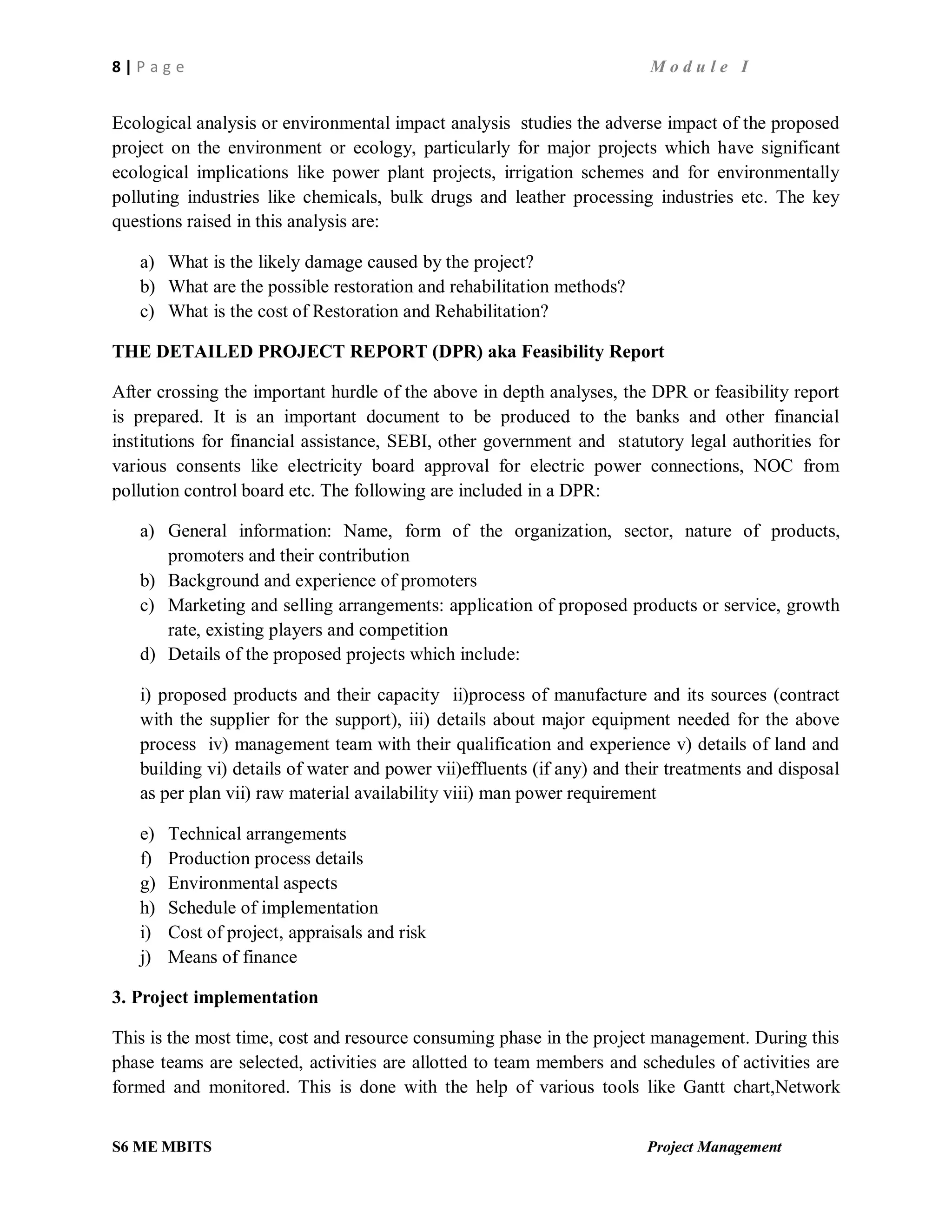

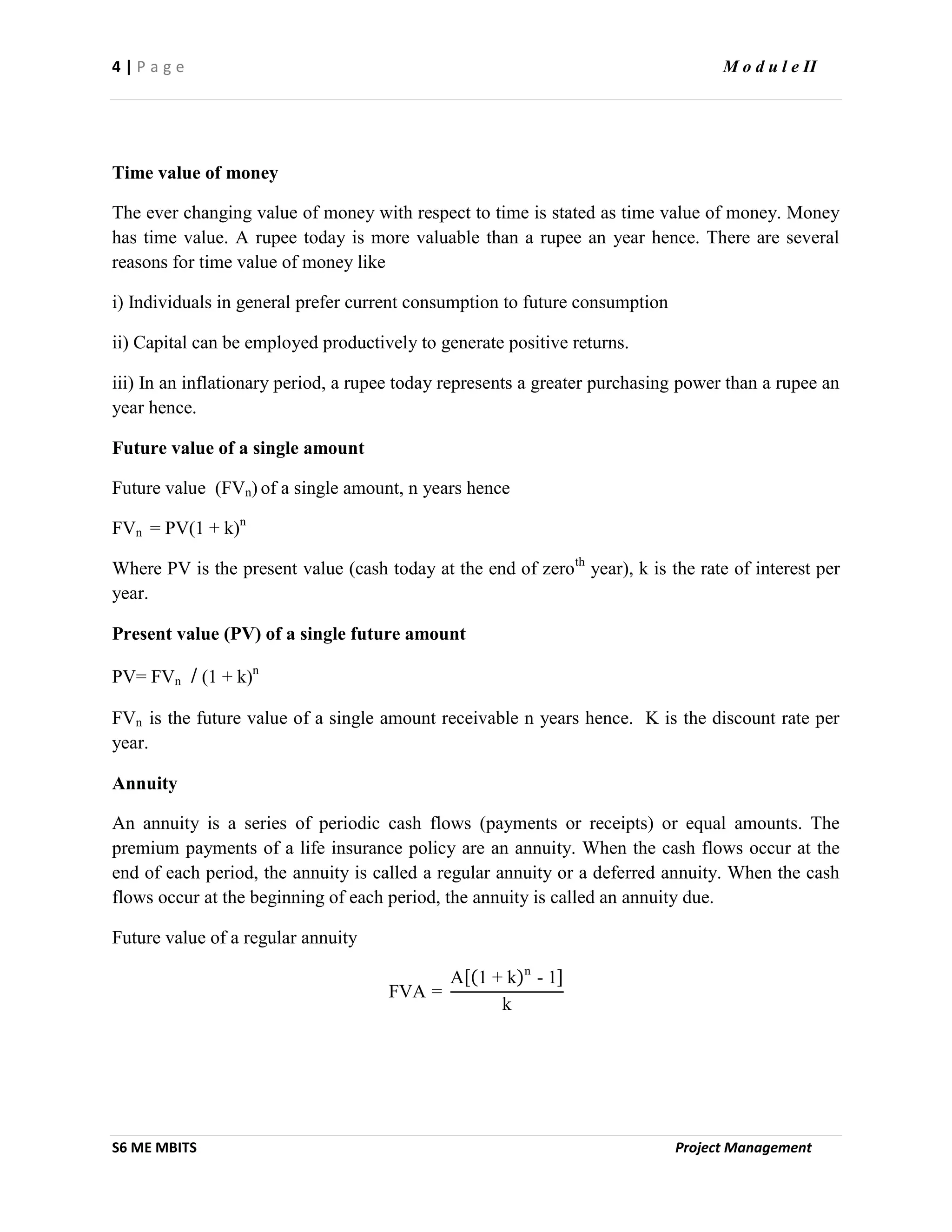

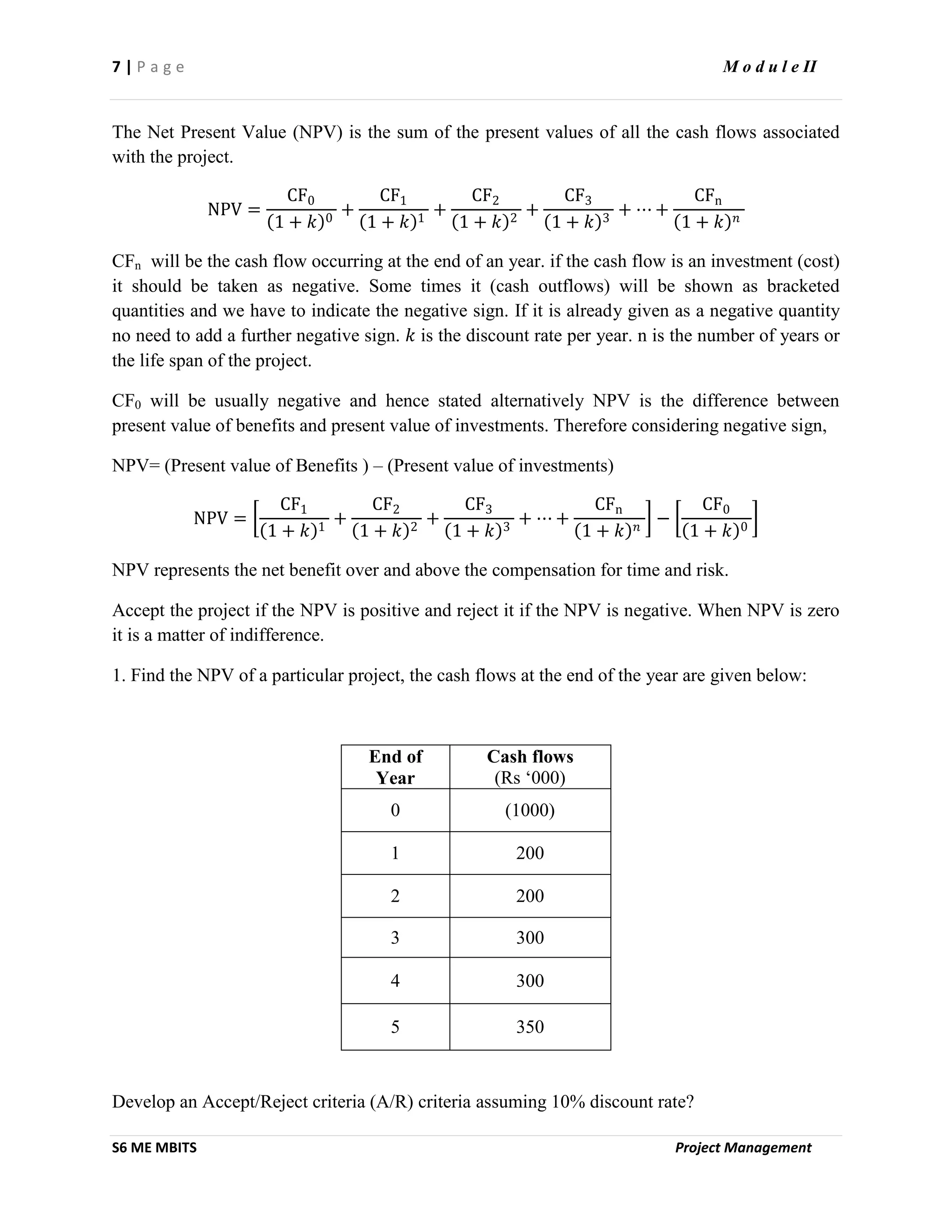

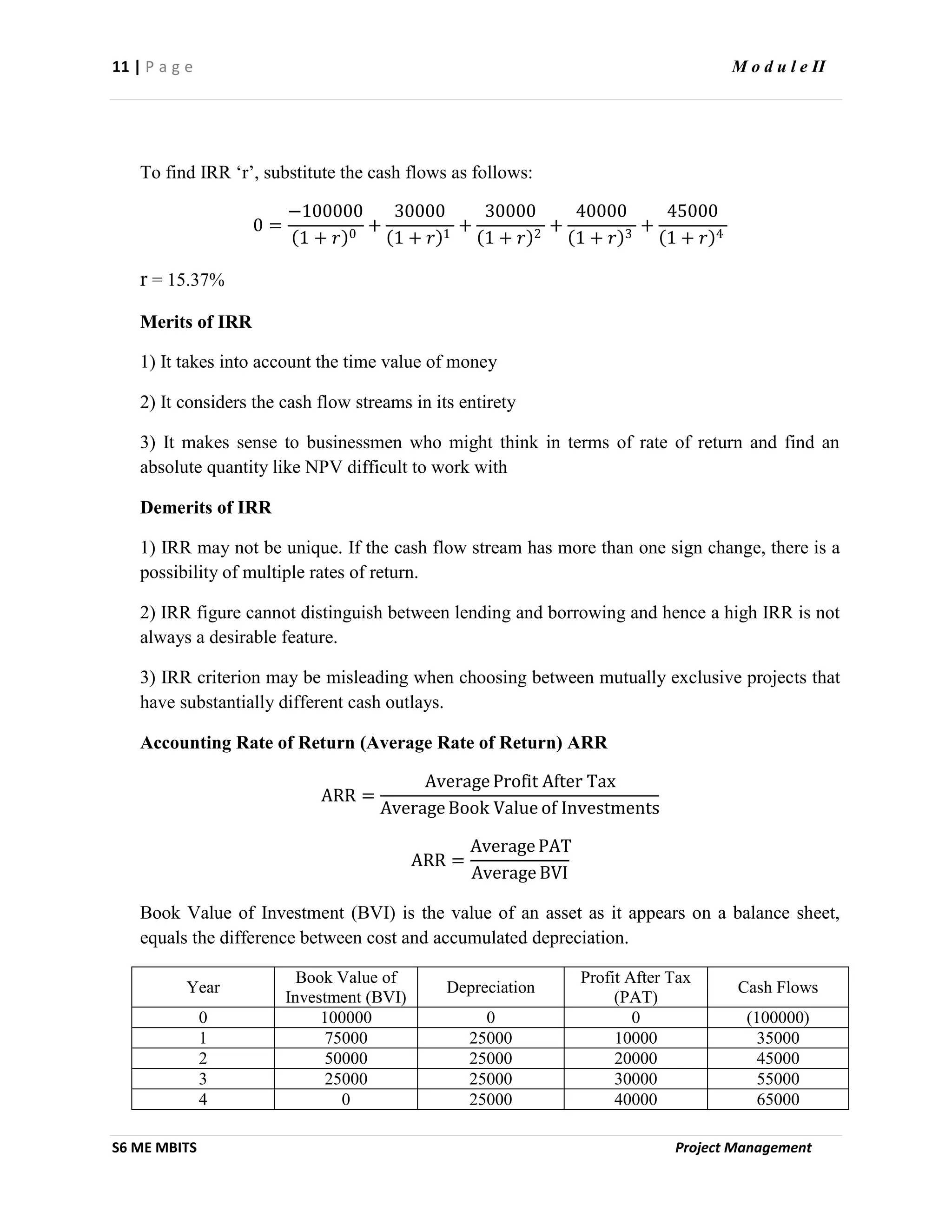

5. Simulate the experiment by means of Random Sampling

Example 1: A Retailer deals in perishable items, the daily demand and supply of which are random

numbers, the past 500 days data shows the following:

Supply Demand

Available(kg) Number of days Available(kg) Number of days

10 40 10 50

20 50 20 110

30 190 30 200

40 150 40 100

50 70 50 40

The retailer buys the item at Rs. 20 per kg and sells the item at Rs. 30 per kg. If any of the commodity

remains at the end of the day, it has no sell value and is a dead loss. More over the loss on any unsatisfied

item is Rs. 8 per kg. Given the following random numbers: 31, 18, 63, 84, 15, 79, 07, 32, 43, 75, 81 and

27. Use the random numbers alternately to simulate supply and demand for six days sales.

Answer: Create RNI and Probability Distribution

Supply side Demand side

Supply

(kg)

Probability

Random

Number

Interval

(RNI)

Demand

(kg)

Probability

Random Number

Interval

(RNI)

10 0.08 00-07 10 0.10 00-09

20 0.10 08-17 20 0.22 10-31

30 0.38 18-55 30 0.40 32-71

40 0.30 56-85 40 0.20 72-91

50 0.14 86-99 50 0.08 92-99

Using Random numbers , simulate for six days: The Net profit is found to be +400 (see the table)

Day RN

Supply

(kg)

RN

Demand

(kg)

Cost

(Rs.)

Revenue

(Rs.)

Loss of

Unmet

Demand

(Rs.)

Profit

(Rs.)

1 31 30 18 20 600 600 - -

2 63 40 84 40 800 1200 - 400

3 15 20 79 40 400 600 160 40

4 07 10 32 30 200 300 160 -60

5 43 30 75 40 600 900 80 220

6 81 40 27 20 800 600 - -200

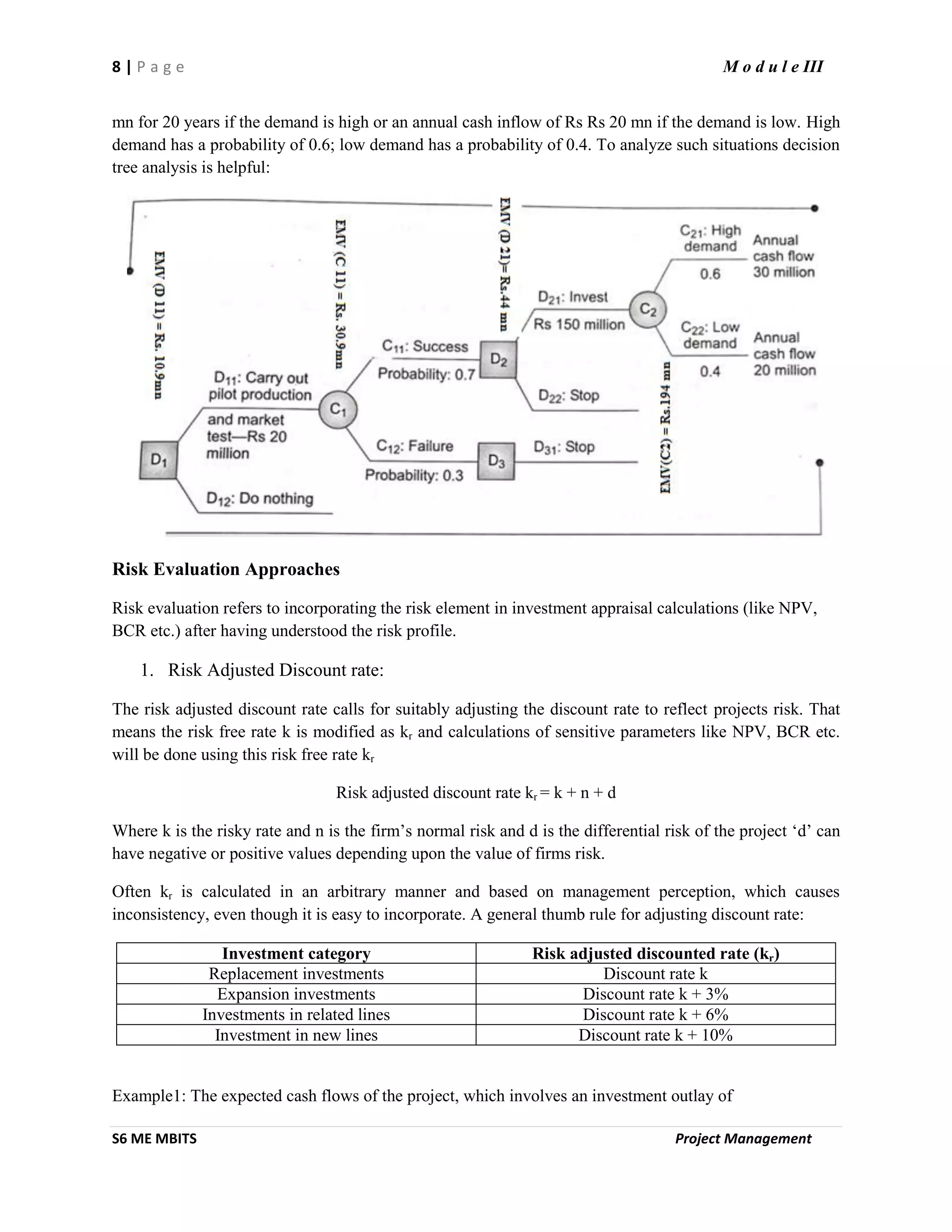

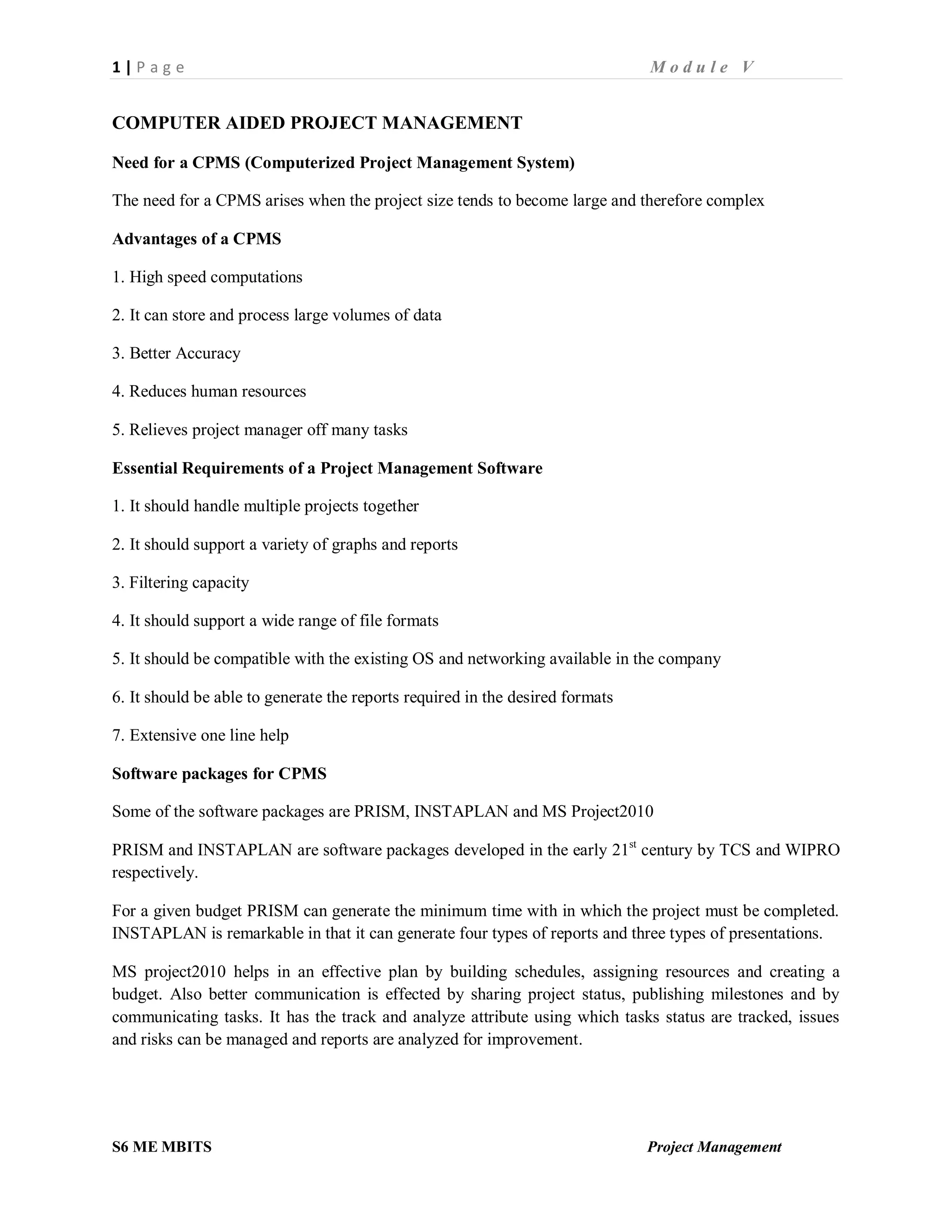

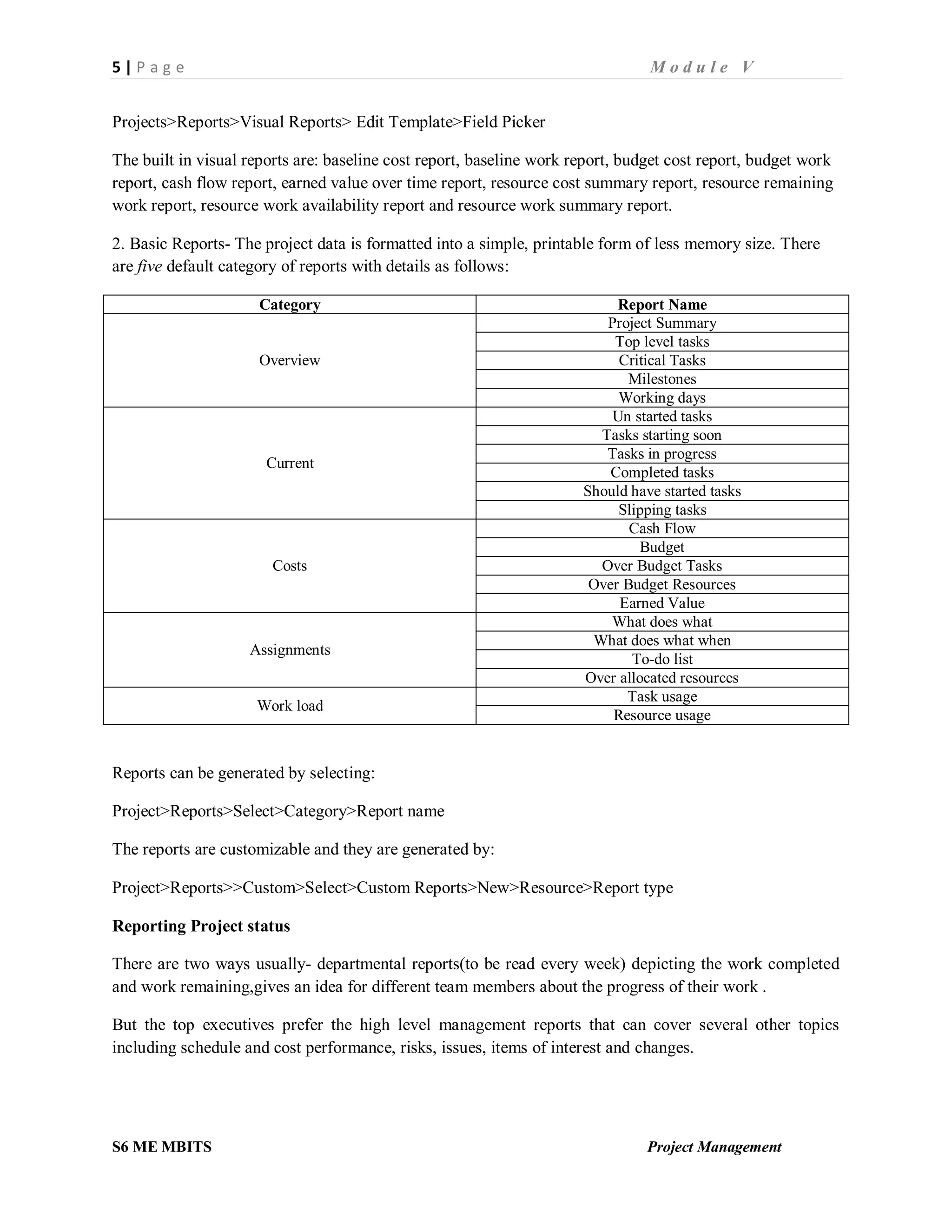

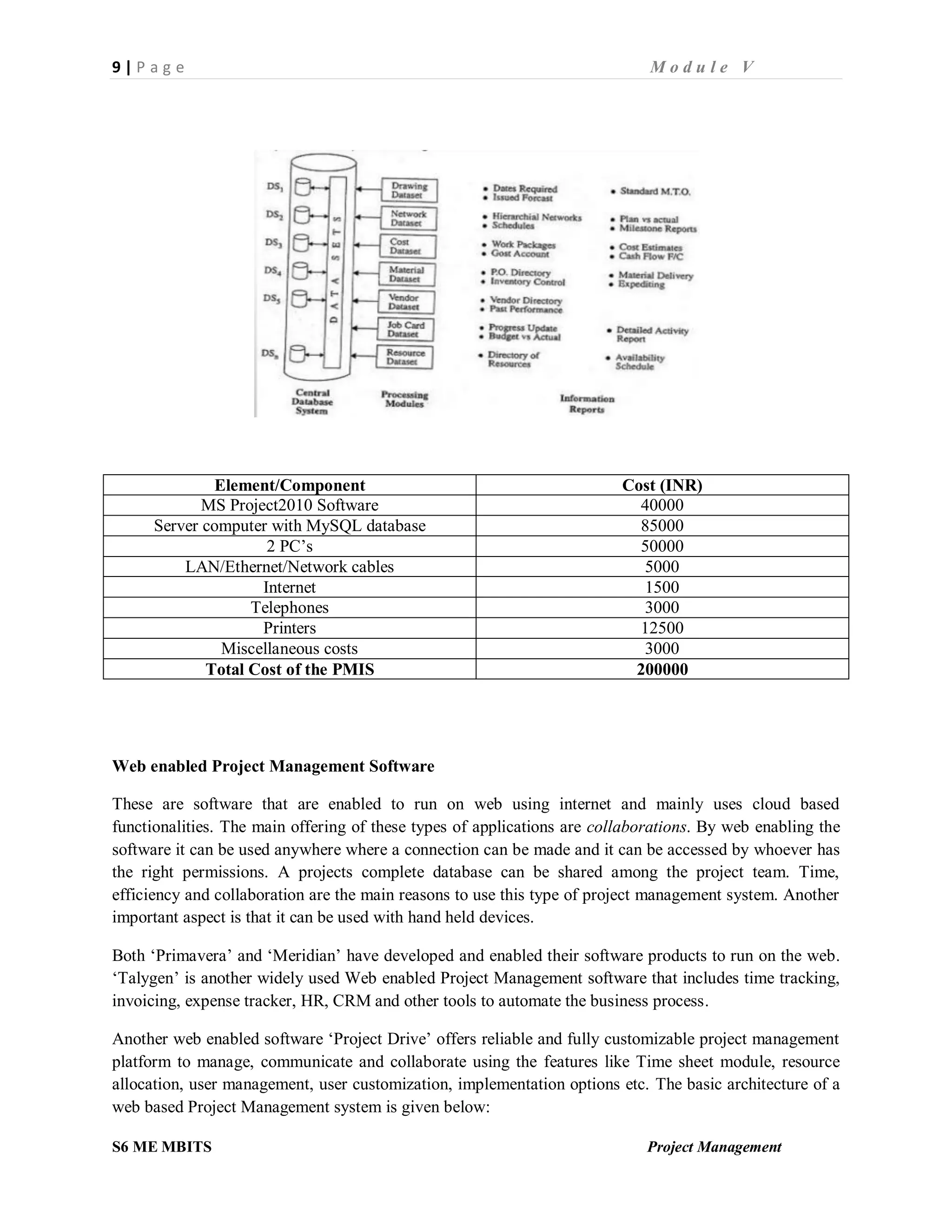

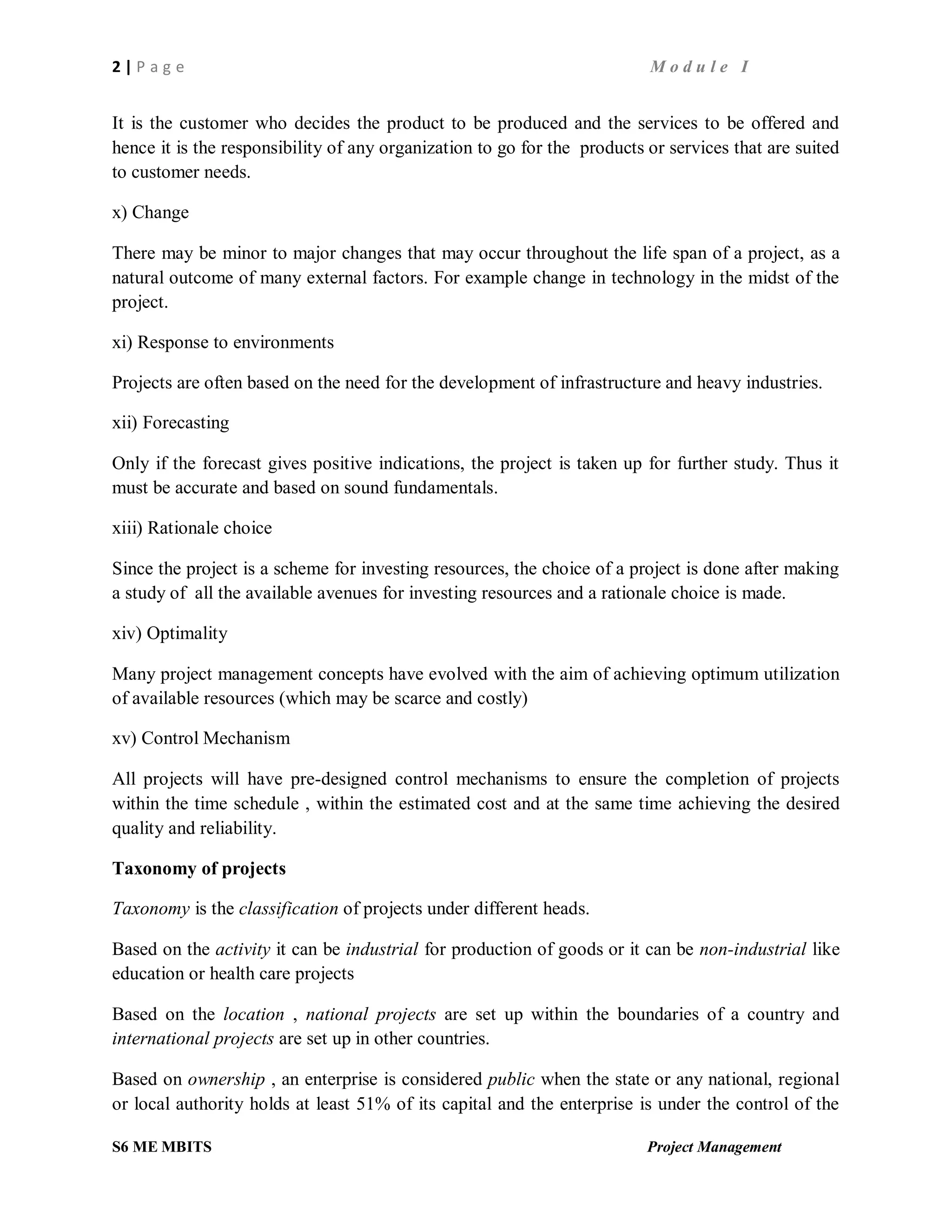

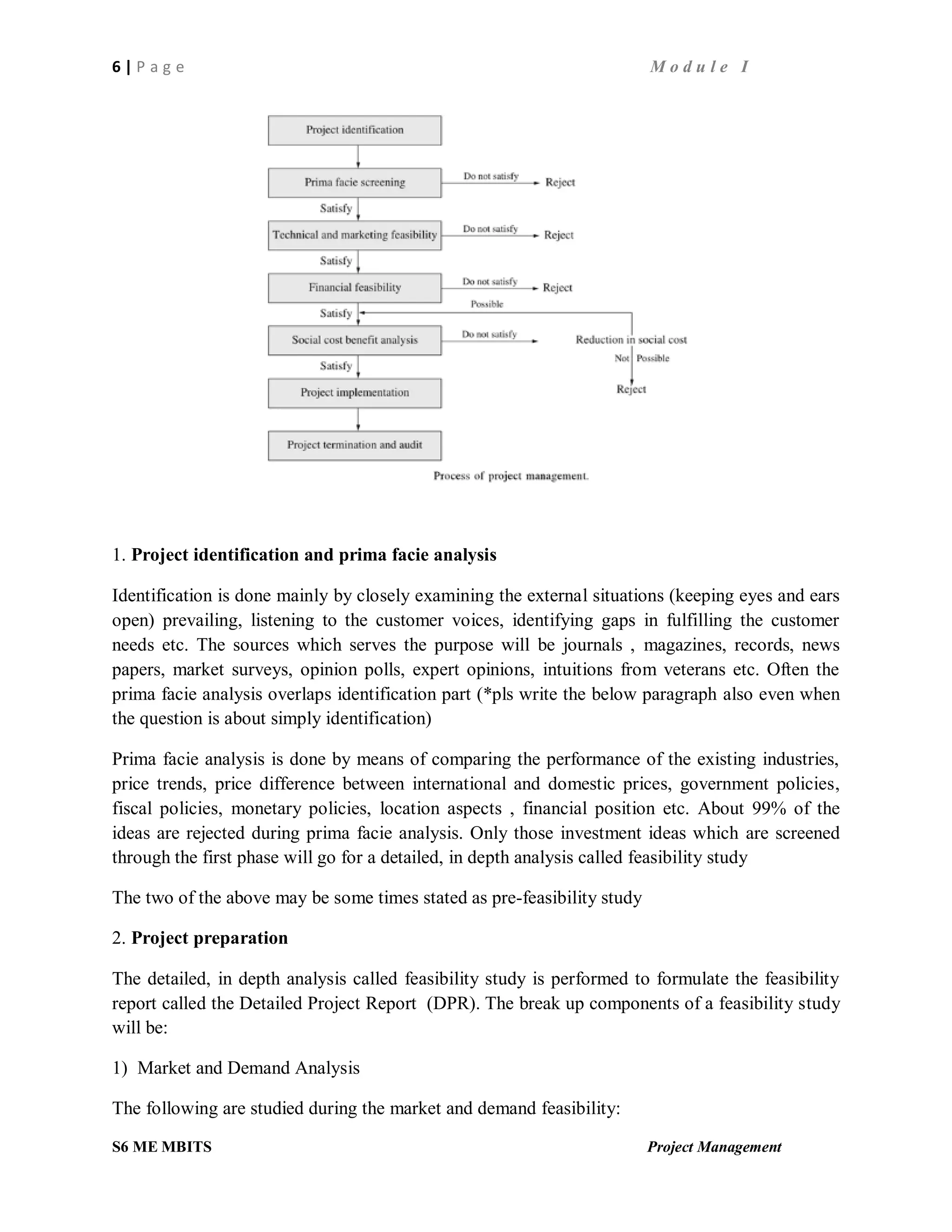

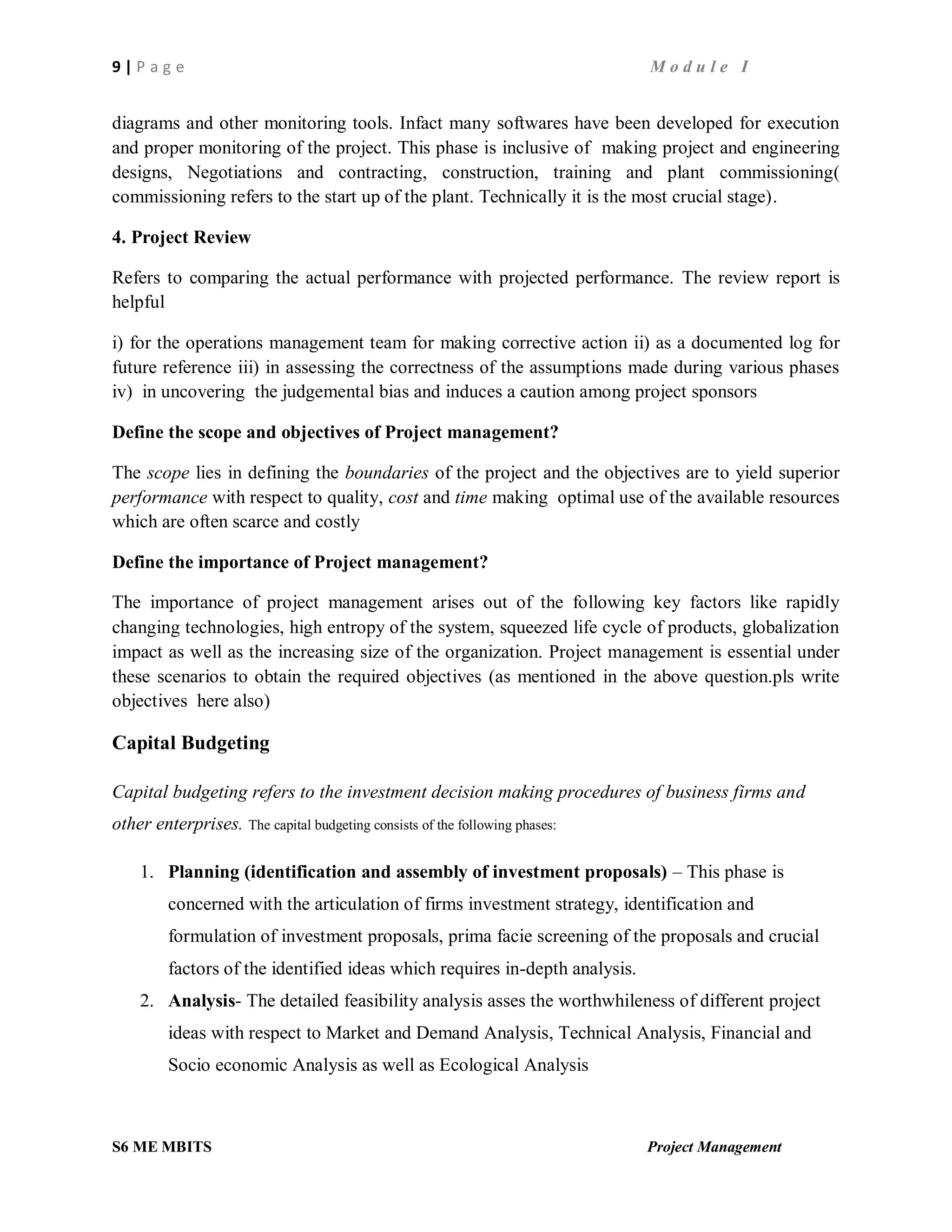

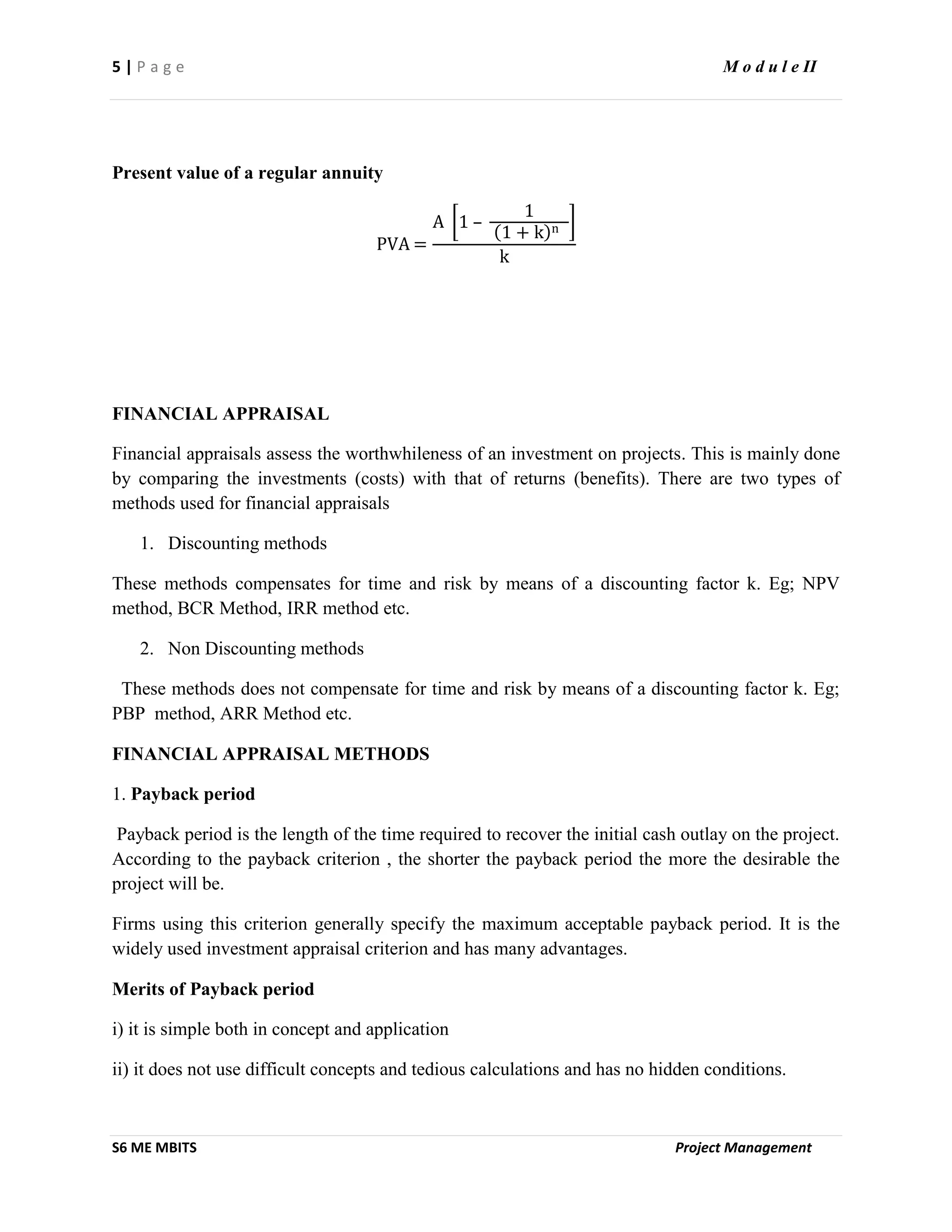

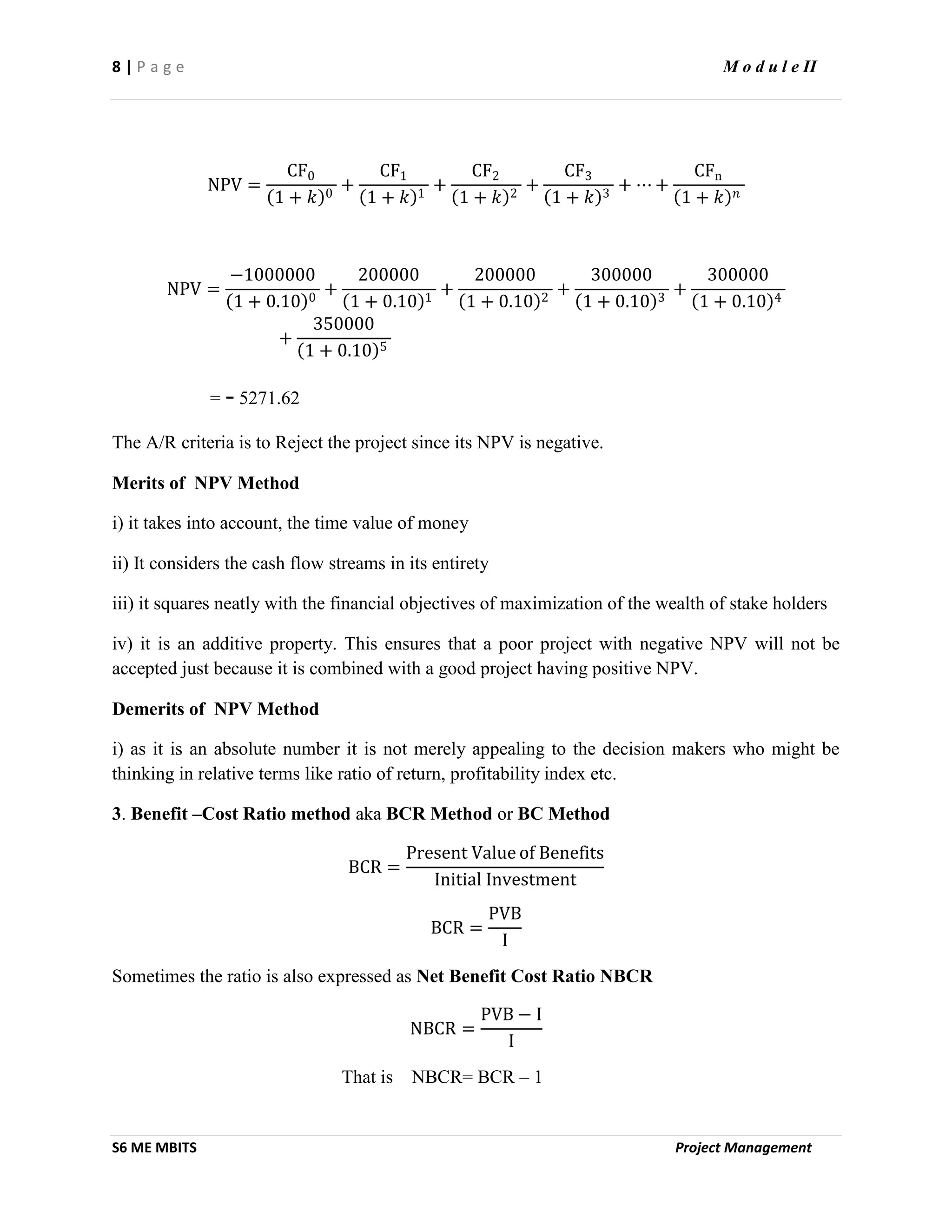

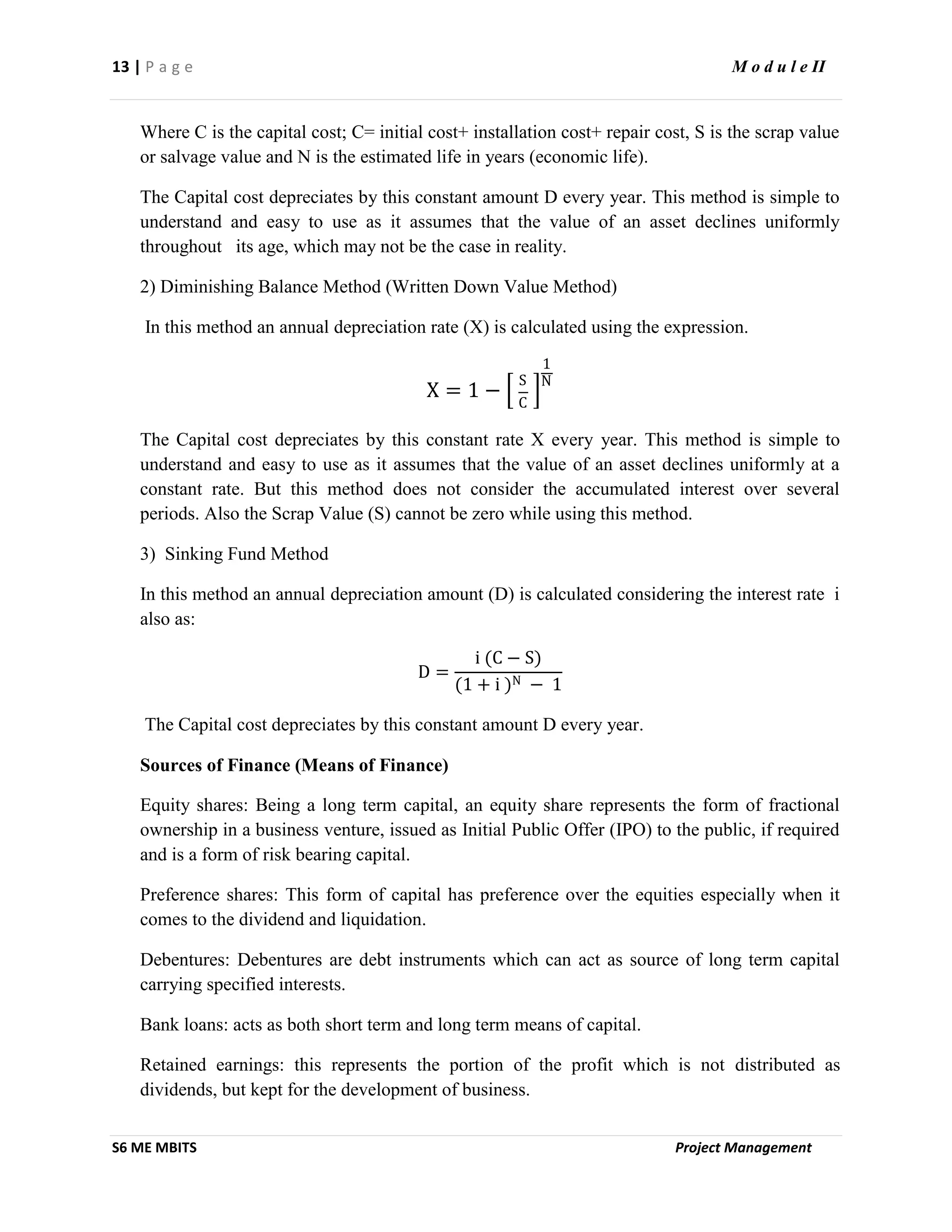

iv) The Hillier Model

The Hillier Model gives the NPV and the standard deviation of the NPV [𝜎(𝑁𝑃𝑉)] based on expected

cash flows under two different situations viz; perfectly correlated cash flows and uncorrelated cash flows.](https://image.slidesharecdn.com/ilovepdfmerged-200220114434/75/project-management-pm-note-in-mg-university-S6-sem-28-2048.jpg)

![5 | P a g e M o d u l e III

S6 ME MBITS Project Management

Response Uncorrelated cash flows Perfectly correlated cash flows

NPV

𝐶𝐹𝑡

1 + 𝑘 𝑡

𝑛

𝑡=1

− 𝐼

𝐶𝐹𝑡

1 + 𝑘 𝑡

𝑛

𝑡=1

− 𝐼

𝜎(𝑁𝑃𝑉)

𝜎𝑡

2

1 + 𝑘 2𝑡

𝑛

𝑡=1

𝜎𝑡

1 + 𝑘 𝑡

𝑛

𝑡=1

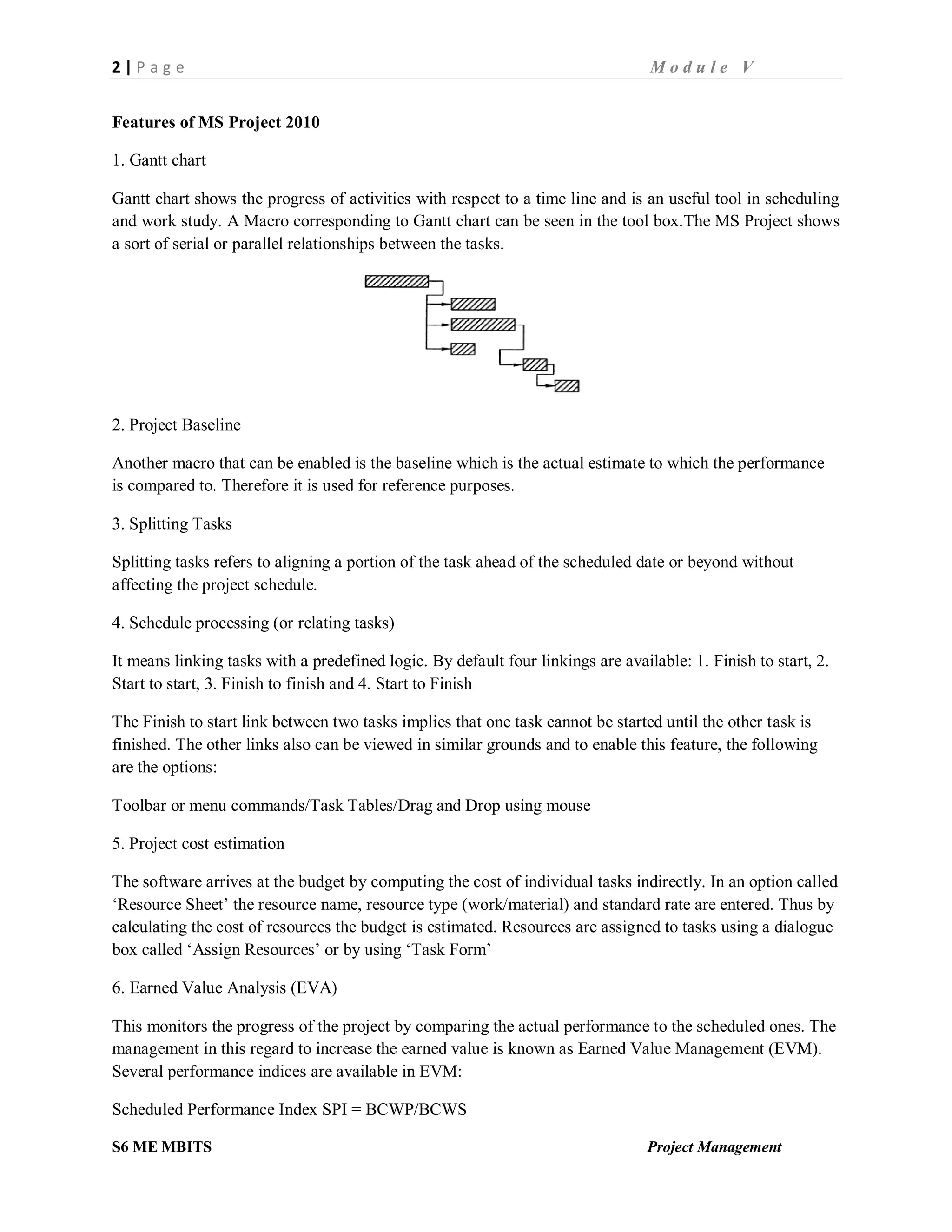

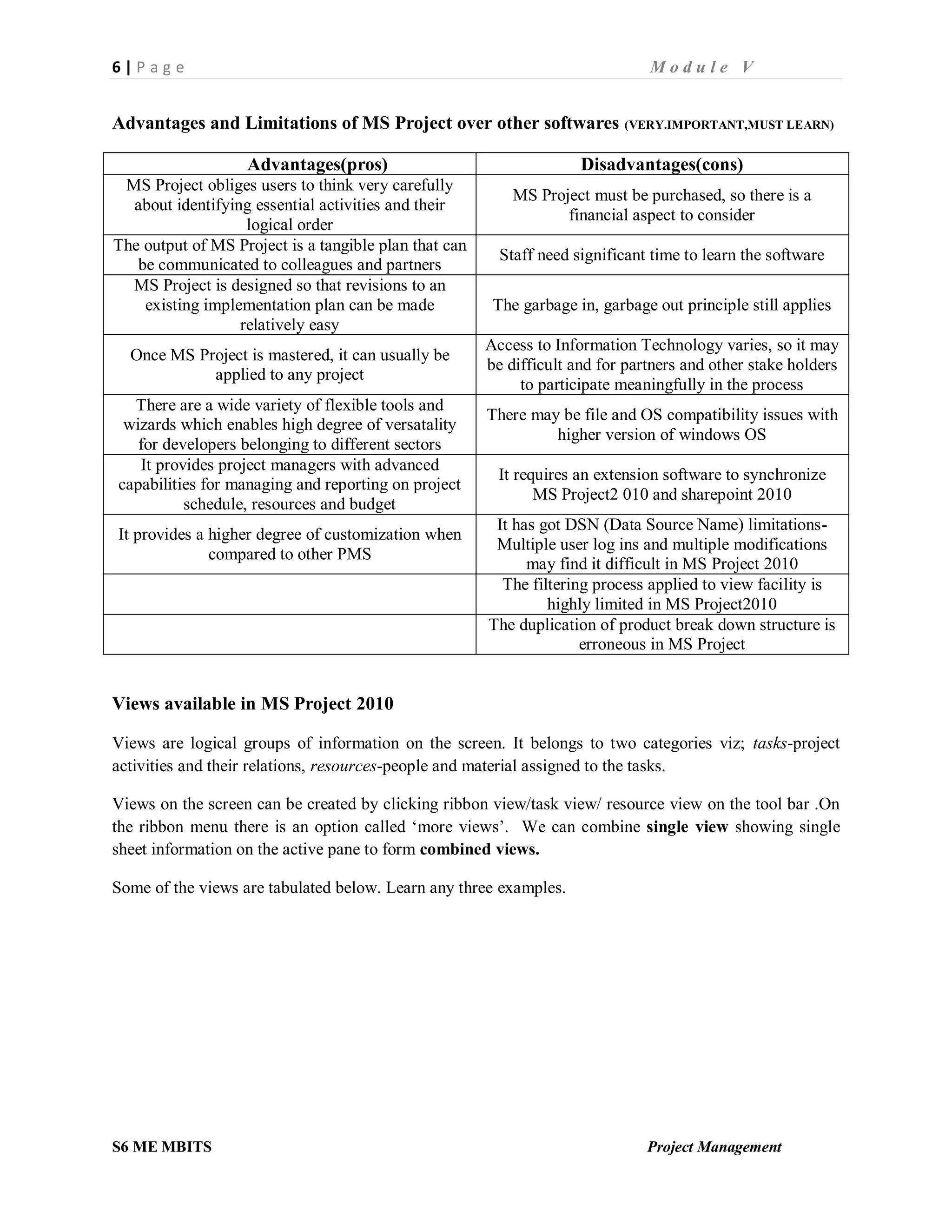

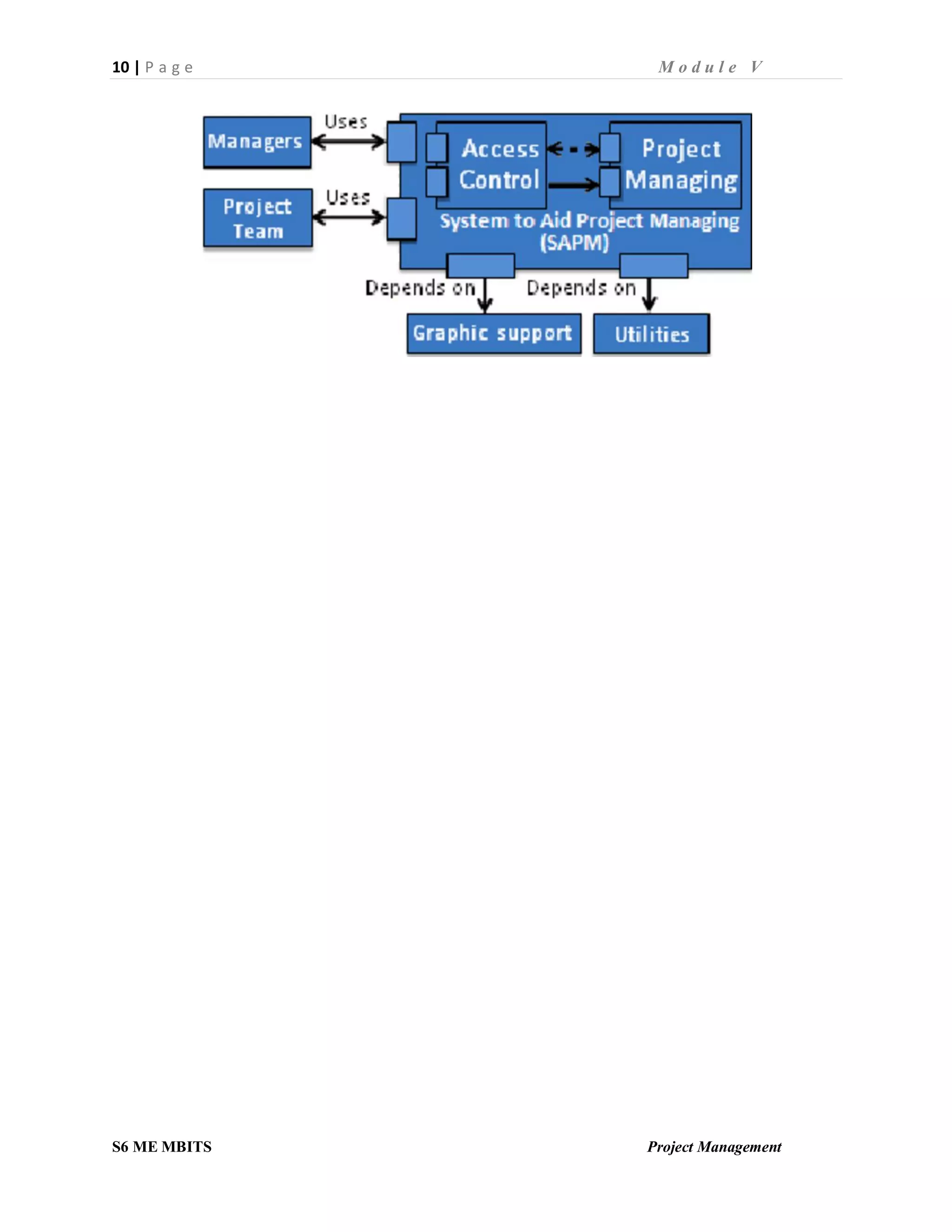

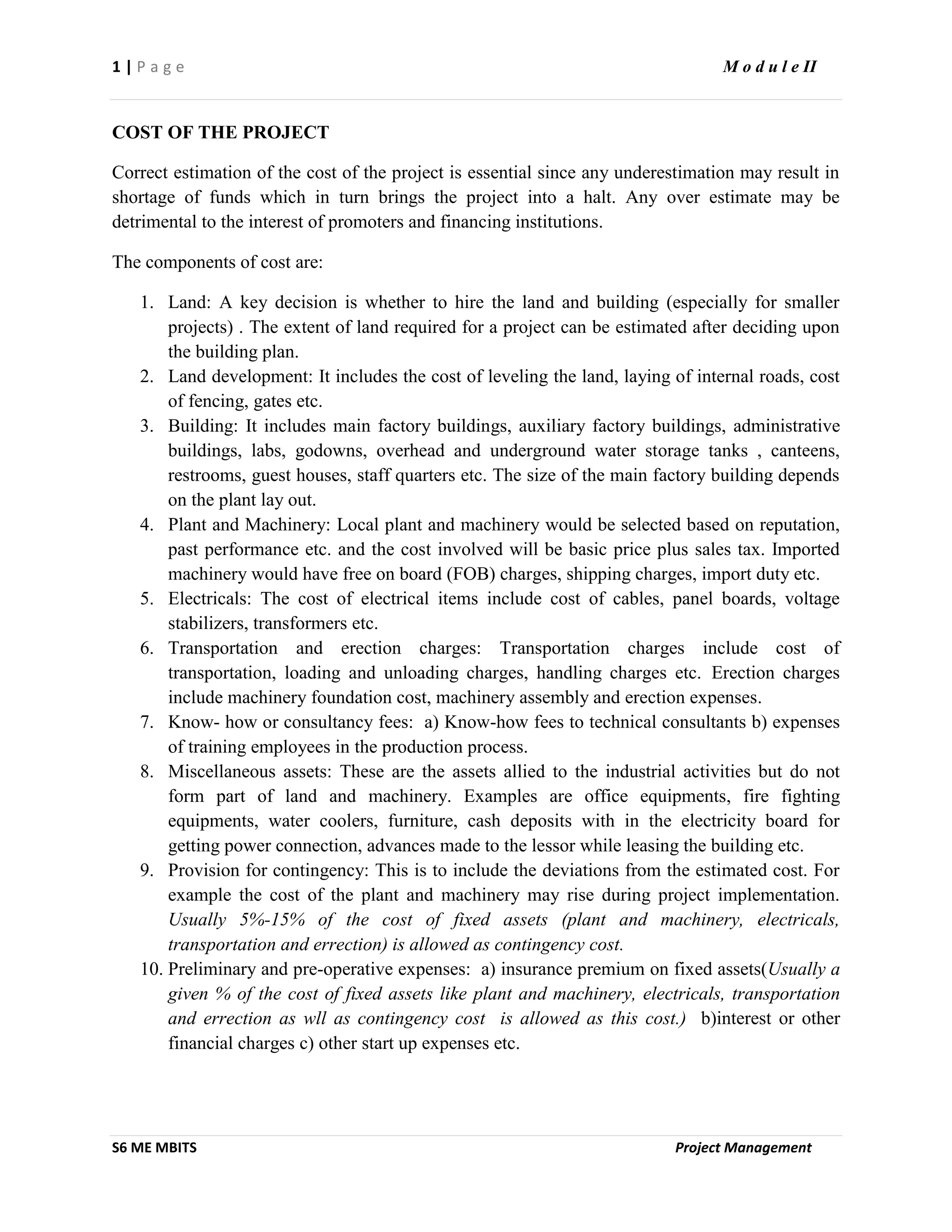

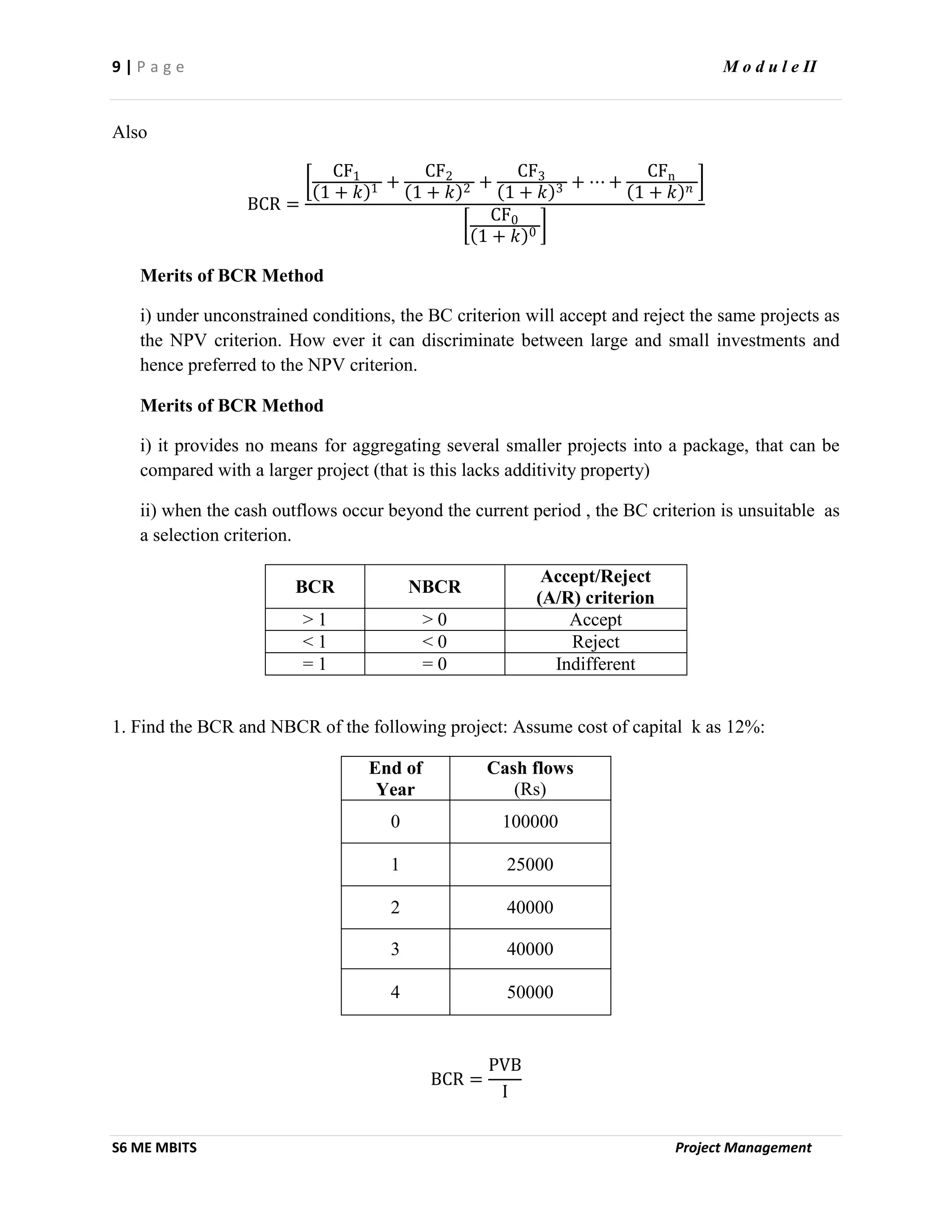

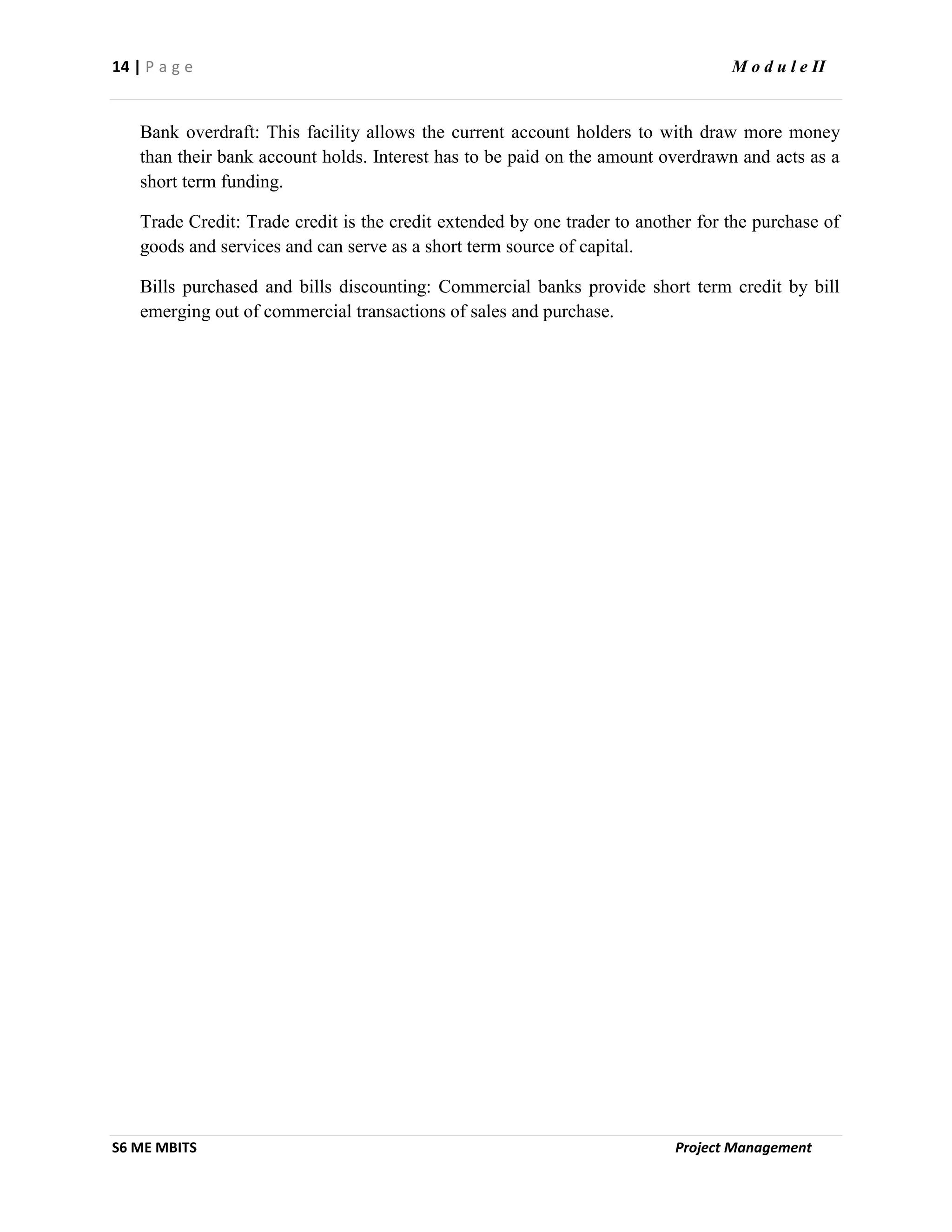

v) Standard Deviation

Standard Deviation𝜎 is the square root of the mean of the squared deviations; the deviation being the

difference between an outcome and the expected mean value of all outcomes. Note that only cash inflows

are considered for the calculations.

𝜎 = 𝑃1 (𝐶𝐹1 − 𝐶𝐹) 2 + 𝑃2(𝐶𝐹2 − 𝐶𝐹) 2 + ⋯ + 𝑃𝑛 (𝐶𝐹𝑛 − 𝐶𝐹) 2

Consider the following example:

Period

(EOY)

Cash Flows (INR Lakhs)

[Project X]

Probability

Cash Flows (INR Lakhs)

[Project Y]

Probability

0 (40000) (40000)

1 5636 0.25 40000 0.25

2 20848 0.50 20848 0.50

3 36060 0.25 1696 0.25

Rate 0.10 0.10

Economic

life (Years)

3 3

For the project X, the standard deviation is given by

𝜎 = 0.25(5636 − 20848) 2 + 0.50(20848 − 20848) 2 + 0.25(36060 − 20848) 2

= 12229.10

For the project Y, the standard deviation is given by

𝜎 = 0.25(40000 − 20848) 2 + 0.50(20848 − 20848) 2 + 0.25(1696 − 20848) 2

= 13542.51

Project Y is more risky as its standard deviation is higher when compared to Project X.

vi) Co-efficient of variation](https://image.slidesharecdn.com/ilovepdfmerged-200220114434/75/project-management-pm-note-in-mg-university-S6-sem-29-2048.jpg)