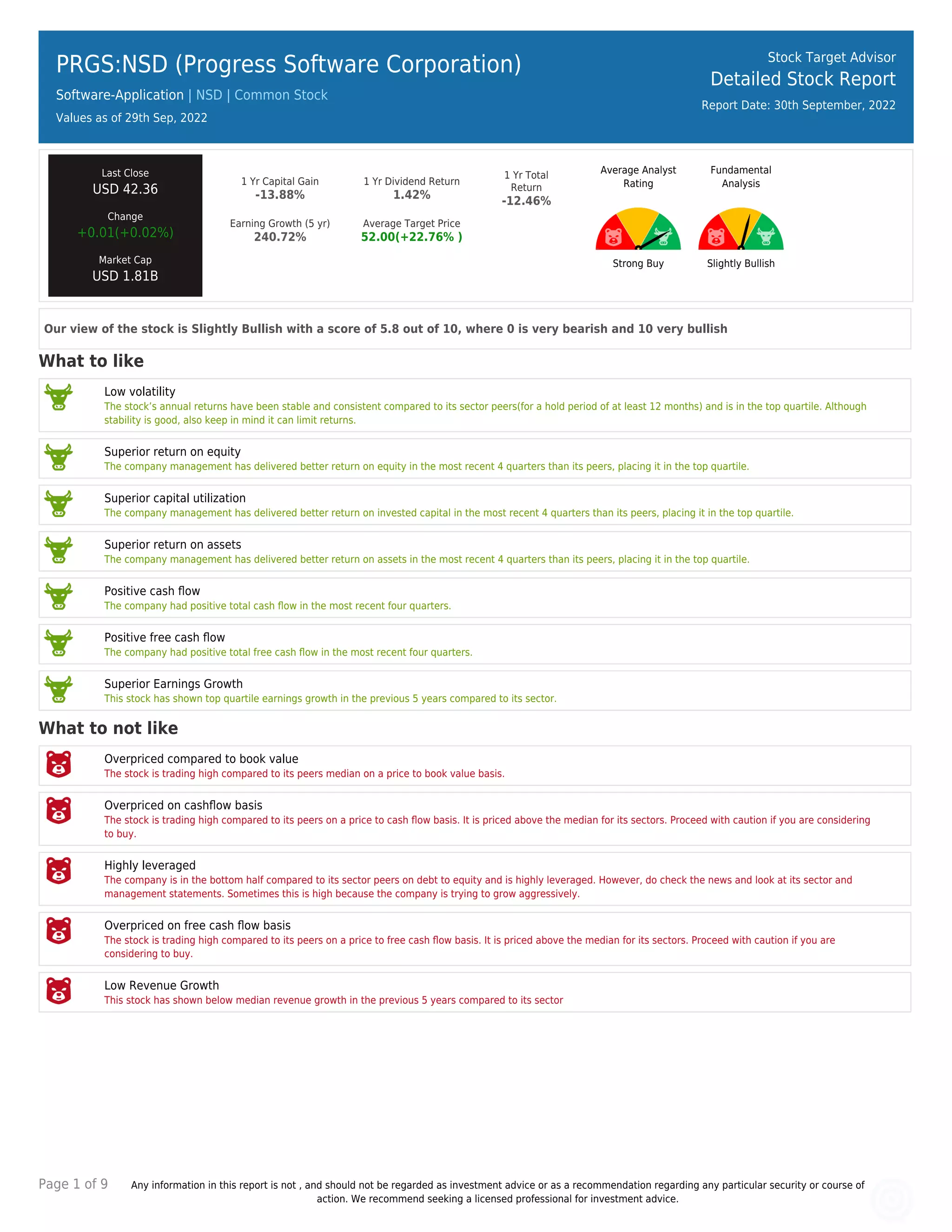

The report provides a detailed analysis of Progress Software Corporation's stock performance as of September 30, 2022, indicating a slightly bullish outlook with a target price averaging $52. It highlights both strengths, such as positive cash flow and superior earnings growth, and weaknesses, including high leverage and being overpriced on various financial ratios. Investors are advised to exercise caution before making investment decisions and seek professional guidance.