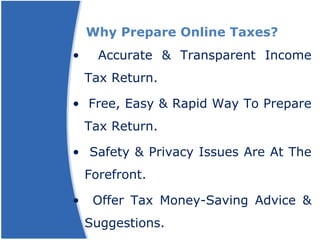

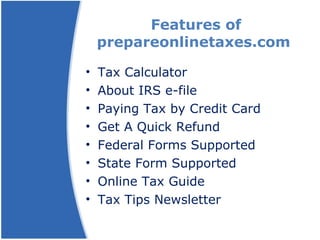

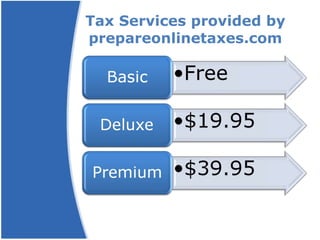

PrepareOnlineTaxes.com offers an easy and secure way to prepare tax returns online, featuring accurate income tax return options. The platform has different service tiers including Basic for simple returns, Deluxe for homeowners and investors, and Premium for complex situations, all while providing tax tips and money-saving advice. Key features include tax calculators, IRS e-filing, and support for various forms and deductions.