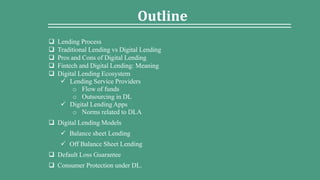

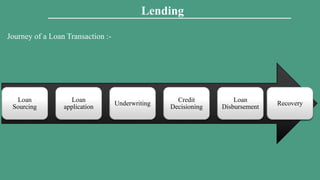

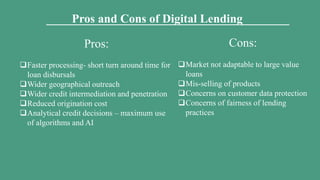

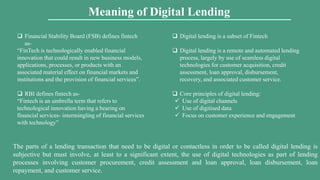

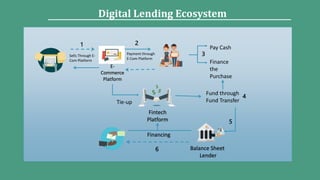

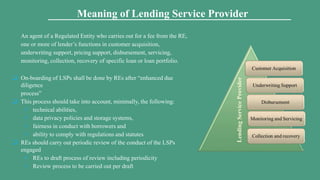

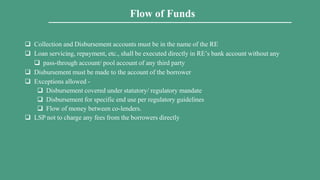

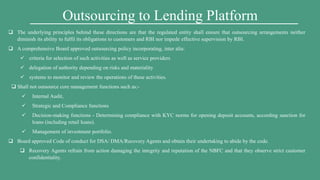

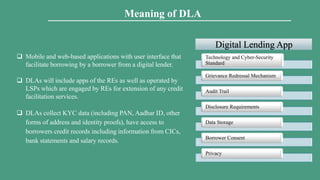

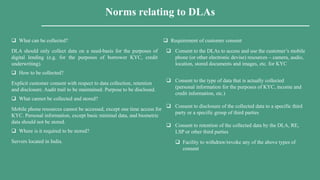

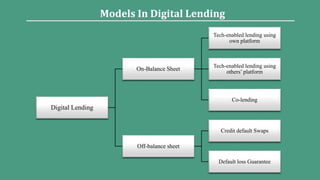

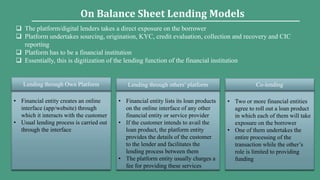

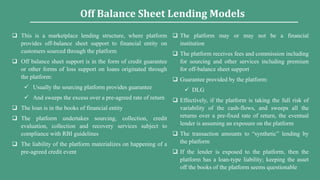

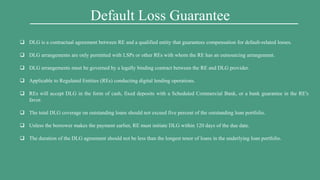

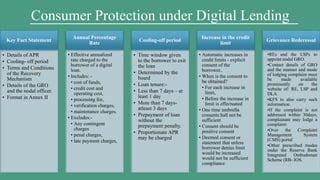

Digital lending refers to remote and automated lending processes that utilize digital technologies for customer acquisition, credit assessment, loan approval, disbursement, repayment, and customer service. There are various models of digital lending, including on-balance sheet models where the lender takes a direct exposure, and off-balance sheet models where a third party provides credit guarantees or loss support. Key aspects of digital lending regulations include requirements for lending service providers and digital lending apps, disclosure standards like the Key Fact Statement, and consumer protection measures such as a mandatory cooling-off period and grievance redressal mechanisms.