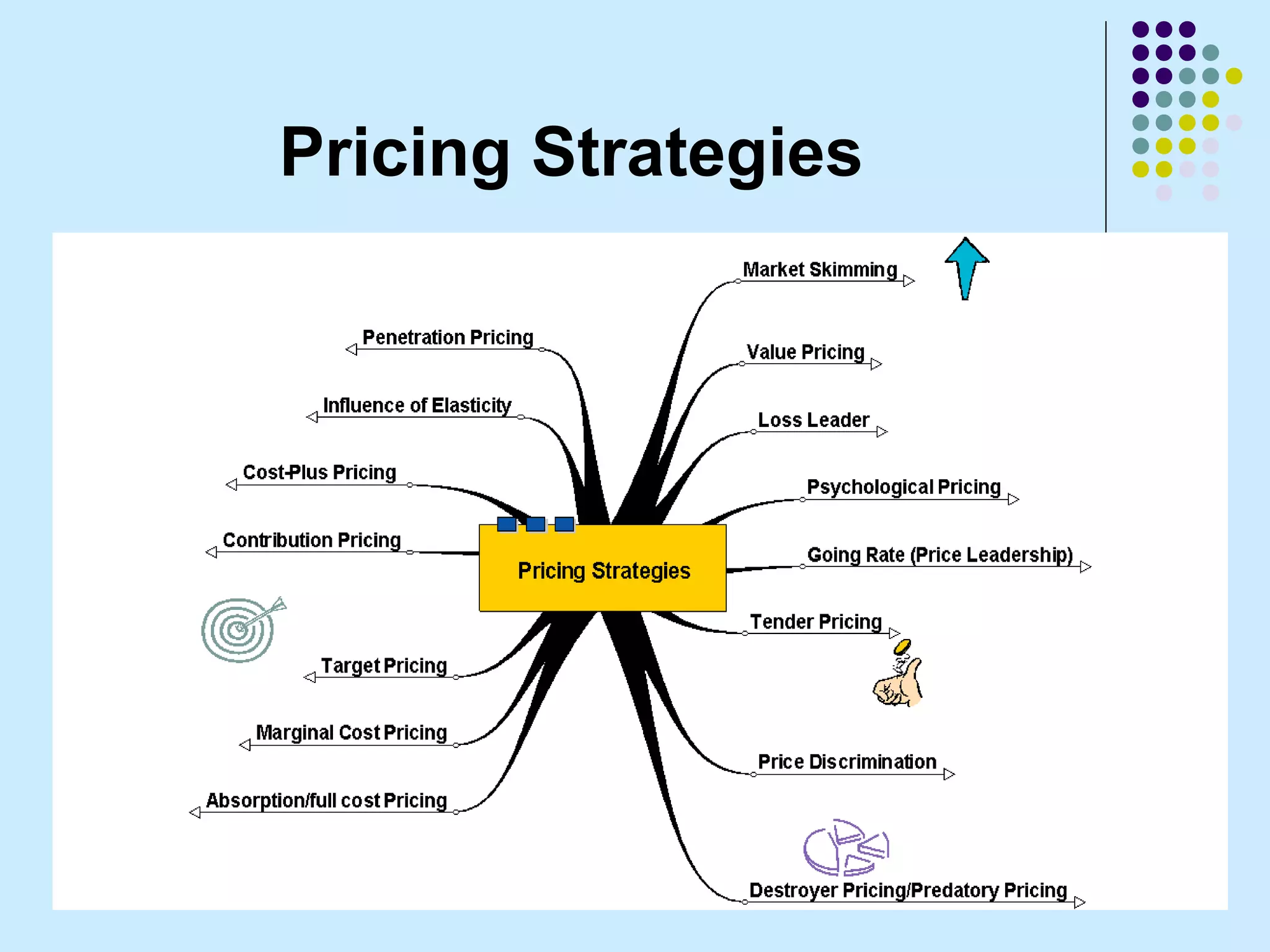

The document discusses various pricing strategies that can be used including penetration pricing, market skimming, value pricing, loss leader pricing, psychological pricing, price leadership, tender pricing, price discrimination, predatory pricing, absorption cost pricing, marginal cost pricing, contribution pricing, target pricing, and cost-plus pricing. It provides examples and explanations of when each strategy may be suitable.