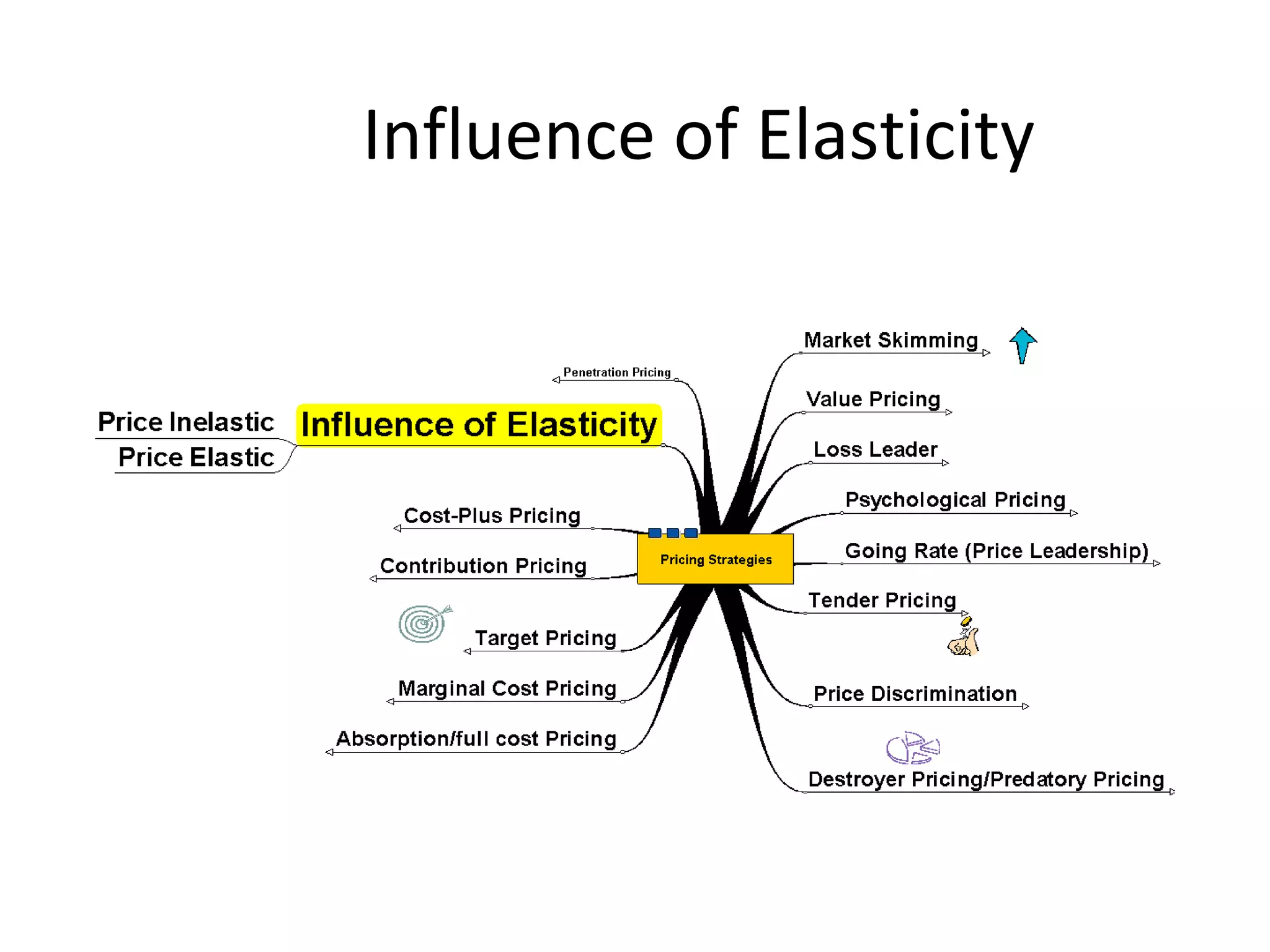

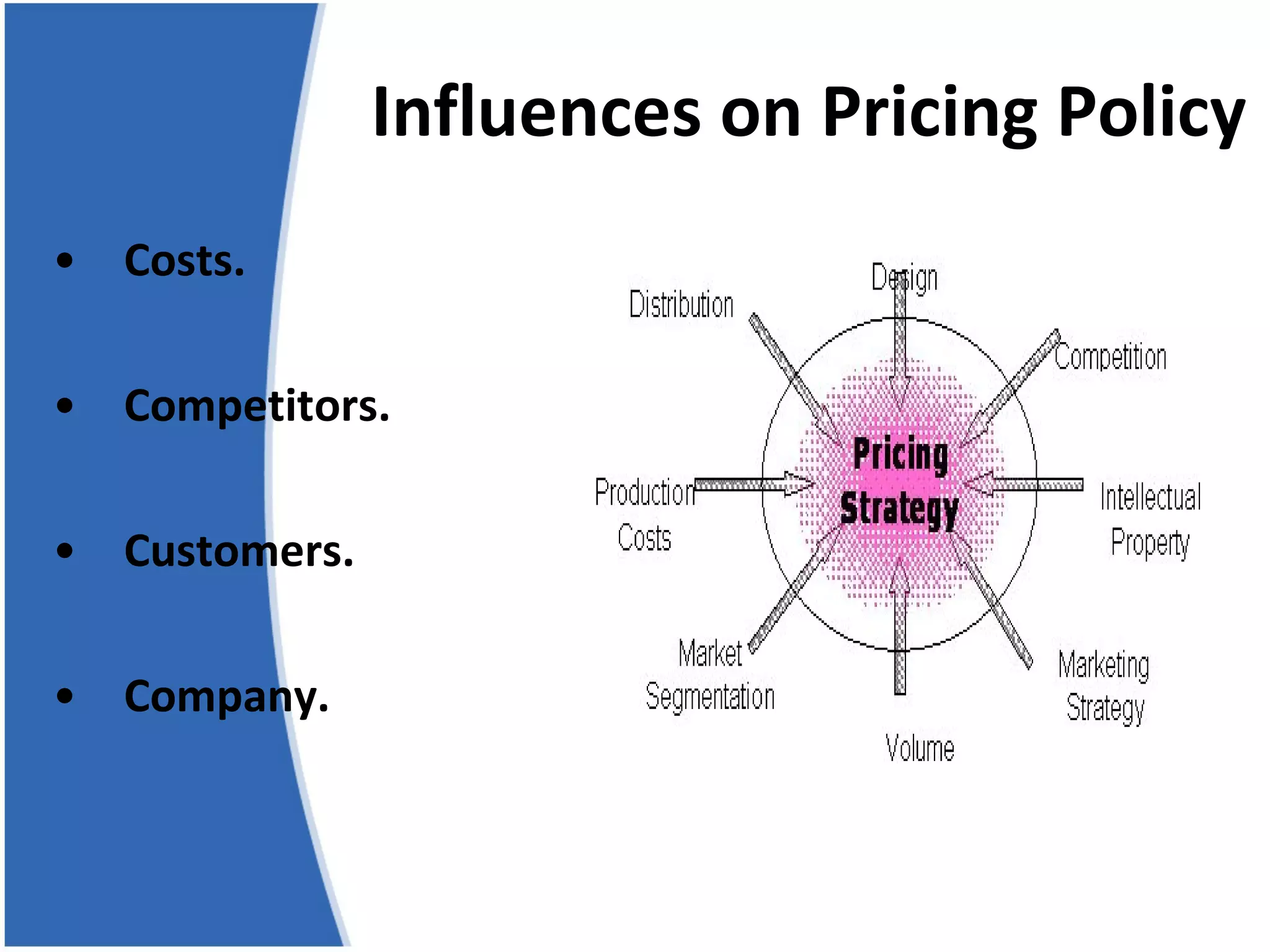

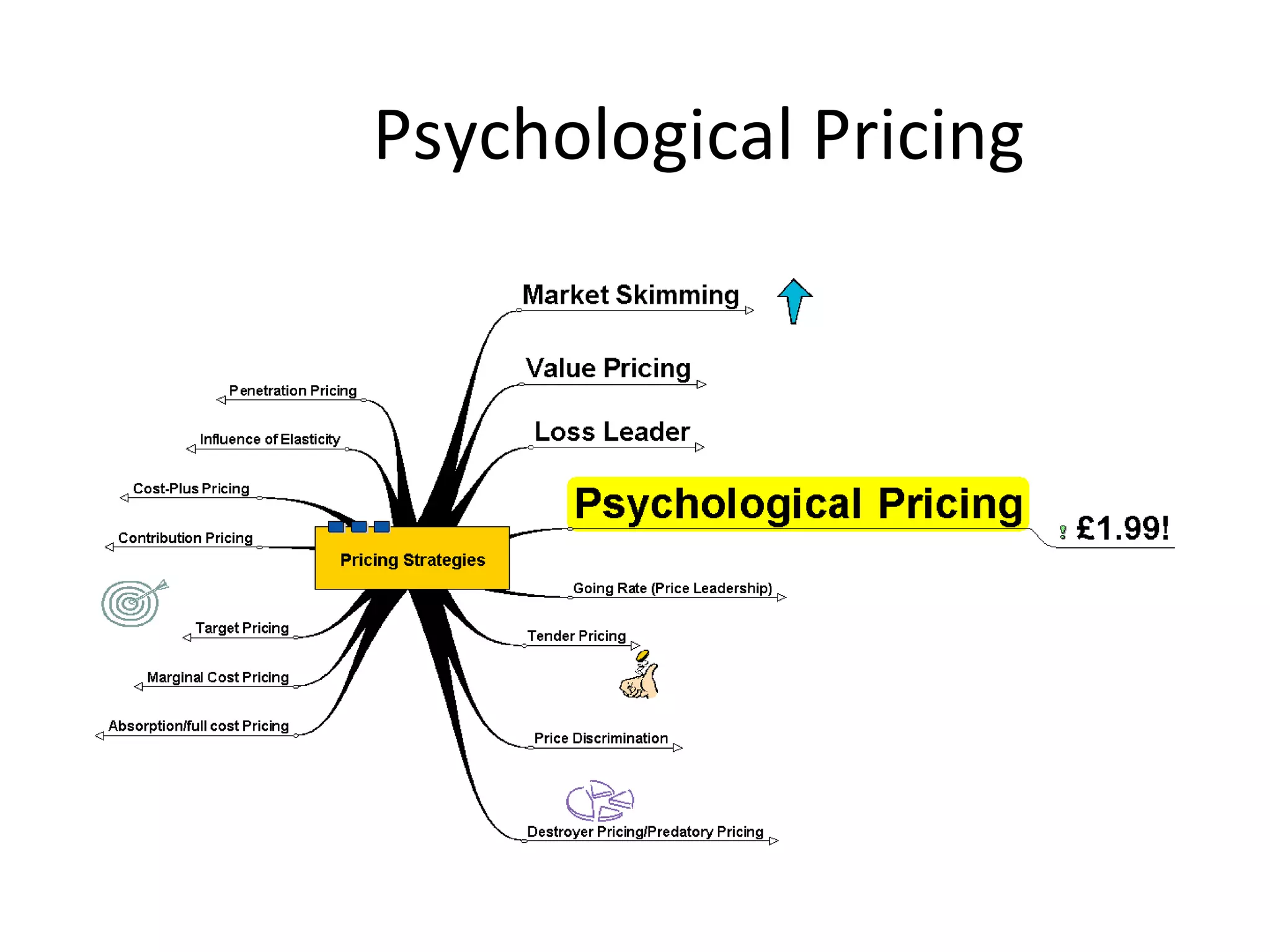

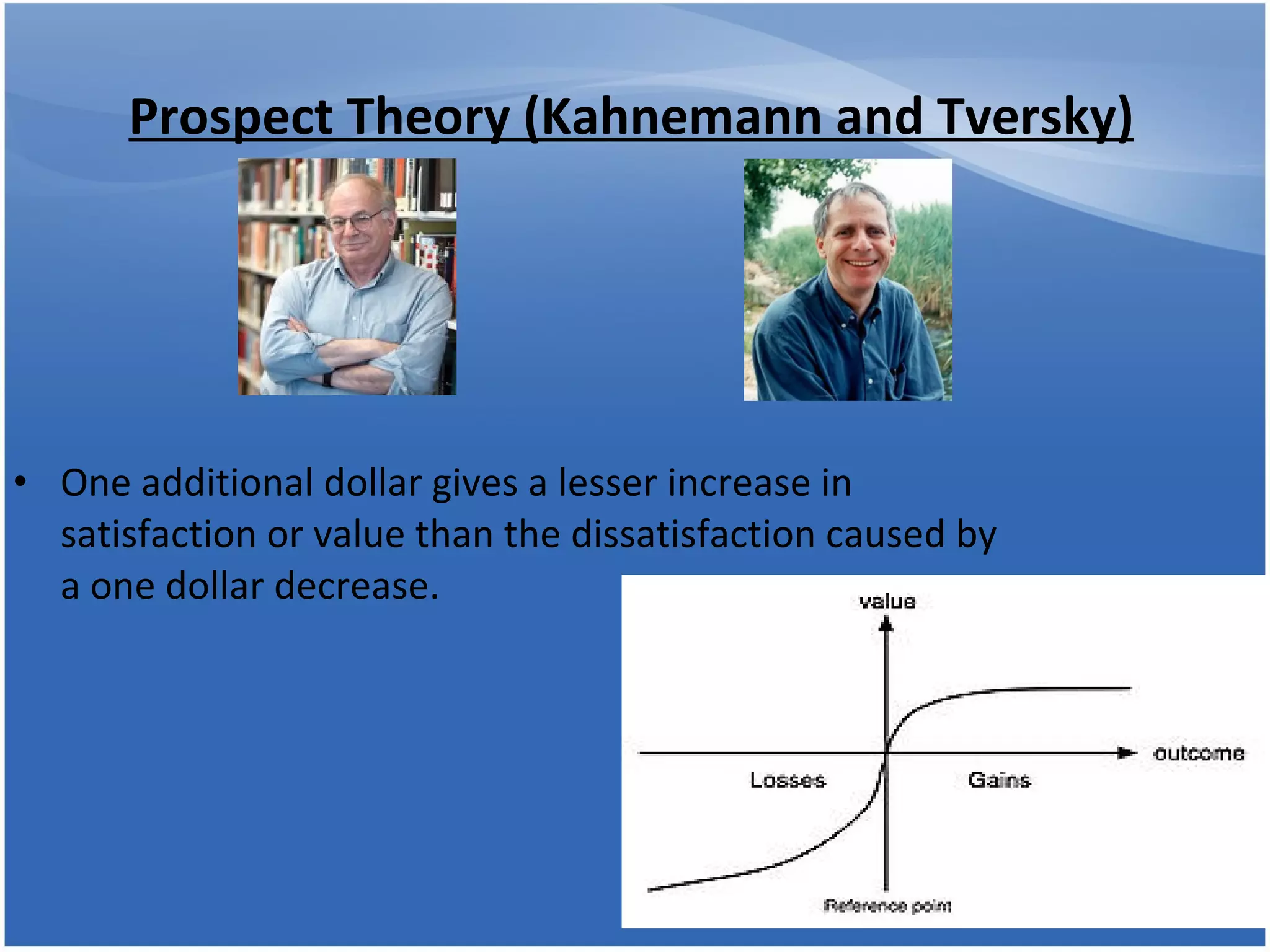

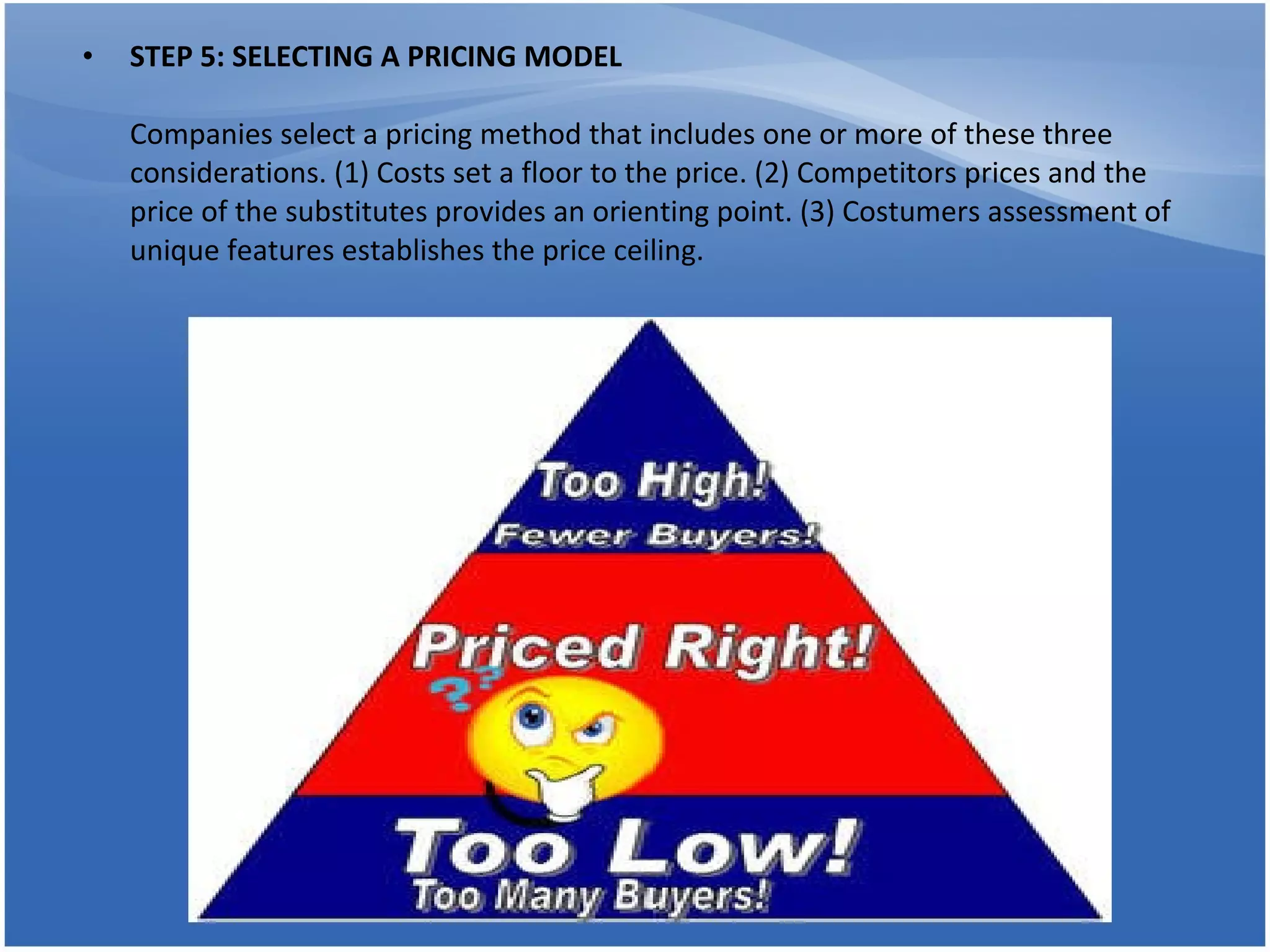

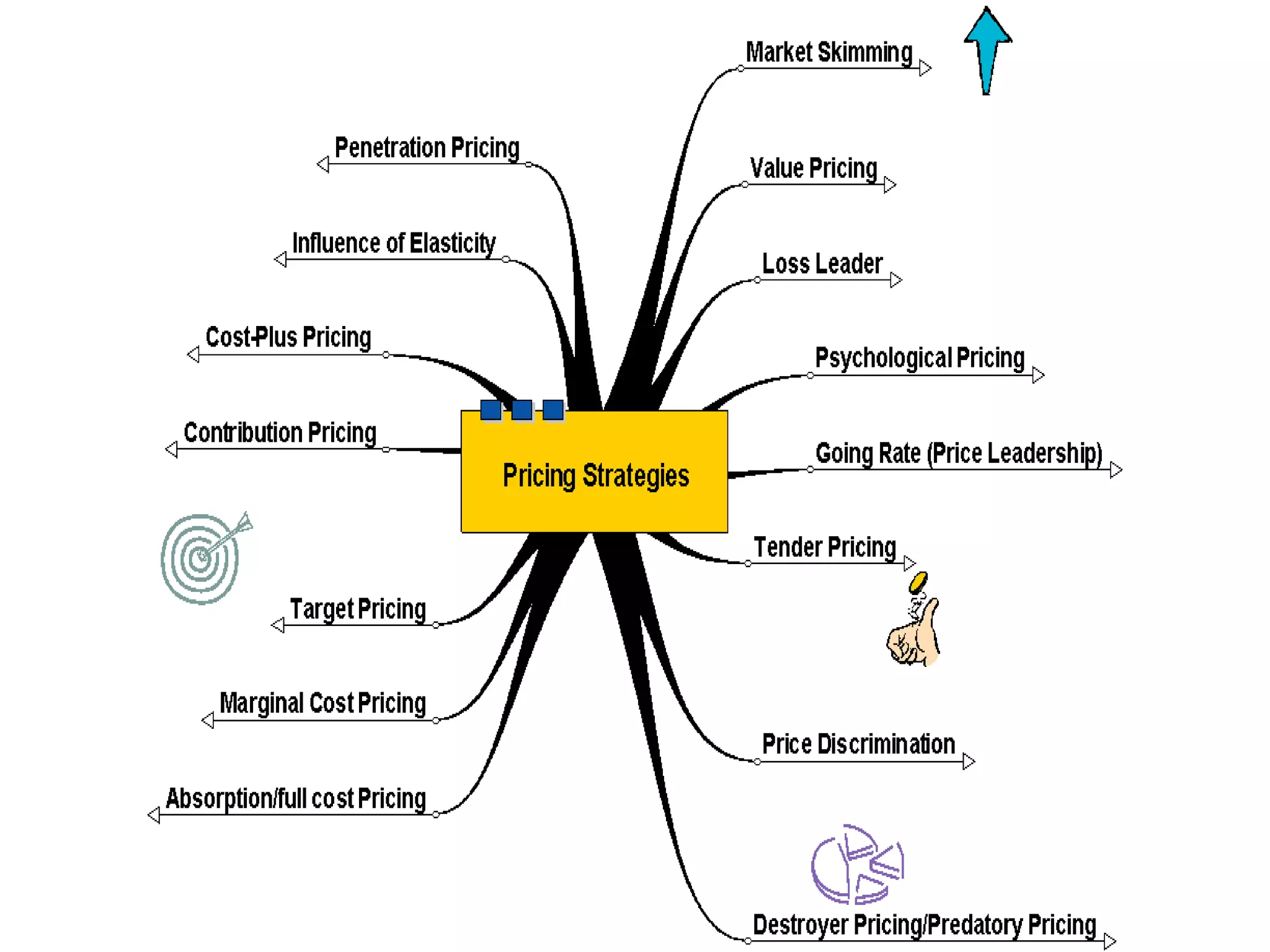

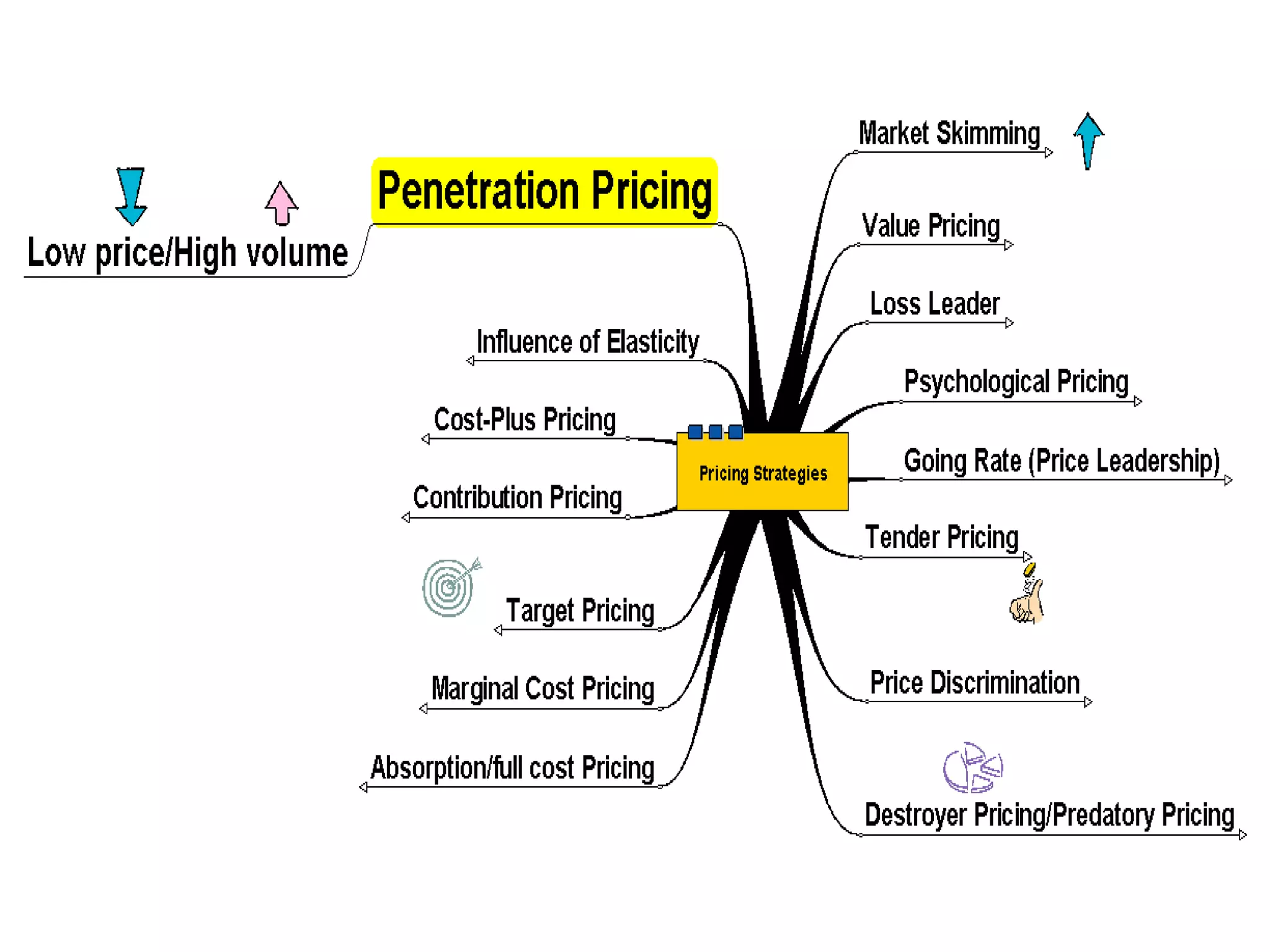

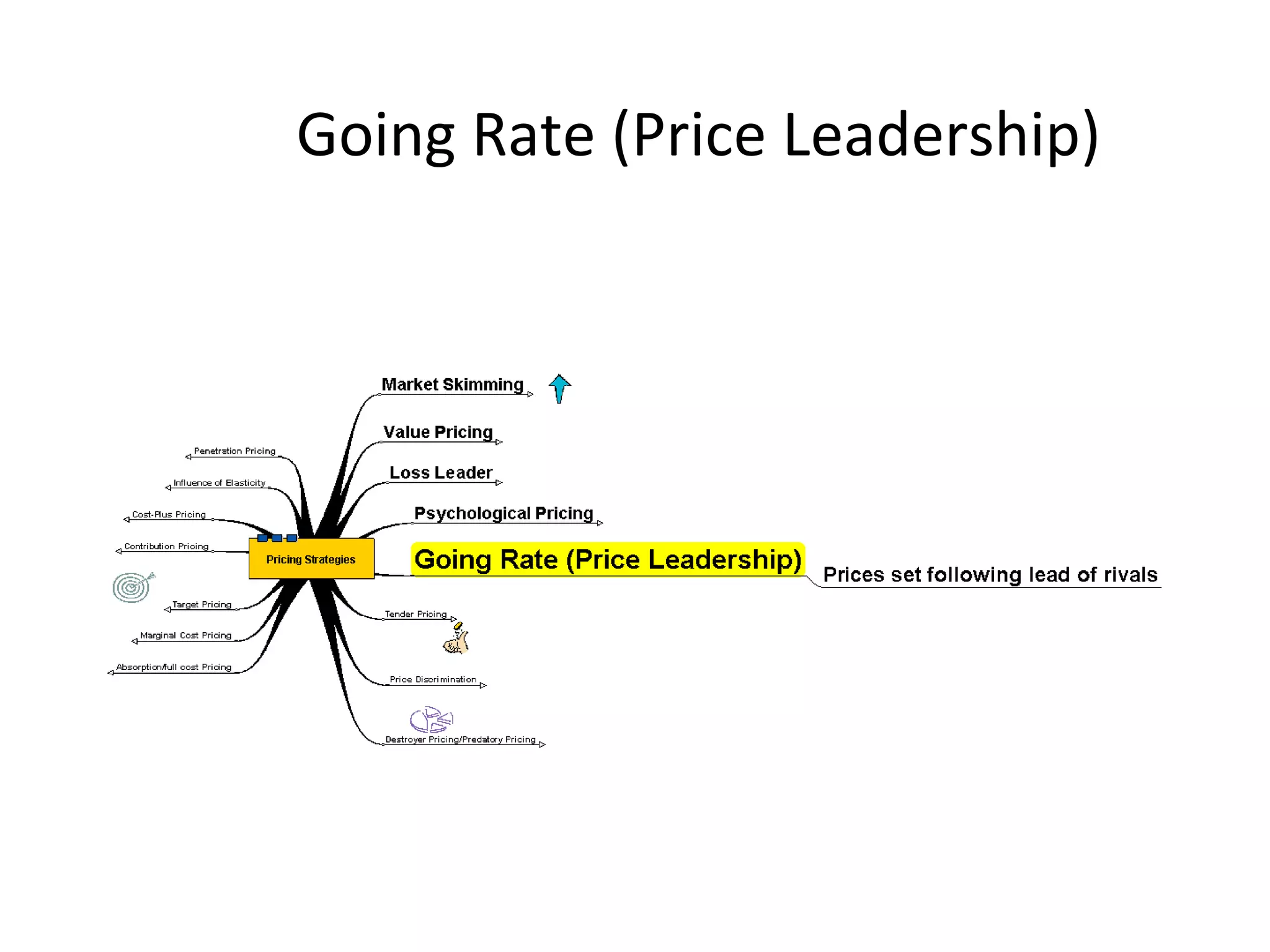

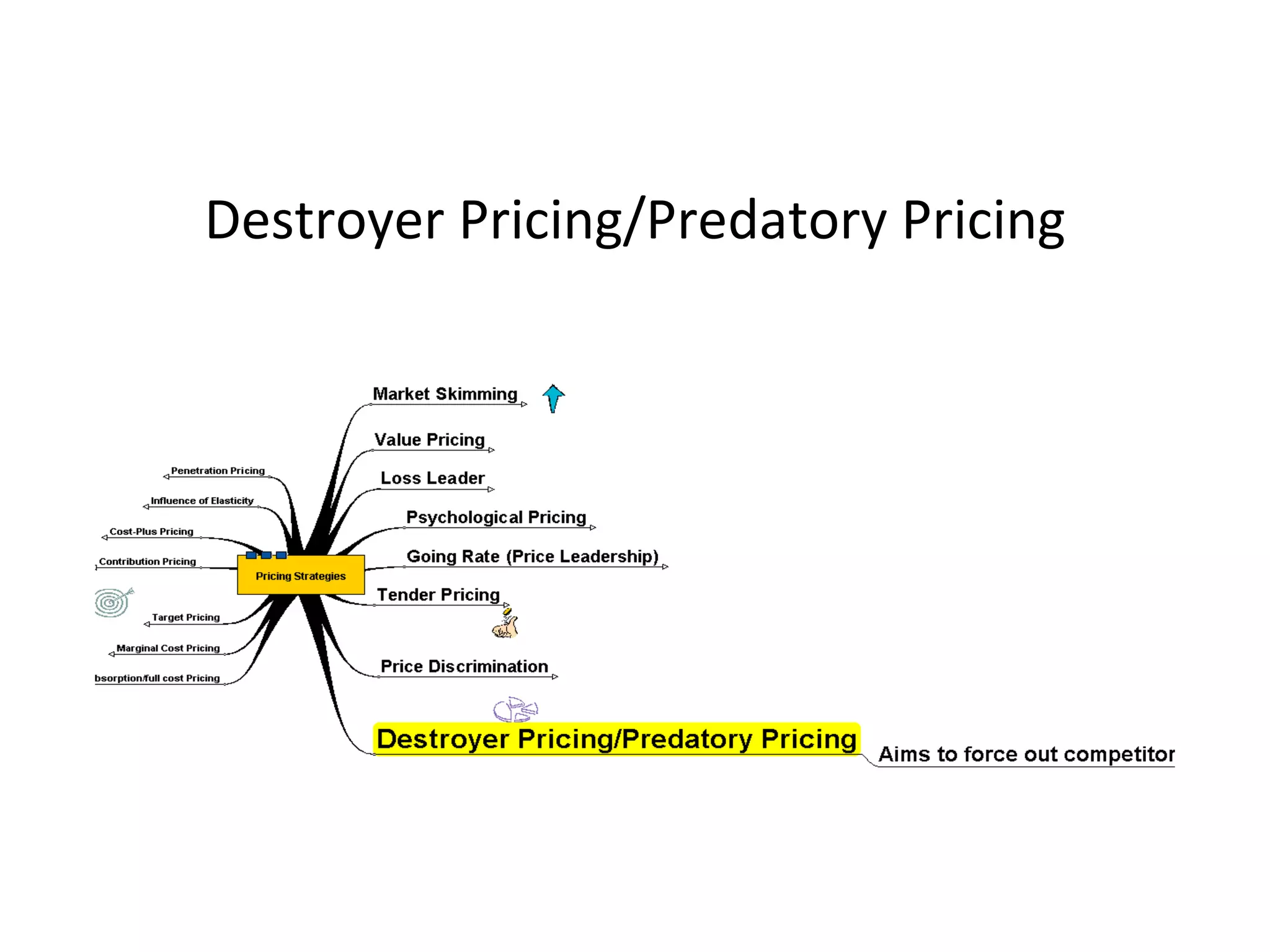

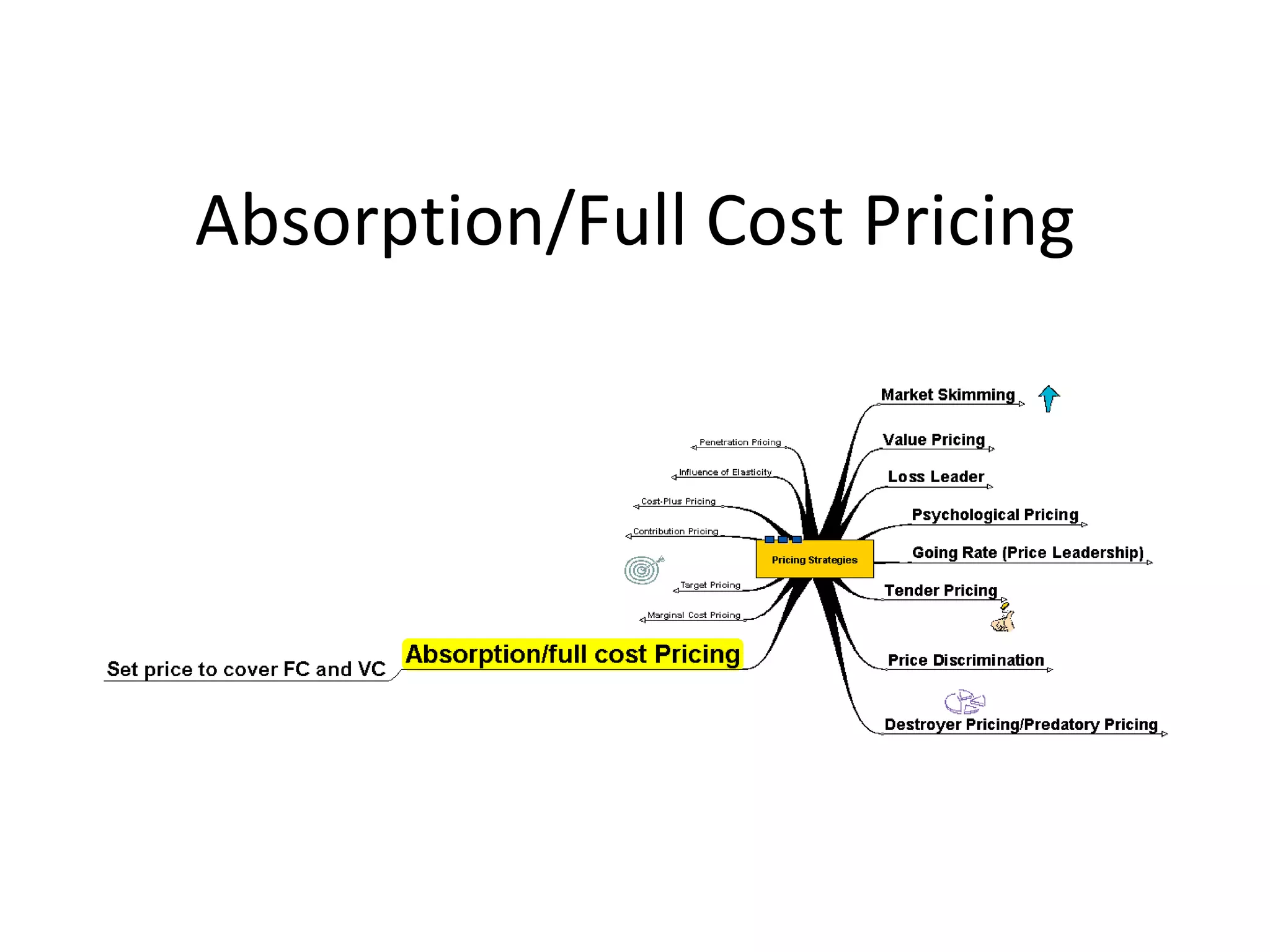

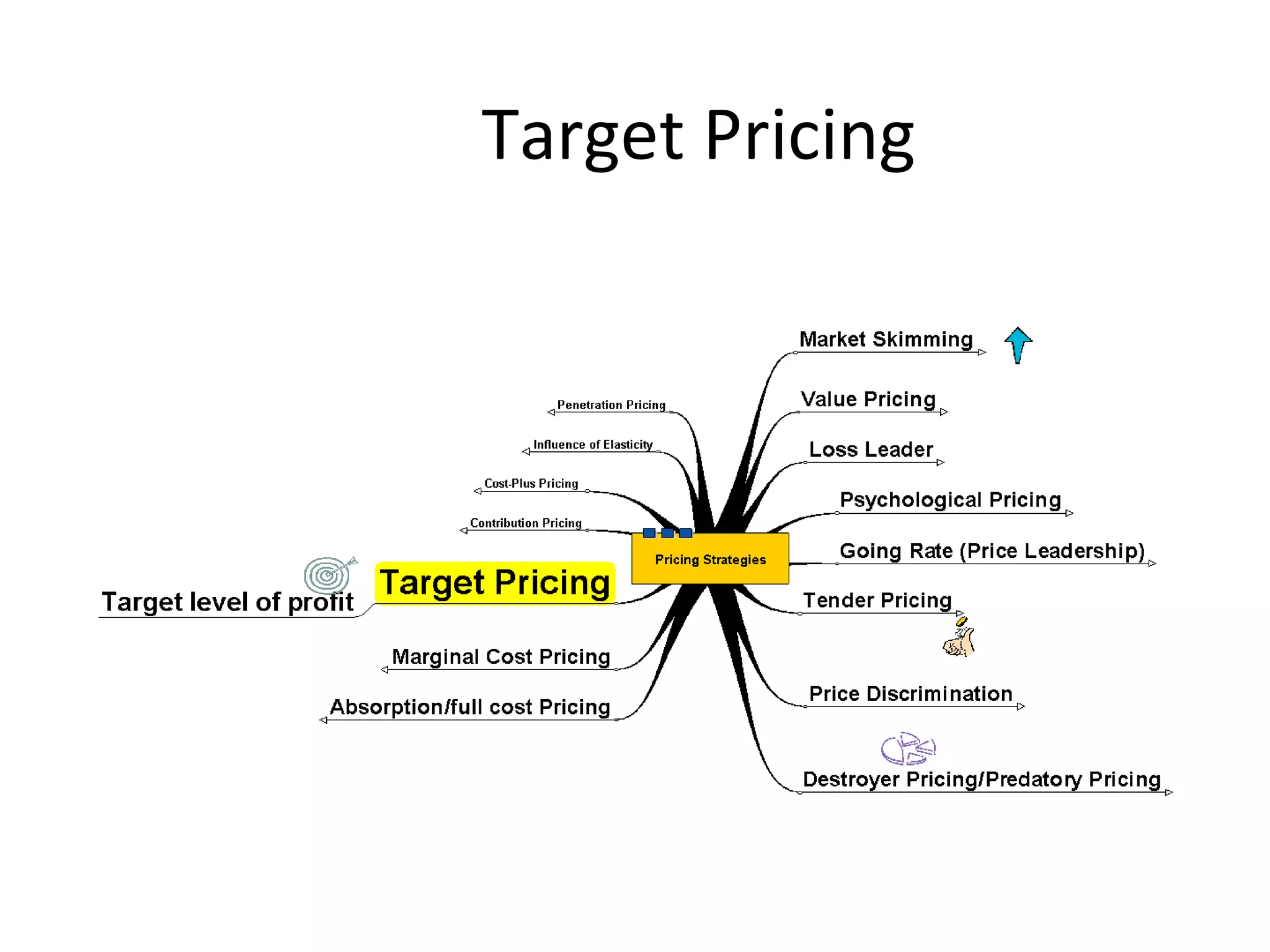

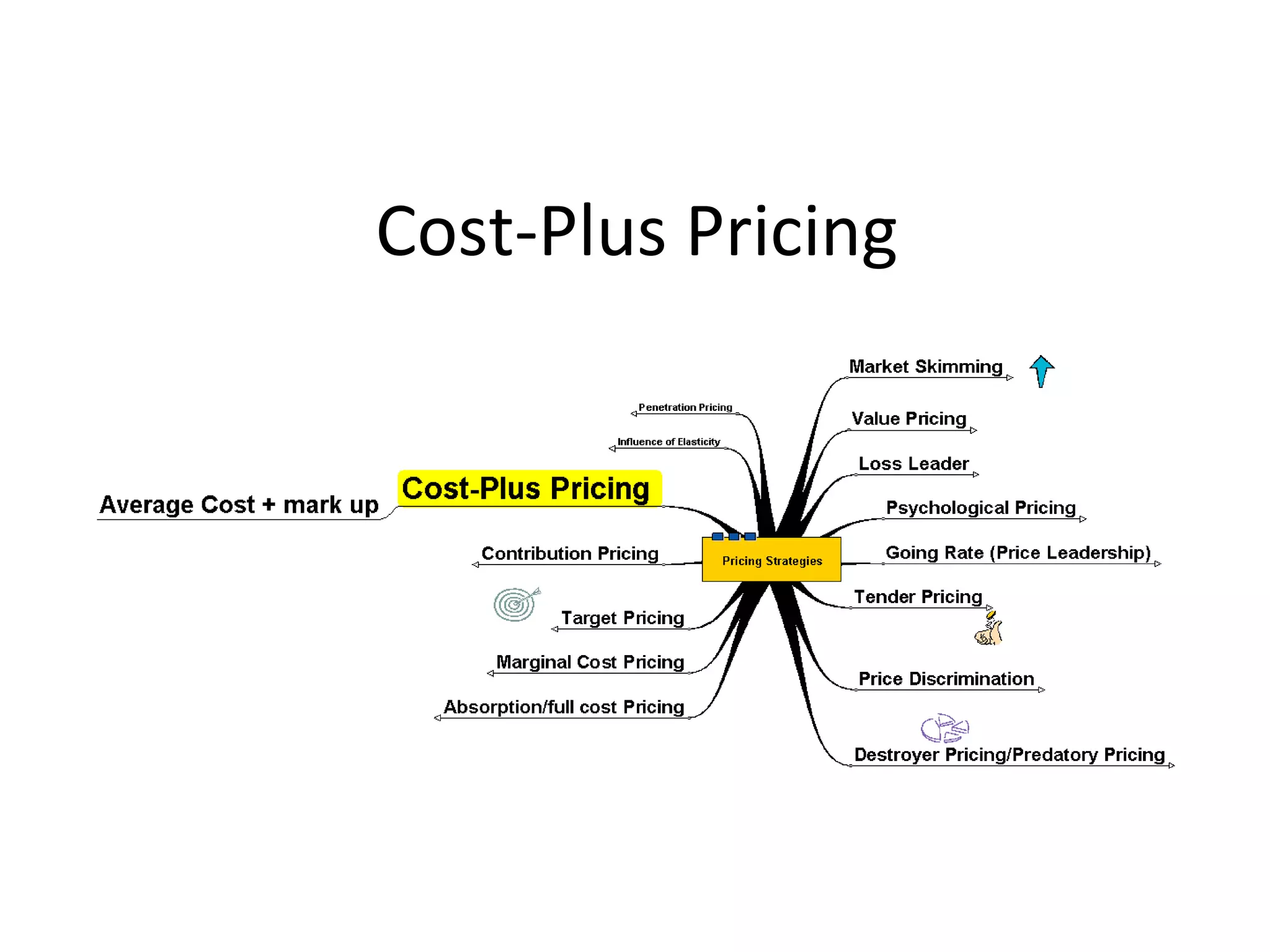

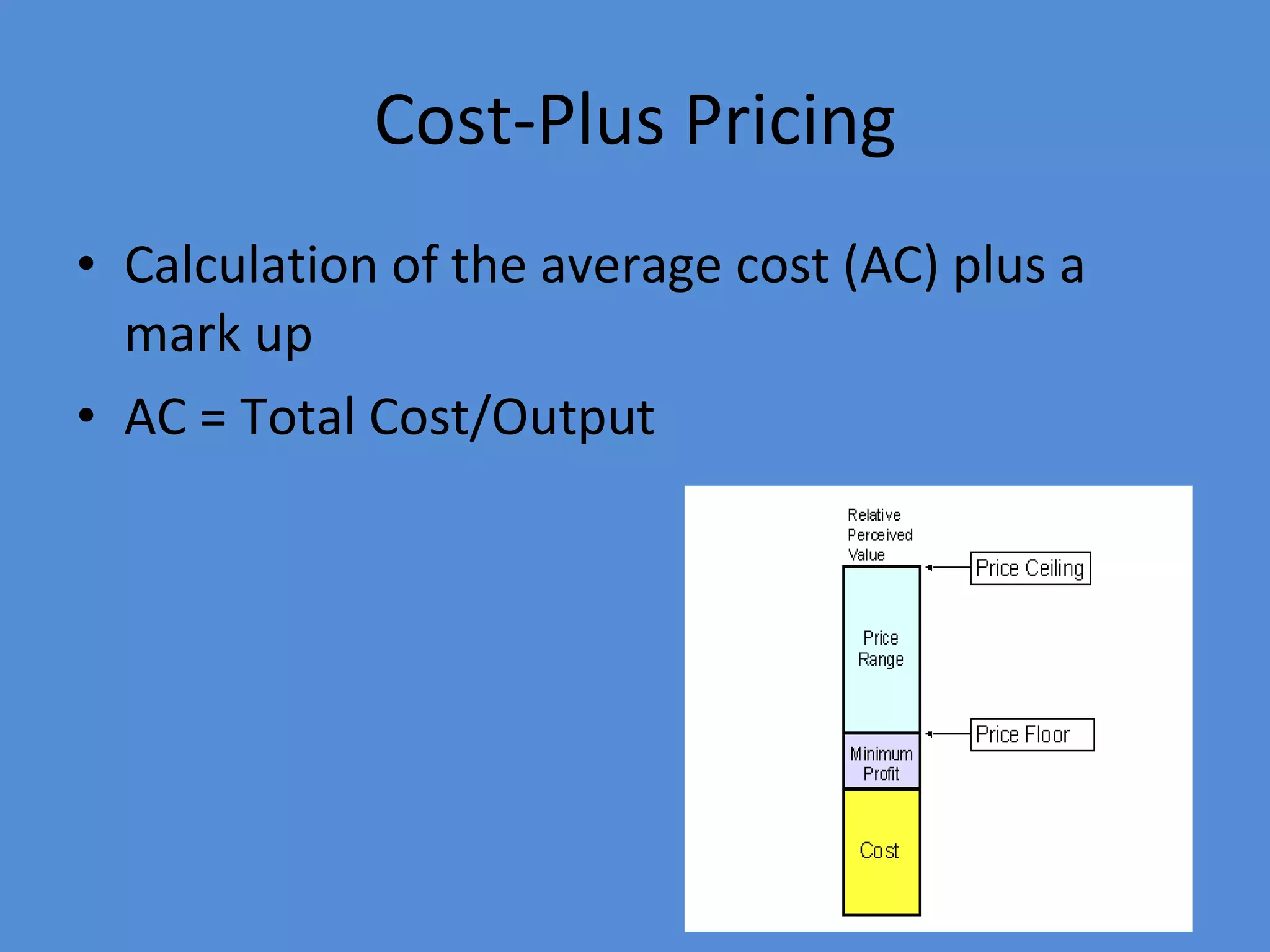

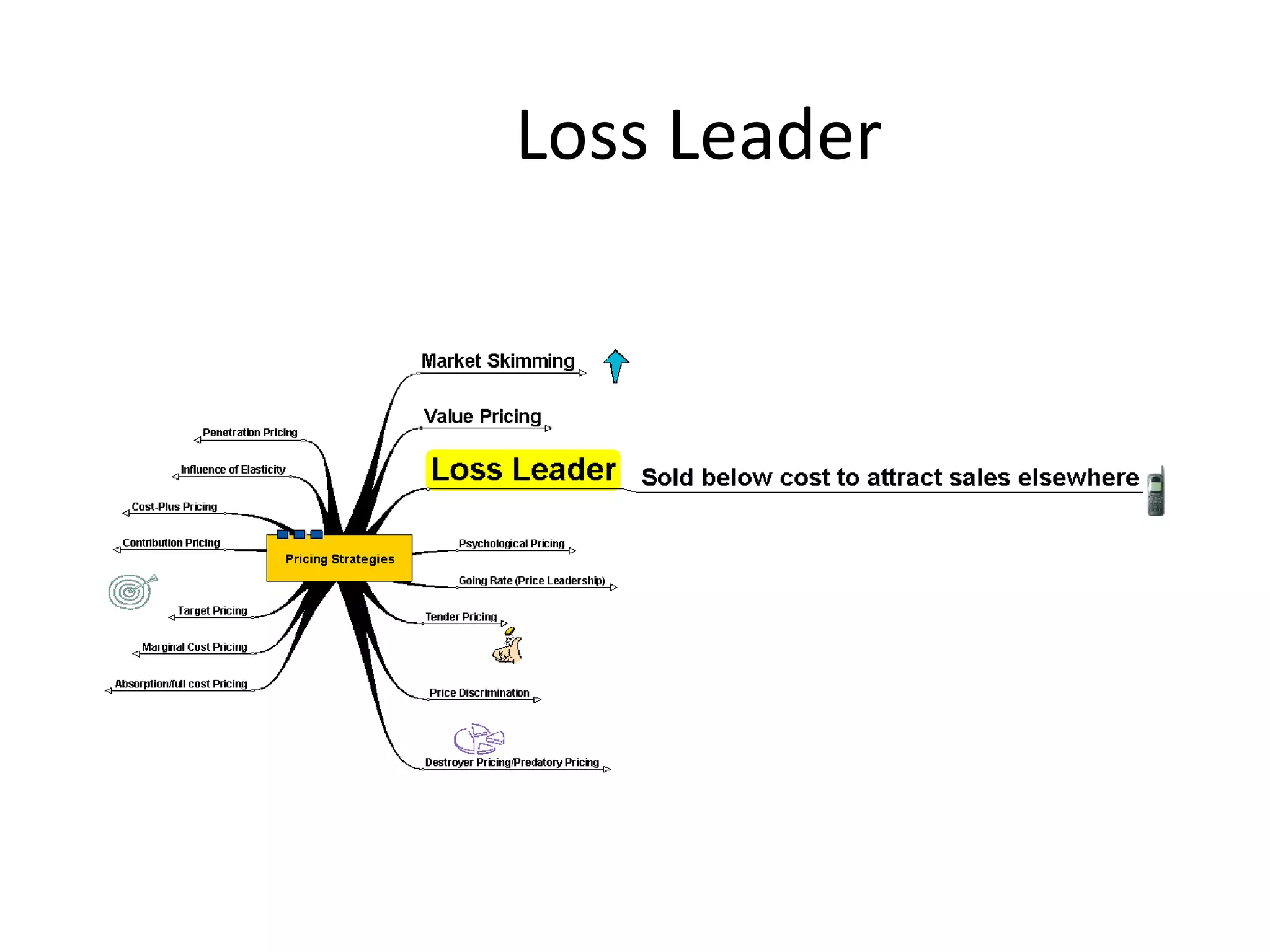

The document discusses various pricing strategies and factors that influence pricing decisions. It covers concepts like price elasticity, costs, competitors' prices, and consumer psychology. Some key pricing strategies mentioned are penetration pricing, market skimming, value pricing, going rate pricing, cost-plus pricing, and differentiated pricing. The document also discusses initiating and responding to price changes, including how companies may react to competitors lowering or raising their prices.