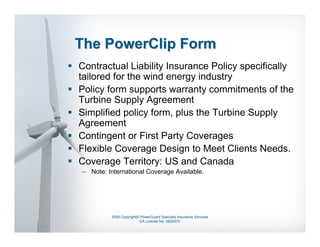

PowerClip provides a warranty program for wind turbines through PowerGuard Specialty Insurance Services. PowerGuard is owned by Stone Point Capital LLC, a private equity firm focused on financial services investments. Stone Point Capital formed Edgewood Partners Insurance Center (EPIC) in 2007 by committing $100 million in funding. EPIC has since acquired several brokerage firms and provides insurance and risk services. PowerClip's warranty coverage includes product defects, serial defects, power curve, noise, availability, and parts and labor. It also offers a self-insured retention cap.