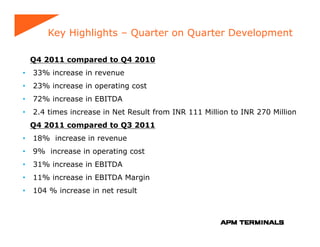

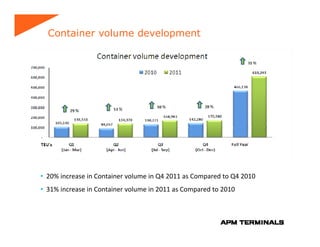

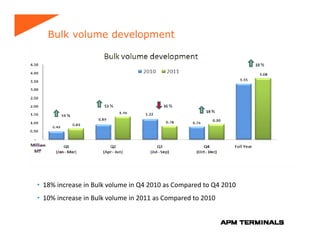

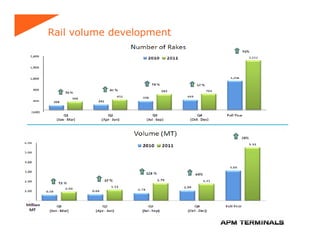

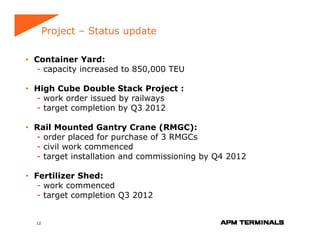

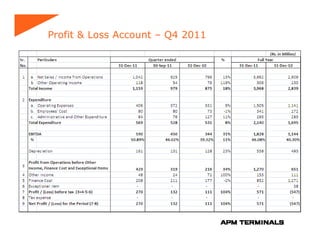

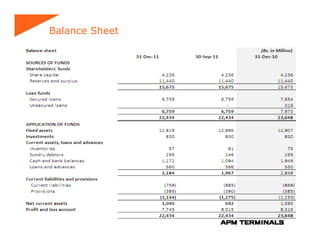

This document summarizes the Q4 2011 results for a company. It highlights that the company achieved its first full year of net profit of 571 million INR, with a 40% increase in operating revenue. Container volume increased 31% and realization increased 17%. Bulk volume increased 10% and realization increased 10%. Projects underway include expanding container yard capacity, a high cube double stack rail project, and purchasing new rail mounted gantry cranes. Financial results for Q4 2011 show a 33% increase in revenue, 72% increase in EBITDA, and a 104% increase in net result compared to Q3 2011.