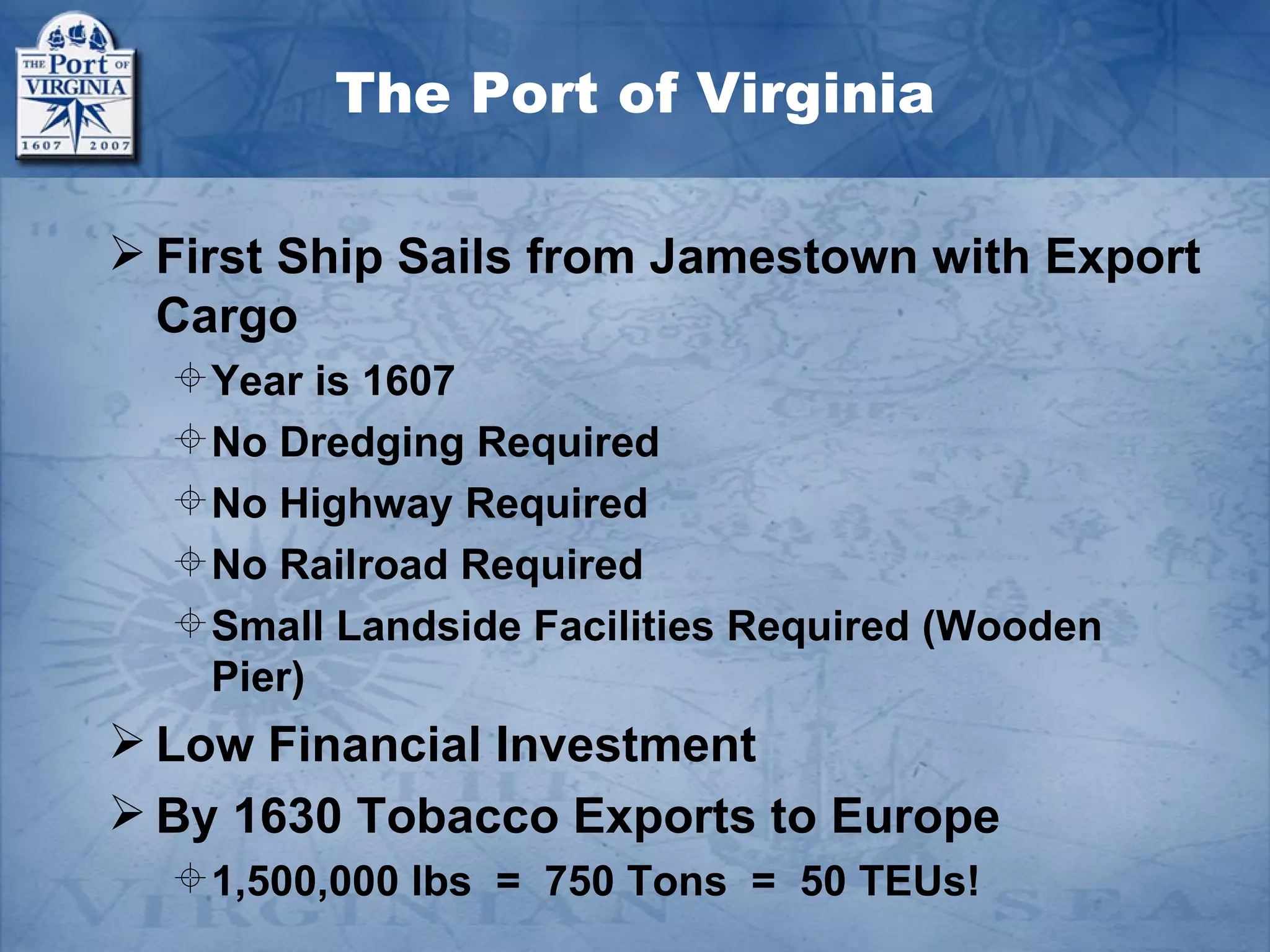

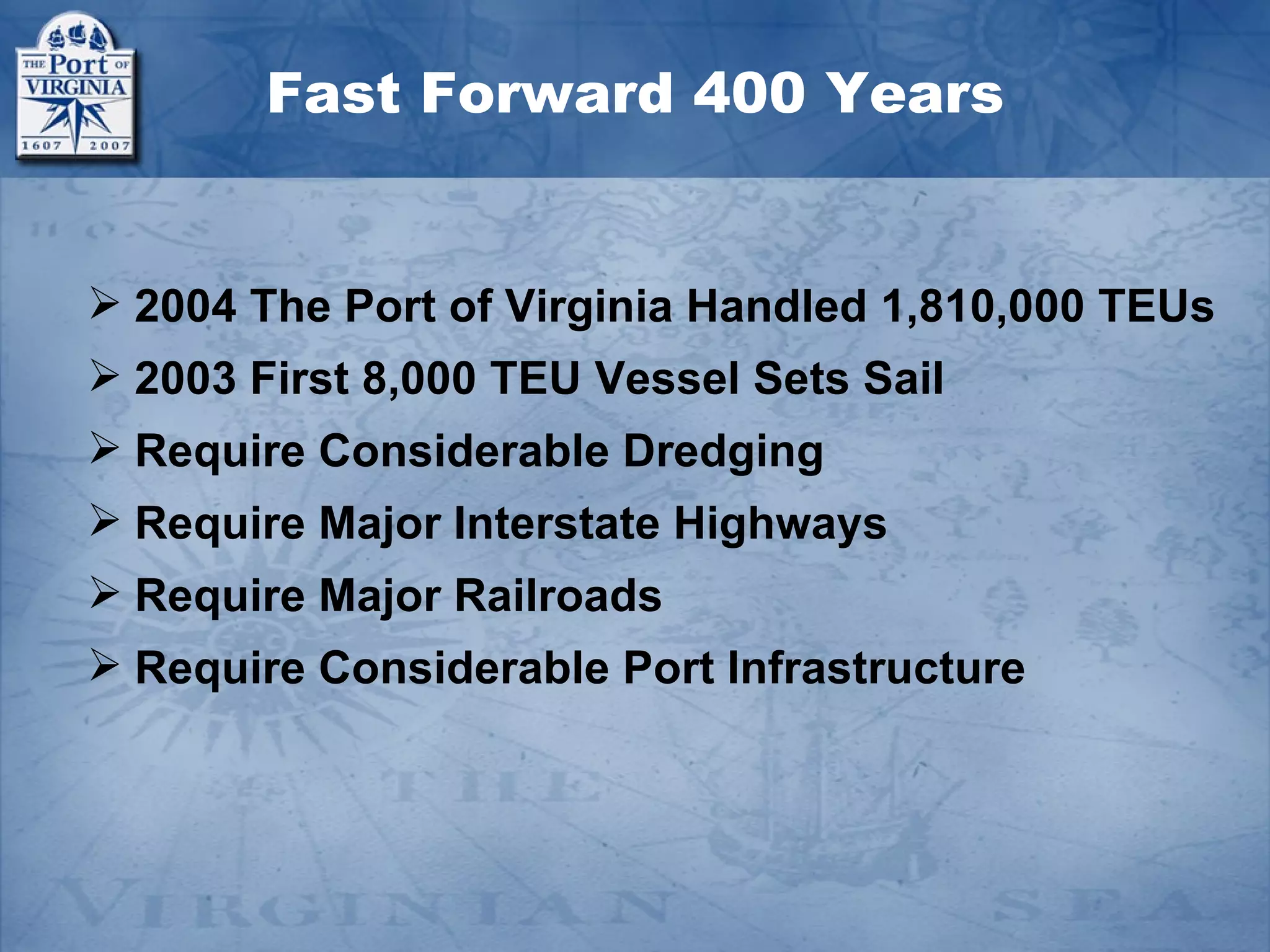

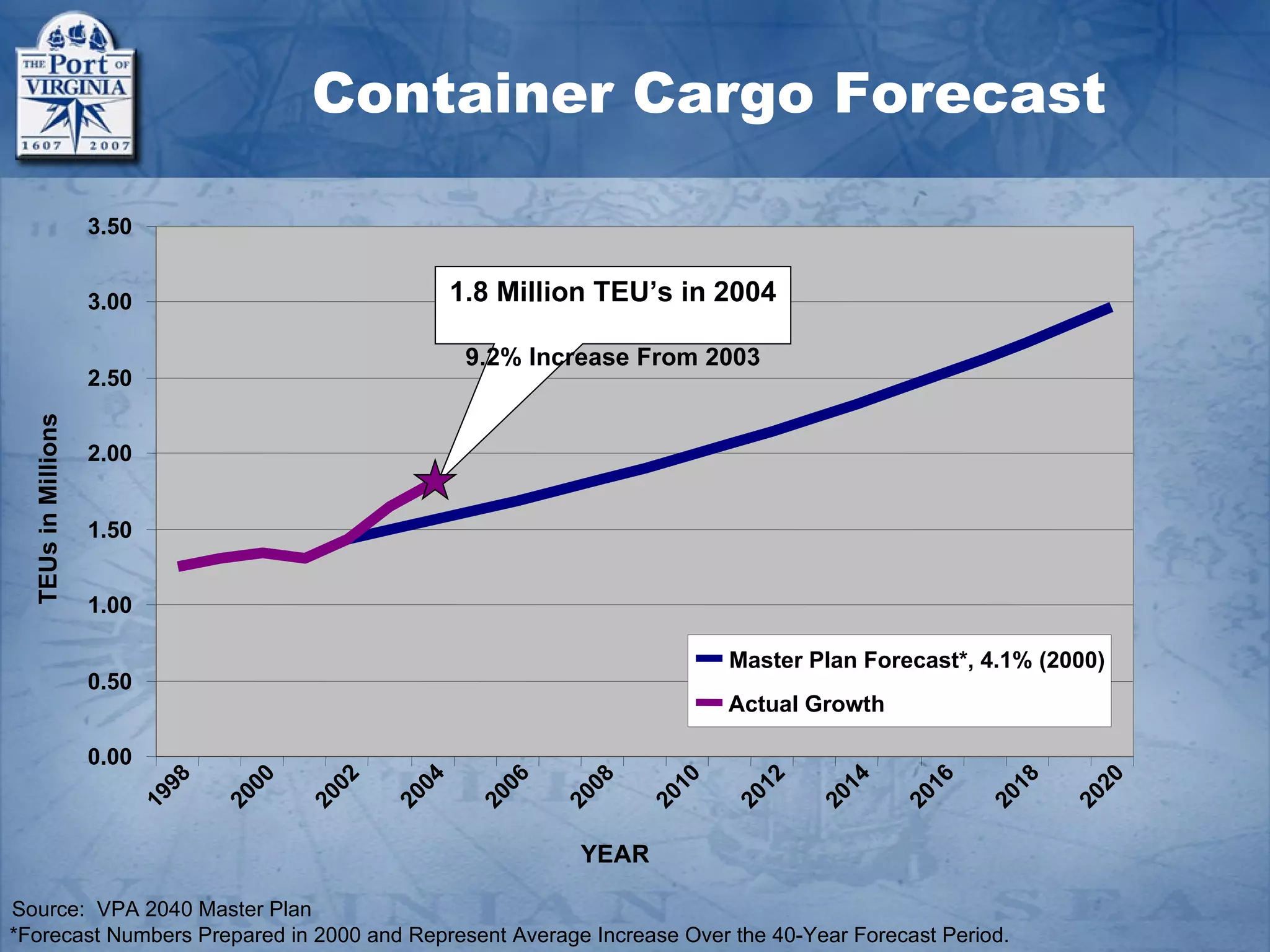

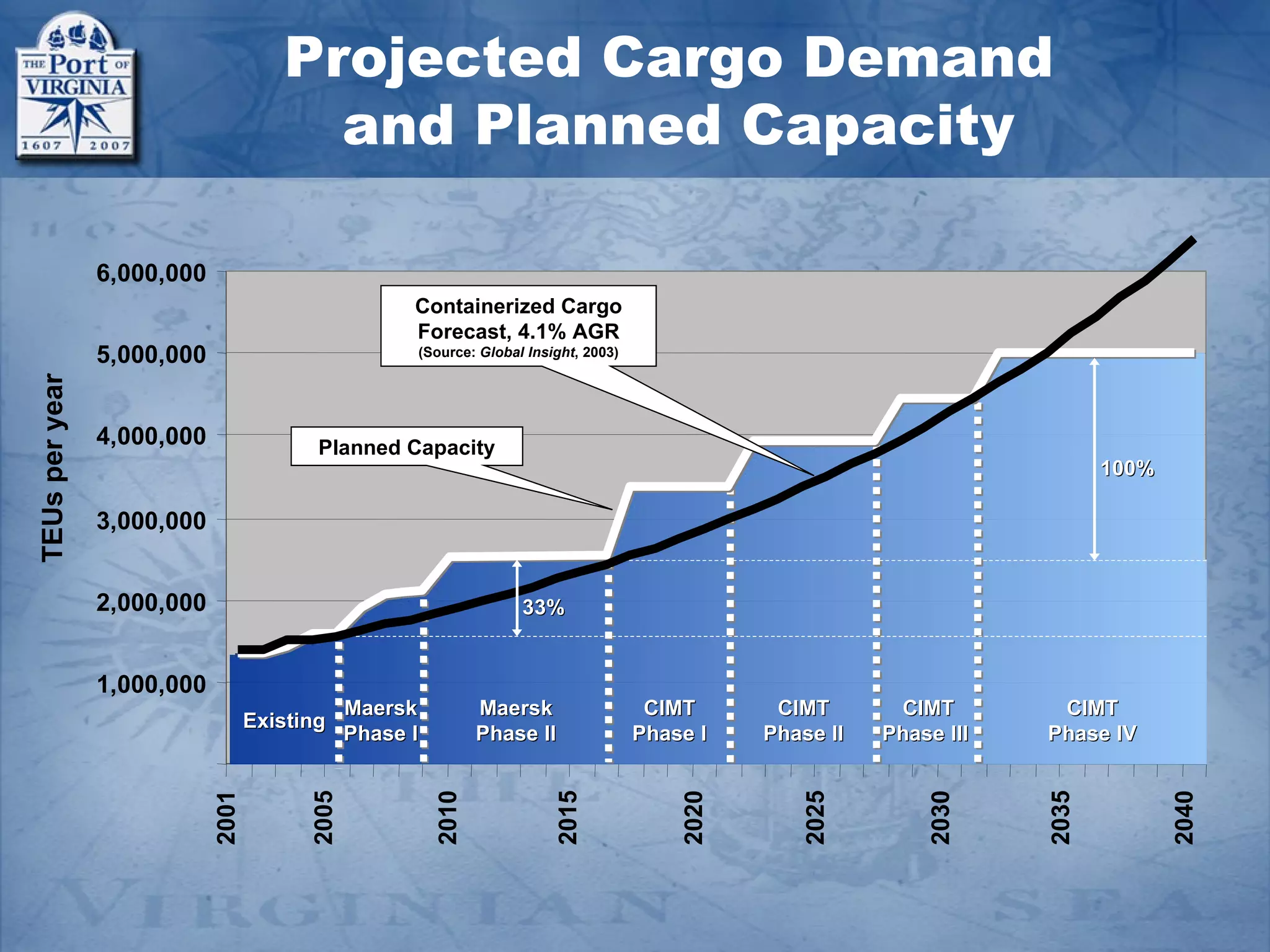

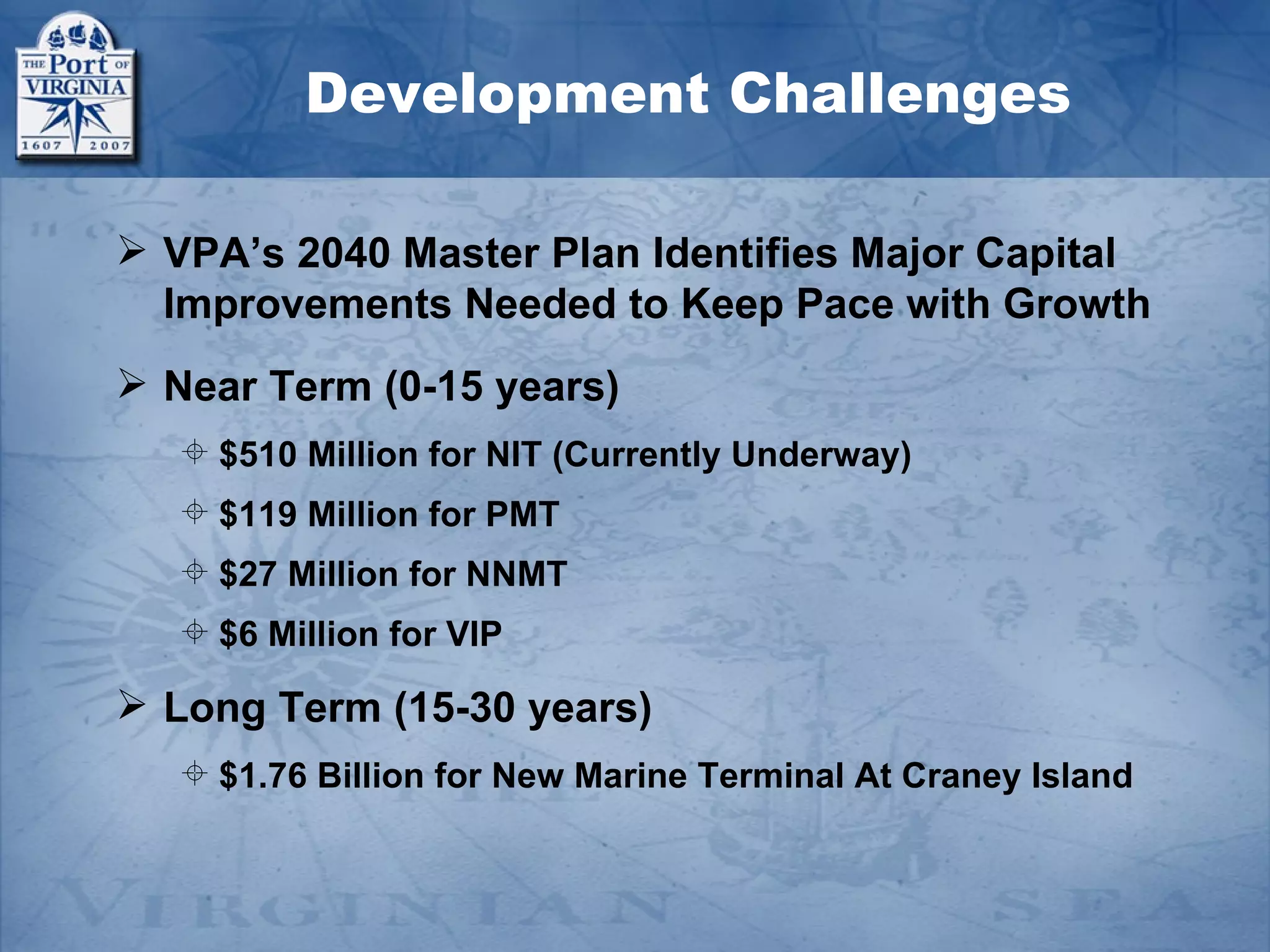

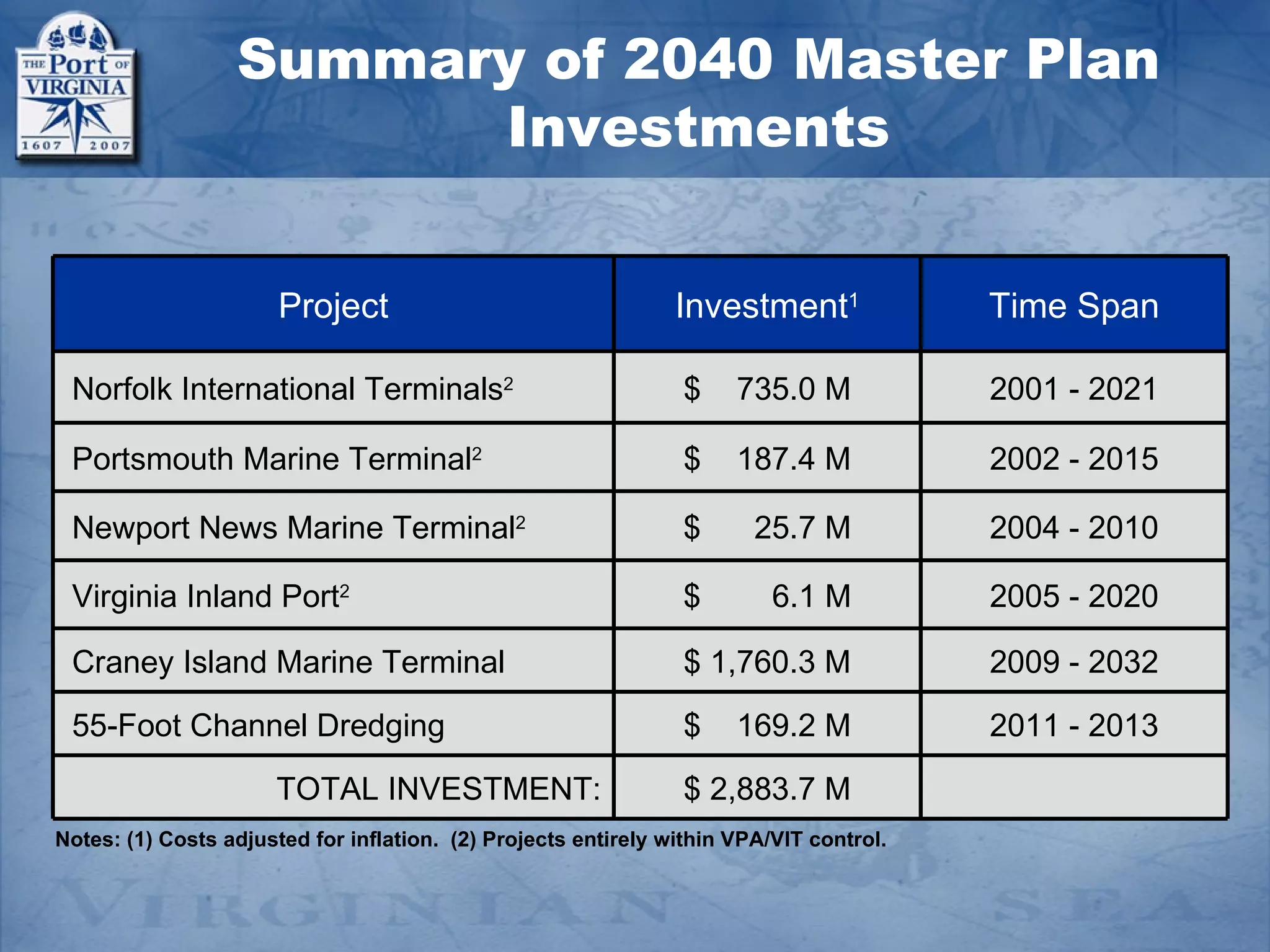

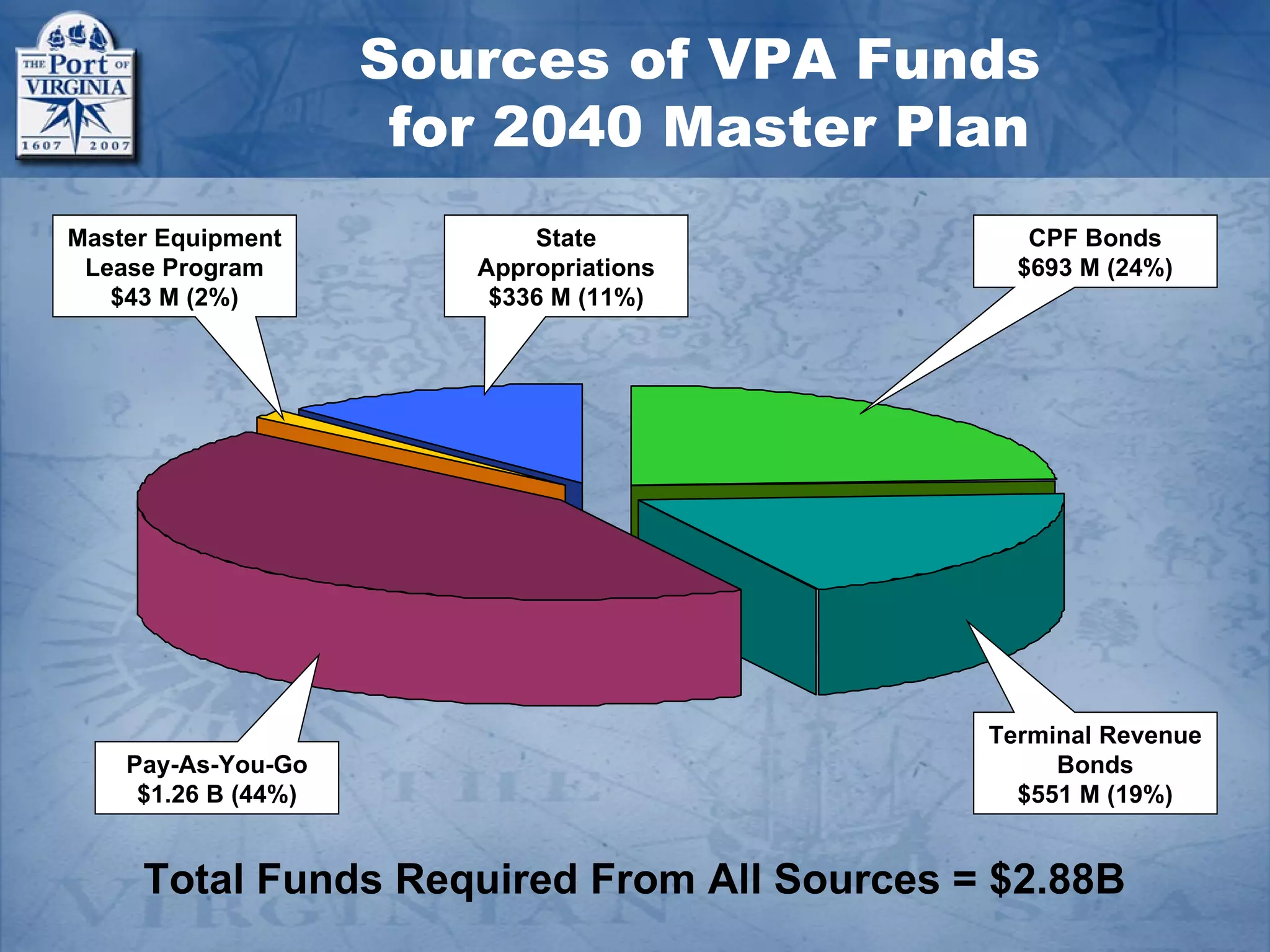

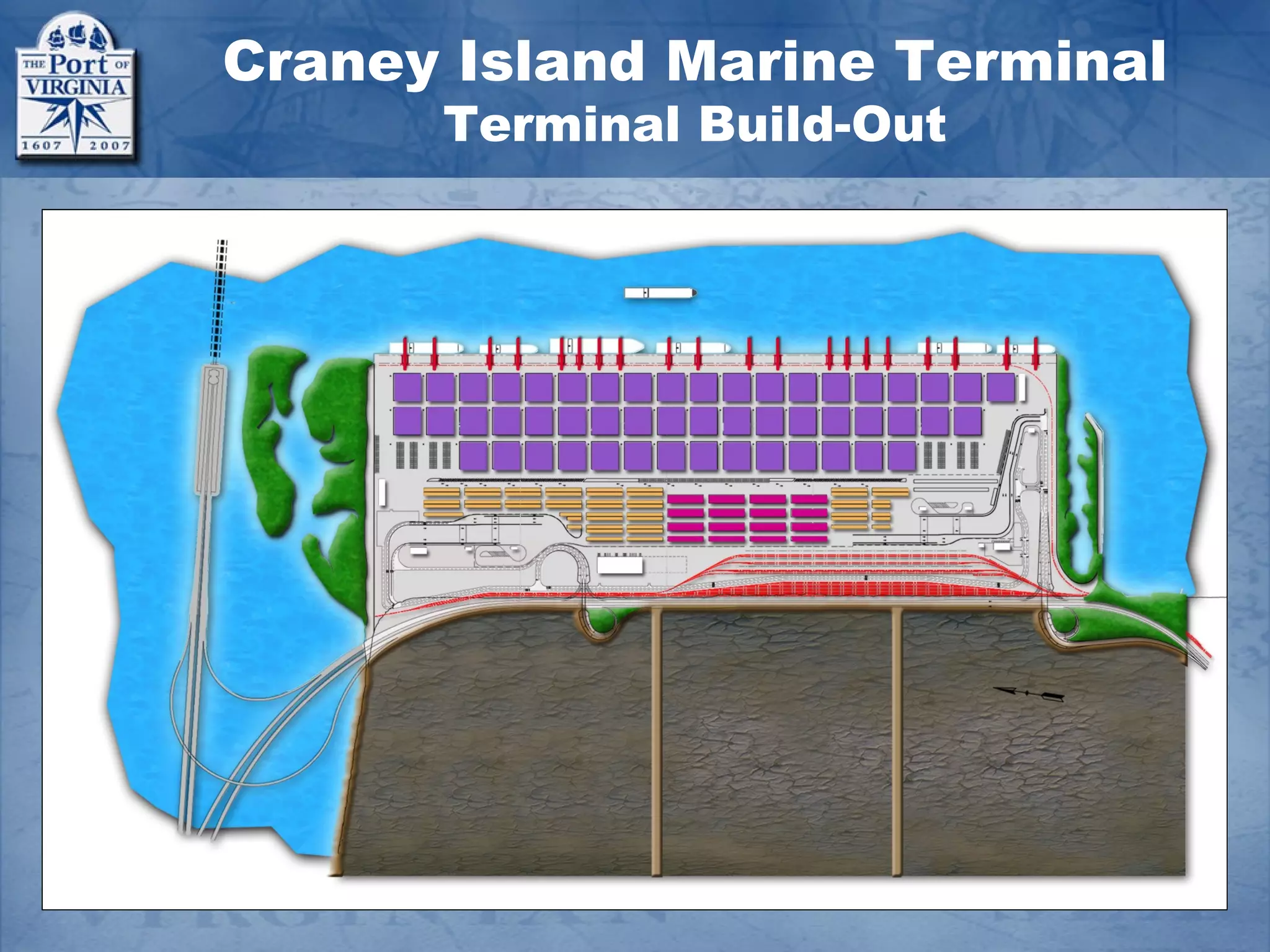

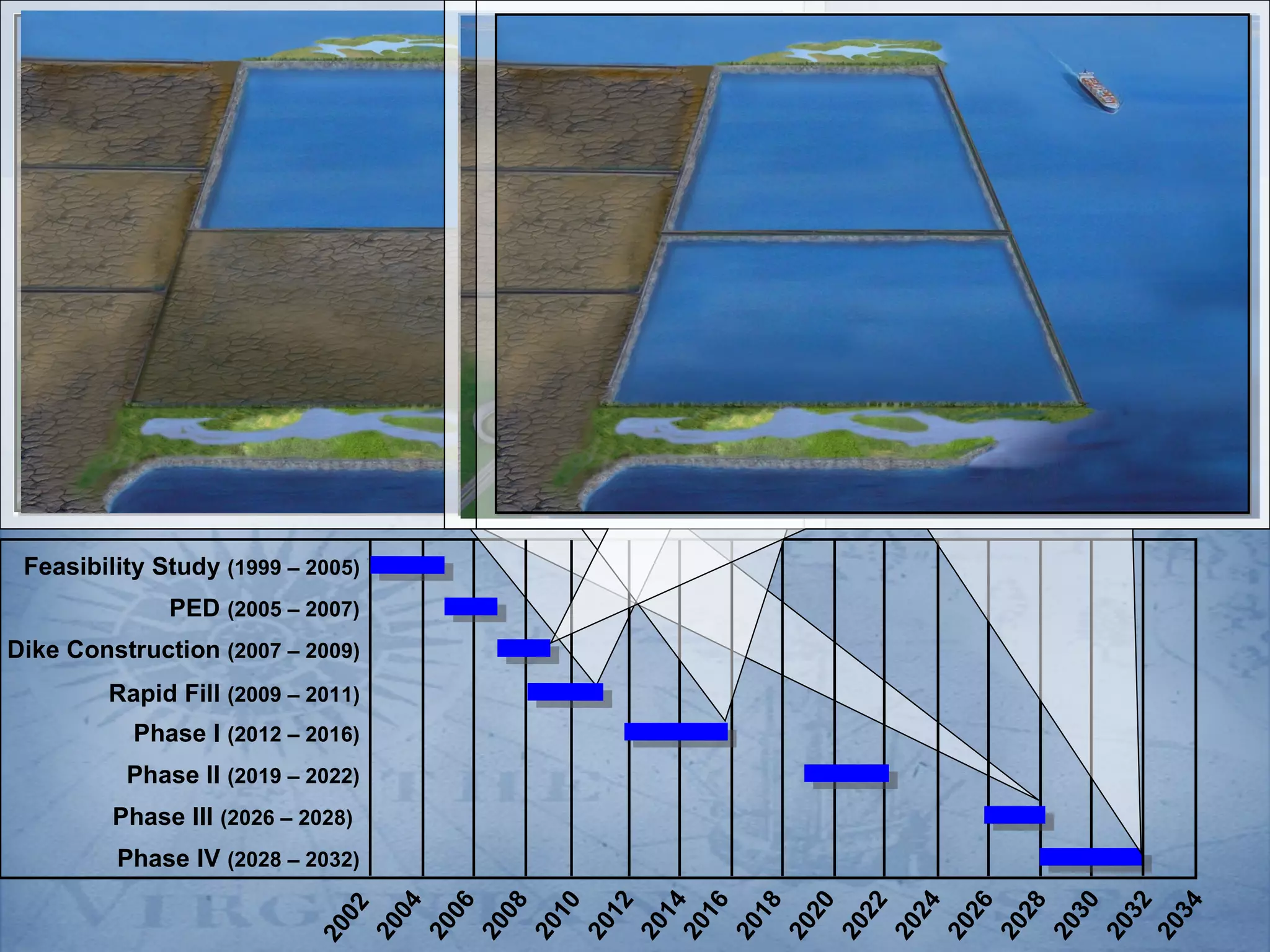

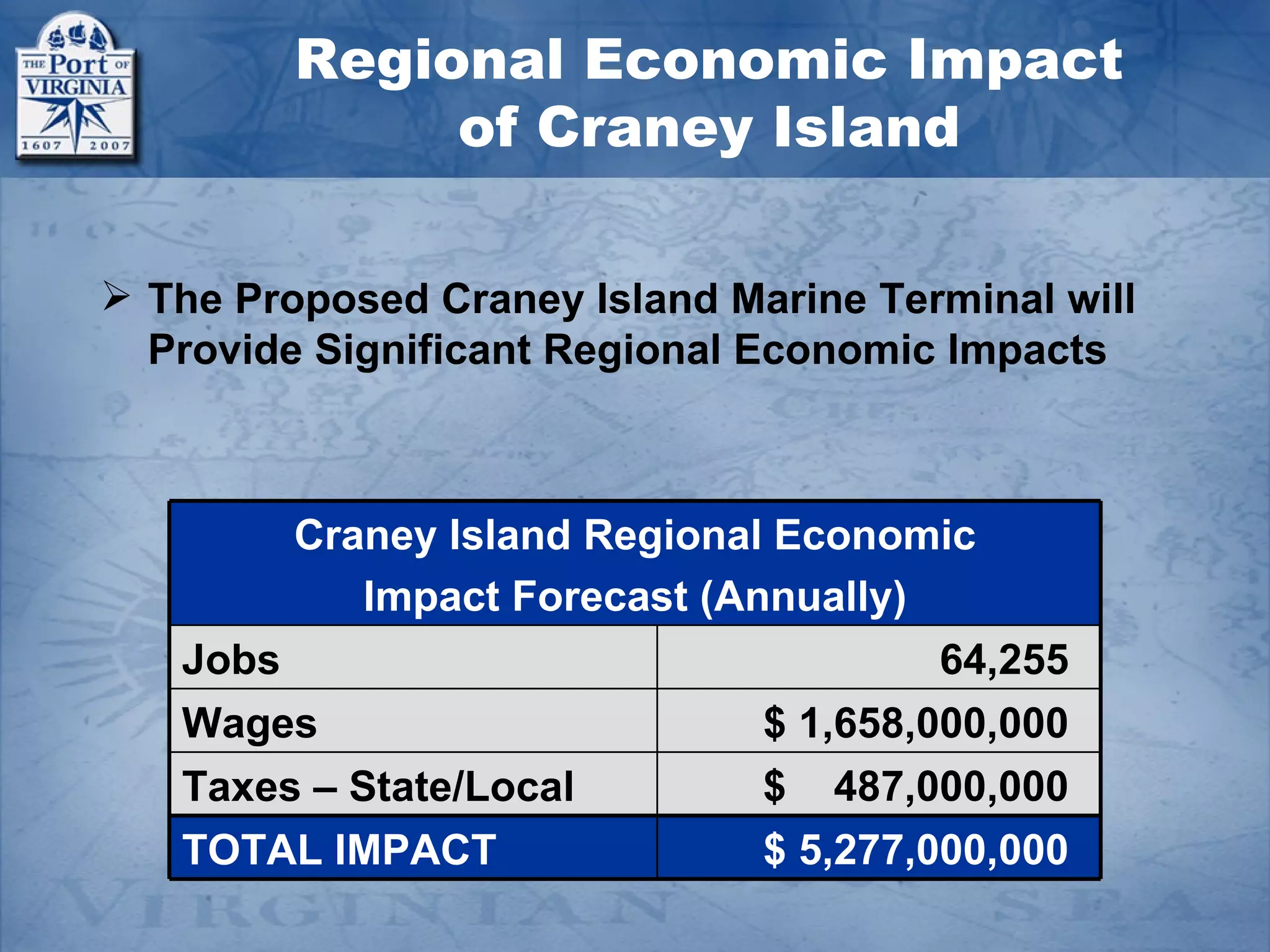

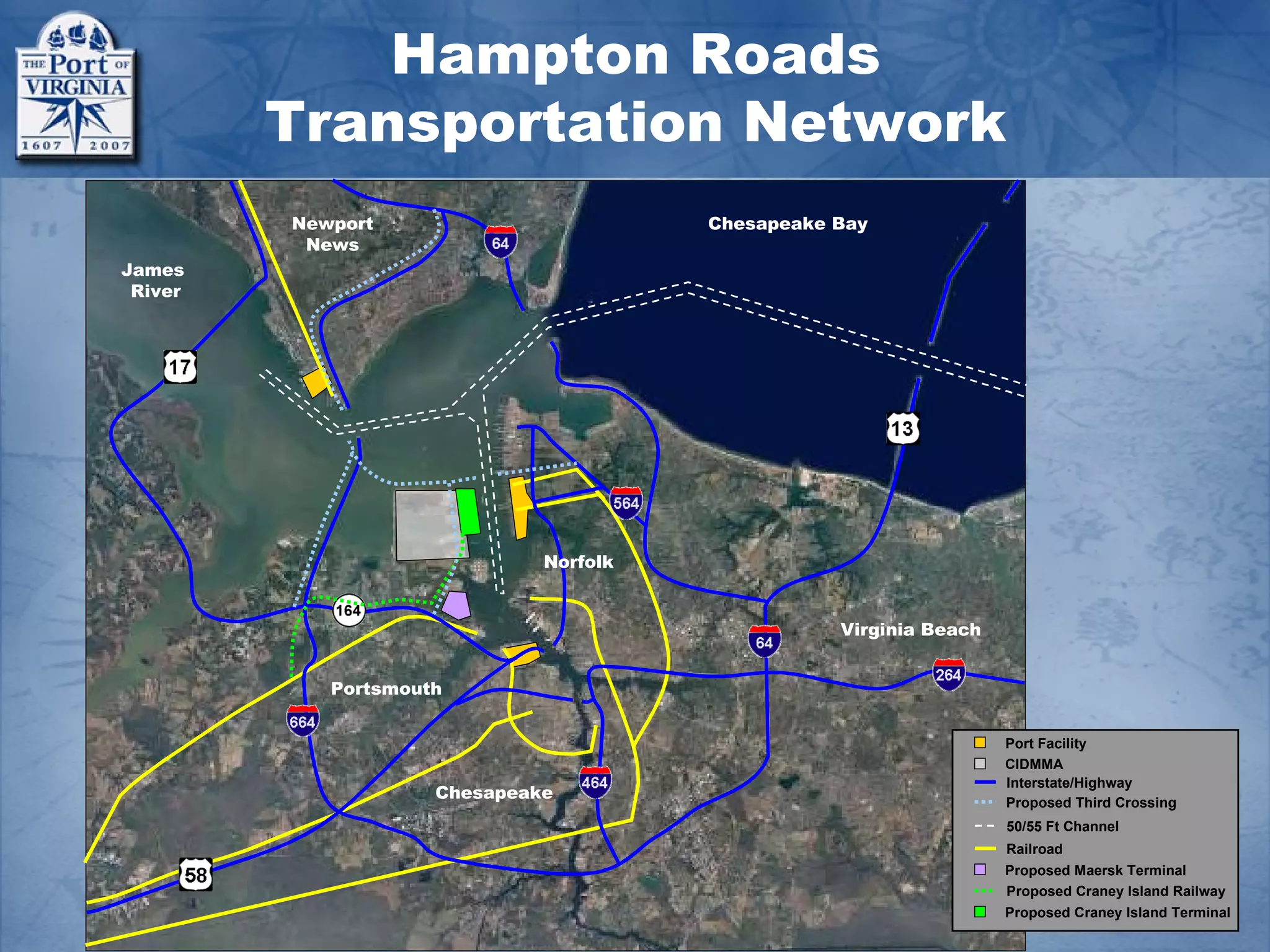

The document discusses the Port of Virginia's 2040 Master Plan to accommodate projected growth in containerized cargo over the next 20 years. The plan includes $2.88 billion in investments for new and expanded marine terminals, dredging, and other infrastructure projects. This level of investment is needed to handle the projected doubling of container volumes and shift to larger ships. The goal is to sustain the Port's role in Virginia's economy by facilitating cargo growth and creating tens of thousands of jobs and billions in annual economic impact.