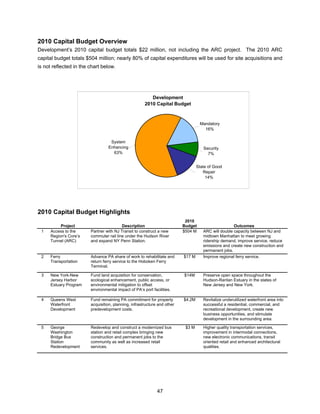

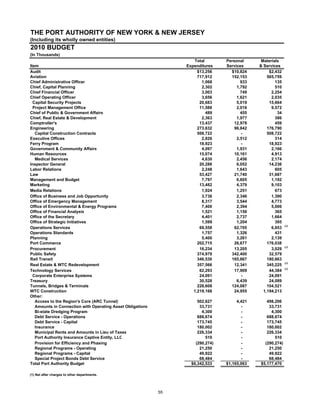

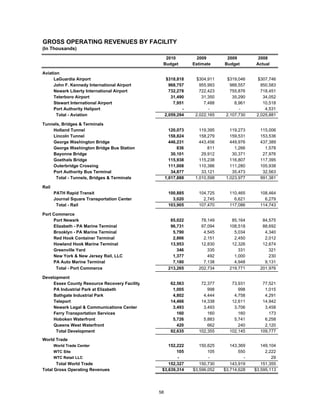

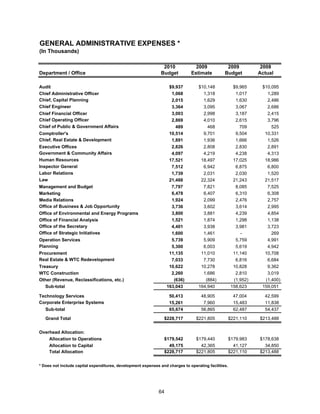

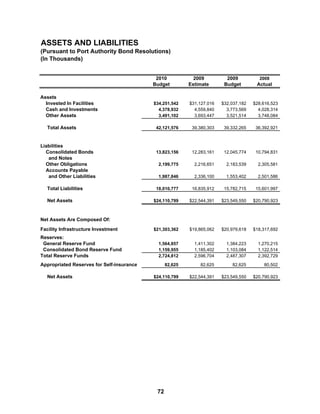

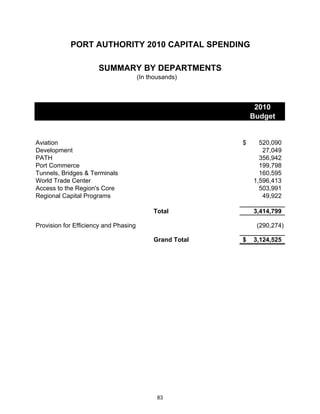

The document summarizes the impact of the economic downturn on the Port Authority's 2010 budget. It states that the recession has significantly reduced the Port Authority's operating revenues and long-term capital capacity. Specifically, the agency's capital capacity for 2007-2016 has decreased by $5 billion, from $29.5 billion to $24.5 billion. The Port Authority has responded by implementing a second straight zero-growth operating budget, reducing headcount, prioritizing capital spending, and deferring some discretionary projects to balance its budget amid lower revenues.